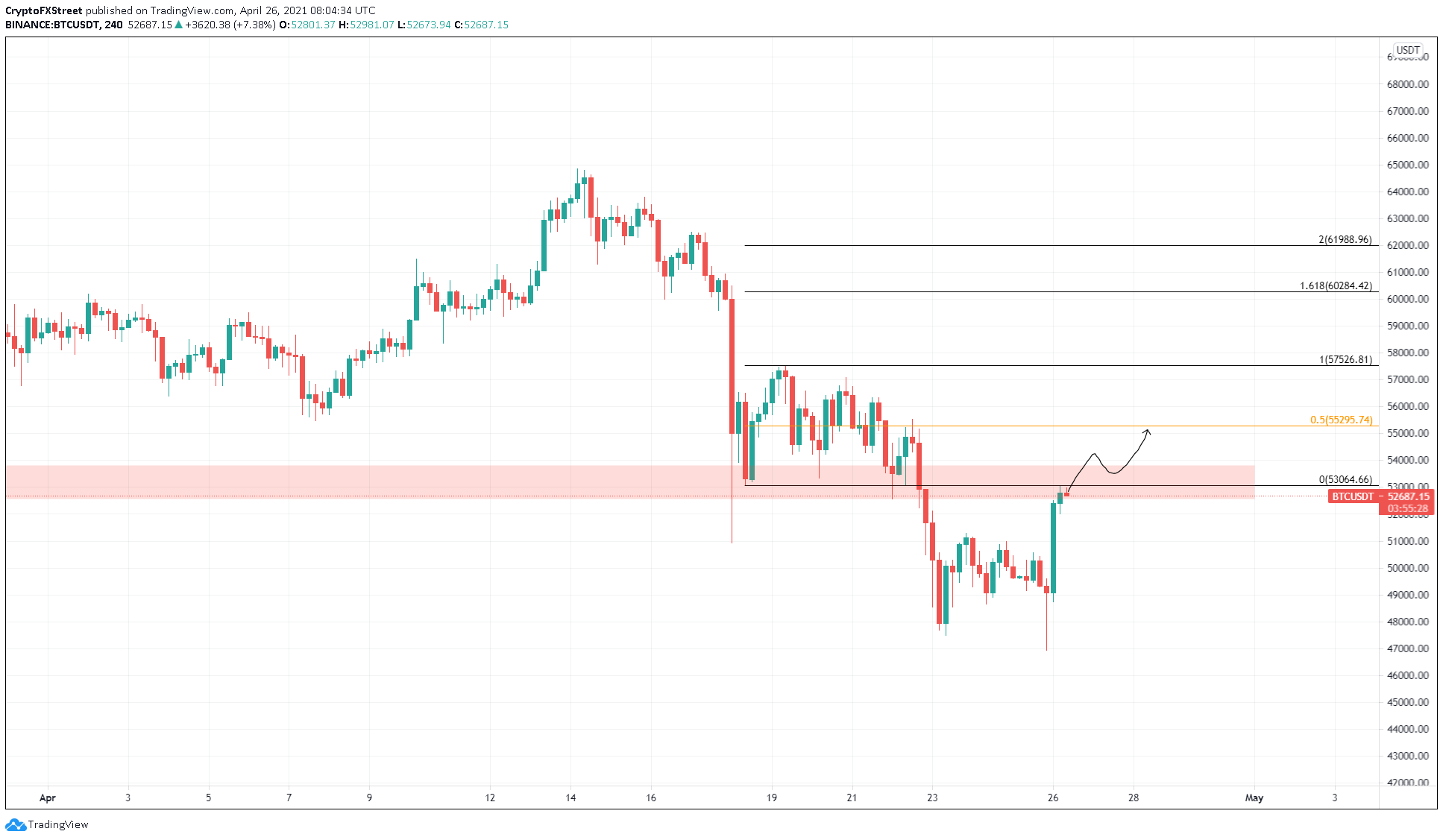

- Bitcoin price shows a sharp spike on April 26, which has run into a stiff resistance barrier around $53,000.

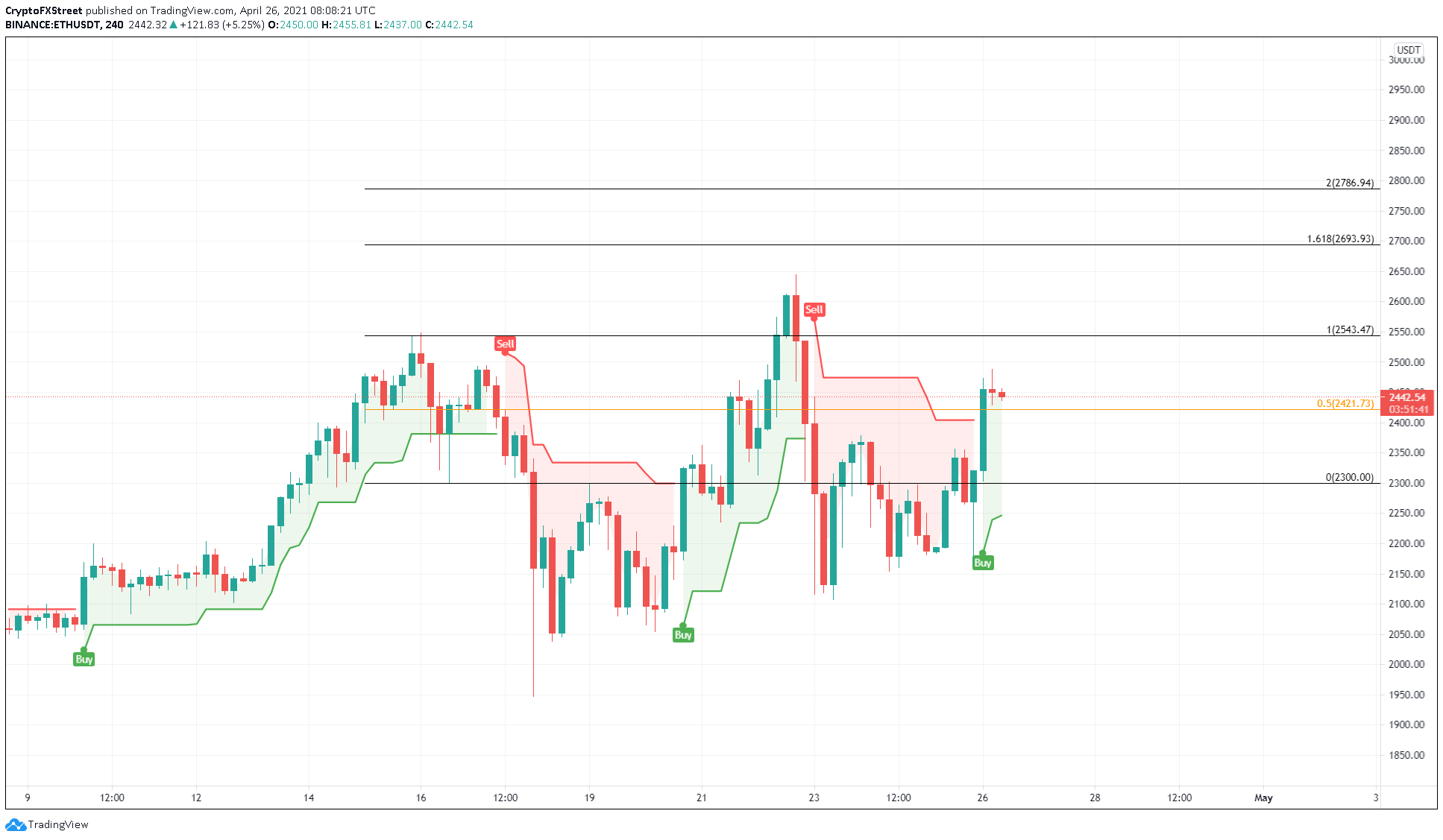

- Ethereum price has overtaken the 50% Fibonacci retracement level at $2,421 and eyes to retest the all-time high at $2,644.

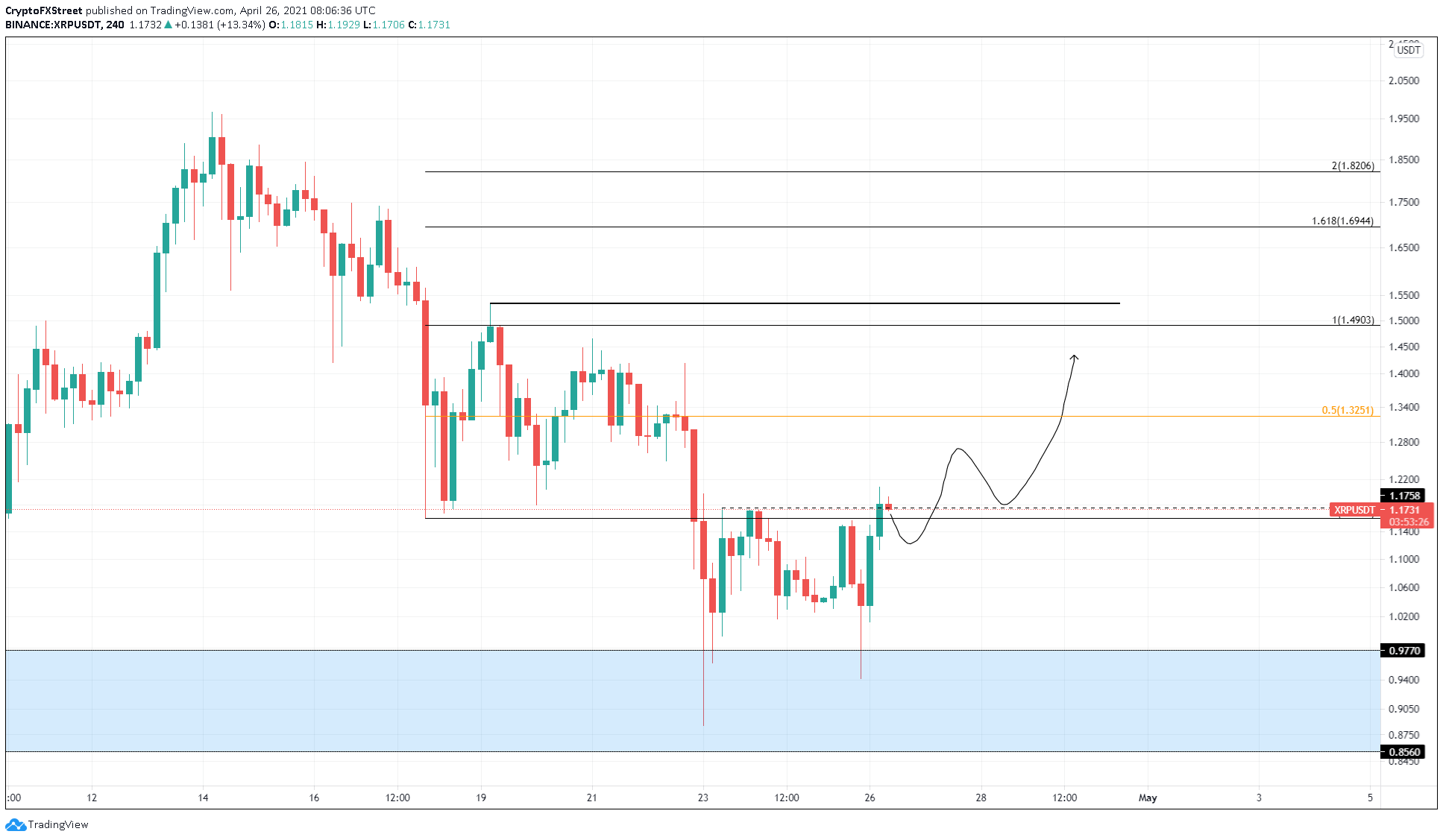

- XRP price seems to be in sync with the market, suggesting a move toward $1.32 and $1.49.

Bitcoin price shows some strength for the first time in three days as it surged toward a crucial supply zone. Since the pioneer crypto and the stock market have shown signs of being in sync since early this year, the cryptocurrency ecosystem might feel the ripples of the market’s earnings season, set to happen this week.

Earnings season and its influence on cryptocurrency market

Jim Cramer, the host of Mad Money on CNBC, stated that this week would have plenty of buying opportunities since the earnings season was in full swing.

He added,

There will be reports next week that are met with negativity and not all of them will be genuinely bad, so I’m urging you to take advantage of that weakness.

Biden’s tax increase caused both the markets to collapse in tandem, albeit Bitcoin’s crash far deeper. Although selecting one data point out of many to suit a specific need would be cherry-picking, BTC has shown a higher degree of correlation with the S&P 500 from the start of 2021.

Since the cryptocurrency market is recovering nicely, an optimistic outcome for the traditional market next week should have a bullish impact on BTC prices.

Bitcoin price goes headfirst into supply zone

Bitcoin price shows an 8.5% increase over the last 8 hours, which has pierced the resistance barrier that extends from $52,570 to $53,826. A decisive close above $53,826 could attract sidelined investors to jump on the BTC bandwagon.

In such a case, BTC could surge 12% to retest the pre-crash area at $60,284. A persistence of bullish actors could further propel Bitcoin price to $62,000, coinciding with the 200% Fibonacci extension level.

BTC/USDT 4-hour chart

On the flip side, a failure to break the supply zone would result in a drop to $50,931, followed by another 6.75% slump to $47,500.

Ethereum price leads by example

Ethereum price has been on a tear despite two crashes. ETH is currently trading around $2,442 after surging nearly 15% from its lowest point during last week’s sell-off. This uptrend in the smart contracts token shows the resilience of buyers and their optimism.

A bounce from the 50% Fibonacci retracement level at $2,421 will signal the persistence of a bullish outlook. In this case, investors can expect Ethereum price to surge 8.7% to retest the record highs at $2,644.

The SuperTrend indicator’s recently spawned buy signal adds a tailwind to this scenario.

ETH/USDT 4-hour chart

Regardless of the bullishness surrounding the pioneer altcoin, if $2,421 is breached, Ethereum price might head toward $2,300. A breakdown of this level might invoke a retest of the $2,235 support level.

XRP price looks to retest $1.50

XRP price has shed nearly 55% since its top on April 14. At the time of writing, the remittance token has recovered 30% from $0.88 to $1.16, where it currently stands.

A decisive close above $1.17 will create a higher high and signal the start of an uptrend. In such a case, XRP price could jump 13% to the 50% Fibonacci retracement level at $1.32. A further pile-up of bid orders could propel Ripple to $1.50.

XRP/USDT 4-hour chart

If XRP investors decide to book profit and, failing to produce a 4-hour candlestick close above $1.17, an extended consolidation could ensue. Here, XRP price might tap the demand zone’s upper trend line at $0.97.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.