Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets turn bullish on ETF approval hopes

- Bitcoin price rallied nearly 15% as it overcame the $30,000 psychological level.

- Ethereum price has shot up 12% in the last two days, clearing $1,727, a key resistance level.

- Ripple price has risen above the $0.540 resistance level, but it is uncertain whether bulls will defend this barrier.

Bitcoin (BTC) price has kick-started a massive rally in the third week of October, dragging Ethereum (ETH), Ripple (XRP) and other altcoins to follow its lead. The rally seems to be driven by a potential spot Bitcoin ETF approval.

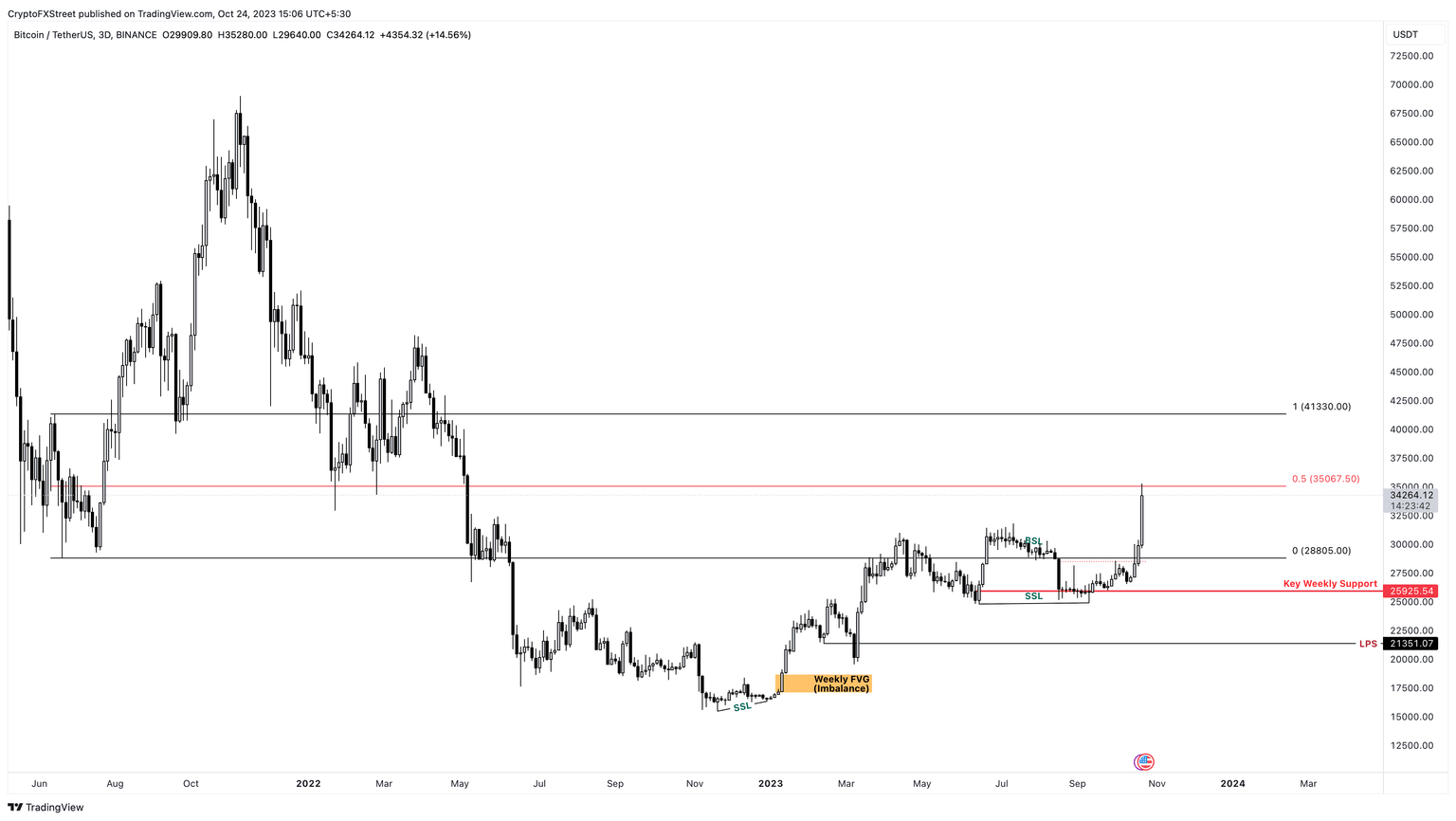

Bitcoin price sustains 2023 bull rally

Bitcoin (BTC) price has sustained the 2023 bull rally by producing a fourth higher high. This bullish move has propelled BTC past the $30,000 psychological level, currently trading around $34,152.

The next hurdle that Bitcoin price will encounter is $36,294, where a potential top might form, especially if the circumstances around the spot ETF approval remain the same. On the other hand, if a spot ETF is officially approved, it could catalyze a massively bullish ascent that could propel BTC to the $40,000 psychological level.

BTC/USD 3-day chart

On the off chance that this rally is a fluke, Bitcoin price could retrace to the immediate support levels of $31,777 and $30,616. These barriers are key to producing another lower high, but a breakdown of these levels could send BTC down by 15% to $25,941.

If Bitcoin price produces a three-day or weekly candlestick close below $25,941 support level, it will create a lower low on a higher time frame. This move would put an end to the 2023 bull rally and potentially send BTC down to $19,294.

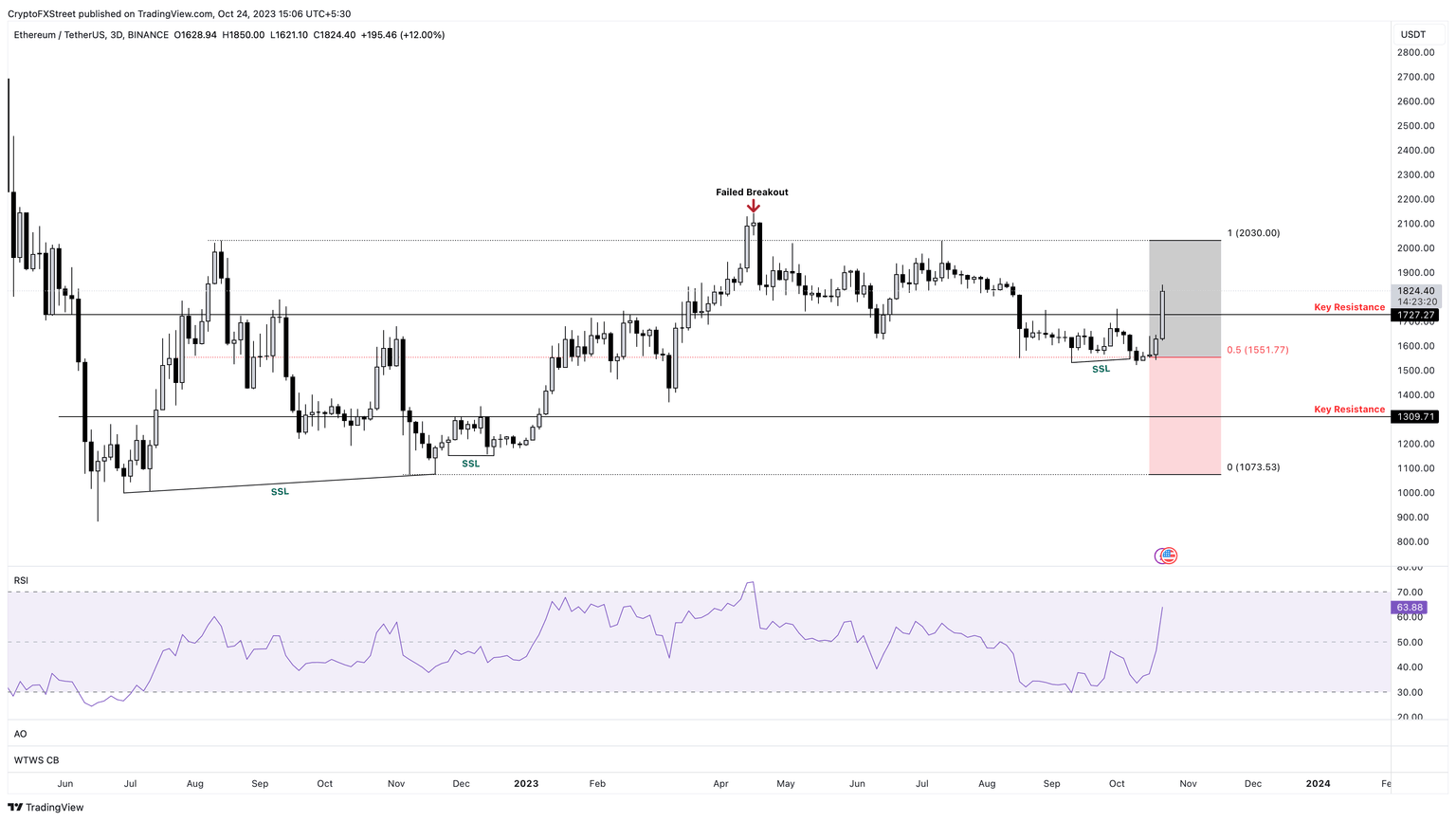

Ethereum price shoots up

Ethereum (ETH) price cleared the key hurdle of $1,727 as it rallied 11.48% in the last two days. This move has caused the Relative Strength Index (RSI) to increase above the 50 mean level, showcasing the spike in bullish momentum.

Bulls need to sustain above this $1,727 level, after which investors can expect the extension of the uptrend to the next critical level of $2,030.

Read more: Ethereum Price Forecast: ETH crash to $1,000 can be prevented on the reclaim of a key resistance level

ETH/USD 3-day chart

On the other hand, if Ethereum price fails to sustain above $1,727, it would denote a bearish outlook. In such a case, investors can expect the bearish trend to take over and trigger a correction to $1,551.

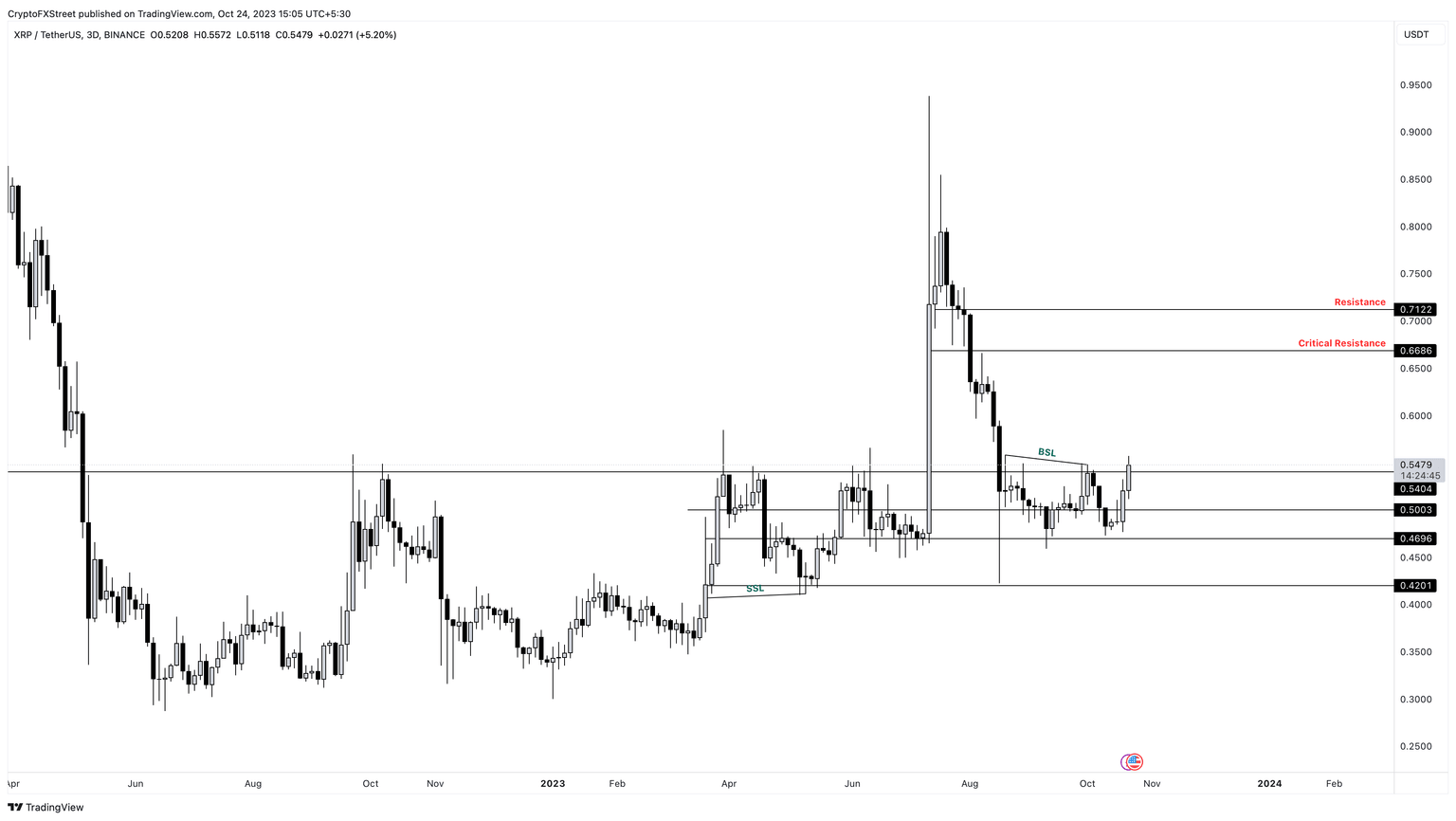

Ripple price at crossroads

Ripple price has cleared the $0.500 and $0.540 resistance levels after a 12% rally in the last five days. This move has been successful in partially collecting the buy-side liquidity resting above the $0.547 level.

Going forward, investors need to exercise caution as XRP price is likely to pull back to retest the $0.540 level. Another bounce from here could see the remittance token extend its rally to retest the next key hurdle at $0.668. This move would constitute a 22% upswing.

Read more: Ripple price could kickstart 140% rally to $1.23 after SEC's “surrender”

XRP/USD 3-day chart

On the other hand, if Ripple price breaks below the $0.540 barrier, it would signal that the bullish momentum is not strong enough. In such a case, XRP price is likely to fall back to find support at the $0.500 and $0.469 levels.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.