Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Early bulls meet the butcher

- Bitcoin price continues to move sideways after the 16% sell-off that occurred last week.

- Ethereum price edges near a key level of interest. More upside should not be ruled out.

- Ripple's XRP price is likely to liquidate bulls who entered the market at the beginning of the summer.

The crypto market shows concerning signals under the hood while retail traders place their wagers on the next directional move. Based on on-chain analysis, an additional plummet is highly probable. For this reason, being an early bull is ill-advised.

Bitcoin price needs work

Bitcoin price currently auctions at $21,561 as a sideways range follows the 16% sell-off that occurred on Friday, August 19. The Volume Profile index remains sparse, signaling that high-cap players lack confidence. It is likely the current trading range is retail traders looking to latch on to the next directional move.

Bitcoin price hovers above the 50% Fibonacci levelsurrounding the entirety of the bullrun accomplished this summer. Traders seeing this have a justified reason to want to participate in an early buy, but based on the lack of volume and lackluster price action, being an early bull is ill-advised.

Traders from last week’s bearish trade setup are still profitable, and the first target at $18,900 has yet to be breached. Moving the risk into profit would be highly risky as a fractal wave of Bitcoin’s prior performance could result in a liquidity hunt tagging as high as the $23,000 price level. Invalidation of the bearish trend remains at $27,000.

In the following video, our analysts deep-dive into Bitcoin's price action, analyzing key levels of interest in the market - FXStreet Team

Ethereum price is concerning

Ethereum price currently auctions at $1,671. Traders have been closely eyeing the smart contract giant as a good rebound is speculated to occur after the steep 25% decline since the $2,030 highs. Since the August 20 low at $1,523 was established, the ETH price has already rallied 10%.

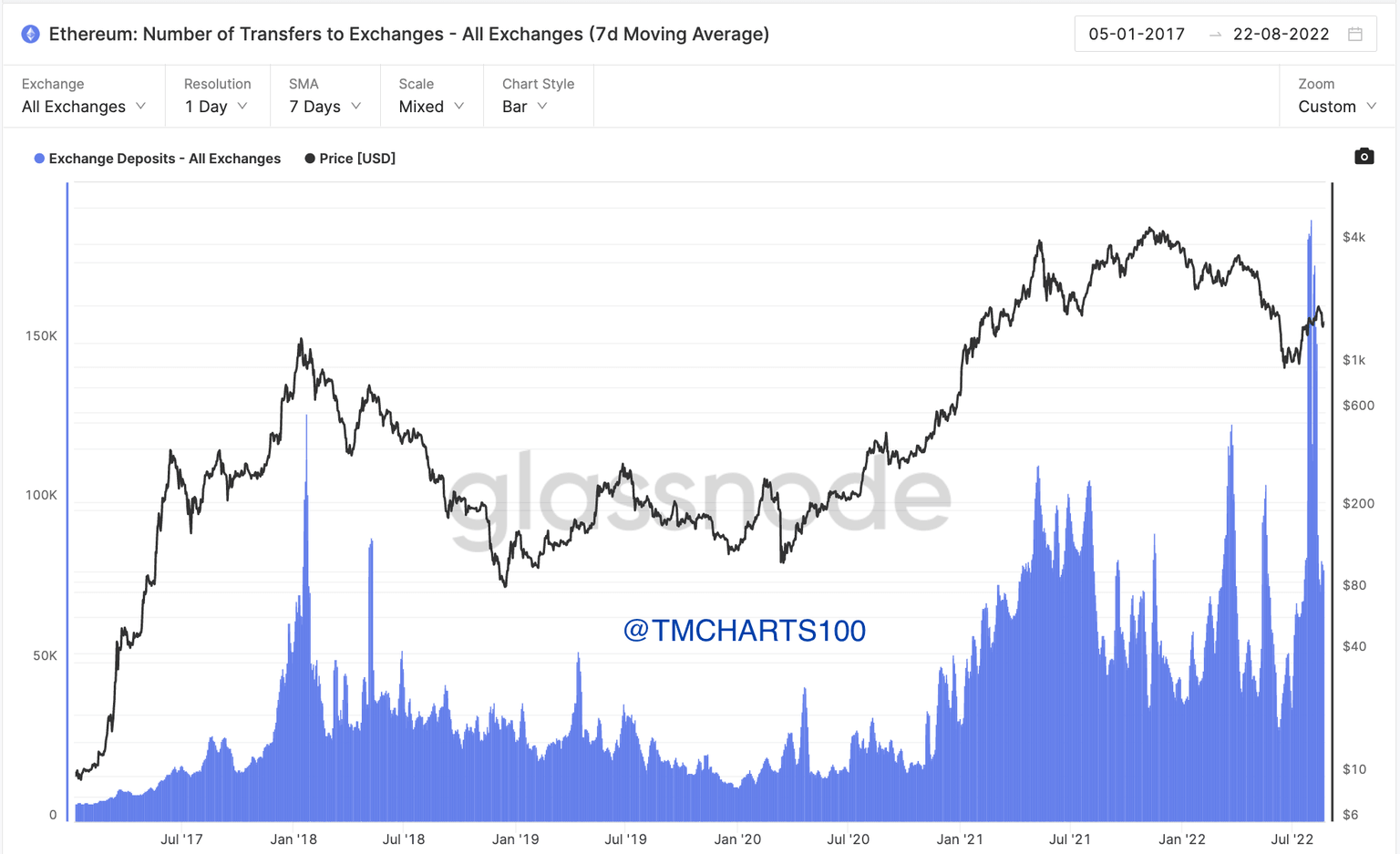

Glassnode’s Number of Transfers to Exchanges indicator has witnessed the largest influx of deposits in the last four years. At 174,549,000, the influx of transfers is almost twice the amount deposited compared to the previous influx of deposits when Ethereum traded near all-time highs at $4,000 in May of 2021.

Due to the massive influx of transfers, the Ethereum price is a highly risky knife to catch. Invalidation of the bullish impulse wave is a breach of the $1,250 level. The invalidation’s breach could set up a sweep-the-lows event targeting $970 in the short term.

Glassnode’s Number of Transfer to Exhcanges Indicator

ETH/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market - FXStreet Team

XRP price is disappointing

Ripple’s XRP price currently auctions at $0.34. The bears appear to have full control over the digital remittance token as the sideways consolidation continues below the 8- and 21-day simple moving averages.

XRP price will likely head south as the Volume Profile dictates bearish force. Additionally, the Relative Strength Index pierced through justifiable-buy territories on intra-hour time frames. A retest-and-rejection signal from the 21-day moving average currently positioned at $0.354 could act as the catalyst to induce a further 15% decline to $0.29 in the short term.

XRP/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.