Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Trapped longs ready to plunge

- Bitcoin price is likely to collapse as smart money has trapped longs.

- Ethereum price action shows concerning sell signals.

- XRP price action is most optimistic, the invalidation levels are vital.

The cryptocurrency market is in an unfortunate spot. Traders may have been enticed to jump the gun following Monday's rally, which played right into smart money's game plan as they are still in control of the downtrend. Bitcoin, Ethereum and XRP price could experience severe liquidity hunts if market conditions persist.

Investing in Bitcoin price now is purely a gamble

Bitcoin price failure to hold the critical levels at $41,500 and $40,000 hints at strong bearish control. Investors still in the trade have probably placed their stop losses under the Monday swing low of $38,536, which is an obvious target for bears to aim for next. If the swing low gets breached, BTC price could disappointingly head back towards the low $36,000 zone.

BTC./USDT 4-Hour Chart

Bitcoin price should warrant traders to wait for a break of $43,000 to say the uptrend will continue confidently. In the grand scheme of things, missing the first 10% of a move is ok when you are on the right side of the trend. If the BTC price can breach $43,000, the $51,000 target will be back on the table, resulting in a 30% increase from the current BTC price.

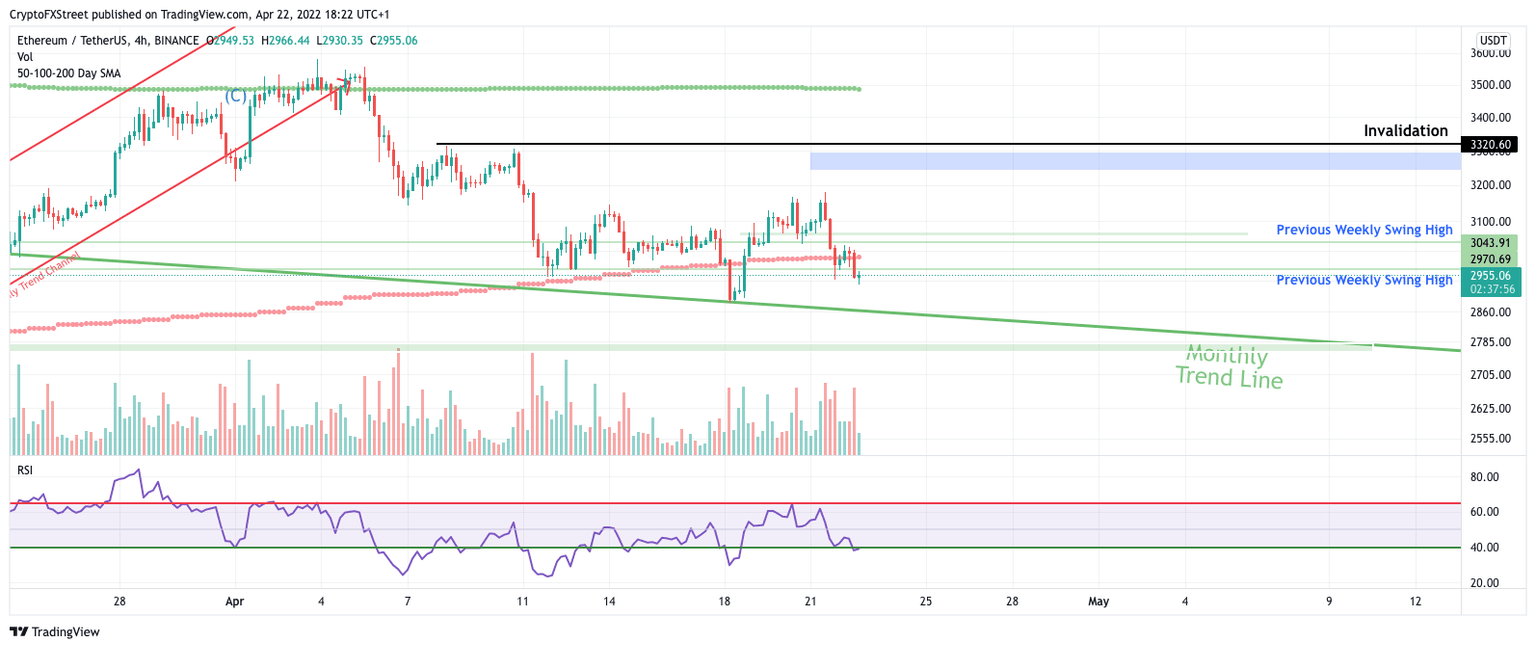

Ethereum price could plunge towards $2,750

Ethereum price has fallen back below the psychological $3,000 level. The ETH price currently trades at $2,950 as the bears have printed repetitive bearish engulfing candlesticks of equal length. If market conditions persist, the ETH price will likely plunge to $2,750.

ETH price has breached all key levels above $3,000 with strong bearish candles. In addition, the 50-day moving average has also been broken and accompanied by decent sell volume on the 4-hour chart.

ETH/USDT 4-Hour Chart

Ethereum price invalidation remains the same as last week at $3,320. If the bulls can rebound into this area, the ETH price uptrend will be back on the table. The bulls could confidently aim for $4,000, resulting in a 35% increase from the current Ethereum price.

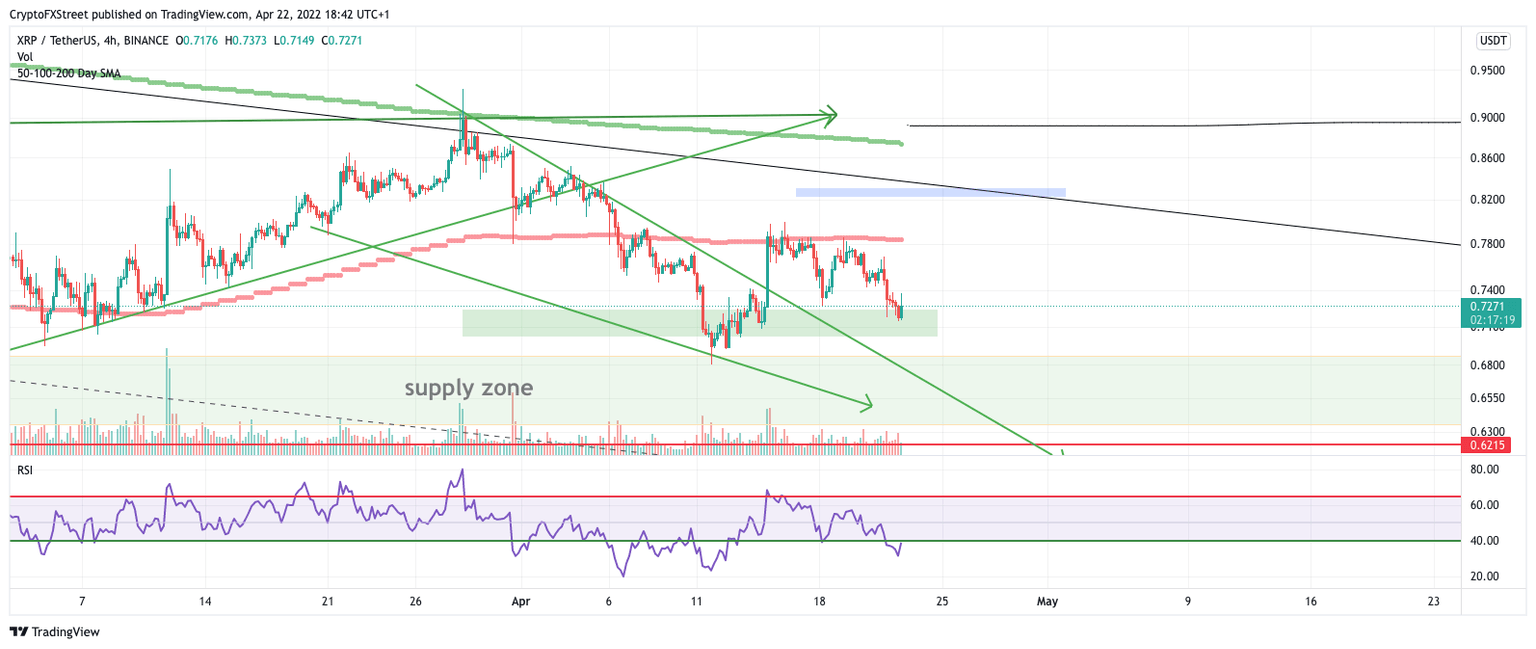

XRP price has the most potential

XRP price still looks the most optimistic in the cryptocurrency market. Ripple price broke out from the descending wedge pattern this month and is now coming to retest the upper trendline. XRP currently trades at $0.72. A dollar-cost average approach could be the best option for XRP enthusiasts.

XRP price volume is still fading on the 4-hour chart, which adds to the optimistic sentiment. There has not been a bearish candle to match the power of the March 15th bullish engulfing candle of 10%.

XRP/USDT 4-Hour Chart

The safest invalidation level will be below the second supply zone at $0.62. XRP long-term targets are in the $3.00 zone, so any discounts given out by smart money are likely to come with some drama. If XRP price breaks $0.62, expect all hell to break loose. XRP price could likely fall back to $0.44, resulting in a 40% dip from the current price.

Author

FXStreet Team

FXStreet