- The strong upward movements are a prelude to the long-awaited bull market in cryptocurrencies.

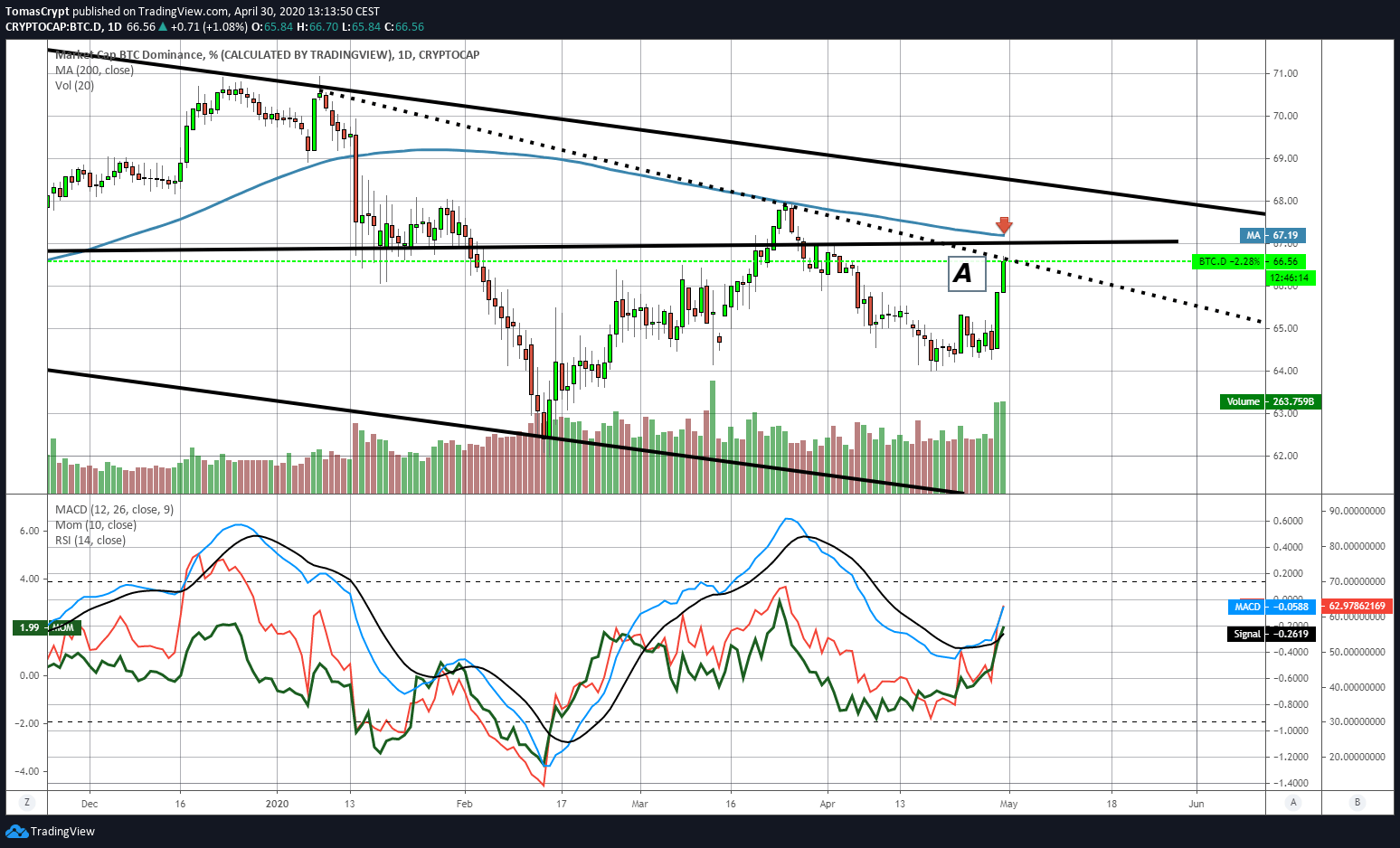

- The strong rises hide a tough fight for market dominance.

- The Bitcoin halving and the launch of Ethereum 2.0 are the rockets that can propel the market towards the Moon.

The pre-established script finally fulfilled, and the crypto market exploded yesterday on the upside a few days before the implementation of the "halving" event in Bitcoin’s mining reward system.

Bitcoin took the lead with a much better behaviour than the rest of the components of the Top 3 cryptocurrencies.

In the fierce fight for market shares, it's shown that the bullish option for Bitcoin crystallized and took the dominance graph to the primary resistance level (A). The technical structure doesn't seem very solid, and before giving Bitcoin the victory in this competition for dominance, we should see in the chart levels higher than the 67.2 level.

In the fierce fight for market shares, it's shown that the bullish option for Bitcoin crystallized and took the dominance graph to the primary resistance level (A). The technical structure doesn't seem very solid, and before giving Bitcoin the victory in this competition for dominance, we should see in the chart levels higher than the 67.2 level.

The market is betting on the potential impact on the price of the "halving" event, but we should not lose sight of the next release of the new version of the Ethereum network.

The long-awaited Ethereum 2.0 implements essential improvements, but above all, it can impact the price directly. The central technological development is the migration from a PoW consensus system (based on computational power) to a PoS system (based on Ethers' participation). It is necessary to stake 32 tokens from the Ethereum network to receive distributed rewards, which will lead to a substantial increase in demand for Ethers.

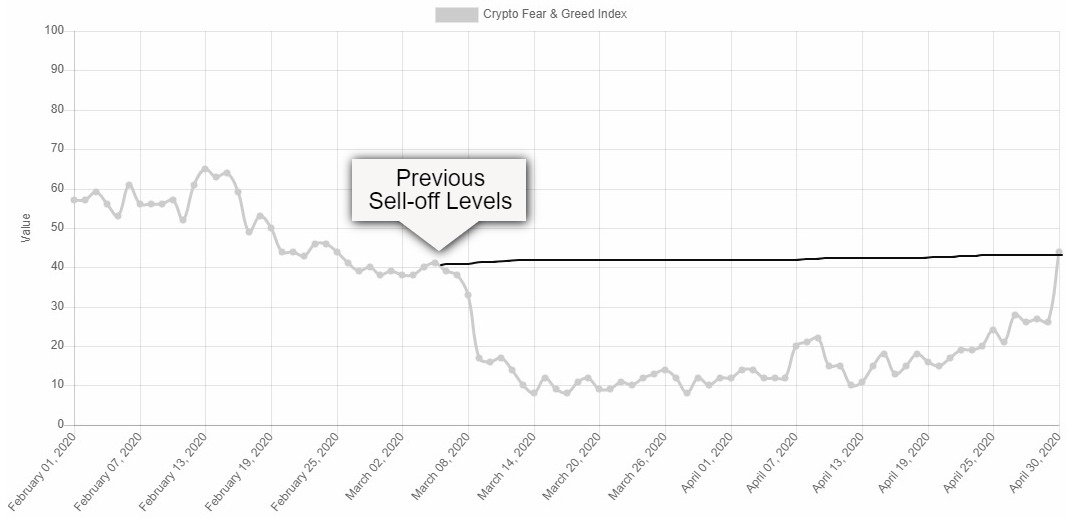

Market sentiment is actively improving and reaches level 44 – mild fear level. Looking at this indicator’s chart for the last three months, we can see how the sentiment level recovers above the level before the March sell-off.

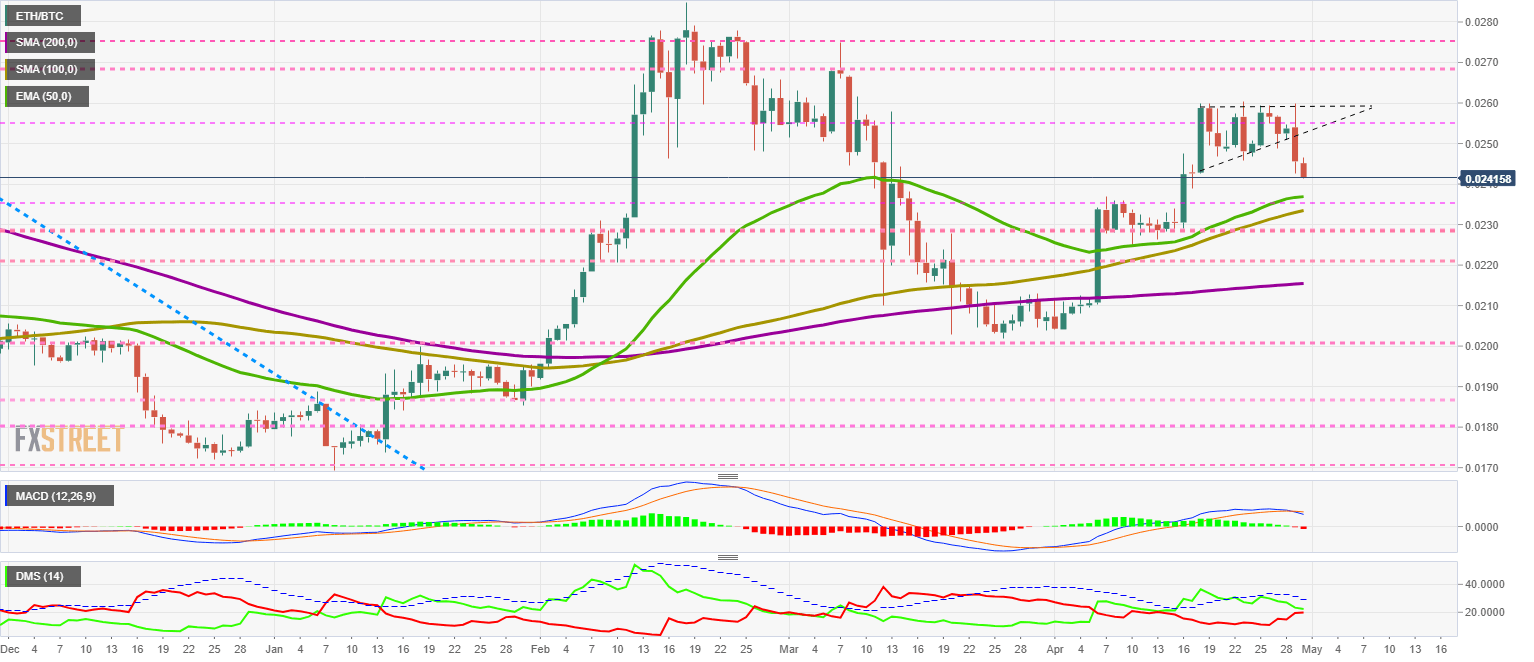

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0241 and shows a sharp upward trend loss that leads to a breakout of the triangular pattern formed in recent sessions.

The fastest-moving averages are at 0.0235, while the 200-day simple moving average is now at 0.0215, a level that should limit the fall.

The market expects the release of version 2.0 of the Ethereum network for next summer, so a scenario of increasing volatility at all Ether crossings is very likely.

Above the current price, the first resistance level is at 0.0255, then the second at 0.0268 and the third one at 0.0275.

Below the current price, the first support level is at 0.0236, then the second at 0.0233 and the third one at 0.0228.

The MACD on the daily chart is crossing downward, confirming the loss of Ether's lead over the rising Bitcoin. The most likely scenario is a continued downward movement to the 0 levels of the indicator, where the Ether's bulls may try again.

The DMI on the daily chart shows how the bulls and bears positions are tied. In this case, it seems that the selling side of the market has all the options to win.

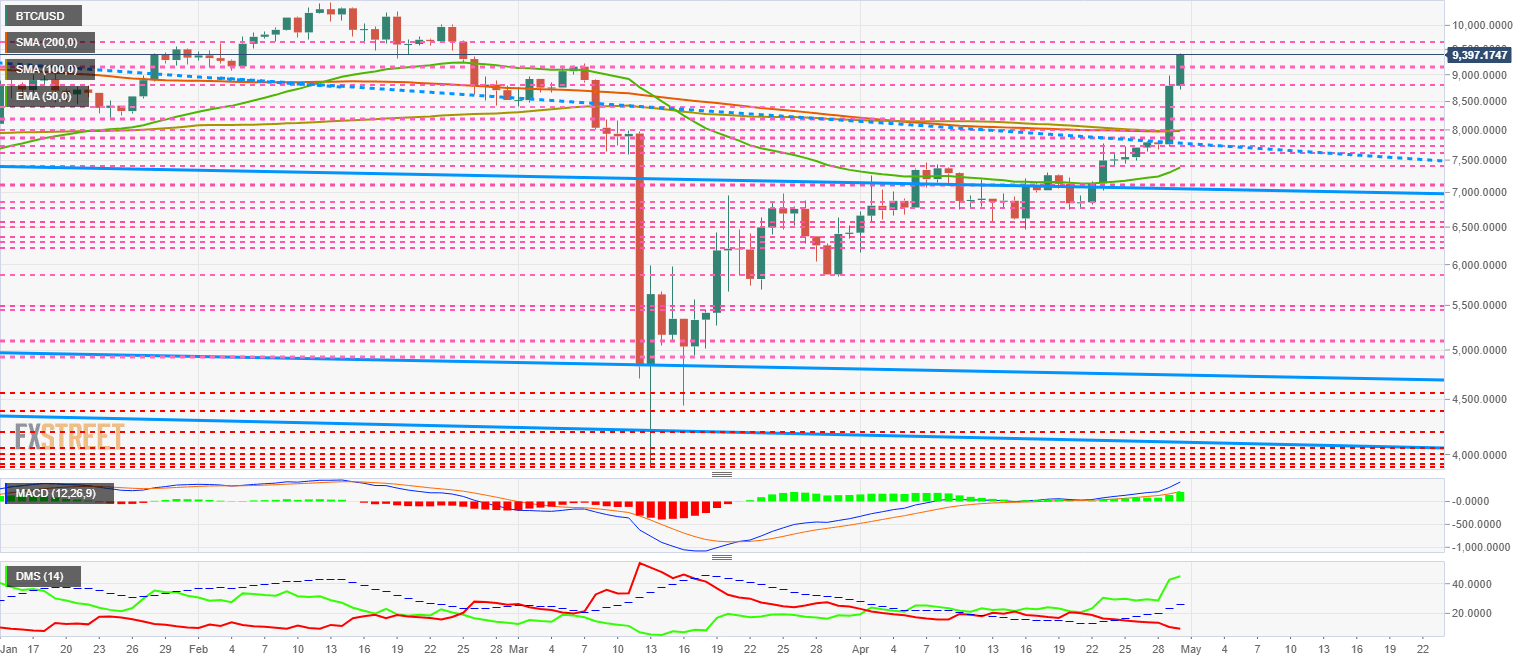

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the price level of $9397 and is encountering resistance to rising prices, a situation related to the current moment in the Bitcoin dominance chart.

The distance to new highs is vast in magnitude but small in the number of hurdles, as breaking through the next six levels of price congestion resistance, headlines will once again be talking about historic highs.

Above the current price, the first resistance level is at $9500, then the second at $10600 and the third one at $11250.

Below the current price, the first support level is at $9250, then the second at $8800 and the third one at $8500.

The MACD on the daily chart shows a strong bullish profile and also a vital line separation, which promises further gains, although not without the scares caused precisely by the excess of optimism.

The DMI on the daily chart shows bulls with an absolute advantage over the bears. The upside potential is huge, although as with the MACD, the excesses are always corrected and will bring excitement to the entire rally.

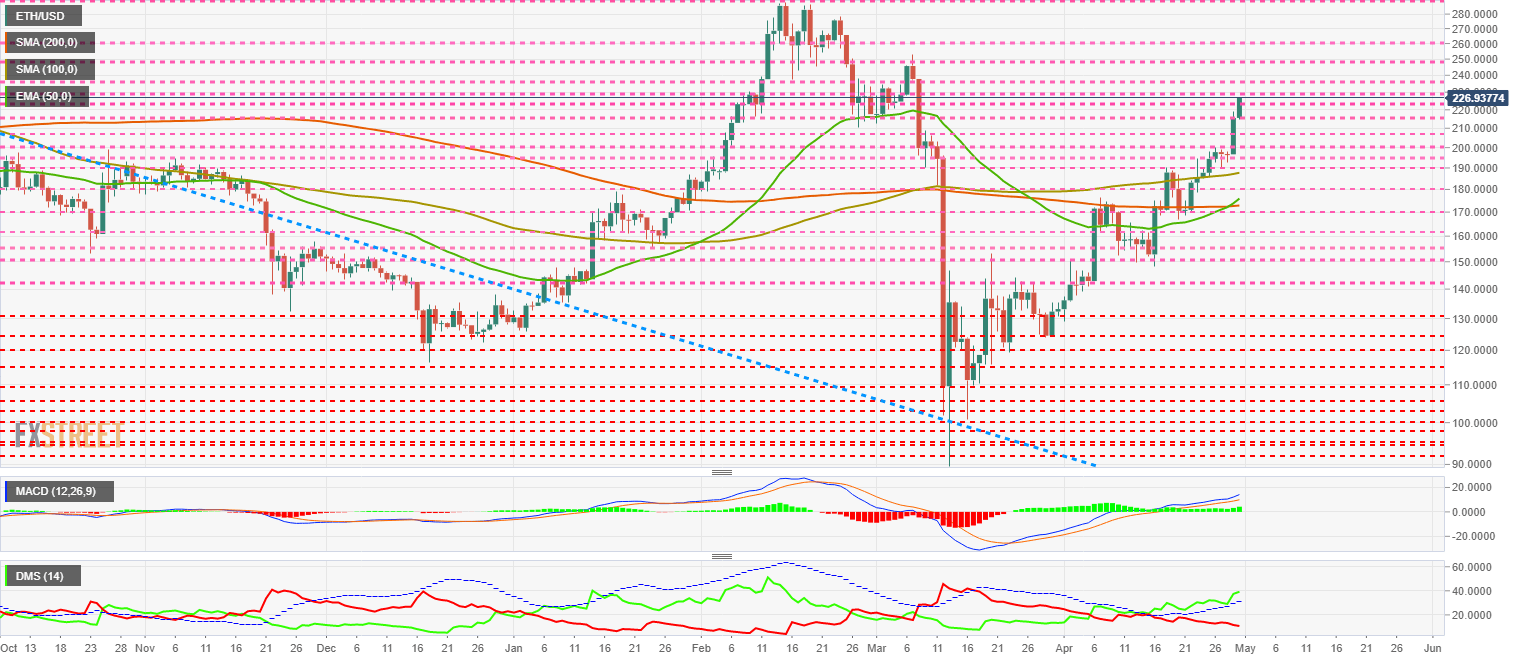

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $226.9 price level, showing difficulty in overcoming the price congestion resistance level at $230. The current technical resolution of the Bitcoin and Ether dominance charts are the best guides to what lies ahead in the coming days.

Above the current price, the first resistance level is at $230, then the second at $238 and the third one at $250.

Below the current price, the first support level is at $223, then the second at $215 and the third one at $207.

The MACD on the daily chart is once again trending higher but with less upward momentum shown by the Bitcoin. This calmer behaviour may help maintain stability in the ETH/USD pair.

The MACD on the daily chart is once again trending higher but with less upward momentum shown by the Bitcoin. This calmer behaviour may help maintain stability in the ETH/USD pair.

The DMI on the daily chart shows the bulls bouncing upwards after finding support at the ADX line. The bears are still down and show no interest in leading the pair.

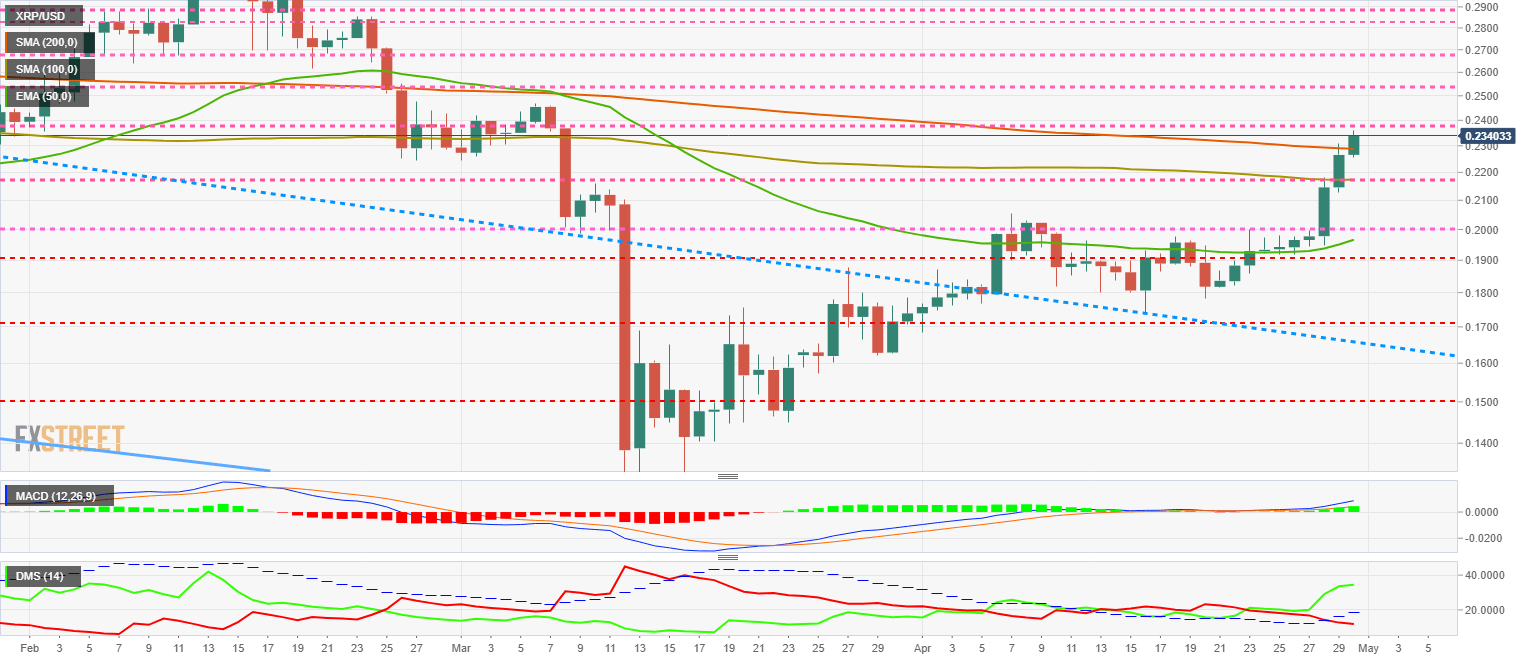

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.234 and is above the 200-day simple moving average. Now the price is in a much more optimal scenario for the development of bullish scenarios.

It is shocking to see the XRP/USD pair moving so smoothly for what is typical for the Ripple. Let's hope this is a sign of maturity.

Above the current price, the first resistance level is at $0.238, then the second at $0.254 and the third one at $0.268.

Below the current price, the first support level is at $0.23, then the second at $0.21 and the third one at $0.20.

The MACD on the daily chart shows a significant improvement, both in terms of upward slope and distance between the lines. The increase in the bullish profile does not have the magnitude of the BTC/USD pair, which could lead to lower volatility levels.

The DMI on the daily chart shows bulls with a significant advantage over the bears, although the lack of speed in the price keeps the ADX low and dangerous for the indicator structure.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.