Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos are primed for explosive breakout

- Bitcoin price is struggling to reach the $60,000 psychological level as it continues to consolidate.

- Ethereum price continues to compress between the $3,387 and $3,623 barriers, lacking directional bias.

- Ripple price is also stuck below a crucial resistance level at $1.135.

Bitcoin price continues its slow uptrend as it lacks volatility. Ethereum and Ripple are promptly following the big crypto as they continue to consolidate. While these top cryptocurrencies continue to consolidate, altcoins are breaking out without any hesitation.

Bitcoin price vies to tackle another significant level

Bitcoin price has rallied 9.8% over the past week despite lacking volatility. The $60,000 psychological barrier is within BTC’s grasp, but it needs to see a bullish breakout from this consolidation. A decisive close above $60,000 will put almost all of the holders “In the Money,” alleviating any sell-side pressure.

Such a development will attract the sidelined investors to jump on the ride to retesting the all-time high at $64,895, and perhaps if the buying pressure continues to build, a new all-time high at $77,525.

BTC/USD 1-day chart

While things are going too slow for Bitcoin price, the breakout from the ongoing consolidation is crucial. If BTC breaks lower, it is likely that a retracement to $55,000 will ensue. In some cases, the downswing might extend to $53,000. This move would not invalidate the bullish thesis, but it would allow buyers to buy BTC at a discount, giving them another chance at the bull run.

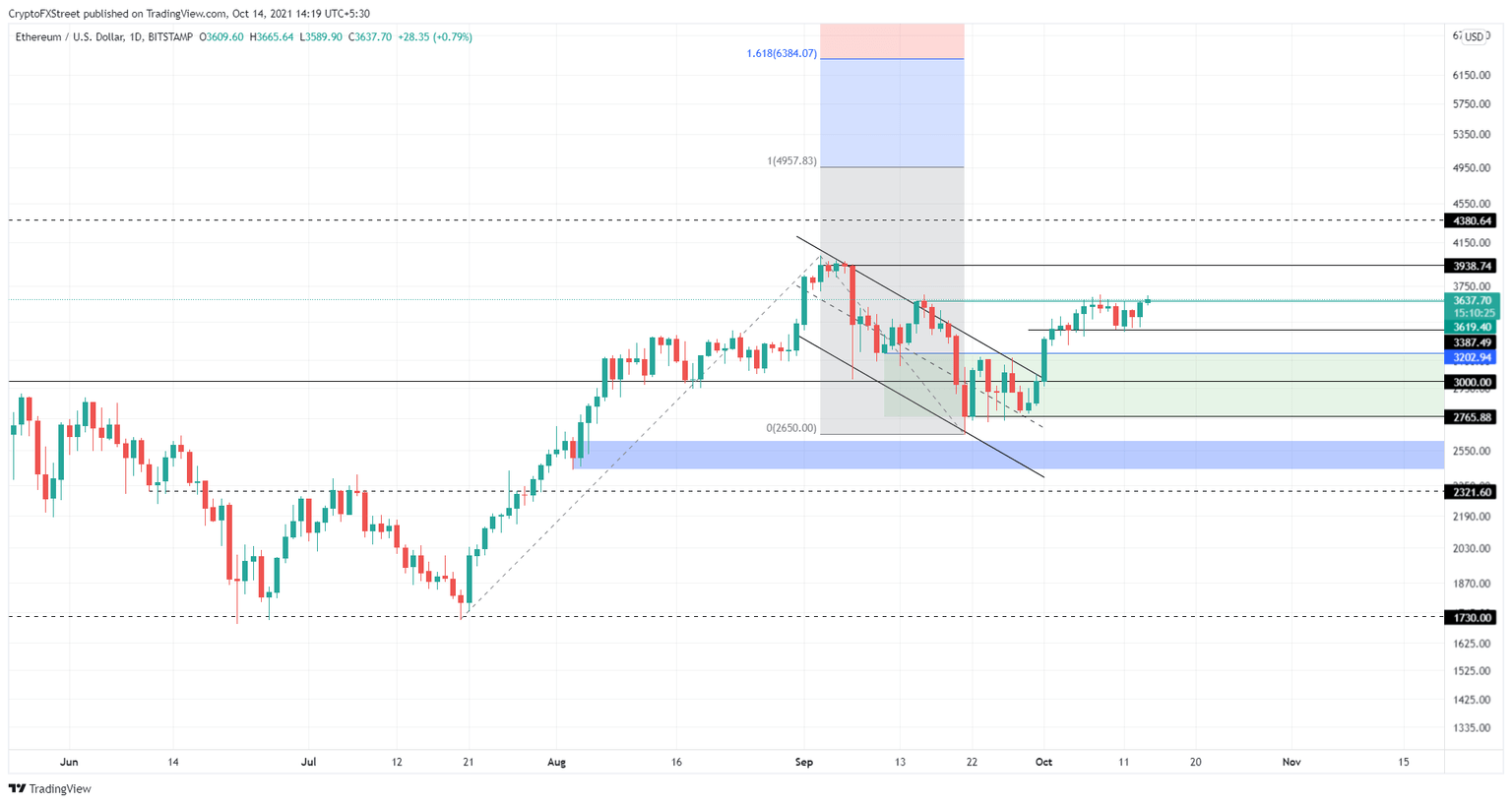

Ethereum price gets crushed between two barriers

Ethereum price has been consolidating between $3,387 and $3,623 for roughly 11 days and shows no signs of a breakout. This lack of direction bias is due to the short-term migration of capital from altcoins to BTC in anticipation of a BTC ETF being approved by the US Securities & Exchange Commission.

Therefore, investors can expect this consolidation to continue for a while. A decisive close above $3,630 will start a new uptrend, but confirmation of this will arrive if BTC dominance continues to decrease. This reduction will help not just ETH but the altcoin ecosystem as a whole.

In such a case, ETH will first take a ride to $3,938 or the September 5 swing high. Following this, Ethereum price will make a run at the $4,000 psychological level. Clearing this barrier will open the doors to retest and even set up a new all-time high at $4,957.

In a way, Ethereum and Bitcoin are in the same boat with respect to retesting their respective all-time highs.

ETH/USD 1-day chart

Regardless of the decrease in pressure from the big crypto, if ETH holders decide to book profits, pushing Ethereum price to produce a decisive close below $3,387, it will produce a lower low, threatening the bullish outlook.

However, ETH will likely be able to make a comeback as long as it stays above $3,200, but a breakdown of $3,000 will likely invalidate the optimistic scenario.

Ripple price struggles as headwinds increase

Ripple price flipped above the $1.05 resistance level and flipped it to a support floor. However, this rally faced headwinds, undoing most of its gains to where it currently stands. XRP price is currently facing off the $1.13 resistance level and is getting overwhelmed by selling pressure.

While this short-term outlook might seem bearish, a decisive close above $1.13 and $1.24 will confirm an uptrend. In this case, Ripple price is likely to continue its ascent toward the range high at $1.42.

However, investors need to keep a close eye on the $1.67 and $1.88 barriers and the buy-stop liquidity resting above these levels. Assuming XRP price tests these hurdles, it would constitute a 62% ascent.

XRP/USD 1-day chart

While Ripple price has a mid-term bullish outlook, a breakdown of the $1.05 support floor will put a dent in that. A decisive close below the 62% Fibonacci retracement level at $0.86 will create a lower low, invalidating the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.