Top 3 Price Prediction Bitcoin, Ethereum, Ripple: The Interminable Bottom

- Bitcoin price recent decline wipes out all bullish liquidity since July while dually printing a bullish candle on larger time frames.

- Ethereum falls into a key Fibonacci level as the decline price action continues under low volume.

- Ripple has rallied 20% under turbulent conditions, the technicals suggest a double scenario underway.

The Cryptocurrency market has wiped out a majority of liquidity established during the summer. Still, the sell-off leaves trails of optimism despite the loss of market value.

Bitcoin price shows mixed signals

Bitcoin price has investors on edge as the peer-to-peer digital currency has fallen below $20,000. The recent breach established a new low for September at $18,271 and wiped out all of the previous swing lows dating back to July 2022.

Bitcoin price currently auctions at $19,224. The bulls were able to print a hammer candle on the 2-day chart, which is an optimistic gesture during the downtrend. A Fibonacci retracement tool surrounding the previous 20% uptrend in September shows the hammer closing below the 61.8% retracement level.

BTC USDT 2-Day Chart

Closing beneath the key Fib level could be a warning for bullish traders not to get too ambitious aiming for higher targets. The Volume Profile indicator compounds the need for caution as the hammer candle shows low volume compared to the previous June 18 candle, which induced the 40% summertime rally. Hammers also generally should be followed by a green candle with a positive close for confirmation which does not look to be the case at the time of writing.

In the short term, BTC could re-route north into $21,200 and $21,600 based on the price projections of the recent 2-day candle. A breach above the 61.8% Fib level at $20,059 could be a signal for a sidelined trader to enter the market. A stop loss could be placed beneath the new low at $18,271, although the safest invalidation would be the June 18 swing low at $17,592.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price is at a critical level.

Ethereum price is enticing sidelined investors to begin entering the market. On September 19, the bears successfully breached the previous swing low established in August and the June 26 swing low at $1,352.The bears forged a new low for September at $1,280. Shortly after the liquidity hunt, the bulls retraced half of the decline, leaving investors puzzled as to what might occur next,

Ethereum price currently auctions at $1,349, A Fibonacci Retracement indicator surrounding the largest upswing within the client’s summertime rally shows the recent sell-off as just a 61.8% retracement. The Relative Strength Index hovers in the ideal territory for a market bottom. Still, it has a few ticks of space left to fall based on previous bottoms throughout Ethereum's trading history. The Volume Profile Indicator remains relatively low amidst the sell-off adding further weight to the idea that the downtrend is a correction that will eventually get reversed.

ETH USDT 2-Day Chart

Still, the Ethereum price has space to fall. The safest invalidation of the uptrend thesis at the current time is a breach below the June 12 swing low at $1006. This provides enough wiggle room for investors to avoid any last-minute liquidity hunts before the next anticipated Ethereum bull run takes place.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

XRP price shows a double scenario

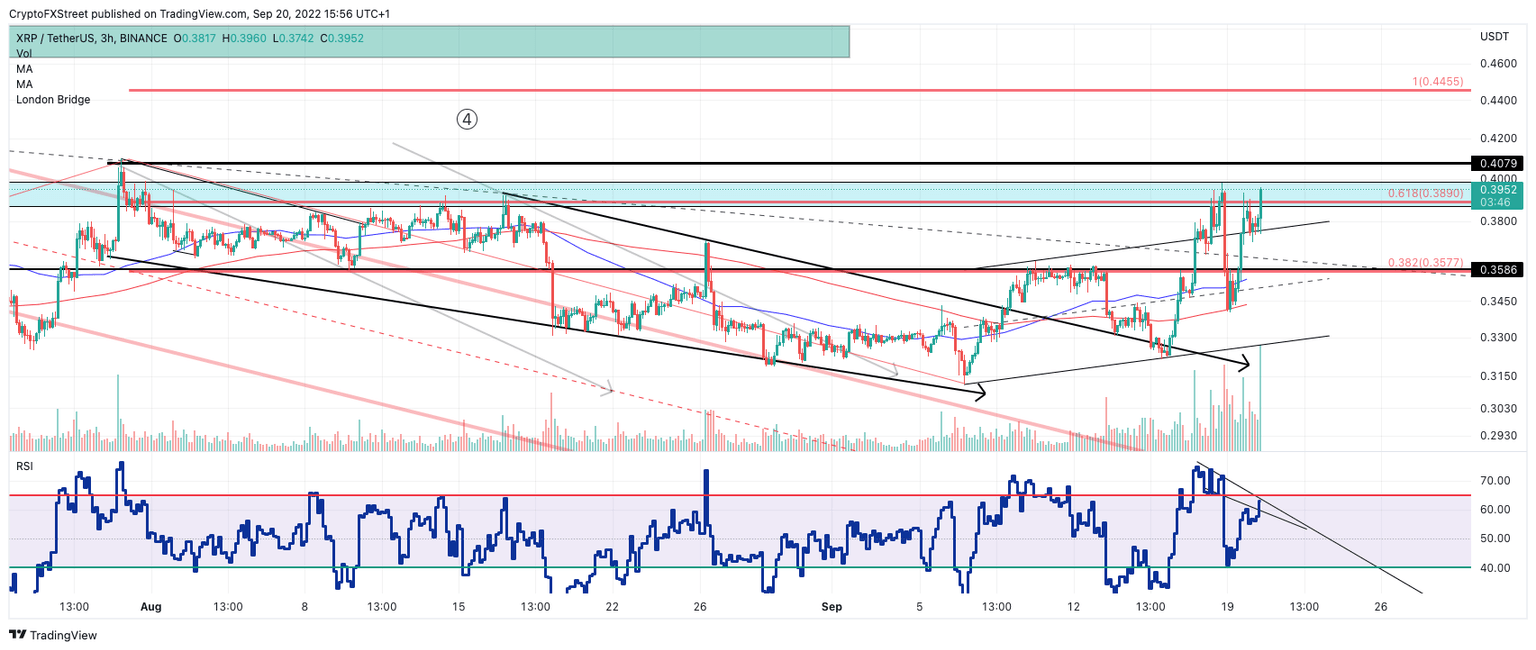

Ripple's XRP price is on the brink of glory or destruction. The digital remittance token has rallied 20% since its previous decline during September 12's CPI release. Still, the uptrend has not been easy as it has produced strong pullbacks with large influxes of volume along the way.

XRP price currently hovers above a broken parallel channel surrounding the first impulsive rally of September. The gesture is very wave-3-like, which could prompt a sharp move towards $0.45 if $0.41 were to get tagged. Still, the current price action is in its early stages, which bears a serious risk if incorrect.

XRP USDT 2-Day Chart

The bearish scenario suggests the current uptrend is an ABC correction of a previous leading diagonal, Thus the $0.041 origin point of the diagonal is the line in the sand to invalidate the bearish scenario.

A buy stop could be placed at $0.41. If the bulls breach this level, an impulsive rally should occur, with the first target at $0.45. Such a move would result in a 20% increase from the current XRP price.

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.