- Bitcoin price rebounds with an uptick in volume after falling below $19,000 for the first time since July.

- Ethereum price shows more investors are currently in profit than at a loss, which could reduce overall selling pressure.

- XRP price produces the largest pullback within the wedging downtrend.

Since crypto’s inception, September has persistently been bearish, yielding negative returns. Nonetheless, there are technical and on-chain metrics suggesting September of 2022 could tell a different story.

Bitcoin price setting for a rebound?

Bitcoin price currently auctions at $19,284 as the bulls are producing a rebound after Bitcoin's recent breach of $19,000. On September 6, the peer-to-peer original crypto token fell beneath the psychological barrier for the first time since July 3 and consequently enabled the bears to forge a daily close at $18,667.

Santiment's Volume Profile Indicator shows an uptick in volume near the newly established low. At slightly over $43 billion worth of transactions, the $18,667 has $1 billion more transactions than the June 18 low at $17,593, which had $42 billion. This is an anomalous signal as the June 18 low became pivotal on the summertime floor, providing support before a 40% rally occurred.

[09.06.48, 08 Sep, 2022]-637982561166763172.png)

Santiment’s Price & Volume Indicators

Is smart money pulling a fast one?

A rebound could occur in the coming days. Key levels of interest are a 38.2% Fibonacci level at $21,850. The FIB level is derived from the 2020 lows of $3,850 to the 2021 swing highs at $69,000. Additionally, the 200-week moving average is currently positioned at $23,040. This gives BTC aviation space up to 20%.

Invalidation of the bullish thesis will be a breach below the June 18 swing low at $17,592. Traders should also wait for a confirmation signal, such as a bullish cross of moving averages or a definitive daily close over $20,450 for a safer entry to a highly risky countertrend idea.

BTC USDT 3-Day Chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price has potential

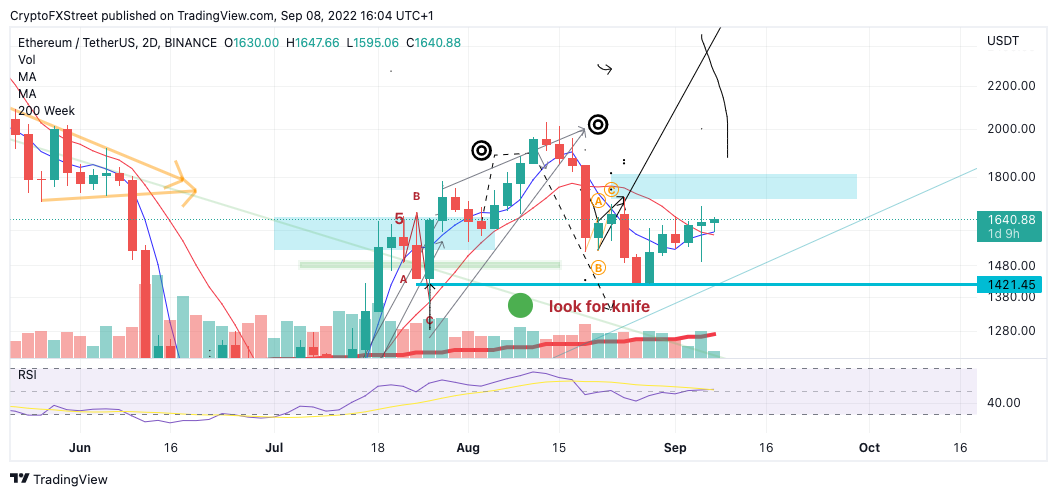

Ethereum price currently auctions at $1,634 as the bulls have rebounded from the crypto downslide experienced on September 6. The bulls managed to print a 2-day doji candle with relatively low volume, suggesting there are still bulls in the market anticipating higher prices. Additionally, the settlement at $1,630 was established above the colliding 8- and 21-day simple moving averages.

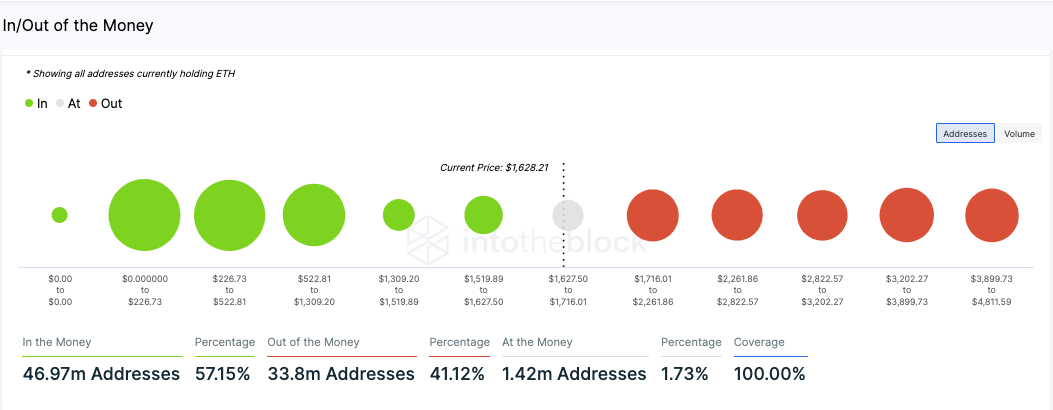

Into theblock's In/Out of the Money indicator confounds the idea that the Ethereum price could rally higher. According to the indicator, about 47 million addressed are currently in the money, meaning they bought in at an average price lower than the current market value. The indicator shows the next significant selling pressure could arise near $1,900, where nearly 6.74 million addresses are out of the money, having bought the Ethereum price with an average price of $1,936.

Into the Block’s In/Out of the Money Indicator

In theory, the indicator suggests fewer investors in the market are feeling the pressure to break even. This subtle bullish cue could enable a continuation of the summertime uptrend. If the bulls can hurdle the $1,900 resistance, the $2,200 zone will be the next key level of interest, providing 30% of potential gains from the current Ethereum price.

Combining these factors, a short-term pullback should not be ruled out for the decentralized smart contract token. A close above $1,735 could be the catalyst to induce the bullish move. Invalidation of the bullish thesis, however, depends on $1,250 remaining unbreached.

ETH USDT 3-Day Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team.

Ripple price can rebound higher

Ripple's XRP price could make a case for a more countertrend pullback. Since the final days of July, the digital remittance token continues to descend in wedging-like formation. Amongst chart pattern traders, the wedge could be a gesture of a weakening downtrend.

On September 7, the XRP price produced a strong rebound since breaching the $0.31 barrier earlier in the week. The current 5% pullback is the largest retracement within the wedge relative to each decline prior.

XRP USDT 3-Day Chart

Ripple's XRP price currently auctions at $0.33. The Relative Strength Index shows subtle bullish divergence on the 3-day chart, which may be an overlooked cue amongst the traders using smaller timeframes. Additionally, the 8-day exponential and 21-day simple moving Averages collide near the current price action.

If the bulls can produce a 3-day candle close above the colliding indicators, an additional rally to $0.36 could occur. Such a move would result in a 10% rebound from the current XRP price.

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.