Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Mexican central bank sidesteps crypto adoption, while BTC consolidates

- Banxico, Mexico’s central bank, revealed in a statement on June 28 that offering crypto services would violate its regulations.

- This announcement came after billionaire Ricardo Salinas Pliego said that his bank would accept BTC.

- Bitcoin price consolidates before establishing a clear trend, while ETH and XRP follow suit.

Bitcoin price has been in a massive consolidation phase showing no bias whatsoever. On the other hand, Ethereum price shows an affinity to move higher but might encounter a minor pullback before the upswing begins. The same holds for Ripple price, which is contemplating a rally.

Mexican Central Bank stifles BTC adoption

Mexican billionaire Ricardo Salinas Pliego stated on June 27 in a tweet that his bank is working on accepting Bitcoin.

Soon after, the Mexican Central Bank, along with the Finance Ministry and the country’s banking regulator, issued a joint statement stating,

Virtual assets do not constitute legal tender in Mexico nor are they currencies under the current legal framework.

The announcement further read,

The country’s financial institutions are not authorized to carry out and offer to the public operations with virtual assets, such as Bitcoin, Ether, XRP and others… Those who issue or offer said instruments will be subject to the applicable sanctions.

While Mexico is not as welcoming as El Salvador, Bitcoin price seems to be consolidating, anticipating a volatile move. Ethereum and Ripple are likely to follow suit if this happens.

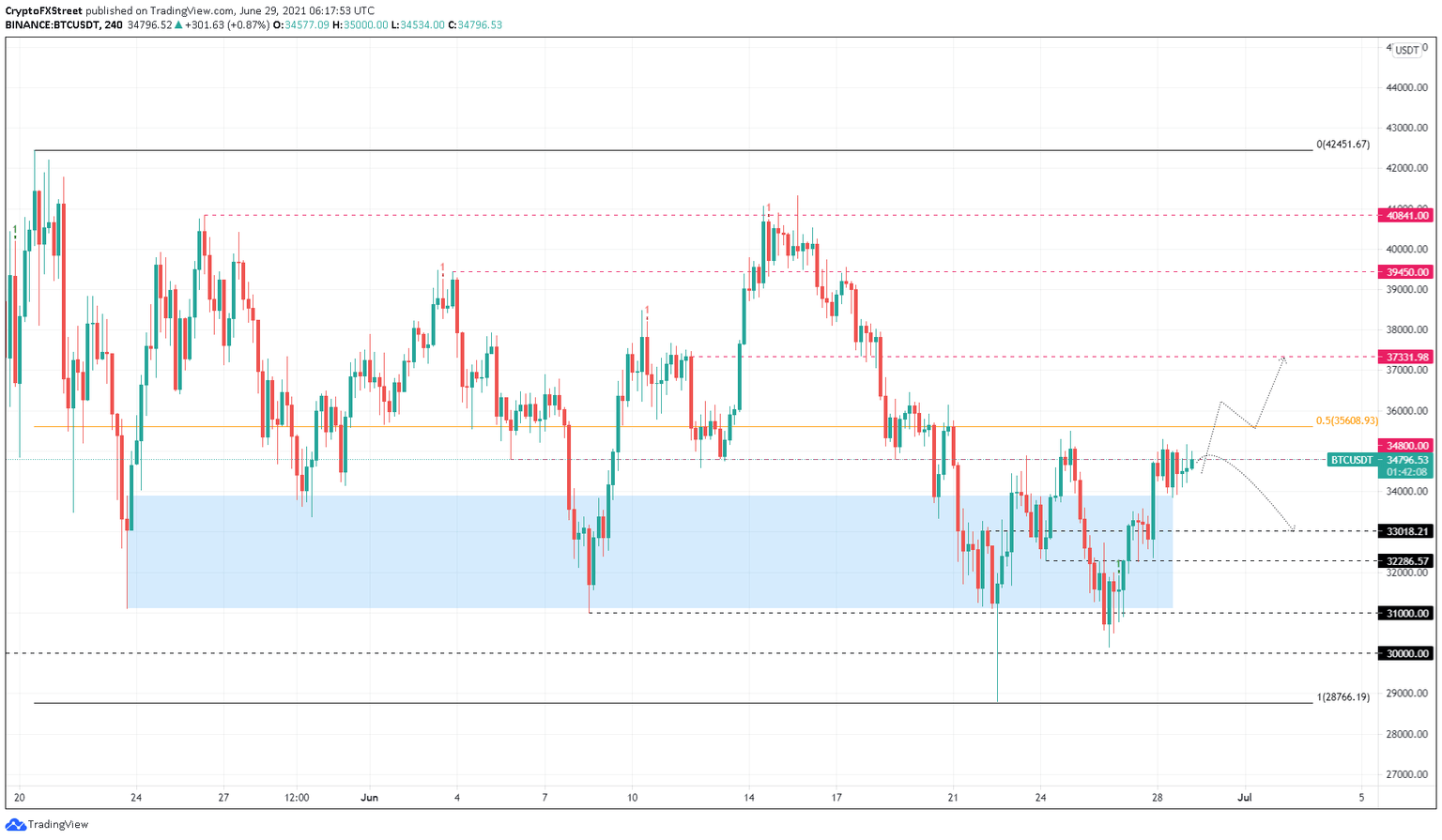

Bitcoin price struggles to establish bias

Bitcoin price rallied 18% from June 26 to date but has failed to tag the swing high at $35,500 set up on June 25. A sweep of this swing point will indicate that a pullback is likely. However, a decisive 4-hour candlestick close above $35,500 or $35,608, aka the 50% Fibonacci retracement level, would signify the start of an uptrend.

Therefore, investors need to be cautious of the indecisive state of BTC right now.

However, the likely course of action for the flagship crypto would be a sweep of $35,500, followed by a 7% drop to the $33,018 support level. In some cases, the sell-off could extend up to $32,286.

These pullbacks will form the foothold from which a new uptrend is likely to evolve. Therefore, market participants can expect an 8% rally to the 50% Fibonacci retracement level at $35,608.

If the buyers slice through the said barrier, BTC might continue the climb to the subsequent supply level at $37,331.

BTC/USDT 4-hour chart

On the flip side, if Bitcoin price fails to hold above $32,286, it will invalidate the bullish outlook and trigger a 4% crash to $31,000.

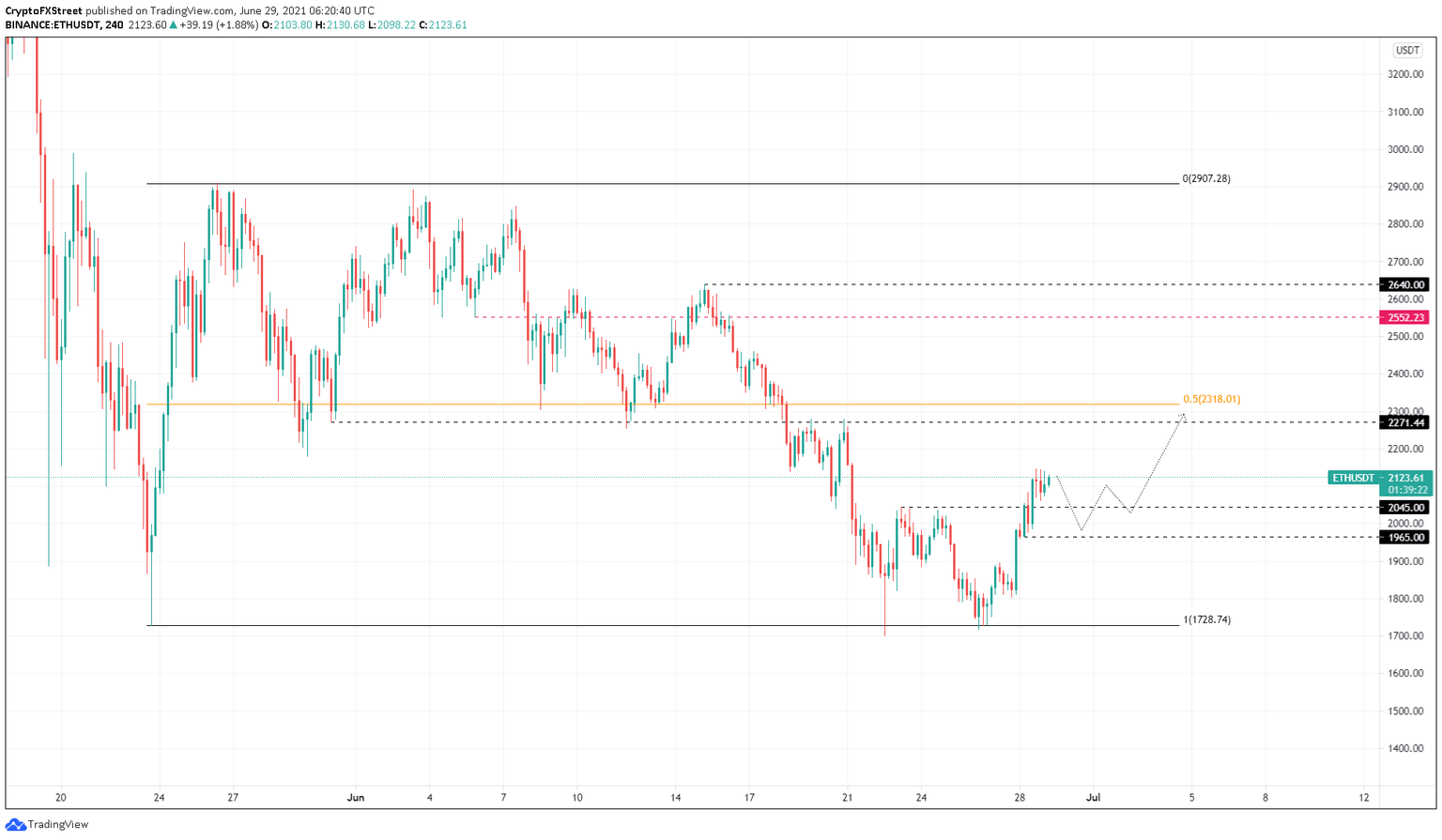

Ethereum price to follow pioneer crypto

Ethereum price is contemplating a pullback since it breached through the equal highs at $2,045 on June 28. Now, a correction that retests $2,045 or $1,965 seems likely. In a highly bearish condition, the dip might extend to $1,804, the swing low set up on June 27.

Either way, these retracements help buyers accumulate ETH at a discount, preparing to move higher. Therefore, investors can expect a spike in buying pressure that catapults Ethereum price to $2,271 or the 50% Fibonacci retracement level at $2,318.

ETH/USDT 4-hour chart

Regardless of the bullishness witnessed in BTC price, if Ethereum price fails to reclaim $1,804, it will invalidate the bullish scenario and trigger a steeper downtrend.

In that case, ETH might revisit the range low at $1,728.

Ripple price reclaims crucial level

Ripple price has sliced through the range low at $0.65, suggesting a bullish presence while the rest of the market is consolidating. However, there is a possibility that the recent run-up could end up like the attempt on June 24, so investors need to exercise caution.

Considering how BTC and ETH look primed for a pullback, XRP price might also head lower to retest $0.596 or $0.581 before successfully flipping the range low at $0.65 into a support level.

If this were to happen, XRP price would have an opportunity to ascend 15% to tag the 79% Fibonacci retracement level at $0.745.

However, in a highly bullish condition, if the bid orders continue to pour in, Ripple will likely retest the 70.5% Fibonacci retracement level at $0.783.

XRP/USDT 4-hour chart

On the other hand, if XRP price slices through the support levels at $0.596 and $581, it will invalidate the bullish scenario and signal a solid affinity to continue the sell-off.

In such a case, Ripple will likely revisit the range lows at $0.509 or $0.496.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.