Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets prepare for final pullback before next leg up

- Bitcoin price is due for a retracement as MRI flashes a sell signal on the daily chart.

- Ethereum price continues to consolidate under the $3,938 resistance level.

- Ripple price slides below the $1.09 support level as the crypto markets prepare for a minor correction.

Bitcoin price is facing resistance and selling pressure as it is inches away from retesting its all-time high. The technicals are also hinting at a retracement, which could translate to other altcoin markets.

Bitcoin price readies itself for a launch

Bitcoin price has risen a whopping 48% since October 1 but is finally slowing down as it approaches its all-time high of $64,895. On the daily chart, the Momentum Reversal Indicator (MRI) has flashed a red ‘one’ sell signal. This technical formation forecasts a one-to-four candlestick correction.

Investors should exercise caution as a pullback could be on its way. This correction could knock the big crypto downer to $62,944, the immediate support level below price, or push it down to the $60,000 psychological level. In some cases, if profit-taking intensifies, BTC might retest the $56,000 support barrier.

The aforementioned retracement may provide an opportunity for sidelined buyers to jump on the bandwagon and kick-start a massive uptrend that not only breaches through the all-time high at $64,895 but also sets up a new target at $70,000.

The 161.8% trend-based Fibonacci extension level at $77,525, could be the next pitstop for bulls.

BTC/USD 1-day chart

While things are looking slightly bearish for Bitcoin price in the short-term, a breakdown of the $56,000 support level has the chance to deepen the corrective wave, pushing BTC as low as $52,000 or, in some cases, $51,000, therefore, market participants need to be careful and wait for a confirmation of the upswing.

Ethereum price gets stuck again

Ethereum price saw a huge portion of its trading session stuck between $3,387 and $3,938. As ETH coils up below $3,938, investors can expect ETH to follow Bitcoin’s path if it corrects. For Ethereum price, the support levels are much more defined.

A downswing will let ETH retest the $3,619 level first, a breakdown of which will be followed by $3,387 and, in a worst-case scenario, $3,200.

Market participants can expect Ethereum price to kick-start its bull run around $3,200 and head straight toward the $4,000 psychological barrier, and its all-time high at $4,380.

The 100% trend-based Fibonacci extension level at $4,957 is where ETH could erect its next high, and in a highly bullish case, it could head toward the next barrier at $6,384.

ETH/USD 1-day chart

If the Ethereum price cracks below $3,200, however, it may revisit $3,000. This development does not invalidate the bullish thesis but delays it. Moreover, it would allow the buyers to purchase ETH at a discounted price, potentially kick-starting a new leg-up.

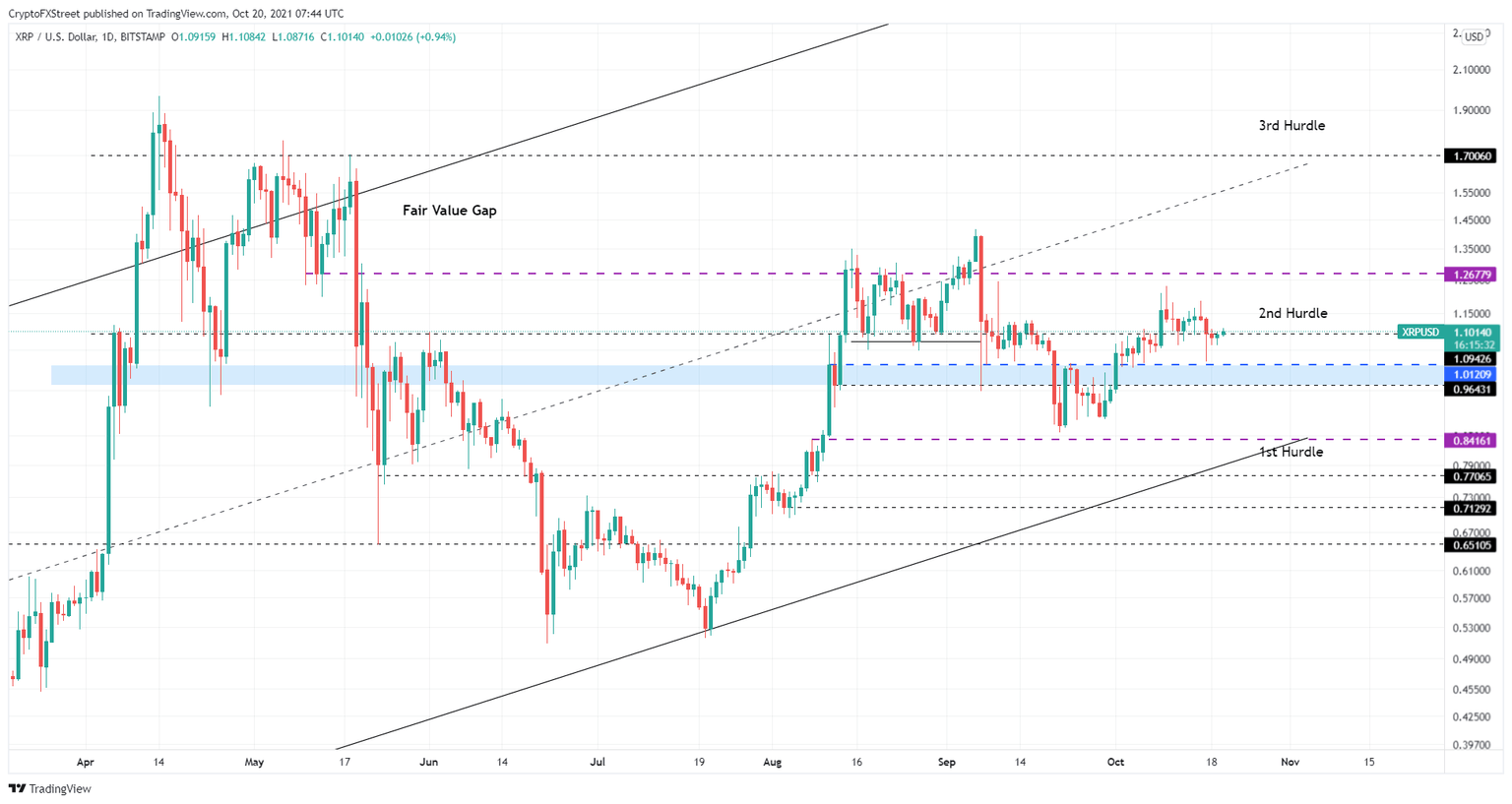

Ripple price tries to reclaim crucial levels

Unlike Bitcoin and Ethereum, Ripple price is seeing less volatility and recently slid below the $1.09 support floor. As XRP price struggles to head above the said barrier, investors need to be careful around this token.

A failure to pull up its weight could result in a retracement to the support area – extending from $1.01 to $0.964. If buyers fail to defend $0.964, the XRP price will likely revisit $0.84 and collect the sell-stop liquidity resting below the September 21 and 29 swing lows.

This development will allow Ripple price to gather enough energy for the next bull rally that will allow it to slice through critical resistance barriers and retest $1.27. If the buying pressure persists, the XRP price could extend its upswing to $1.30 and $1.60.

XRP/USD 1-day chart

While things are looking grim for Ripple price on a shorter time frame, a failure to stay above $0.84 could create deeper pessimism for XRP, leading to a retest of the $0.77, $0.71 or $0.65 support floors.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.