- Ethereum leads an effervescent altcoin segment in search of its golden moment.

- It is time for Bitcoin to take it easy after the impressive show of force.

- XRP is immersed in a game of intrigue, interests and opportunities.

The BTC/USD pair is up over $30,000 after yesterday's drop of 20% to $27,000.

There is anxiety to buy Bitcoin in the market and the options to buy at a discount are short-lived as investors are eager to get hold of the increasingly scarce Bitcoin.

The Bitcoin Dominance chart shows the result, closing the day inside the bullish channel. A close below the 67.5 level of dominance would trigger a downward leg with a first target at the 66 levels, as projected by the MACD downward cross. We cannot rule out a walkout to the 62 levels where the 200-day simple moving average sits. Who would benefit from this move? The altcoin segment in general, but especially Ethereum.

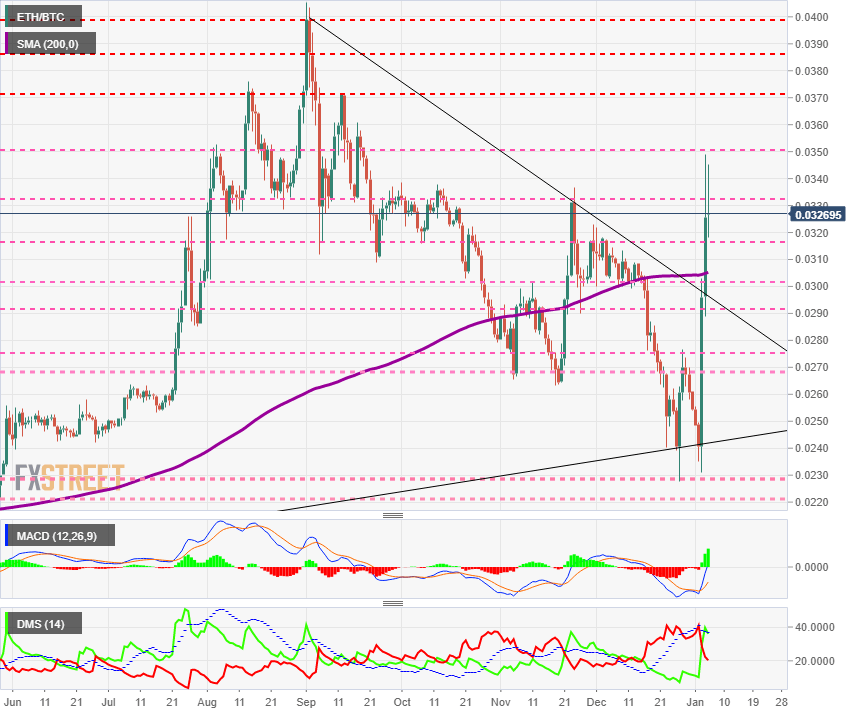

ETH/BTC daily chart

The ETH/BTC pair is currently trading at the price level of 0.0327. The session's peak has been set at 0.035, but more importantly, it has ended the correction that began at the relative highs of September 1st. The 200-day moving average accompanies the pair perfectly and also crosses into the new bullish scenario, giving solidity to the movement.

Above the current price, the first resistance level is at 0.0332, then the second at 0.035 and the third at 0.0371.

Below the current price, the first support level is at 0.0316, then the second at 0.0305 and the third one at 0.0293.

The MACD on the daily chart takes on a radical bullish profile, so extreme that it poses a polarized scenario between the bullish explosion and the technical correction that returns the moving averages to more normal inclinations.

The DMI on the daily chart shows bulls above the ADX line, which usually provides a strong signal for the upward movement. On the other hand, bears continue to lose strength and show no intention of competing for the direction of the ETH/BTC pair.

BTC/USD daily chart

The BTC/USD pair is currently trading at $31,600 following an intraday correction that brought the price up to $28,000, where the money quickly showed up.

Above the current price, the first resistance level is at $33,370, then the second at $34,799. Above this level, the BTC/USD would again enter a free ride mode targeting the moon.

Below the current price, the first support level is at $28,000, then the second at $26,514 and the third one at $23,950.

The MACD on the daily chart is showing a loss of the upside profile but retains the separation between the moving averages, leaving room for possible upward extensions.

The DMI on the daily chart shows bulls losing strength but still retaining a considerable advantage over the market's buy-side. The bears are pausing in their upward trajectory but are not giving up their attempt to control the BTC/USD pair.

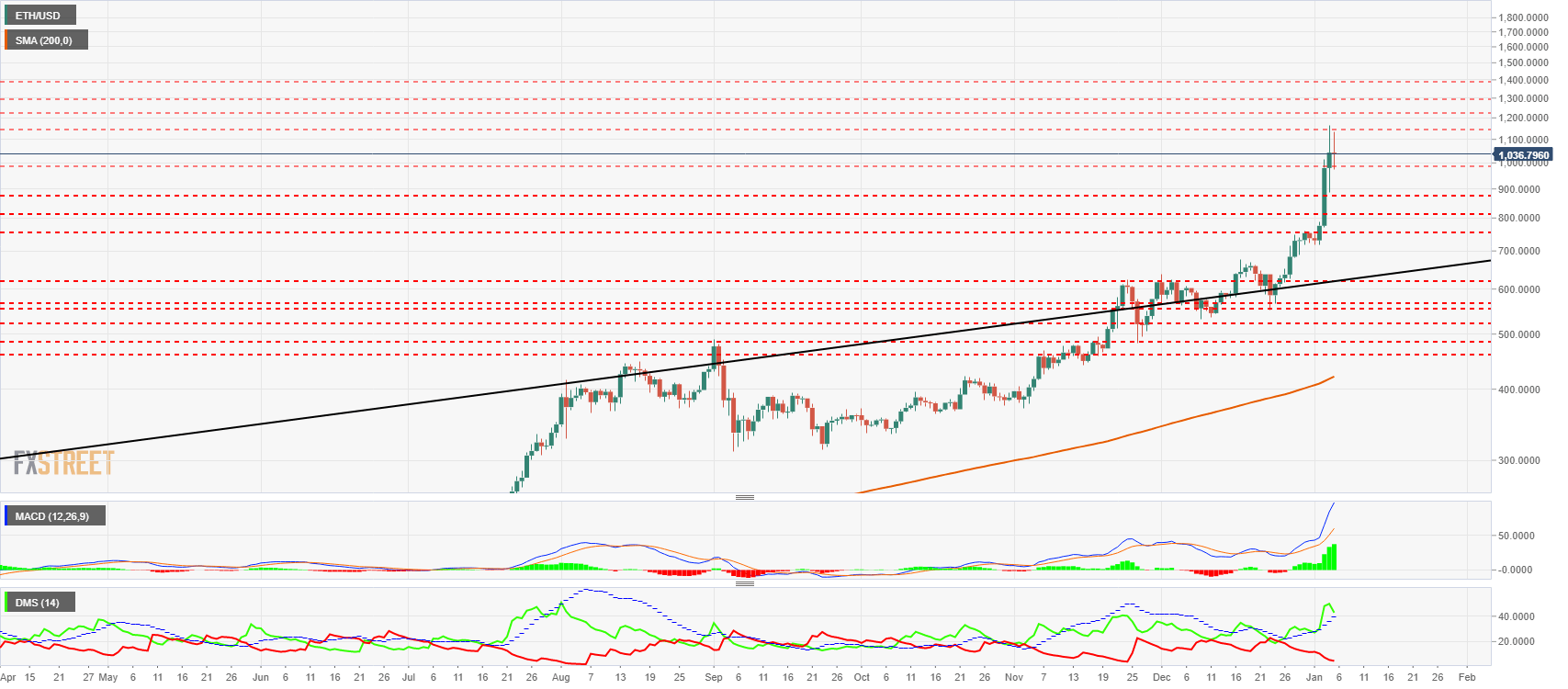

ETH/USD daily chart

The ETH/USD pair is currently trading at $1,036. All eyes are on the historic high of $1,400, but we should not ignore the danger warning provided by the 200-day simple moving average, which is located in the $440 zone, well below the current price.

ETH/USD needs to rise with some speed to pull this moving average up and provide reliable support.

Above the current price, the first resistance level is $1,145, then the second at $1,215 and the third at $1,291.

Below the current price, the first support level is at $975, then the second at $885 and the third one at $815.

The MACD on the daily chart shows a radically upward profile in terms of slope and line spacing. The current structure indicates an increase in volatility, with possible violent – but temporary – price reversals.

The DMI on the daily chart shows bulls losing strength but retaining an overwhelming advantage over clearly bearish bears.

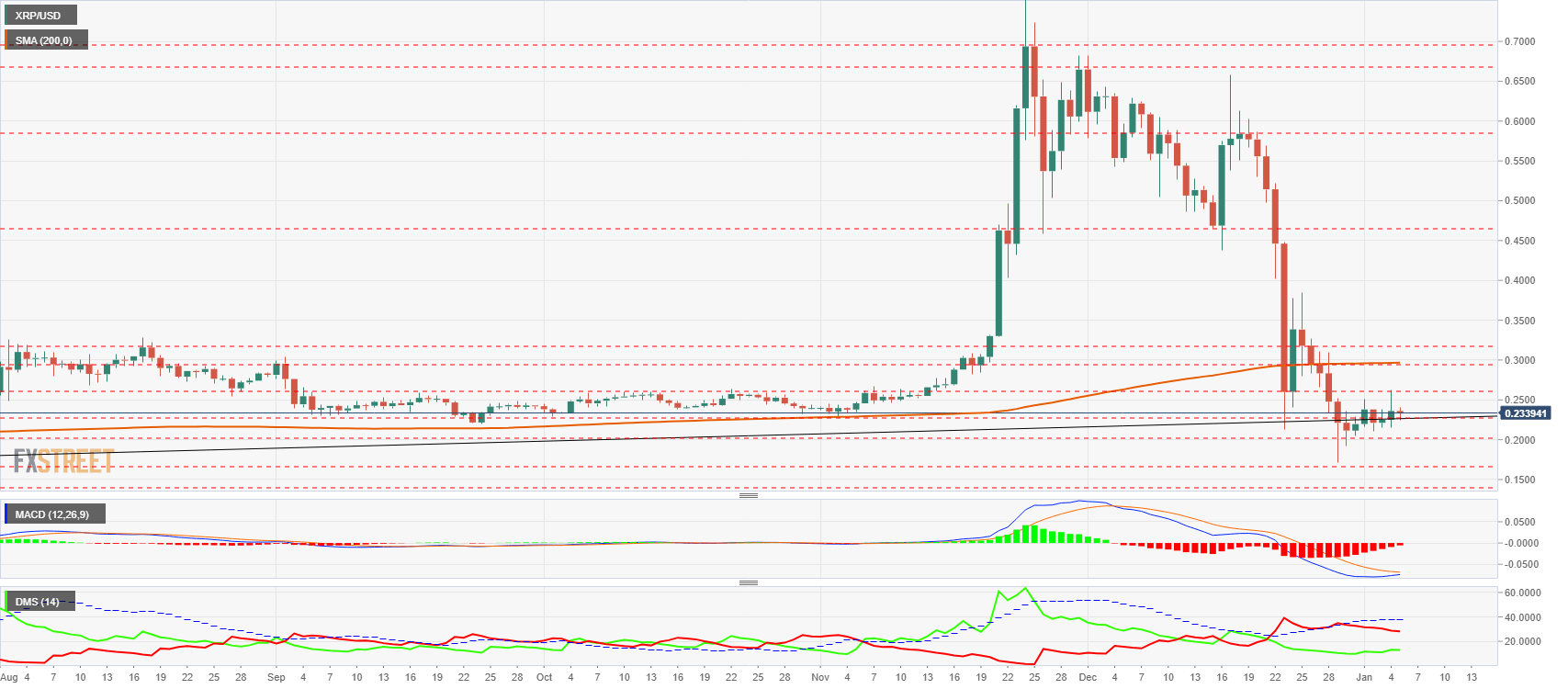

XRP/USD daily chart

The XRP/USD pair is currently trading at the price level of $0.2339 as the game is played in meeting rooms, regulators' offices and courts. I have always argued that Ripple Ltd was financed by selling XRP and should be considered as equity. I do not see this process as a risk to XRP holders, as long as the ratio of change from XRP token to XRP share is appropriate.

The 200-day simple moving average is at the $0.30 price level, a feasible goal in the short term.

Above the current price, the first resistance level is at $0.261, then the second at $0.30 and the third at $0.315.

Below the current price, the first support level is at $0.228, then the second at $0.201 and the third one at $0.168.

The MACD on the daily chart shows an optimal position for an upward cross to occur in the short term. This technical event will allow us to properly assess the technical condition of the XRP/USD pair.

The DMI on the daily chart shows bears maintaining control of the pair despite a slight drop in strength, which bulls use to recover after the sell-off.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.