- Ethereum's failure at the $400 level kicked off a much-needed technical correction.

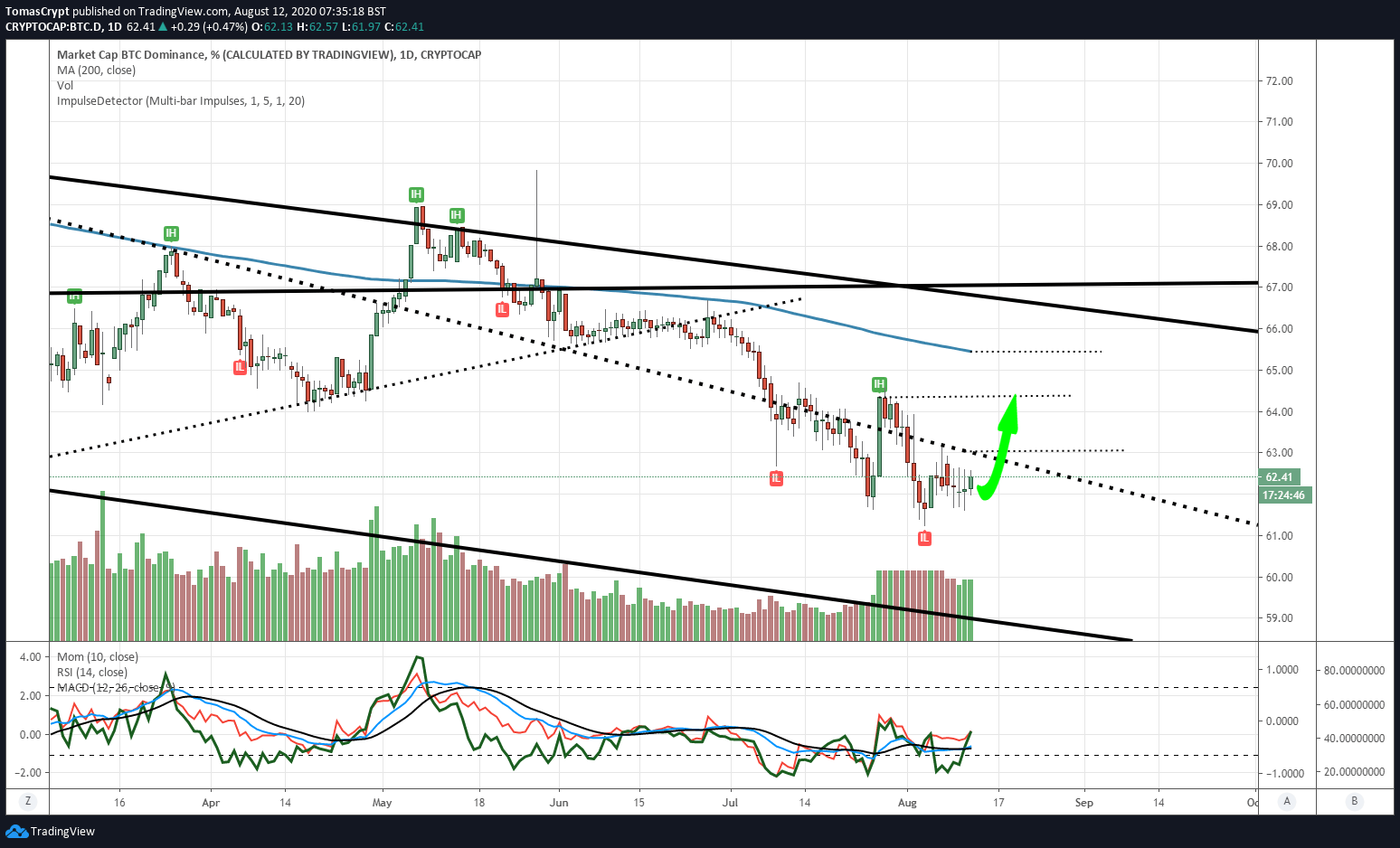

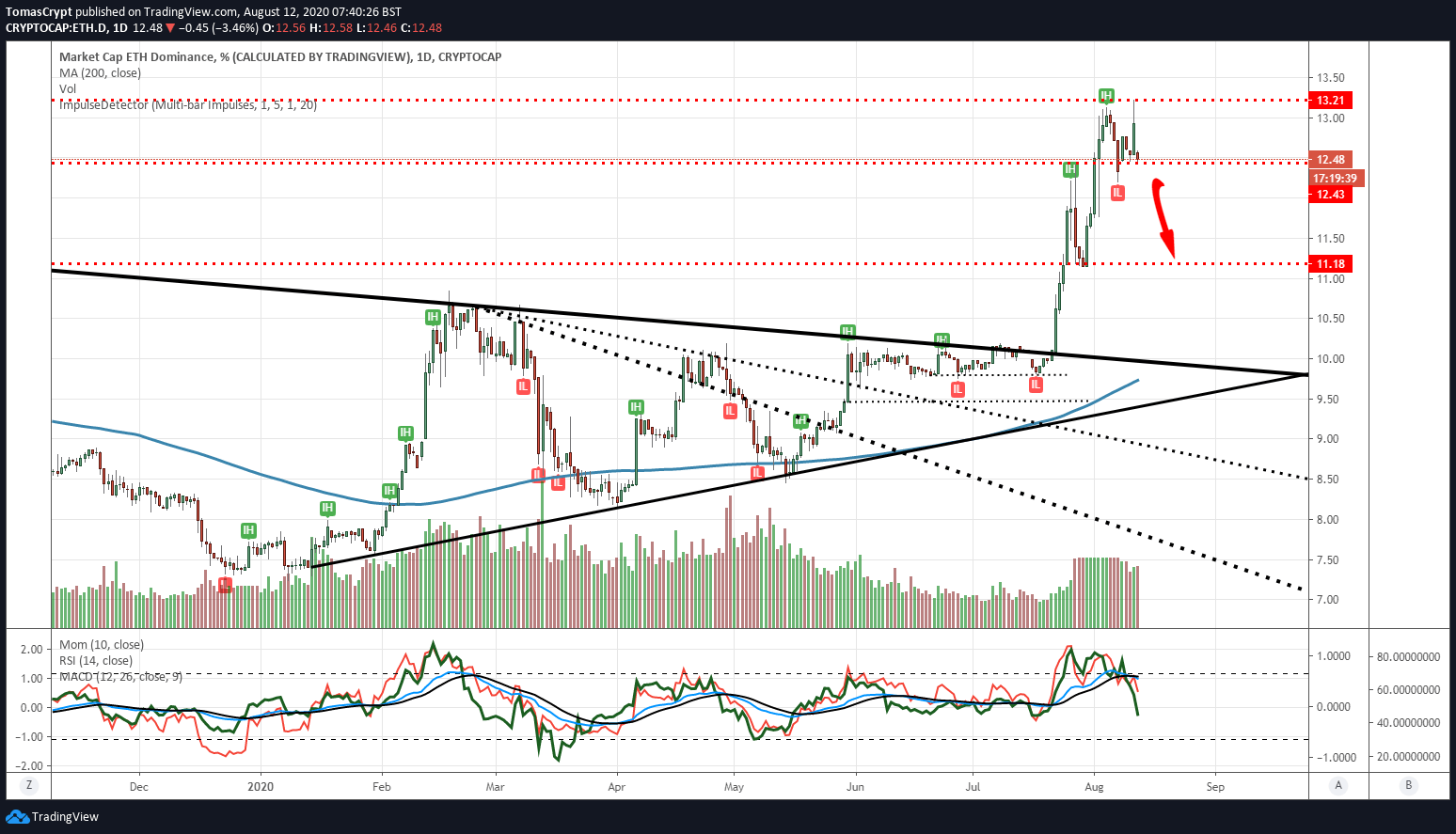

- Bitcoin regains market share in a typical rotation of consolidation phases.

- Sentiment levels fall by 10% after reaching extreme euphoria levels.

The overbought level in the crypto market, reflected in extreme bullish sentiment levels, called for a pause in the uptrend and has come in recent hours.

Ethereum, the undisputed leader of the bullish movement, met stiff resistance due to price congestion at $400 and was unable to break out.

The crypto segment needed to look for fresh money and moves now into a price decline that will take the minds off of buyers who were reluctant to buy after a significant cumulative rise.

The Bitcoin and Ethereum dominance charts also suggested a change of course, with it now being Bitcoin's turn to make up some of the lost ground.

The effect on sentiment levels has been immediate, falling more than 10% to level 75 from 84 yesterday. This level is still high but should find traction again in the 60-65 range.

Today is an excellent day to retrieve past technical analysis and check the validity of the levels that we already announced months ago. The charts accompanying the report are from January 15, 2020.

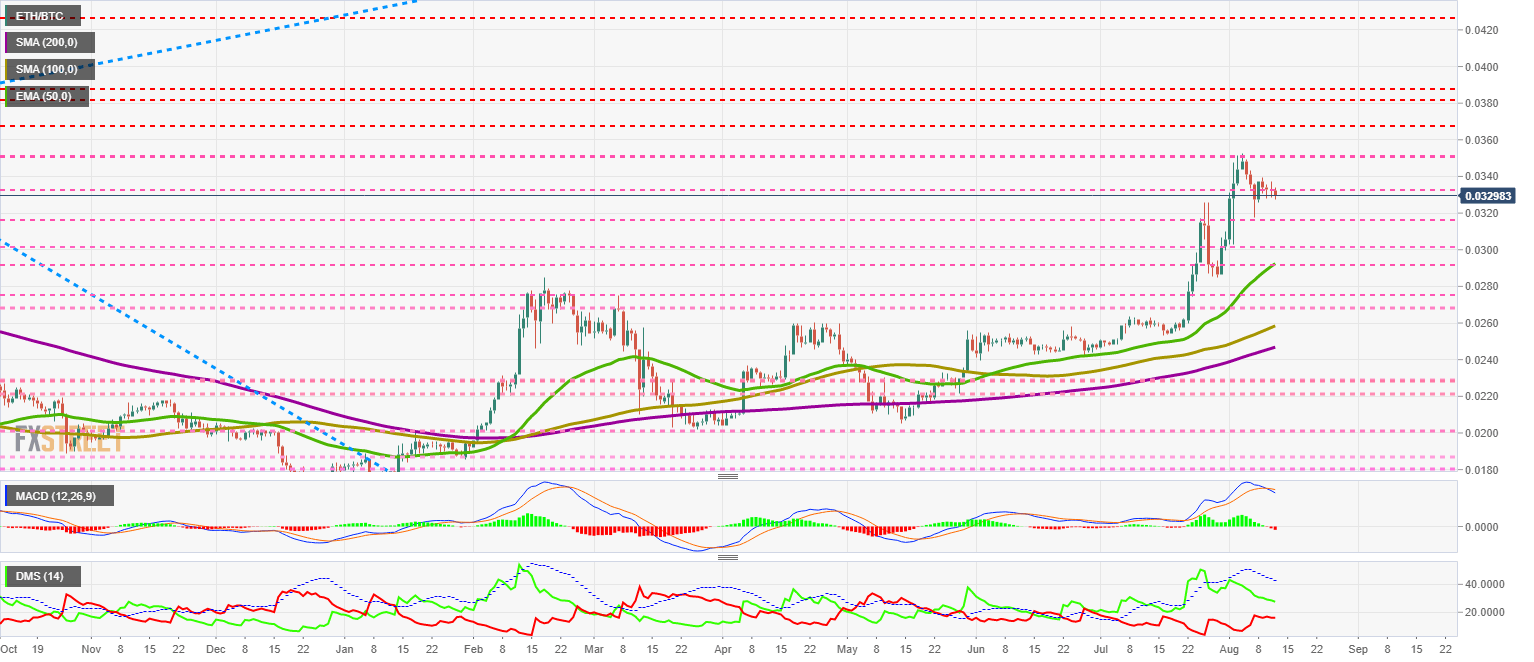

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0329 and is losing support due to price congestion at 0.032. Throughout the bullish stretch, ETH/BTC has been moving between levels of congestion that have provided support and resistance generated in previous months. The price level of 0.030 seems to be the most likely target for the reversal that has begun in the last few hours.

Above the current price, the first resistance level is at 0.0332, then the second at 0.0351 and the third one at 0.0368.

Below the current price, the first support level is at 0.0316, then the second at 0.0302 and the third one at 0.0291.

The MACD on the daily chart is crossing downward with a significant downward slope. Such a steep profile suggests volatility and wide range movements.

The DMI on the daily chart shows bulls and bears moving in parallel downwards. The lack of activity on the sell side could indicate doubts about the validity of the move, probably due to the recent change in trend.

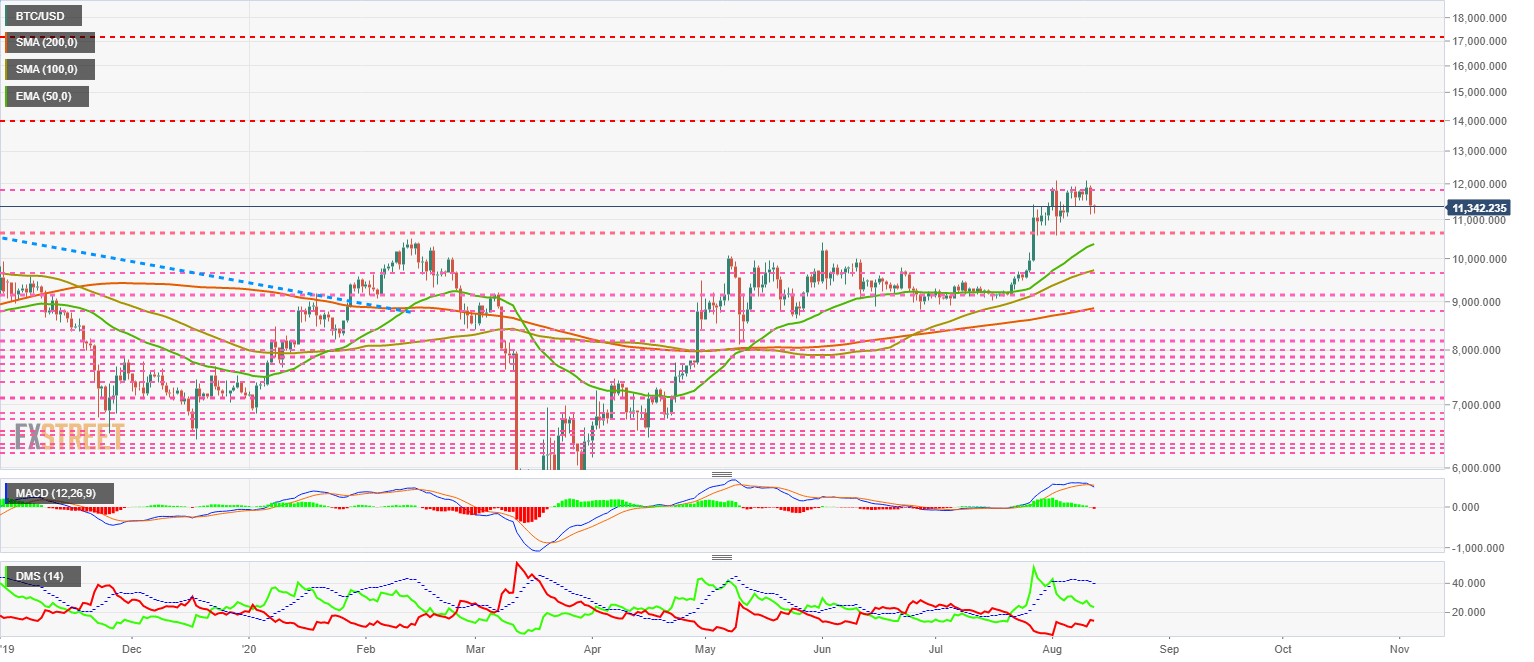

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the price level of $11355 and is on the verge of a significant upward movement that will take it above the price congestion resistance level of $11850. BTC/USD could look for support in the $9750-$10000 range.

Above the current price, the first resistance level is at $11850, then the second at $14000 and the third one at $17200.

Below the current price, the first support level is at $10650, then the second at $10350 and the third one at $9700.

The MACD on the daily chart is crossing downward with a significant slope of the fast-moving average. This setup suggests that the technical retracement will be quick and relatively violent.

The DMI on the daily chart shows bulls and bears on a collision course, with a crossing horizon towards the end of the current week.

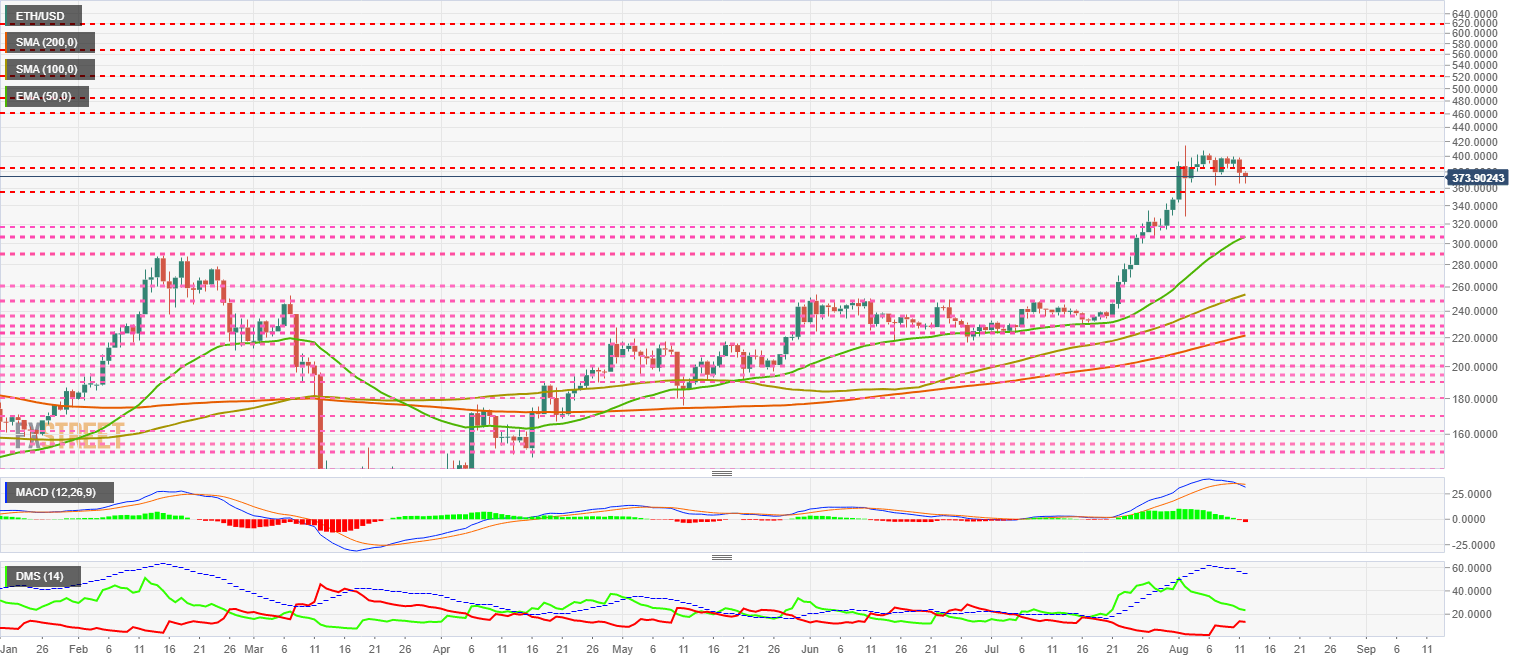

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $374 price level, and is giving way to the – now reinforced – resistance level of $400.

Above the current price, the first resistance level is at $400, then the second at $460 and the third one at $485.

Below the current price, the first support level is at $350, then the second at $315 and the third one at $300.

The MACD on the daily chart is crossing downward with a significant slope, which could lead to increased volatility in ETH/USD.

The DMI on the daily chart shows bulls and bears close. The cross between them is likely to occur before the end of this week. This setup could lead to a volatile trading session and a sharp change in direction.

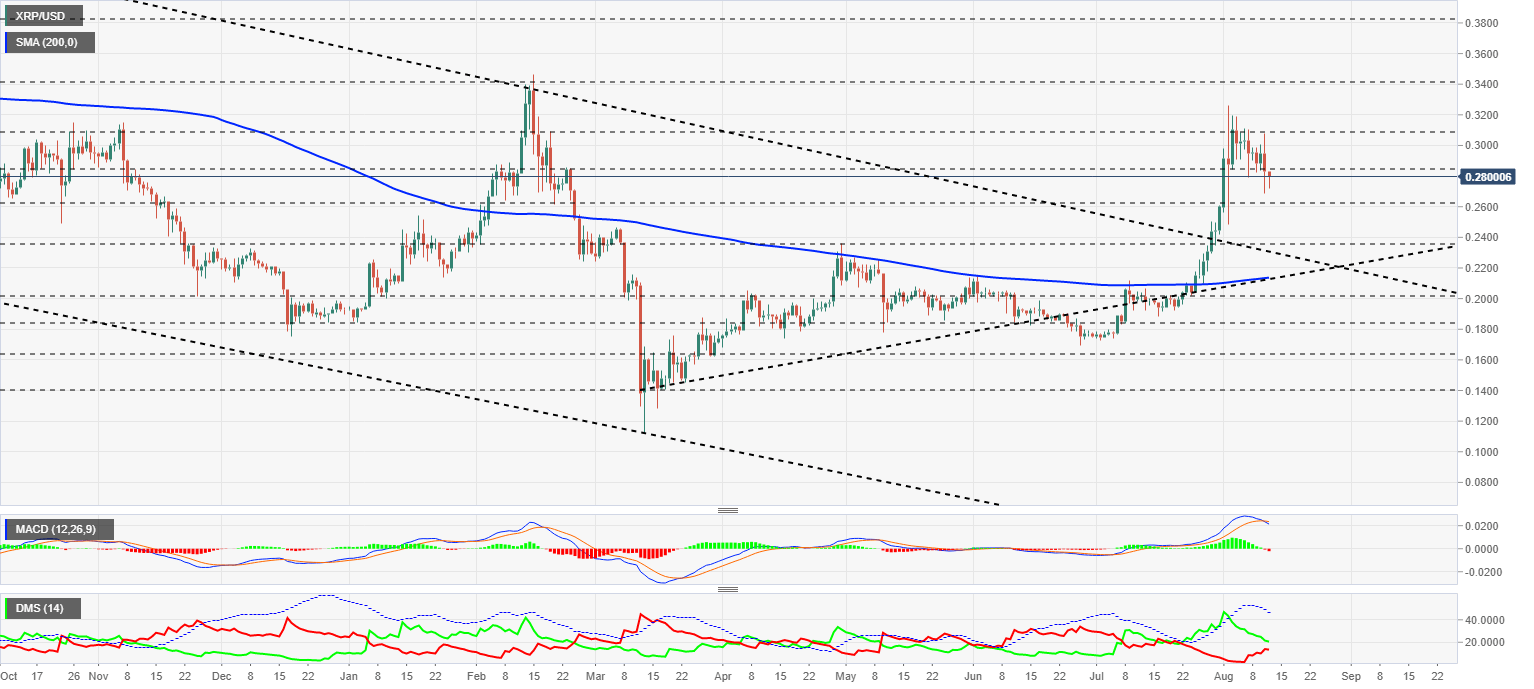

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.2775 and confirms the strength of the price congestion resistance level at $0.31. Ripple saved a critical technical situation during June and has recovered dramatically. The chart below was drawn on June 6, 2020.

Above the current price, the first resistance level is at $0.284, then the second at $0.308 and the third one at $0.34.

Below the current price, the first support level is at $0.263, then the second at $0.235 and the third one at $0.223.

The MACD on the daily chart is crossing downwards and, as we have seen on Bitcoin and Ethereum, it is doing so with a significant downward slope. This setup implies that the pair is likely to go increasingly volatile, which in the case of the XRP/USD pair it could lead to exaggerated movements.

The DMI on the daily chart shows both sides of the market-facing each other, with a time horizon of a few hours before hostilities between the two groups begin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.