Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Inflation's Repreve 2023

- Bitcoin price experience resistance near the $22,000

- Ethereum price still has the potential to rally tours $2100 based on current price action

- Xrp price may be forming an interim reversal pattern which could trigger a rally toward $0.44.

The Crypto Market is showing signs of retaliation after last week's market decline. Traders should consider watching price action closely, as volatility could be on the uptick in the coming days.

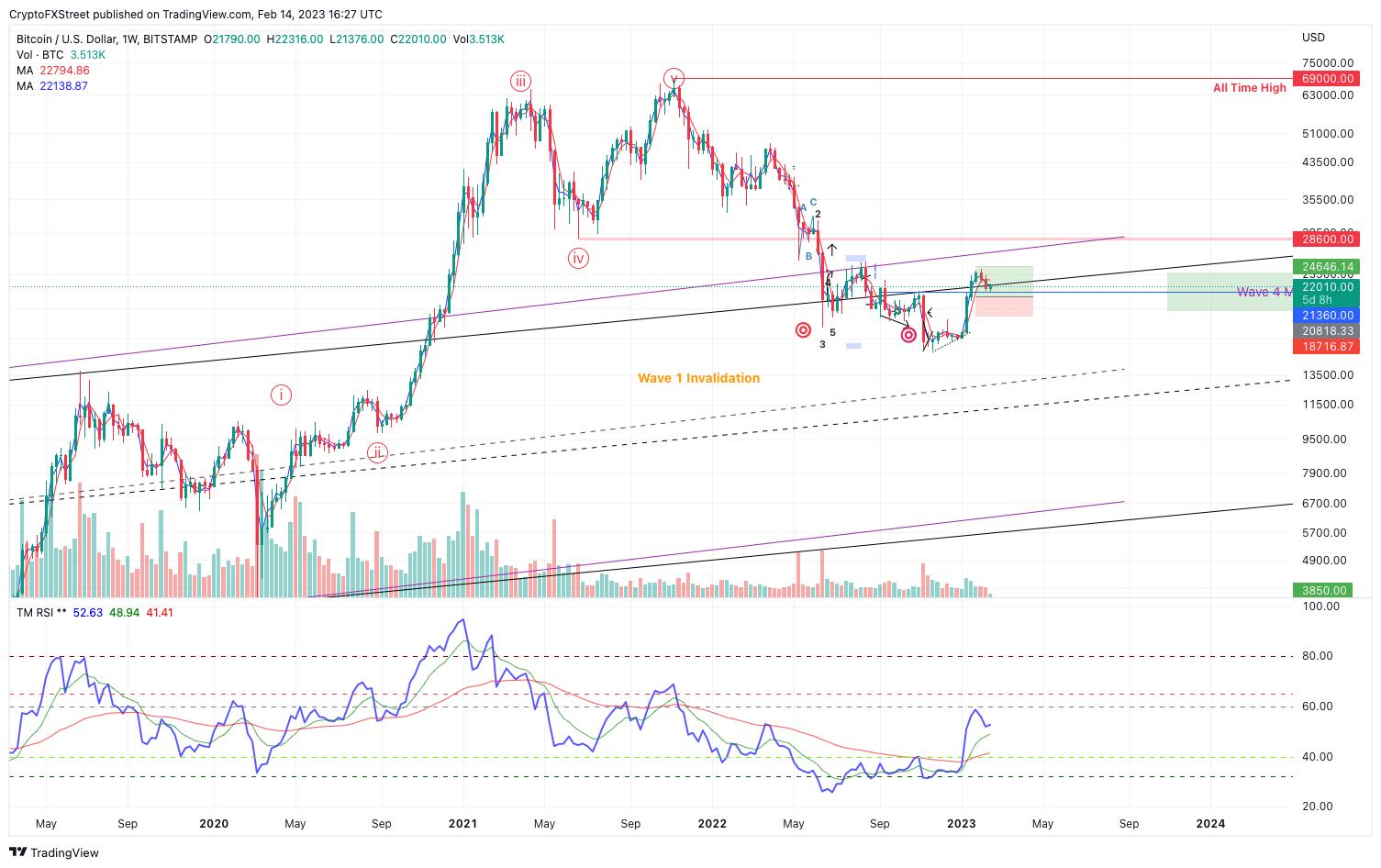

Bitcoin price finding resistance

Bitcoin price has slipped beneath a significant boundary after losing 5% of market value last week. At time of writing, The BTC price remains suppressed beneath the $22,000 level. The technicals on larger time frames suggest Bitcoin could endure a steeper decline in the short term.

Bitcoin price currently auctions at $21,989 as the bulls are performing their first counter-trend attack to last week's 5% decline. The resistance formed is also prompted by an ascending trendline that dates back as far as 2018. The barrier provided both bullish support and bearish resistance during the 2019 to 2020 bull run.

A Fibonacci retracement tool surrounding The winter rally from $15,476 into the year-to-date high at $24,258 shows a golden pocket 61% retracement level at $18,267. If the bulls do not reconquer the ascending trend line, traders can expect the 18% decline into the $18,000 zone in the coming weeks.

BTC/USDT 1-Day Chart

Invalidation of the bearish occurs from a breach above the 21-day simple moving average at $22,985. A breach of the barrier would put the Bitcoin price back on pace to rally toward the $25,000 liquidity zone, resulting in a 15% increase from Bitcoin's current market value.

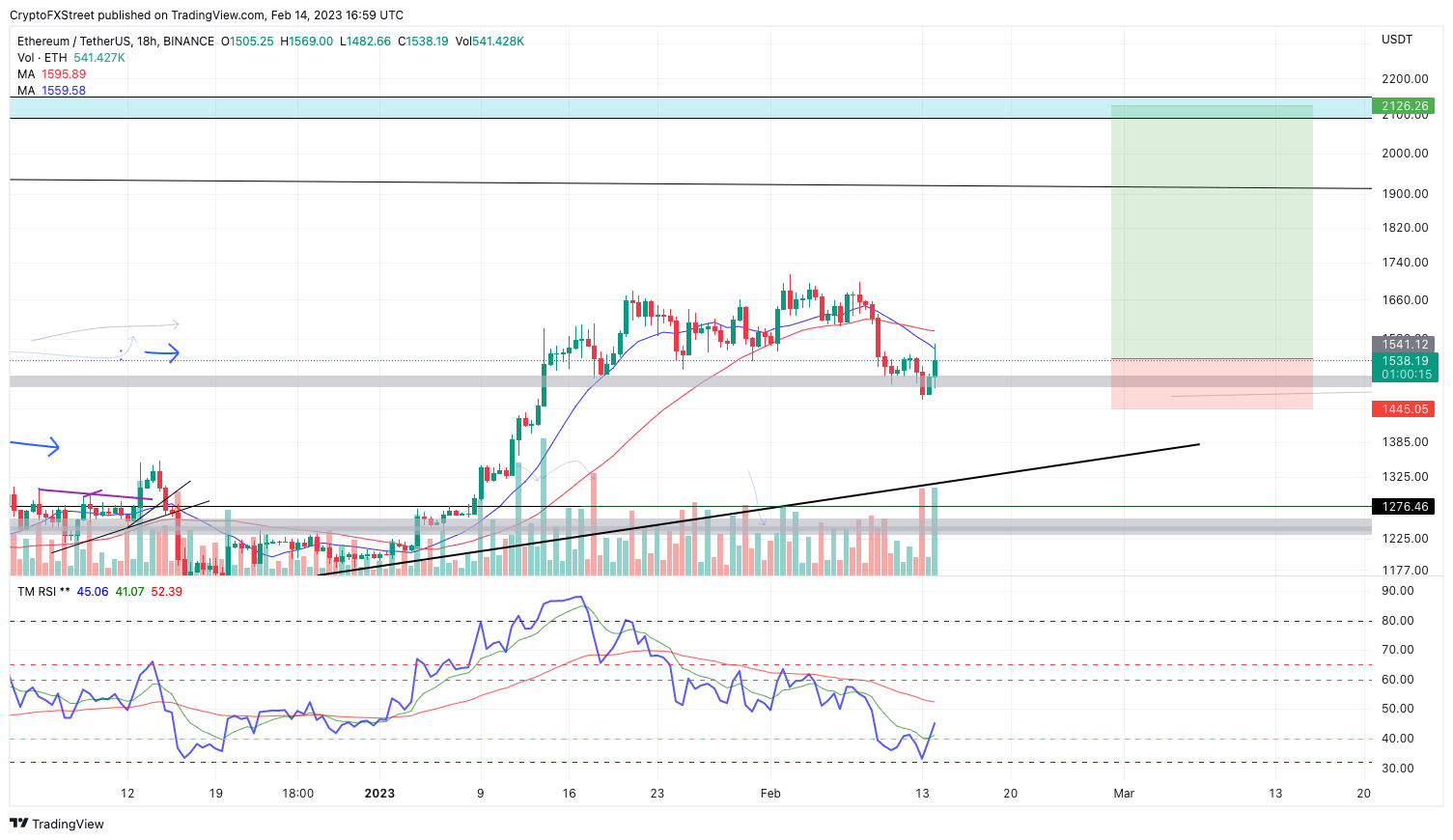

Ethereum price has potential

Ethereum price is showing optimistic signals during the crypto markets' downswing. On February 14th, the decentralized smart contract token is up 3% and is retesting the ad exponential moving average as resistance since falling back into the $1,500 barrier last week. Still, Traders should be on the lookout for the bullish trade setup that could prompt Ethereum toward a new year-to-date high, as ETH could be forming a reversal pattern near a crucial support zone.

Ethereum price currently auctions at $1,536. Throughout the summer of 2022, the $1,500 dollar zone acted as crucial areas of resistance and support, catalyzing large swings to both sides of the market. Several forecasts have mentioned their potential to Rally toward the 2100 liquidity zone. A sustained consolidation above the 8-day EMA placed at $1,560 would be early evidence to suggest a future hike is on the way. The bullish scenario creates the potential for a 40% increase from Ethereum's current market value.

ETH/USDT 1-Day Chart

For traders looking to join the market, the invalidation point would be a beach beneath the candlestick low that pierced the current support 1500 zone to the upside during the winter rally at $1,449. A breach of the level would likely induce a steeper decline towards the next support level, near $1250, resulting in a 19% decrease from Ethereum's current price.

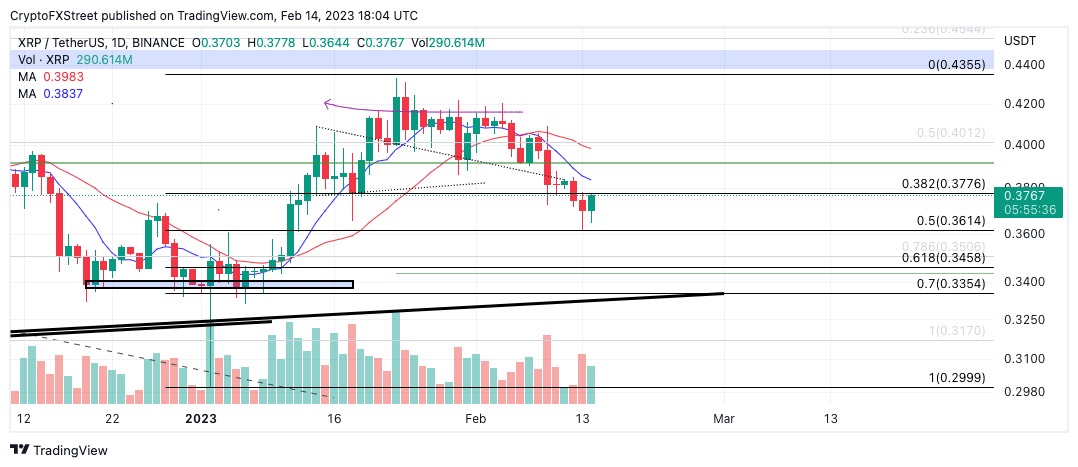

XRP price is a must watch

XRP price Is up 2% on the day as bullish interest is taking place near the $0.36 zone. On February 13th, the Bulls produced a hammer reversal stick pattern which prompted the buyers' interest in the market. The pattern would be a confirmed Morning Star reversal signal known to catalyze market bottoms.

XRP price currently auctions at 0.376. Traders should be on the lookout if the equals can hurdle the 8-day Moving average near $0.38, as it will be the nail in the coffin to suggest xrp's downtrend move is coming to an end. If this is the case, the bullish Target zone of 40%, which has been mentioned throughout the winter, would likely be tagged in the coming] in the coming weeks

XRP/USDT 1-Day Chart

Invalidation of the uptrend thesis would occur if the bears so happen to tag the $0.31 liquidity zone, which is the strongest candlestick within Winter's uptrend rally. A tag of the level would likely induce a decline toward the $0.30 support level, resulting in a 16% decrease from XRP's current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.