Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Knife Catching 101, Wiggle Room and Papercuts

- Bitcoin price is in profit and continues to display bullish signals. However, things could change rapidly.

- Ethereum price looks poised to rally higher. Risk has been reduced as per the bearish divergence on the Relative Strength Index.

- Ripple price is at a critical point in the market. No favorable setups at the current time.

The crypto market has provided dozens of profitable opportunities for traders willing to engage. At the current time, the market shows potential for more upside gains. Still, qualifying when to call Crypto Season over will separate profitable traders from the brave who could not succeed and the spectators who could not be brave.

Bitcoin price maintains a bullish stance

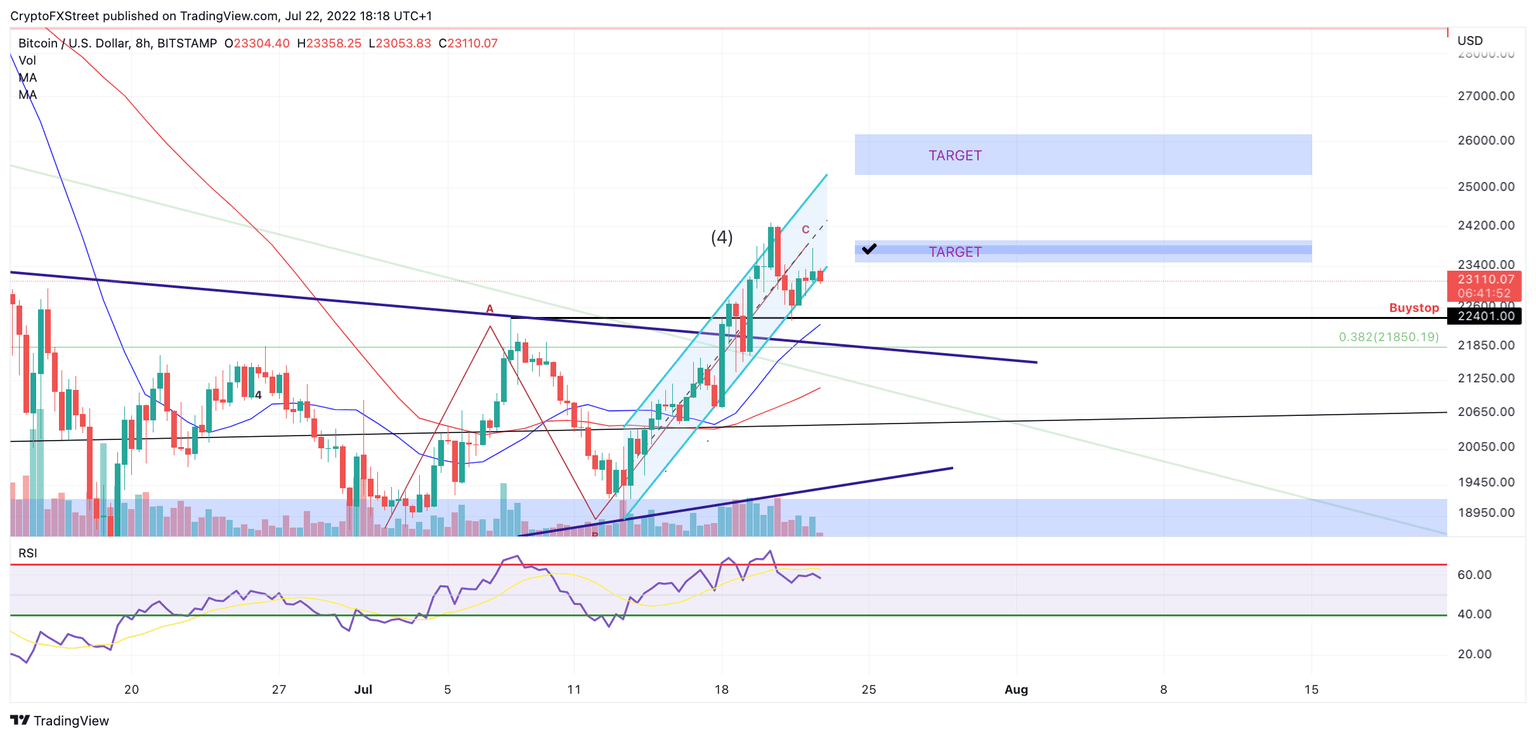

Bitcoin price currently trades at $23,608. The peer-to-peer digital currency maintains a macro bullish stance and proves that more short-term gains are underway. Short-term targets reside in the $25,800 level, while a breach of the $22,000 could be the catalyst to end the short-term uptrend scenario.

Bitcoin price provides bullish confluence as the peer-to-peer original cryptocurrenxy hovers over a macro 38.2% Fibonacci retracement level. The Fib tool surrounds the BTC price action, from pandemic lows at $3,500 to the all-time highs at $64,000.

Traders from Monday's forecast are now in profit 2x the initial risk. Bulls looking to join the trend are likely to experience papercuts and liquidity hunts along the way. The congestion displayed is expected before an influx of volatility enters the market. The choppy price action will either propel an additional rally towards $25,800 or a decline below $22,000, which most sidelined investors may be hoping for.

Invalidation of the uptrend scenario has increased to $22,000 to reduce risk. If $22,000 is breached, the bears could re-route south, targeting $19,600 and possibly $17,500 for up to a 25% decrease in bitcoin market value.

BTC/USDT 8-Hour Chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price has wiggle room to fall before more gains

Ethereum price currently trades at $1,580, just above Ethereum's first target zone from July 17 bullish thesis. Traders are now in profit 1x their risk. There is an uptick in bearish volume on intra-hour time frames, which could be a hopeful indicator for sidelined investors.

Still, the slope of the current incline is quite steep, leaving enough wiggle room for smart money to go for one more liquidity hunt as low as $1,290 without invalidating the bullish midterm thesis. A Fibonacci retracement indicator surrounding the steep incline confounds the wiggle room idea with a 50% fib level at $1,293. The Relative Strength Index also shows subtle bearish divergence near the current $1,580 price level, which warrants the idea of a possible liquidation hunt.

Thus, placing an additional entry at the current time is unfavorable. A knife-catching opportunity could present itself within the $1,300-$1,350 zone in the coming days, with a bullish target in the $1,900 after the plunge. Invalidation of the uptrend scenario is now a breach below $1,270.

ETH/USDT 8-Hour Chart Wiggle Room

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Ripple price still has an unclear mid-term trajectory

Ripple price breaches a short-term ascending trend line. The digital remittance token has not displayed clear evidence to warrant a favorable bullish trade setup.

The Relative Strength Index shows a double-top pattern accompanied by bearish divergence on the 8-hour chart. It may be best for traders to consider other opportunities in the crypto market as the midterm trajectory is still unclear.

Invalidation of the bearish thesis is a breach above $0.4807. A breach above the invalidation barrier could promote a favorable trading environment for bulls to target $1.20 for up to a 233% increase from the current Ripple price.

XRP/USDT 8-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.