Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Markets pause before continuing the relief rally

- Bitcoin price is taking a U-turn after sweeping the range high at $31,493.

- Ethereum price is likely to retrace to the $1,813 support level before triggering the next leg-up.

- Ripple price is also looking to pullback to $0.389 to recuperate and catalyze a move to $0.455.

Bitcoin price seems to have triggered a relief rally that is going to revisit significant levels, formerly critical in catalyzing the sell-off. Some altcoins have already started their run-ups, but for Ethereum and Ripple a minor retracement seems likely before they start their upswings.

Bitcoin price prepares for a quick rally

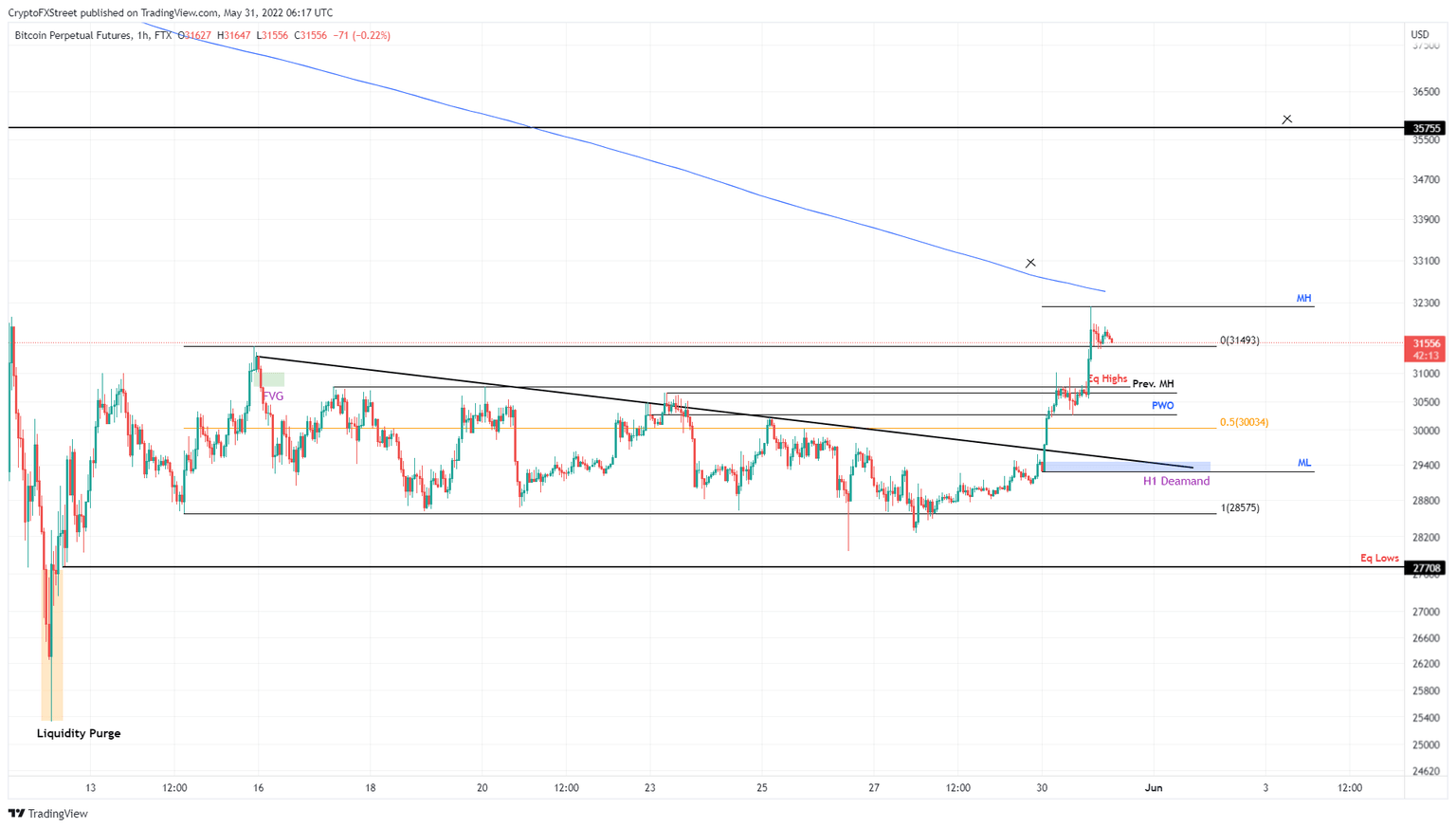

Bitcoin price swept the upper limit of the range, extending from $28,575 to $31,493 on May 30. This move comes after multiple dips below the range low over the last week. As BTC trades above the upper limit, a pullback is on its way.

This retracement will likely sweep or retest Monday’s low at $29,288, allowing bulls to recuperate. Such a development will mark the end of the correction and indicate the start of the next bullish leg that will propel Bitcoin price to 200 four-hour Simple Moving Average at $32,507.

BTC/USD 1-hour chart

On the other hand, if Bitcoin price breaks below $27,708, it will create a lower low and invalidate the bullish thesis.

Ethereum price follows along

Ethereum price pierced the 100 four-hour SMA at $1,951 as it rallied 13% between May 29 and 30. This run-up, however, is facing exhaustion, suggesting that a pullback is on its way. While the 100 four-hour SMA will cushion the initial selling pressure, a breakdown of this level will knock ETH down to $1,813.

This move will allow sidelined buyers to scoop ETH at a discount, catalyzing a minor rally for Ethereum price to retest the May 16 swing high at $2,164.

ETH/USD 4-hour chart

While things are looking up for Ethereum price, a four hour candlestick close below $1,731 will invalidate the bullish thesis by producing a lower low.

Ripple price is ready for a take-off

Ripple price action resembles Ethereum’s as both are promptly following Bitcoin due to the underlying correlation. As BTC retraces, investors can wait on the sidelines to accumulate XRP at a discount.

BYC’s pullback is likely to knock Ripple down to retest the $0.389 support floor. A bounce off this level or the subsequent foothold at $0.379 is likely to cause a resurgence of buyers and a kick off a minor uptrend as a result

Investors can expect the rally to visit the $0.455 hurdle from a conservative standpoint.

XRP/USD 4-hour chart

Regardless of the bullish retracement, a sudden spike in selling pressure that produces a four-hour candlestick close below $0.371, will invalidate the optimistic outlook.

Such a move could further crash Ripple price to $0.345.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.