Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Patience is key until markets hit this level

- Bitcoin price continues to sell-off and could sweep the previous weekly low at $18,097.

- Ethereum price could revisit the $1,191 to $1,234 demand zone if BTC continues to tumble.

- Ripple price continues to sink as sellers aim for a retest of the $0.397 support level.

Bitcoin price shows a steep sell-off over the last 24 hours that has undone the gains seen between September 21 and 24. This correction has caused Ethereum, Ripple and other altcoins to crumble as well.

Going forward, investors need to be cautious and expect this trend to continue until BTC finds a stable support level to reverse.

Bitcoin price continues to search

Bitcoin price is hovering around the weekly open at $18,745 and is likely to grapple with it until sellers knock it down. A sweep of the previous weekly low at $18,095 is a good place for BTC to reverse, but it could continue sliding lower until the June 18 swing low at $17,593 is swept.

One of these levels will likely trigger a recovery in Bitcoin price in the coming week. Furthermore, secondary confirmation of this upcoming sell-off can be spotted if the Relative Strength Index (RSI) drops below the 43 to 46 support area.

A reversal, however, could see Bitcoin price climb back to $20,737, which is the first hurdle. Beyond this level, BTC buyers could disappear at the 200-week Simple Moving Average at $23,473.

BTC/USD 8-hour chart

While things might seem bearish for Bitcoin price in the short-term, this downswing could turn into a nightmare if BTC breaks below the $17,593 level. A flip of this foothold into a resistance barrier will invalidate the bullish thesis and trigger a correction to $15,500, taking altcoins down with it.

Ethereum price awaits BTC’s signal

Ethereum price continues to linger around the $1,200 to $1,300 support area, which is crucial for bulls to defend. If the selling pressure spikes due to BTC taking a hit, however, ETH could be in trouble.

A breakdown of the said support could result in a retest of the $1,080 foothold, which is a good place to accumulate and is also close to a psychological level. Therefore, investors should consider the possibility of Ethereum price revisiting $1,000 in the near future, especially if BTC continues to tank.

ETH/USD 1-day chart

Regardless of the ongoing sell-off in Bitcoin price, if Ethereum price flips the $1,730 hurdle into a support level, it would trigger premature rally. This development would also indicate that the buyers are back and are likely to retest the $2,000 psychological level next.

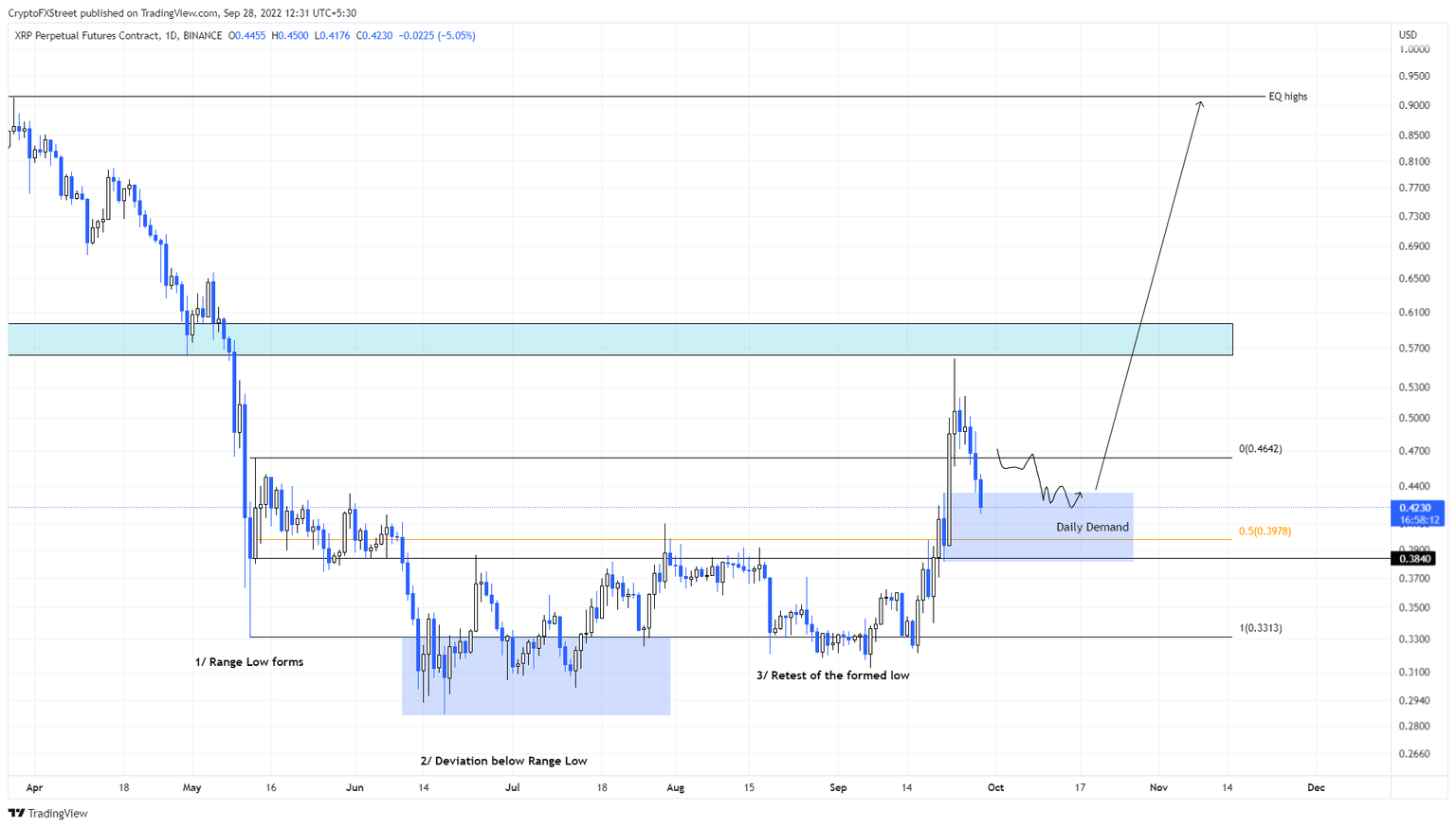

Ripple price prepares for its next move

Ripple price has crashed 25% since its local top at $0.559 and is likely to continue until Bitcoin finds a stable support floor. This might ideally happen after a bounce off the $0.397 level, which is the $0.331 to $0.464 range’s midpoint.

A retracement to this level, therefore, would be a mean reversion play and a good place for sidelined buyers to accumulate XRP at discount.

A bounce off this level combined with positive sentiment in the market could see XRP price return to $0.559 and even attempt to surpass the $0.561 to $0.596 resistance box.

XRP/USD 1-day chart

While things are looking up for Ripple price from a swing trader’s perspective, investors should pay close attention to the $0.381 to $0.433 demand zone. A breakdown of this level will create a lower low and flip the midpoint acting as a support level into a resistance barrier.

This development could see XRP price return to the range low at $0.331.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.