- Bitcoin and S&P 500 correlation is facing a shift that would affect the whole crypto market.

- The ETH/BTC pair, another market benchmark, could also move towards a new positive scenario for the crypto market.

- Bitcoin could reach $288K if the S&P 500 reached 4300, according to an analyst.

The crypto market continues to stress the relationship between Bitcoin and Ethereum, the latter now subject to much criticism because of the high transaction costs charged.

The emergence of multiple DeFi (Decentralized Finance) projects running on the ETH 1.0 network has congested the network and raised the cost for all users.

Bitcoin meanwhile is trying to break the ties with Wall Street, a relationship that became very intense since late 2017.

The spread indicator between the BTC/USD and the S&P 500 faces the superior resistance of the triangular-shaped compression figure that began after the bullish market ended in 2017.

A technical upside break at the top of the triangle would open the possibility of a sharp increase in the value of Bitcoin.

On the opposite side, a downward movement of the spread line would imply falls in the equity markets and Bitcoin. When fear spreads among investors, and they get rid of the riskiest positions, cryptocurrencies are in the "high risk" category.

In March, we already saw the effect that the crash in the world's stock markets had on the value of the BTC/USD pair.

At the moment, the technical indicators applied to the simple spread would tend to be in a lateral downward movement. Still, there are options to move in the opposite direction.

The well-known twitter Plan B predicted this complicated relationship between Bitcoin and S&P 500.

#Bitcoin is scarce (measured by S2F) and people value it in line with gold & silver (in $)

— PlanB (@100trillionUSD) June 27, 2020

BTC is also correlated & cointegrated with S&P500. S&P 2x =BTC 416x (in $)

This can both be true! QE pumps stocks (cash flow) and BTC (scarcity): asset inflation in $. BTC$288K ~ S&P$4300 pic.twitter.com/Sgs0MBpCT2

According to Plan B, the effects of QE on asset valuations would push the S&P 500 index to 4300 points while Bitcoin, with a 208X correlation to the US index, would reach 288K.

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0247 and is in a similar technical situation to the BTC vs S&P Spread. This scenario is no coincidence since the relationship between Ethereum and Bitcoin also has an essential structural component in the Crypto market.

A combined upward break in the ETH/BTC pair along with a break in the BTC/USD vs S&P spread would be explosive for the market.

Above the current price, the first resistance level is at 0.025, then the second at 0.026 and the third one at 0.0276.

Below the current price, the first support level is at 0.0248, then the second at 0.0235 and the third one at 0.0225.

The MACD on the daily chart is improving the profile and is just a few points away from resuming the previous bullish cross.

The DMI on the daily chart shows a slight advantage for the bulls, but not enough to secure the position. The leadership in the ETH/BTC pair may change sides quickly.

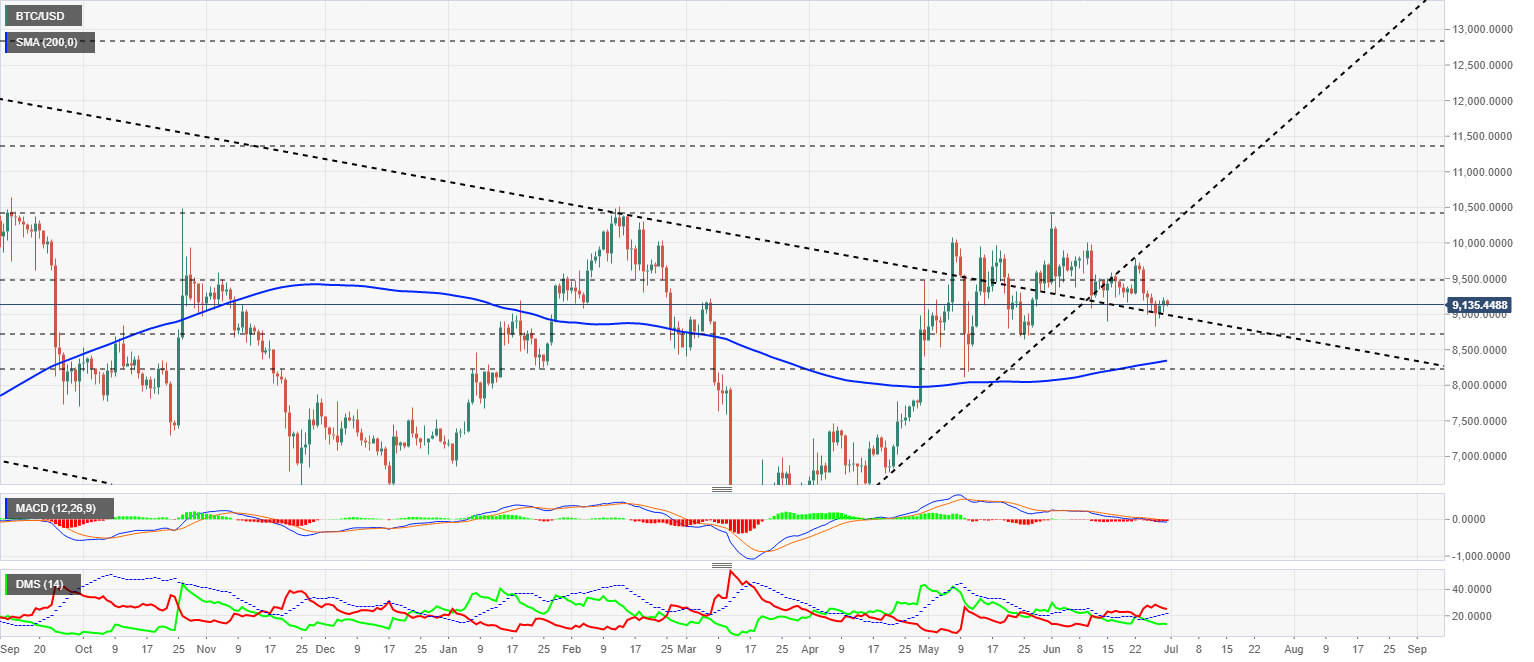

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the $9131 price level as it slides down another day following the previous bearish channel ceiling. It is vital for the BTC/USD not to breach this support level to avoid a major downward movement.

Above the current price, the first resistance level is at $9500, then the second at $10480 and the third one at $11350.

Below the current price, the first support level is at $8990, then the second at $8750 and the third one at $8350.

The MACD on the daily chart is entering the bearish zone at the bottom of the indicator, which could trigger some selling that could jeopardize the current situation.

The DMI on the daily chart shows the bears losing strength to the bulls, which are now moving upwards and reversing the trend of the past few days.

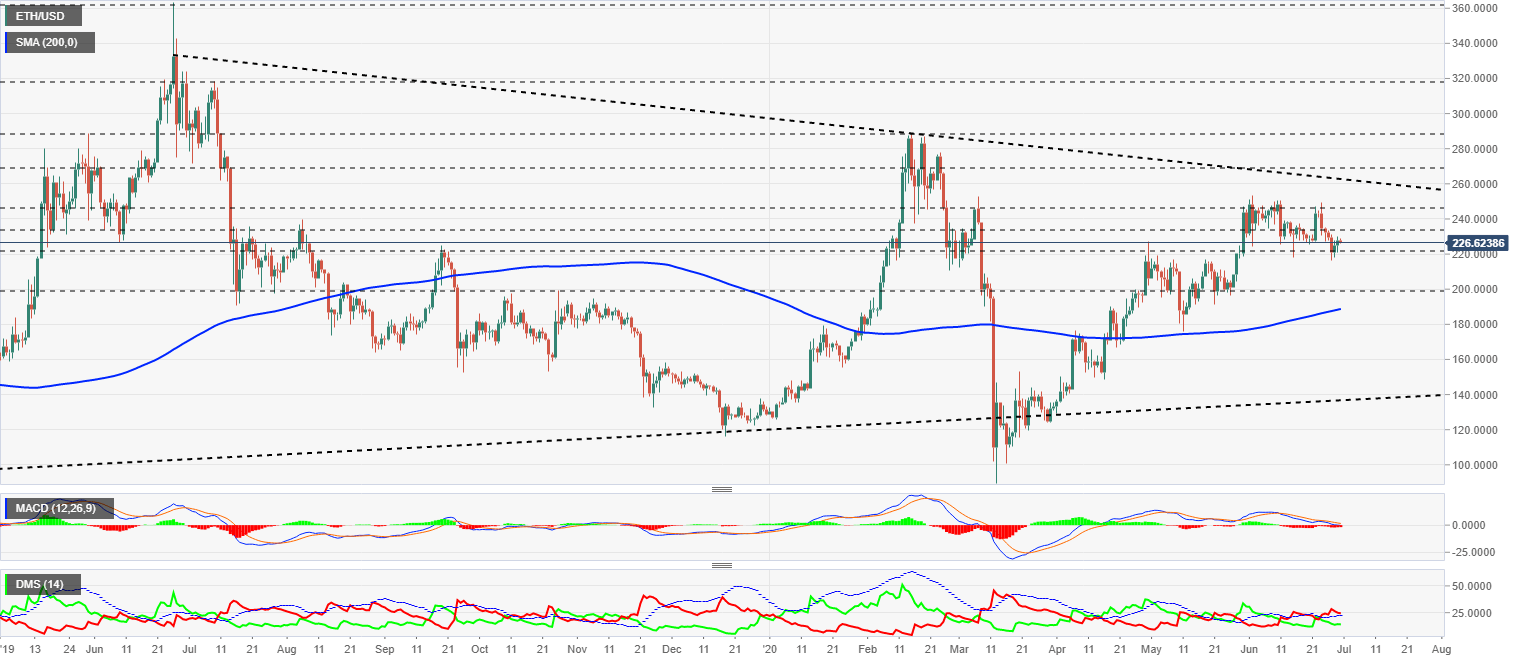

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $226.2 price level and is moving in the middle of the current scenario. The upper limit is at $260, while below the current price, the red line is around $140.

Above the current price, the first resistance level is at $235, then the second at $245 and the third one at $262.

Below the current price, the first support level is at $220, then the second at $200 and the third one at $190.

The MACD on the daily chart has grounded on the neutral level of the indicator, where you can find support to go back up.

The DMI on the daily chart shows bears looking for support on the ADX line. The bulls are moving slightly upwards but will need a few more days to have more visibility at the front.

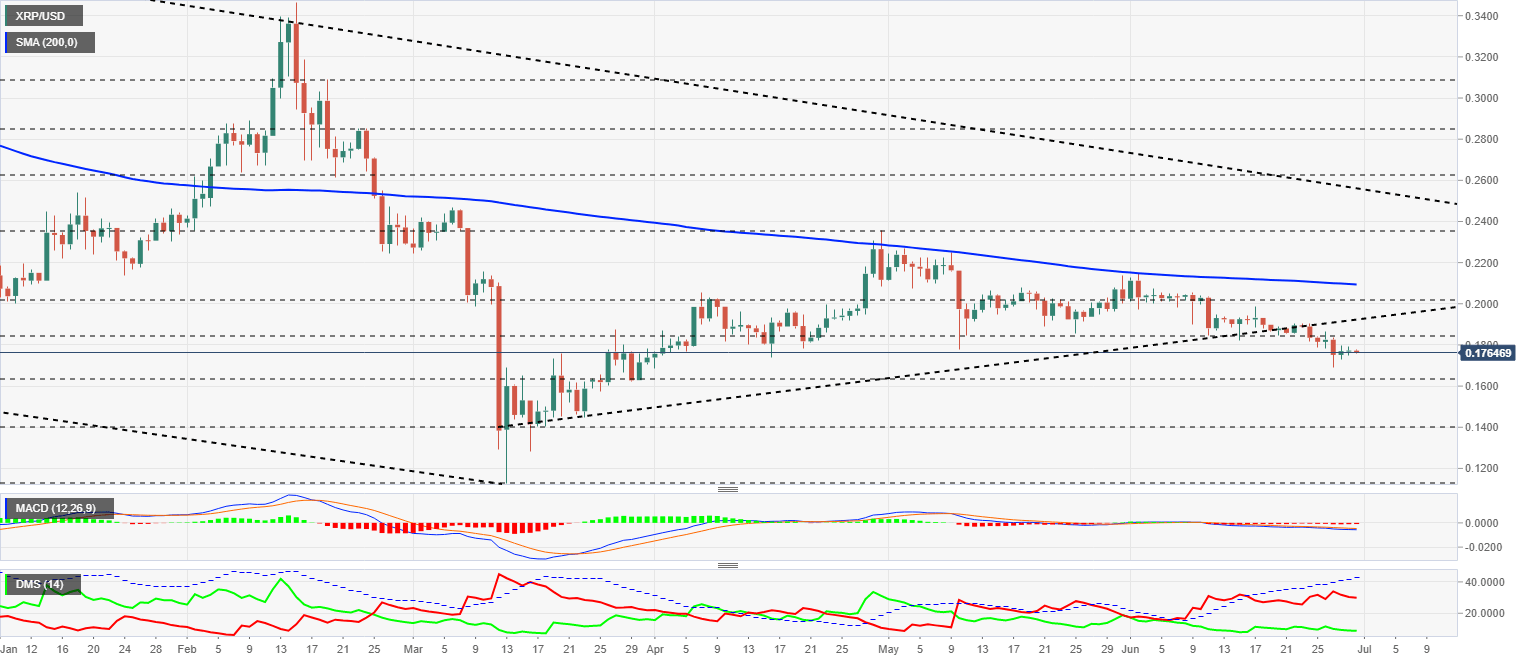

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.1764, floating almost magically between the last reliable support level and the gorge of the $0.10 level per Ripple. The technical situation is scary, and it seems like no one sees the elephant in the room.

Above the current price, the first resistance level is at $0.185, then the second at $0.192 and the third one at $0.20.

Below the current price, the first support level is at $0.164, then the second at $0.14 and the third one at $0.10.

The MACD on the daily chart is flattening out again, just a few points below the neutral zone.

The DMI on the daily chart shows bears leading the pair, while bulls are showing no interest in taking the lead on XRP/USD.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.