Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets scramble for recovery before the next crash

- Bitcoin price is in a potential recovery rally that could push it up to $22,600.

- Ethereum price recovery could only push it up by $1,650 due to multiple hurdles in the way.

- Ripple price is slowly in terms of recovery as it grapples with the $0.340 support floor.

Bitcoin price saw a massive sell-off over the last four days and has been trying to consolidate and recover since then. Some altcoins have been much better at recovery than Ethereum and Ripple. Regardless, a recovery rally seems plausible for the crypto markets.

The Australian government concurs that more than one million users have interacted with cryptocurrencies since 2018, as a result, it is taking a different approach to regulating the crypto space. In this effort, the Australian federal government is said to be creating a “token map” for the crypto assets. This move is to safeguard investors and protect them from themselves. Treasurer Jim Chalmers stated,

As it stands, the crypto sector is largely unregulated, and we need to do some work to get the balance right so we can embrace new and innovative technologies while safeguarding consumers.

While different countries are taking different approaches to regulating the crypto space, Bitcoin is looking ready for recovery before its next leg down.

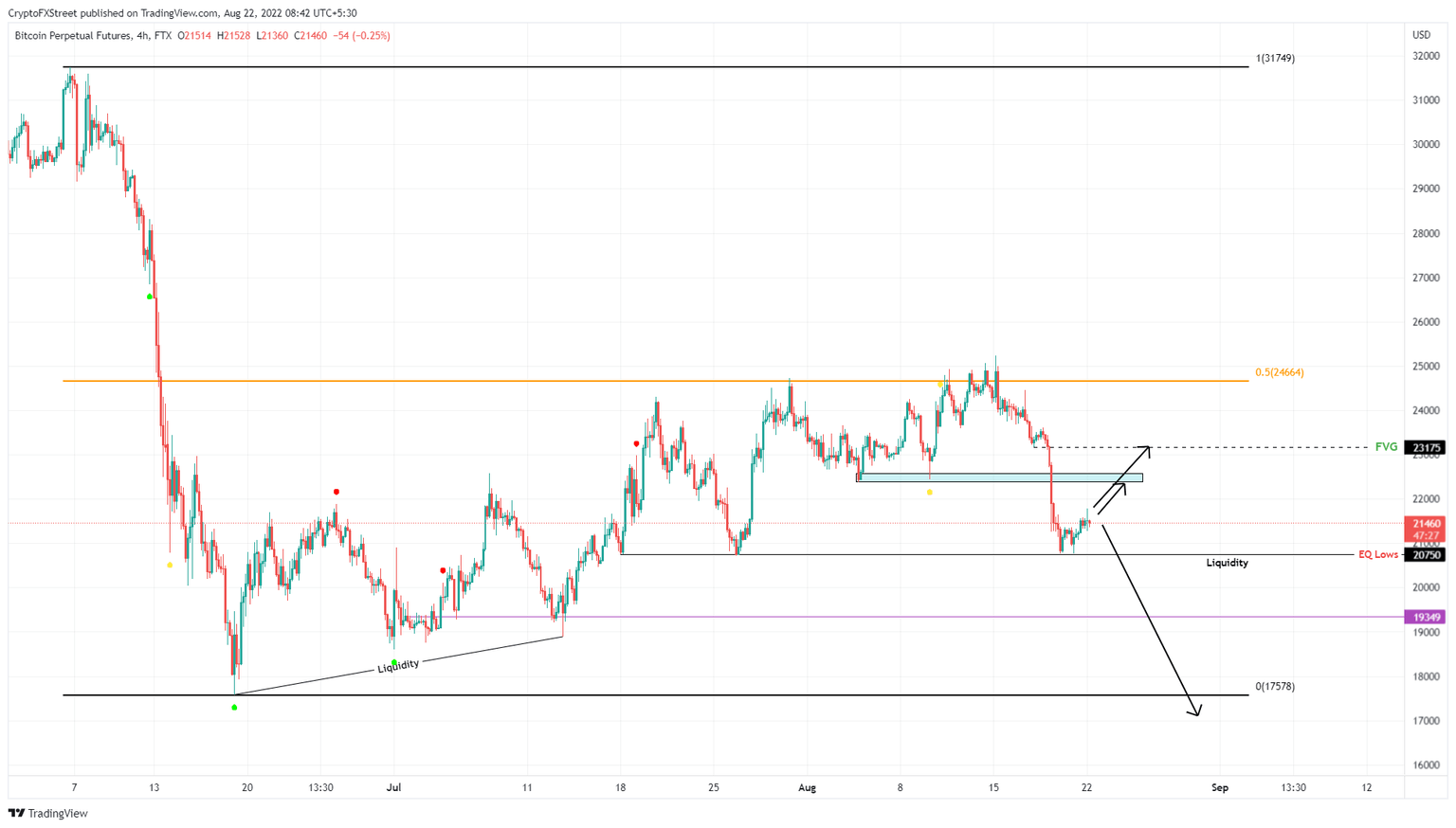

Bitcoin price eyes recovery

Bitcoin price crashed 12% between August 18 and August 20 and set a swing low at $20,750, which is the fourth equal low formed since July 18. Although the recovery has pushed BTC to $21,500, the upside seems capped at $22,600.

A rejection at the aforementioned level followed by a sweep of the $20,750 seems plausible. Therefore, investors should be cautious of a premature recovery rally.

BTC/USD 4-hour chart

While things are looking on the fence for Bitcoin price, a breakdown of the $20,750 support level and flipping it into a resistance level will postpone the recovery rally. In such a case, BTC could crash as low as $17,578 to collect liquidity, resting below the swing lows formed between June 18 and July 13.

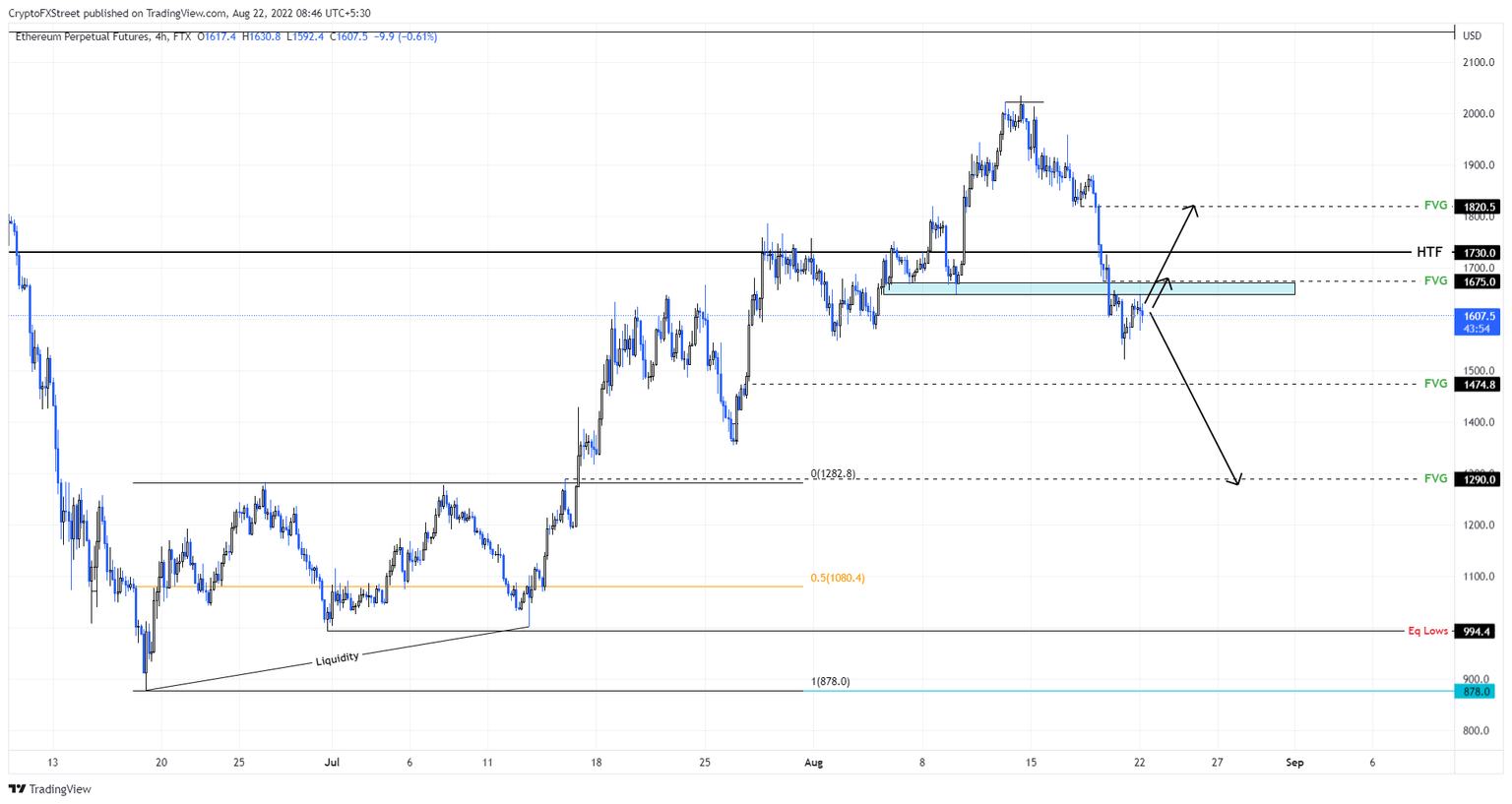

Ethereum price outlook remains so so

Ethereum price also crashed roughly 19% following Bitcoin’s cue between August 18 and 20. However, the recovery seems to be much shorter as ETH is already retracing. Investors can expect a minor uptick to $1,675 to fill the inefficiency and trigger its reversal here.

However, in some odd cases, this move could extend to $1,730 and form a local top there before reversing and continuing its downtrend. Regardless of where the local top forms, Ethereum price is due to retesting the imbalance to the downside at $1,474.

ETH/USD 4-hour chart

Although the recovery targets are looking ambiguous, a flip of the $1,730 hurdle will indicate the resurgence of buyers. However, a higher high above the recent swing point at $2,019 will invalidate the bearish thesis for Ethereum price.

Ripple price ready for some bounce

Ripple price is hovering around the $0.340 hurdle with no directional bias in mind. The recovery rally for Bitcoin is the only thing that can push XRP price higher.

In such a case, investors can expect the remittance token to make a run for the $0.360 resistance level. The recovery rally is likely to form a local top here, before reversing and potentially swapping the liquidity resting below the equal lows formed at $0.326.

XRP/USD 4-hour chart

On the other hand, if Ripple price flips the $0.381 hurdle into a support floor, it will invalidate the bearish thesis by conquering a long-standing resistance level. In such a case, investors can expect XRP price to make a move to the $0.439 barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.