Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Lack of weekend love recalls crypto bears

- Crypto market flashes red in absence of weekend love.

- BTC sellers continue to lurk around $10,800 for the fourth straight day.

- Ethereum is the worst performer on the week vs. Bitcoin and Ripple.

The most favorite crypto coin, Bitcoin, continues to face rejection around 10,800 levels while trading around the $10,650, having briefly breached the $10,600. Ripple is the main laggard when compared to its peers, Bitcoin and Ethereum so far this Sunday. However, on a weekly basis, Ethereum emerges as the worst performer, down over 6%. The total market capitalization of the top 20 cryptocurrencies now stands at $341.64 billion, as cited by CoinMarketCap.

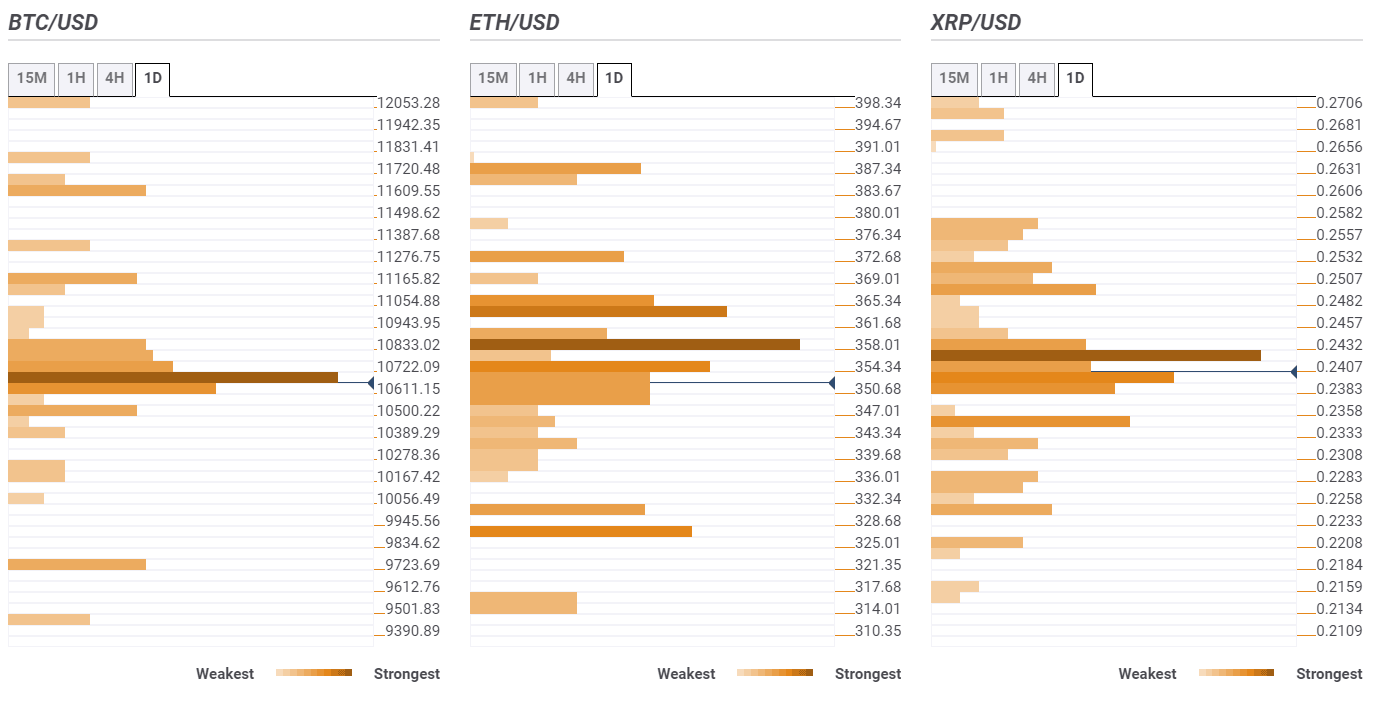

How are these three coins positioned technically starting out a fresh week? Let’s take a look at FXStreet’s Confluence Detector tool to identify key resistance and support levels.

BTC/USD: Bearish bias intact while below $10,833

Bitcoin holds the lower ground while battling the key support around $10,610 region, where the Pivot Point 1D S1, previous day and month lows coincide.

Should the above support give way, the next soft cushion at $10,450 could come into play. That level is the convergence of the Pivot Point 1D S1, Fib 38.2% 1W and SMA100 1D.

On the flip side, the bullish momentum will regain traction only a firm break above the strong resistance at $10,833, which is the intersection of the previous day high, Fib 23.6% 1D and SMA200 4H.

Buyers will then target the next relevant barrier at $11,150, the confluence of the SMA50 1D and Pivot Point 1W R1.

ETH/USD: Path of least resistance is down

Ethereum stalled its three-day recovery mode, having faced robust resistance at $362, which the intersection of the previous day high, Pivot Point 1M S1 and Fib 61.8% 1W.

Acceptance above the latter is critical to take on the next significant barrier that sits at $365.50, the meeting point of the previous year high, SMA100 4H and Pivot Point 1D R2.

To the downside, a dense cluster of healthy support levels is aligned around $348, which is the convergence of the Fib 61.8% 1D and previous low on 4H.

The ETH bears are likely to face a tough time extending its control amid a stack of minor support levels. Powerful support at $330 will likely limit the downside. That level is the confluence of the SMA100 1D and Fib 23.6% 1W.

XRP/USD: Rebounds to $0.2400 but not out of the woods yet

Ripple tested the SMA100 1D support near $0.2392 over the last hours this Sunday. However, the XRP bulls fought back control and regained the $0.2400 level.

The No. 4 coin now faces immediate resistance at $0.2420, where the Fib 61.8% 1D intersects with the previous high on 4H. Further north, the daily high of $0.2448 could be put at risk.

Alternatively, should the renewed upside lose momentum, the sellers could likely retest the daily low of $0.2374.

Acceptance below that cushion could open floors towards the next significant support at $0.2345, which is the convergence of the Pivot Point 1D S2, Fib 161.8% 1D and SMA5 1D.

See all the cryptocurrency technical levels.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.