Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Markets rarely fall in a straight line

- Bitcoin price briefly tags the mid $18,000 level.

- Ethereum price shows the possibility of a recovery rally.

- Ripple price shows extremely oversold signals hinting at a strong bearish presence.

The crypto market shows evidence of a strong downtrend underway. Still, markets rarely fall penny-from-Eiffel style without countertrend pullbacks along the way.

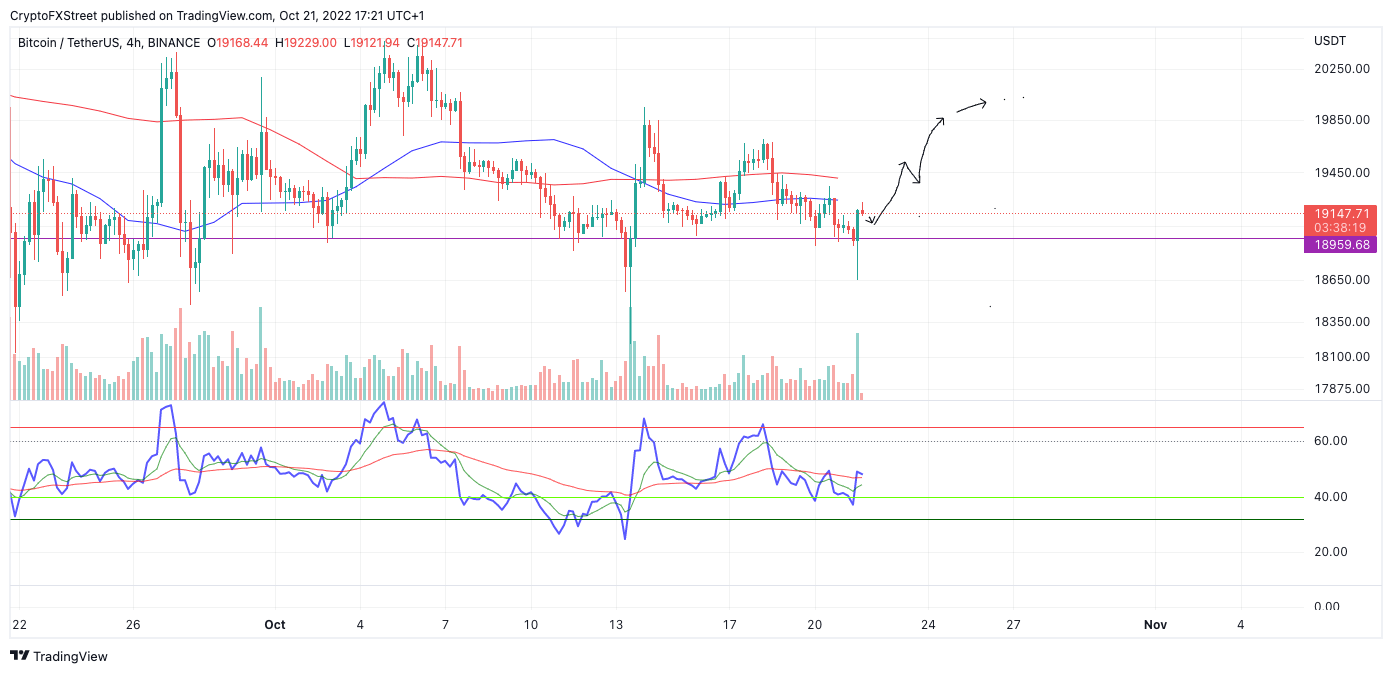

Bitcoin price shows bounce-worthy signals

Bitcoin price currently trades at $19,073. After being rejected from the 8-day Exponential Moving Average (EMA) just a day earlier, the peer-to-peer digital currency fell to a low at $18,650. The bulls immediately stepped in to scoop the BTC price, causing a 2% rebound during the New York session.

An influx of volume is shown on smaller time frames while the BTC price has bounced from the oversold territory into healthy supportive bounds. If market conditions persist, the bulls should be able to test the 21-day Simple Moving Average (SMA) at $19,400; if the momentum maintains strength near the first target, a rally toward $20,000 could occur.

Invalidation of the short-term thesis is a breach below the swing low at $18,650. If the bears happen to re-tag that level, an additional plummet toward the October 13 lows at $18,300 will likely be underway. Such a move would result in a 5% loss from the current Bitcoin price.

BTC/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

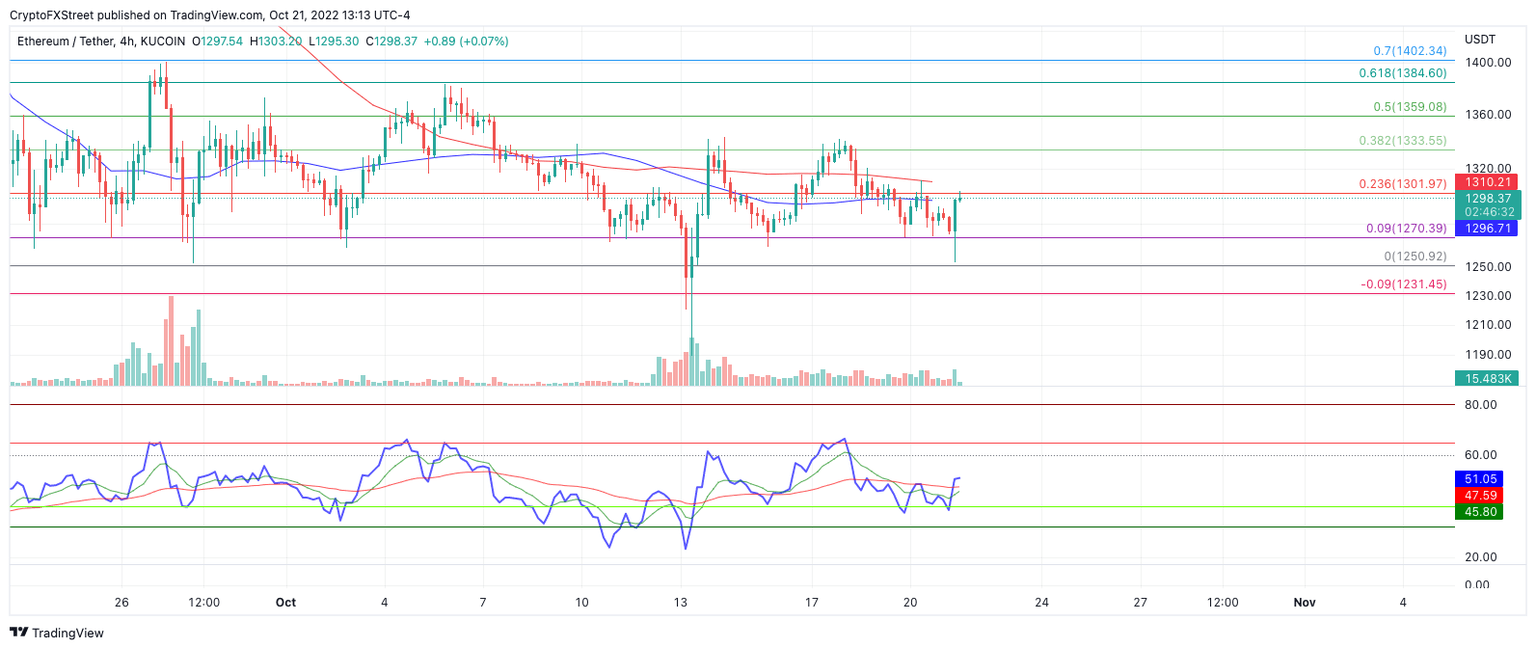

Ethereum price has room to climb

Ethereum price has been reacquainted with the $1,250 price level on October 21, 2022. Ethereum, the decentralized smart contract token, fell into the mid $1,200 level during the New York session and abruptly propelled higher.

Ethereum price auctions at $1,296. The countertrend move has shown and was catalyzed by a subtle bullish divergence on the Relative Strength Index. ETH’s price is now back above the RSI’s moving averages, which added additional resistance prior to the fall.

Combining the indicators’ narratives could suggest the decentralized smart contract token is ready to bounce and recover some of this week’s losses. Probable targets would be liquidity levels between $1,360 and $1,385.

The countertrend invalidation level is below the October 13 swing low at $1,189. Any attempt to retest the low will spell bad news for Ethereum. If the invalidation level is tagged, the bears could induce a cataclysmic sell-off targeting the summer lows at $880. Such a move would result in a 30% decline.

ETH/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

XRP price is extremely oversold

XRP price currently auctions at $0.45 as the digital remittance token remains submerged during the third trading week of October. Although a bounce is likely to occur near the current levels, the larger trend seems to be pointing to lower targets for the coming weeks.

The bears have produced a very large bearish engulfing candle, which breached through the largest bullish candle in the previous trend established on September 22. The Relative Strength Index is stair-stepping within oversold territory, compounding the notion that the market bottom is not yet secure.

Invalidation of the bearish downtrend is a breach above the October 24 swing high at $0.52. If the bulls manage to reconquer the $0.52 barrier, an additional rally targeting September highs at $0.56 would be reasonable. Such a move would result in a 20% increase from the current XRP price.

XRP/USD 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.