Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Retail watches from the sidelines with a bias for shorts

- Bitcoin price could clear $73,777 peak as BTC bulls resurface.

- Ethereum price might fall 10% before next leg up as ETH RSI teases with sell signal.

- XRP price could lose $0.6000 threshold as Ripple bulls fail to show up.

Bitcoin (BTC) price is showing strength as markets head into the Easter holidays. As it rises, altcoins are following suit, with Ethereum (ETH) and Ripple (XRP) prices posting almost similar gains. Meanwhile, there remains an unfilled CME Gap, with a lot of liquidity also resting above and below BTC price.

#Bitcoin CME Gap remains open as price is moving higher.

— Daan Crypto Trades (@DaanCrypto) March 28, 2024

Shows you why it's important not to fixate on these too much, it can really throw you off.

Fact is, during bull markets, gaps get created and often don't get closed.

Same in bear markets with gaps above that sometimes… https://t.co/2DP0Cgq1U1 pic.twitter.com/IGNQ2p0NkO

Analysts are now awaiting some action, one side or the other as the market remains rather inactionable as Bitcoin price oscillators within a narrow range of between $70,700 and $68,240. With this outlook, retail continues to watch from the sidelines with a subtle bias for short

Also Read: Bitcoin price holds above $70K as old whales sell BTC to TradFi, not retail

Bitcoin bulls haul BTC above $70,000

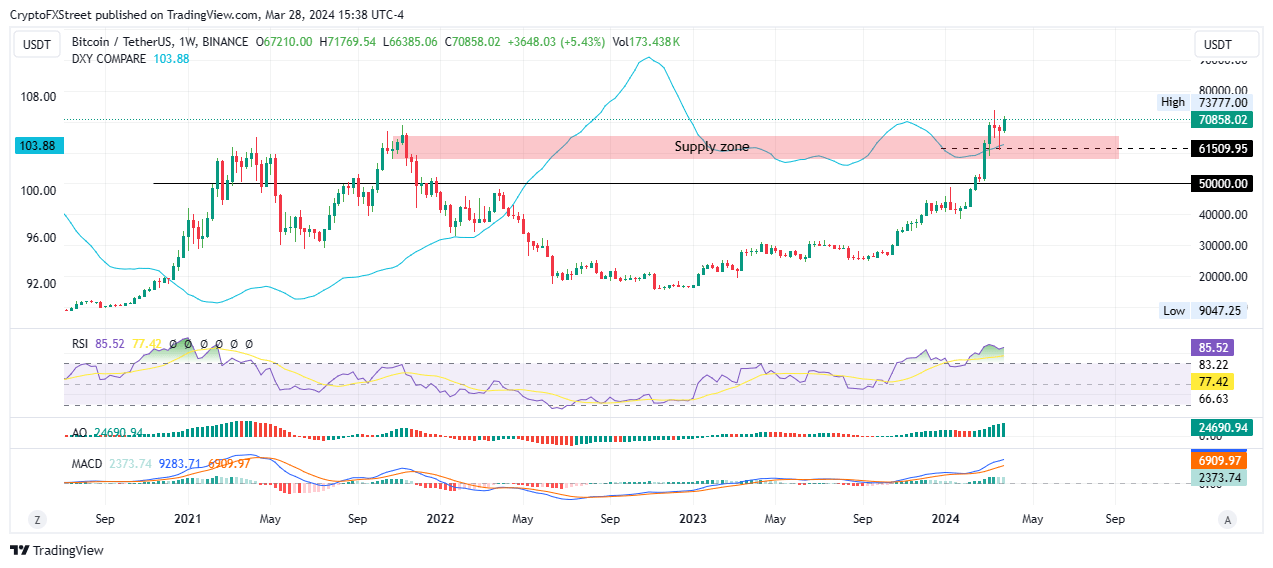

Bitcoin price is well above $70,000 as BTC bulls resurface. However, without any significant catalyst to drive the BTC market, traders have a bias for shorts, anticipating a correction before the next leg up.

While this is plausible, it may be delayed as technicals flash bullish. First, the Relative Strength Index (RSI) remains well above the 50 midline, with higher highs amid rising momentum. Both the Awesome Oscillator and the Moving Average Convergence Divergence (MACD) are showing green histograms, suggesting a growing bullish sentiment.

If the bulls increase their buying pressure, BYC could extend to recover its peak at $73,777, with the potential to clear this roadblock and record a higher high.

BTC/USDT 1-week chart

On the flip side, traders starting to cash in now could cut the rally short for Bitcoin price, causing a retraction. If it breaks and closes below the mean threshold of the supply zone at $61,509, it could open the drains for an extended fall.

Also Read: Bitcoin extends retreat from $69K as old whales shift their holdings to new whales

Ethereum price likely to correct 10% before a pivot

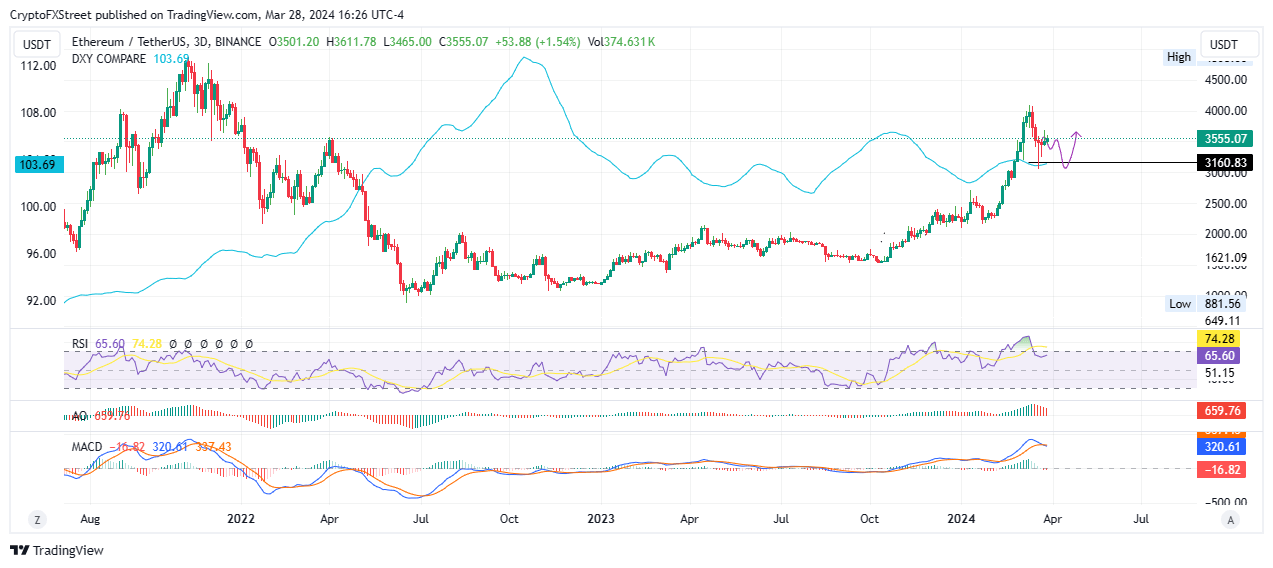

With Bitcoin price still stalling, Ethereum price could drop around 10% to $3,160 before a possible recovery. For one, the MACD has crossed below the signal line, while the AO histograms are red hot to show a weakening bullish trend.

ETH/USDT 3-day chart

On the other hand, the bulls could still haul Ethereum price north, considering the RSI is rejecting further downside. Increased buying strength could see ETH price extend to take back the $4,000 psychological level.

Also Read: BlackRock CEO optimistic on Ethereum ETF, but GSR analyst lowers approval odds to 20%

Ripple price could drop below $0.6

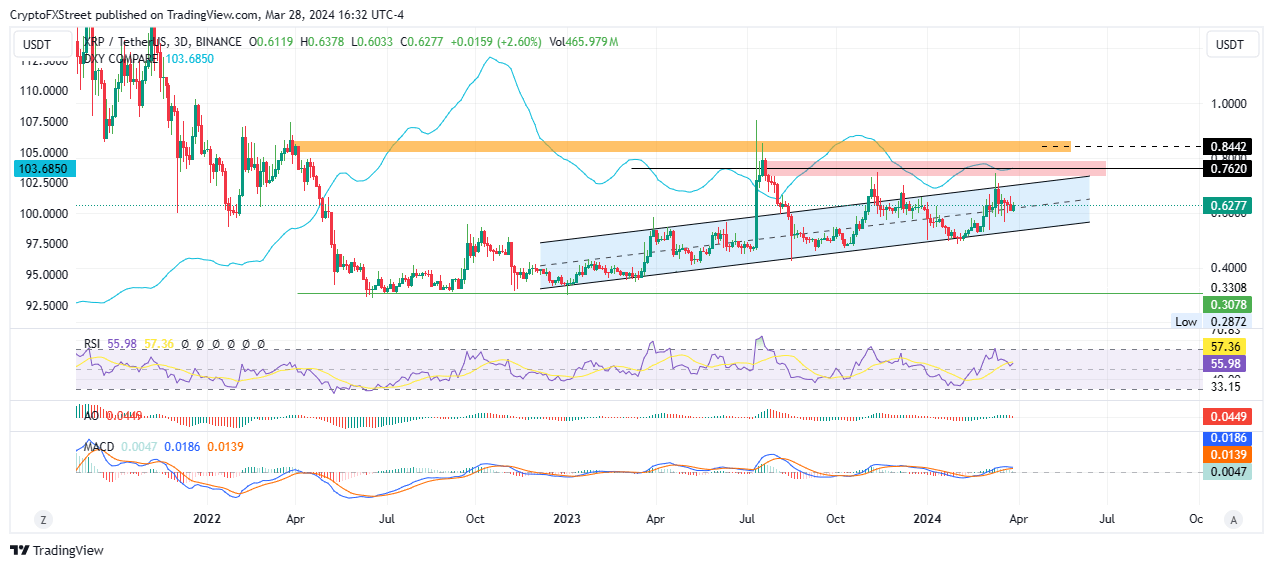

Also pegged to the show of strength in the BTC market, weakness in Bitcoin price could influence XRP price, causing the payments token’s market value to drop below the $0.6000 psychological level and potentially to the bottom of the ascending parallel channel.

XRP/USDT 3-day chart

However, enhanced buying strength could set XRP price in discovery mode, sending it high to breach $0.7000 level. While a move above $0.7620 would be a good sign, the most desirable flip would be that involving the $0.8442 support.

Also Read: XRP price stuck below $0.65 resistance, Ripple lawsuit could suffer from Coinbase defeat

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.