Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto Season faces resistance

- Bitcoin prints a higher low but faces resistance at $17,000.

- Ethereum remains submerged below a broken support level.

- XRP price has recovered 20% of market losses but may be losing steam.

The crypto market is attempting a retaliation against the recent onslaught experienced earlier in the month. As a congestion zone forms on BTC near the psychological $17,000 level, the top 3 cryptos remain indecisive. Key levels have been defined to forecast possible outcomes for the crypto giants in the coming weeks.

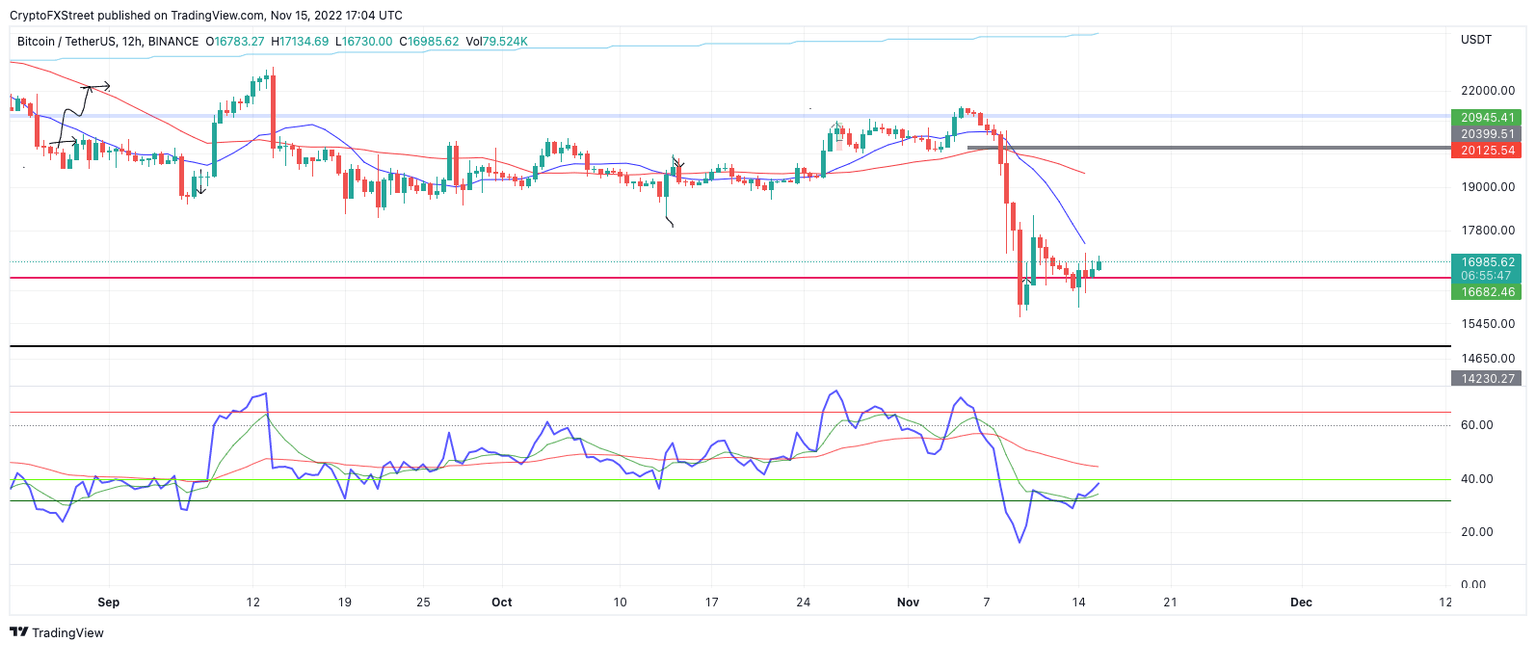

Bitcoin price facing resistance

Bitcoin price is the primary focus for crypto traders going into the third trading week of November, as its next move will likely determine the outcome for the rest of the market. After a 10% decline over the weekend, the bulls finally stepped near the upper $15,000 level to provide support. The peer-to-peer digital currency managed to recover 8% of its market value. Still, despite the hopeful gesture, Bitcoin will need to take on a lot more work to truly define a strong countertrend rally.

Bitcoin price currently trades at $16,996. The 10% decline printed a higher low at $15,815. The Relative Strength Index (RSI) shows the market is cooling off as the indicator has climbed back into support on smaller time frames. Still, the peer-to-peer digital currency faces considerable bearish pressure as the 200-week moving average, the 21-day simple moving average, and the 8-day exponential moving average hover above the current auctioning price.

If market conditions persist, Bitcoin may be headed for one more low near $15,000. Invalidation of the bearish idea is a breach above the $18,531 thrust candle. If the level is tagged, the bulls could produce a countertrend rally back to $20,000. Bitcoin price would rise by 20% if the invalidation scenario occurs.

BTCUSDT 12-hour chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price is submerged

Ethereum price is facing significant bearish pressure going into the third trading week of November. After a 35% decline on the month, the bulls produced a retaliation rally that was capped near the recently broken support at $1,300. After a few days of consolidation, the ETH price is still submerged below the barrier and shows signals that suggest bulls are hesitant to stay in the market.

Ethereum price auctions at $1,264 as the bulls attempt to hurdle the 8-day exponential moving average. A rejection from the indicator would be explosive and could provoke a second test of the $1,080 lows. The Relative Strength Index breached oversold levels during the previous decline, which suggests the downtrend is still ongoing.

Invalidation of the bearish thesis could arise if the bulls hurdle the $1,350 swing high. In doing so, an additional spike towards the 21-day simple moving average at $1,450 would stand a fair chance of occurring. Such a move would result in a 17% increase from the current Ethereum price.

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key market interest levels. -FXStreet Team

XRP price fights back

XRP price currently auctions at $0.39 as the bulls have pulled off a second recovery rally of recouping 20% losses from the week prior. Now, as the price consolidates just below the $0.40 barrier, traders are forced to ask a central question: is the countertrend rally coming to an end or just getting started?

XRP price has hurdled above the 8-day exponential moving average, which sets it apart from Bitcoin and Ethereum. The Volume Profile Indicator also shows the bulls attempting to produce a ramping pattern, but the number of transactions is still relatively lower than the previous declines. Keeping this in mind, the XRP price may need to remain range bound between $0.39 and $0.31 for a few more days before the next definitive trend can be established.

For bears looking to enter the market, invalidation of the bearish scenario could occur if the bulls hurdle the $0.46 barrier. In doing so, an additional rally toward the monthly high near $0.51 could occur. XRP would rise by 30% if said price action were to occur.

XRPUSDT 12- hour chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.