Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Short term bullish outlook in the market, May lows are key

- Bitcoin price has turned bullish as positive momentum continues to grow, better odds above $27,680, but May lows are key.

- Ethereum price above $1,825 means buyers are stepping in with $2,000 in sight.

- Ripple price aims for $0.50, but its independence from BTC and reliance on network news is concerning. May lows also key.

Bitcoin (BTC) price action shows bulls slowly regaining market control as they try to push toward the next resistance level. The market opened today's session with a bullish inclination, and the buyers have been able to keep the momentum going. The outlook extends to Ethereum (ETH) price, inspired by Hong Kong's decision to allow retail traders to trade crypto. Ripple (XRP) price remains optimistic, but while the broader market looks to BTC for direction, the remittance token heeds to nothing but network news.

Also Read: Hong Kong leaves the door open to Ethereum killers Cardano, Solana, AVAX, MATIC, and LINK

Bitcoin price is looking to push higher

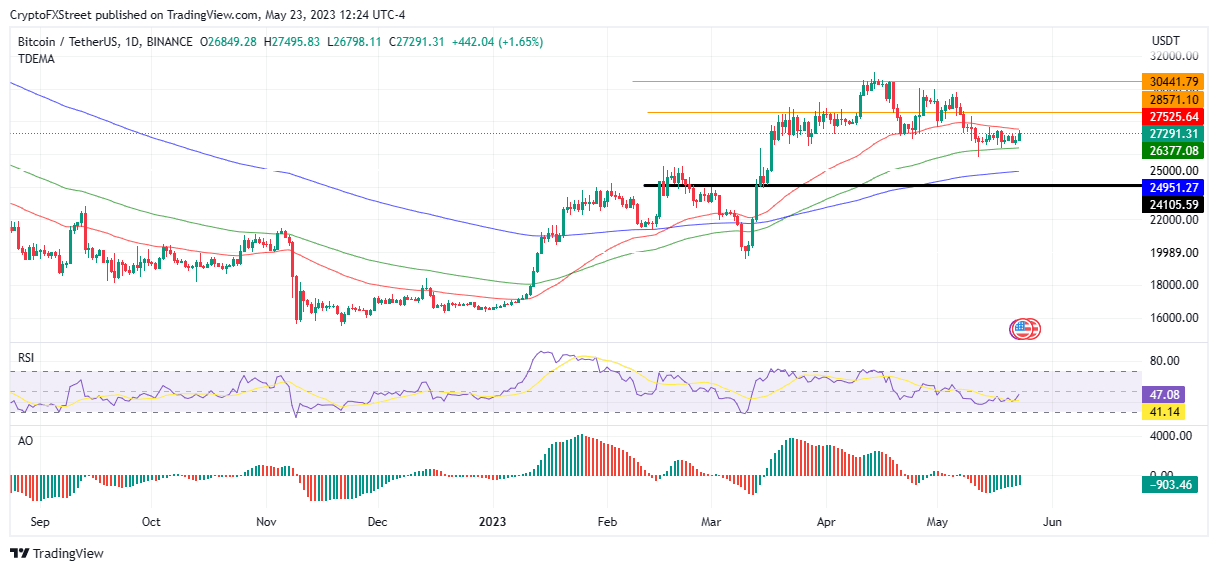

Bitcoin (BTC) price is committed to pushing higher after bulls regained control in the Tuesday trading session. At press time, Bitcoin price of $27,291 is confronting selling pressure from the 50-day Exponential Moving Average (EMA) at $27,525. A decisive flip of this hurdle into support could pave the way for more gains, and as investors cast their nets further, the odds would be better once the king crypto crosses above the $27,680 psychological level.

An increase in buying pressure above the aforementioned level could see Bitcoin price tag the $28,571 resistance level and, in a highly bullish case, extend to reach the $30,441 level soon. Such a move would denote a 10% upswing from the current level.

Staying above the May lows will be key for bulls to mount a recovery. A break below them will establish a new sequence of bearish peaks and troughs lower, with lower lows and highs – keeping above could mean the pullback from the April highs was merely a correction in a broader uptrend.

This bullish outlook draws vigor from the Relative Strength Index (RSI), which gave a signal to buy BTC when it crossed above the yellow band. Its northbound move and the Awesome Oscillators flashing green and pulling toward the midline shows more bulls approaching the scene.

BTC/USDT 1-Day Chart

Conversely, bears taking over could cause a pullback in Bitcoin price, losing support from the 100- and 200-day EMA at $26,377 and $24,951, respectively, before a retest of the mid-March lows around $24,105.

Also Read: Bitcoin price under $27,000 incentivizes investment as the market remains at a cyclical low

Ethereum price could rally toward $2,000 in June

Ethereum (ETH) price is also bullish, moving in tandem with BTC, but experts attribute its rally to Hong Kong's latest decision to permit retail crypto transactions. "Approved tokens on regulated crypto exchanges will need a 12-month track record." This raises ETH's listing prospects.

Notwithstanding, Ethereum price could escape the bullish falling wedge pattern if buyer momentum grows. Such an outcome could see the PoS token tag the $2,000 target by June, denoting a 10% climb from its current position.

This optimism is highly likely considering that Ethereum price had overpowered selling pressure from the 50-day EMA at $1,836 while more buyers joined the bandwagon from the 100- and 200-day EMA at $1,772 and $1,702 levels, respectively. Furthermore, the RSI had also crossed above the midline after bulls heeded the signal to buy ETH. Similarly, the AO was easing toward the midline with bulls in the driving seat. All these favor the upside.

ETH/USDT 1-Day Chart

On the other hand, early profit-taking or a pullback in BTC could cut short Ethereum price rally, influencing a trend reversal to the mid-February lows of around $1,504 in the dire case.

Also Read: Ethereum price shows optimism as ETH Beacon Chain continues to defy critics

Ripple price wants nothing but network news

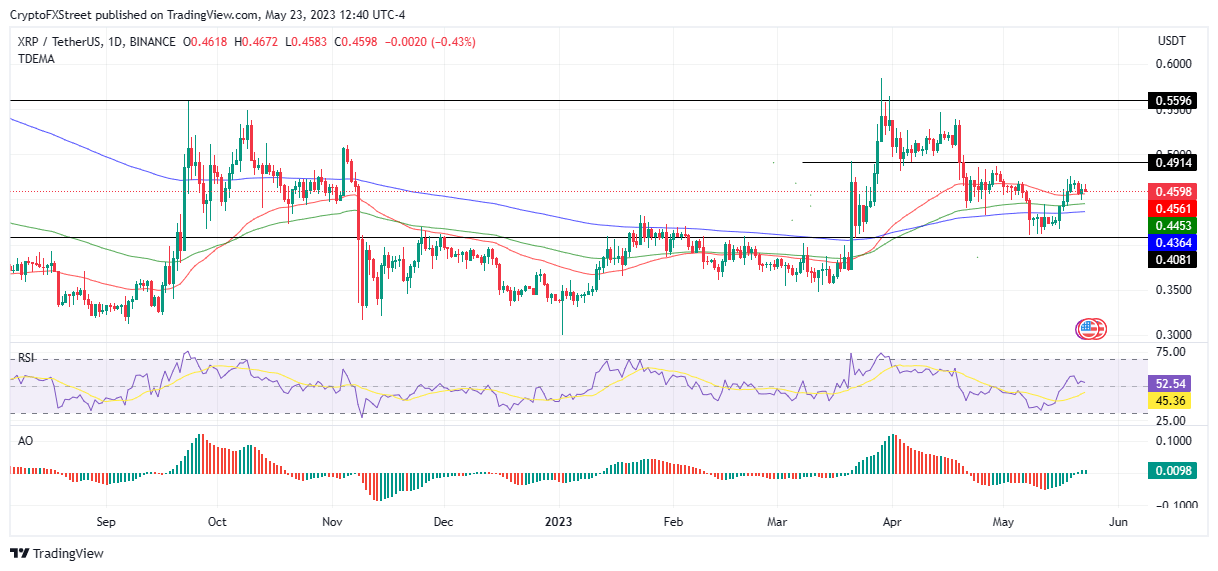

Ripple (XRP) price has rallied around 10% since mid-May, not because of BTC, but positive network developments, particularly in the XRP lawsuit. Nevertheless, the May lows around $0.40 remain crucial as the remittance token targets the region above $0.50.

Increased buyer momentum above current levels could see Ripple price break above the $0.49 resistance level into its target zone and, in a highly bullish case, extend to tag $0.55. This would denote a 20% upswing from current levels.

Both the RSI and AO support this outlook, moving above the midline to indicate buyers had taken the driver's seat.

Similarly to BTC the May lows are critical. If price can remain above them and continue rising it will suggest the sell-off since May was just an ABC correction in a broader uptrend, whilst a break could suggests a new bear trend is forming.

XRP/USDT 1-Day Chart

Waning buying pressure could tip the odds in favor of bears, who could quickly pull Ripple price toward the make-or-break $0.40 support level. The RSI tipping downward hints at the possibility of such a turn of events.

Also Read: Ripple price eyes 5% gains as $1.9 billion in market capitalization comes in

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.