Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos at risk of another crash

- Bitcoin price fails to set up a higher high as it retraces to the $48,326 support level.

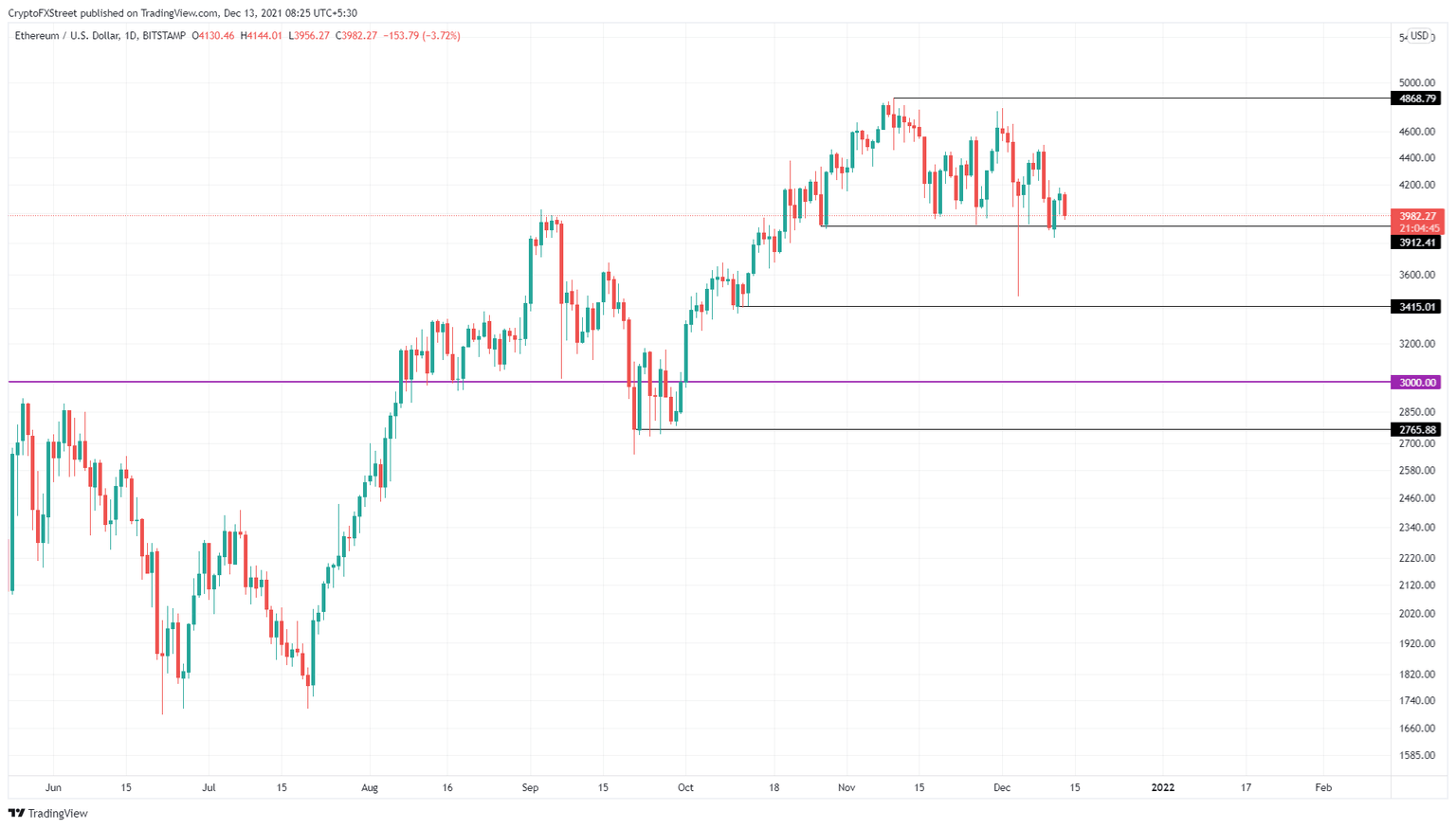

- Ethereum price also retests the $3,912 foothold, as bears vie to revisit the $3,000 psychological level.

- Ripple price breaks out of an ascending parallel channel, indicating a 10% crash is on its way.

Bitcoin price is hovering around a crucial support level for the ninth day in a row. This sideways movement indicates a lack of strength and is likely to result in a volatile move. Ethereum is following the big crypto and is also knocking on a vital support floor, indicating it is ready to penetrate lower. Ripple is hinting at the likelihood of a bearish move emerging soon.

Bitcoin price on thin ice

Bitcoin price has been hovering around the $48,376 support level for roughly nine days and the recent run-up failed to produce a higher high above $51,991. The inability of the buyers to push through suggests a lack of interest.

If increased selling pressure shatters the $48,376 demand barrier, it could trigger a sell-off that pushes the big crypto down to the $40,000 psychological barrier. In this scenario, there is a chance market makers might push BTC under $40,000 to collect liquidity.

BTC/USD 1-day chart

While things look grim for Bitcoin price, a daily close above $51,991 will set up a higher high and invalidate the bearish thesis. In this situation, investors can expect BTC to rally 11% to retest $57,845.

Ethereum price on a slippery slope

Ethereum price retested the $3,912 support floor four times over the past two months and is heading down to touch it another time. A potential increase in selling pressure that breaks this barrier will likely lead to a 12% downswing that retests the $3,415 foothold.

Buyers have a chance to come back and scoop up ETH at a discount at $3,400, but failing to do so might result in bears taking over. Such a development could see the smart contract token retest the $3,000 psychological level.

In a dire situation, market makers could drive ETH below $2,765 to collect liquidity.

ETH/USD 1-day chart

Regardless of the bearish situation, Ethereum price has an opportunity to remain bullish by setting a swing high above $4,491. If ETH produces a daily close above the $5,000 psychological level, however, it might be enough to catalyze a FOMO that will trigger further buying pressure and invalidate the bearish thesis.

Ripple price eyes a steep descent

Ripple price has been traversing in an ascending parallel channel over the past week. This technical formation is obtained by connecting a series of higher highs and higher lows. XRP price breached through the lower trendline, however, indicating a bearish breakout.

Since then, Ripple price has retested the lower trend line and eyes a 10% descent to $0.75. If this descent occurs, XRP price could dip below $0.75 to collect liquidity resting below it.

In a highly bearish situation, the remittance token might revisit the December 4 swing low at $0.60.

XRP/USD 4-hour chart

On the contrary, if Ripple price manages to produce a higher high above the bearish trend line at $0.90, it will indicate a breakout. In such a case, the XRP price needs to slice through the December 9 swing high at $0.93. Doing so will invalidate the bearish thesis and provide bulls with a resistance-free path to $1.01 and the buy-stop liquidity resting above it.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.