Top 3 Price Prediction Bitcoin, Ethereum Ripple: BTC, ETH, XRP outlook ahead of weekend hush

- Bitcoin price is coiling up for the next move with a 5% slump to $25,856 likely amid falling momentum.

- Ethereum price responds to ETH futures ETF hype, rises 5% in two days after a confirmed buy signal.

- Ripple price at an inflection point, confronts the mean threshold at $0.5337 as XRP looks for directional bias.

Bitcoin (BTC) is leading the market into the weekend when the volumes of trade are expected to be lowest. Ethereum (ETH) and Ripple (XRP) prices have key obstacles to overcome to determine their next moves, with experts cautioning investors to remain vigilant lest they are caught in a fakeout.

Also Read: Trader says Bitcoin and crypto markets need ‘chaos’ for price growth

Bitcoin price coils up for next move

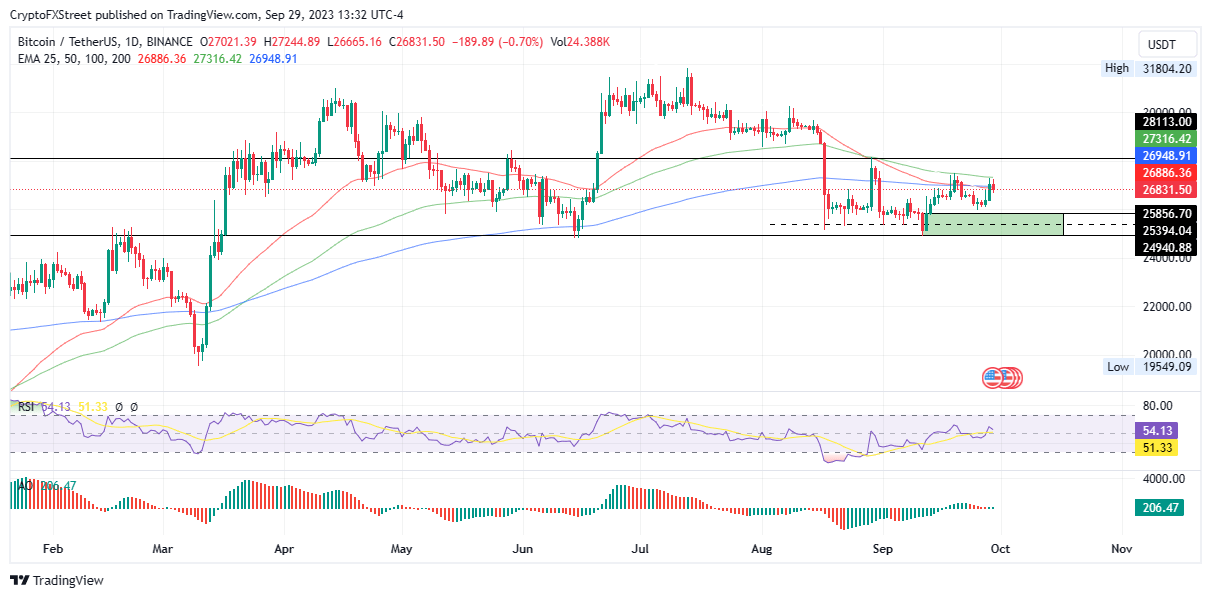

Bitcoin (BTC) price is coiling up for the next move, with analysts saying a recovery rally could turn out to be a bull trap in disguise. Meanwhile, momentum indicators such as the Relative Strength Index (RSI) point to an impending slump as momentum continues to fade. With this outlook, BTC could fall to the demand zone at $25,856, marking a 3% slump.

A break and close below the midline of the demand zone at $25,394 could extrapolate the losses, potentially sending Bitcoin price below $24,940.

The RSI is dropping while the Awesome Oscillator (AO) histograms are edging towards the negative zone, pointing to bears having their say. Furthermore, the RSI is about to activate a sell signal as it draws near the signal line (yellow band) a crossover to the downside could trigger seller momentum to drive Bitcoin price south.

BTC/USDT 1-day chart

On the other hand, increased buying pressure could send Bitcoin price north, overcoming the 100-day EMA at $27,316. In a highly bullish case, the gains could see BTC tag the $28,113 resistance level. The position of the AO in the positive territory shows bulls still have a fighting chance.

Also Read: Bitcoin Weekly Forecast: BTC recovery rally could be bull trap in disguise, here’s why

Ethereum price clears the $1,648 hurdle

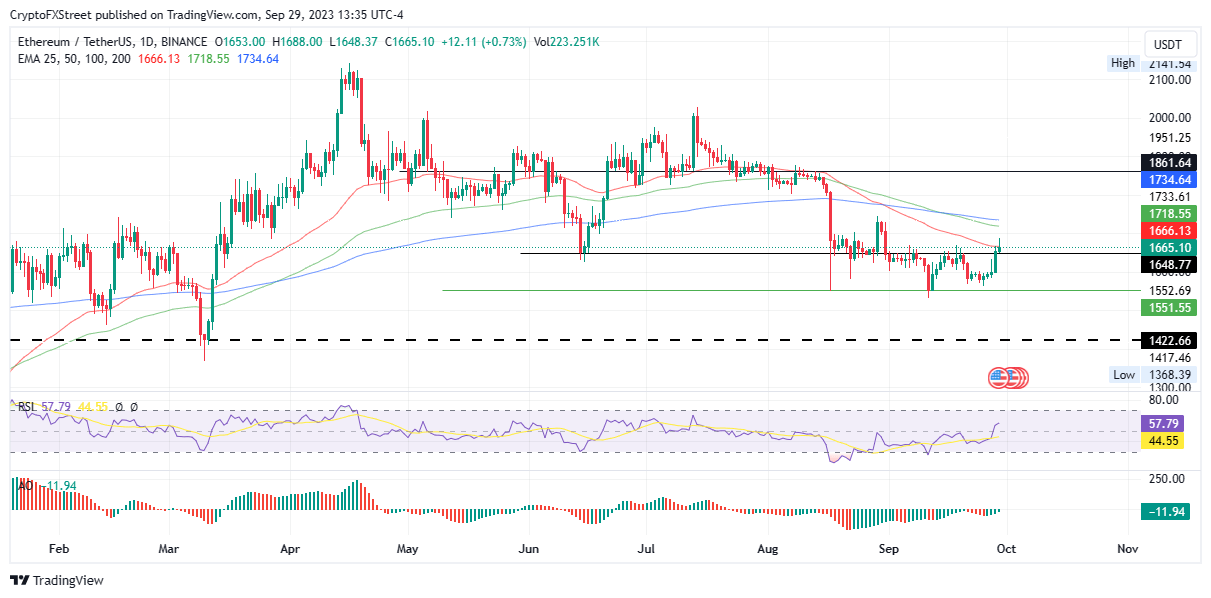

Ethereum price has outperformed Bitcoin, rising more than 5% to flip the $1,648 resistance level to a support floor. The move came after the RSI activated a bullish call as indicated in a previous article. With this momentum indicator still northbound and the AO soaked in green, ETH could continue rising.

A solid move above the 50-day EMA at $1,666 would clear the way for an extrapolation to the 100- and 200- day EMAs at $1,718 and $1,734 levels respectively before the largest altcoin by market capitalization can have a shot at the $1,861 range high.

ETH/USDT 1-day chart

On the flipside, early profit taking could cut the rally short, with the ensuing selling pressure likely to cut down all the ground covered. This could see Ethereum price fall 6% to test the $1,552 support level, or worse, extend to collect the sell-side liquidity residing underneath.

Also Read: Ethereum Futures ETF to roll out by first week of October: Bloomberg ETF analyst

Ripple price at an inflection point

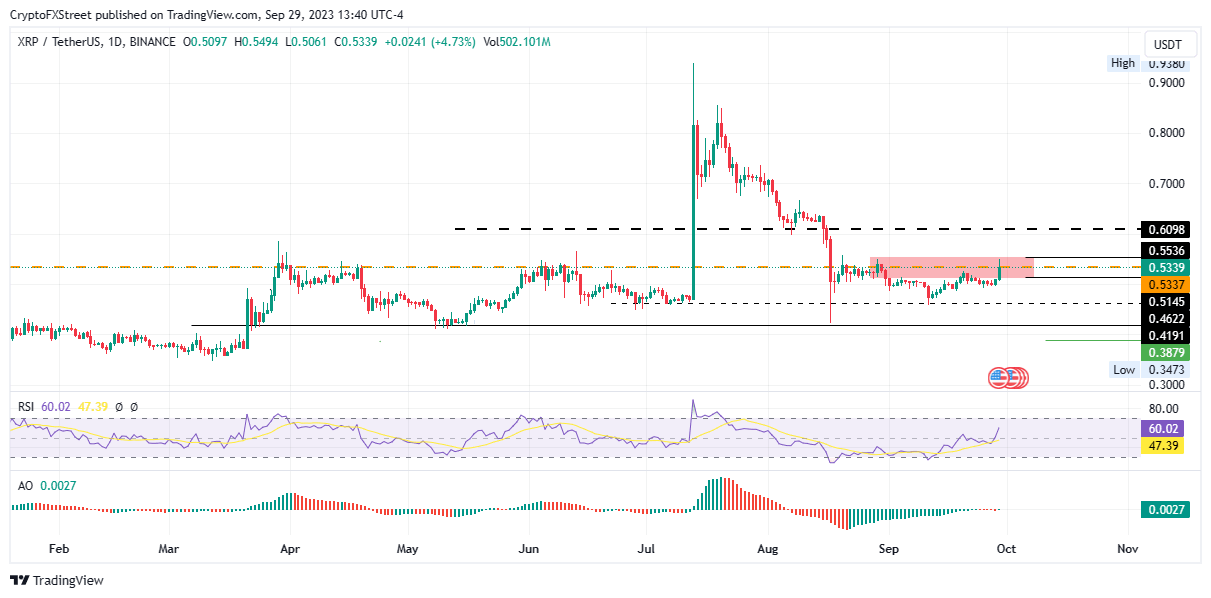

Ripple (XRP) price is at a crossroads, confronting the mean threshold of a bearish order block (supply zone) at $0.5337. Breaking and closing above it will confirm a continuation, while a rejection could steer a downtrend.

From a technical standpoint, the odds favor the upside, with the RSI inclined north, at 60, with more ground to cover before reaching the overbought territory. Increased buying pressure could therefore see Ripple price tag the $0.6098 resistance level, last tested around mid-August.

XRP/USDT 1-day chart

Conversely, a rejection from $0.5337 could send Ripple price out from below the supply zone at $0.5145, or lower to tag the $0.4622 level. In a dire case, the downtrend could send XRP to the range low at $0.4191. This would constitute a 20% slump.

Also Read: Ripple and Coinbase lead the big fight as US crypto firms advocate for regulatory overhaul

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.