Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Retail traders still in disbelief

- The Bitcoin price rose by 10% and now exceeds the previous range.

- Ethereum price rallies 20% this week and could gain an additional 20%.

- Ripple price has the potential to rally higher.

The crypto market's rally may have shaken up retail traders. Currently, the technicals hint at more uptrend movement in the days to come.

Bitcoin price pumps

Bitcoin price currently trades at $20,596 as the bulls have produced an impressive 10% rally during the final week of October. The move north was catalyzed by the 8-day exponential moving average (EMA) crossing above the 21-day simple moving average on Tuesday, October 25.

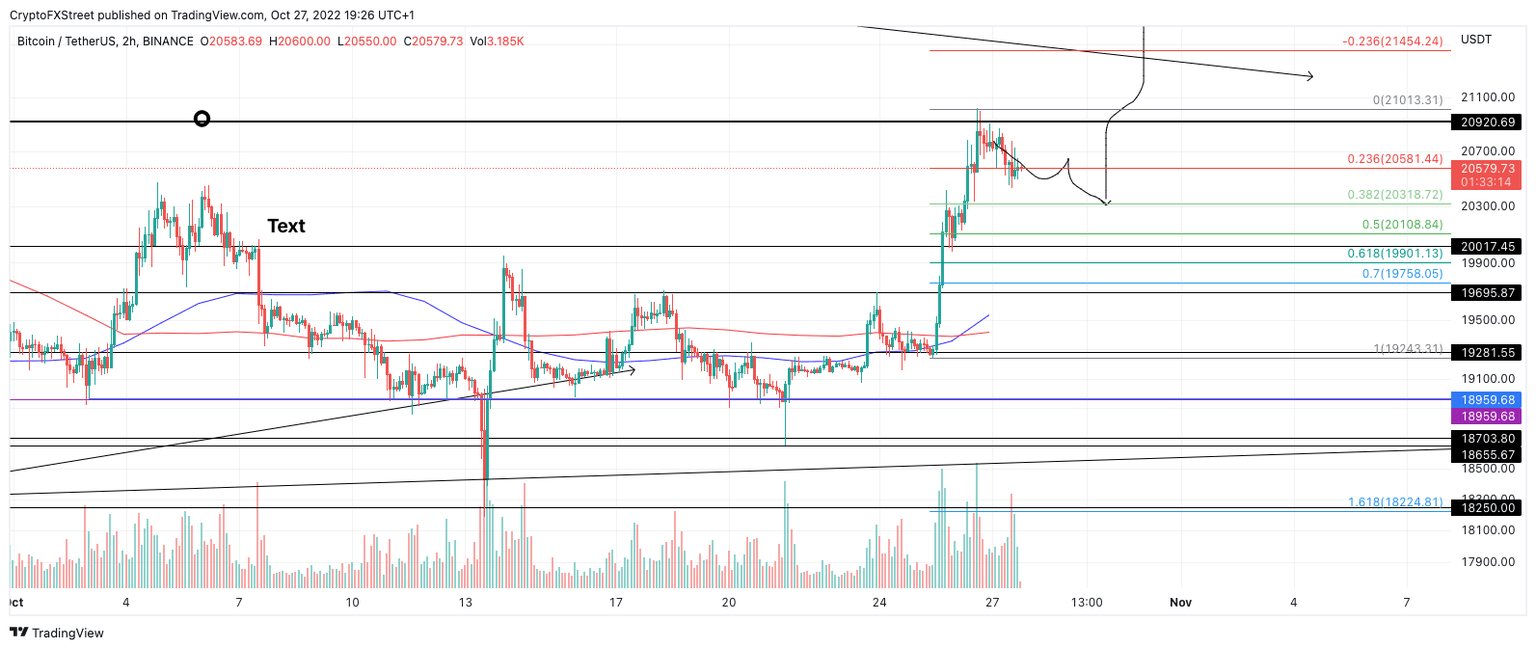

Currently, the bulls are displaying strength as the profit-taking consolidation remains above October’s trading range. A Fibonacci retracement tool surrounding the strongest part of the rally shows the current auctioning price as just a 23.6% retracement. If the market is genuine, bullish BTC price should fall into the 38.2% Fib level at $20,318 before and immediately rally higher. The next bullish target would be liquidity zones near $21,400 and the psychological $22,000 level.

Invalidation of the bullish outlook could occur if the bears cause a breach into the previous range, presumably at $19,800. In doing so, a further decline toward the $19,200 liquidity zone could result in a 7% decrease from the current market value.

BTC/USDT 2-Hour Chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price blows past bears

Ethereum price has stunned the market as the bulls have pulled off a 20% rally in less than a week. Ethereum, the decentralized smart-contract token, now auctions well above the previous range while volume tapers during the current profit-taking consolidation.

Ethereum price is currently trading at $1,550. A Fibonacci retracement tool surrounding the strongest part of the rally shows Ethereum's current price as a shallow retracement, similar to Bitcoins'. A breach of the 38.2% Fib level at the $1,487 price level could be a great place for sideline bulls to enter the market.

The next bullish targets lie between $1,770 and $1,840, which would be an additional

15-20% increase in market value.

Invalidation of the bullish thesis could arise if the bears can tag the $1,400 level. The Ethereum price could be sucked back into the previous trading range and potentially fall near the lows of around $1,270. Such a move would result in an 18% decline from the current market value.

ETH/USDT 1-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

XRP price back to $0.50

XRP price currently auctions at $0.47 as the bulls have managed to breach the 8-day exponential moving average and are now testing it as support. On the week, the digital remittance token is up 5%. At the time of writing, the technicals suggest XRP has one more upswing near the $0.50 zone before facing stronger bearish pressure.

The next hurdle for the bulls to accomplish will be the 21-day simple moving average, currently positioned at $0.48. The Relative Strength Index confounds the idea of Ripple's uptrend potential as the indicator hovers above both moving averages in supportive bullish territory.

XRP/USD 8-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.