Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets could trap bears soon

- Bitcoin price shows signs of improvement as it could rally 7% to a resistance confluence at $20,465.

- Ethereum price gets ready to retest the $1,423 hurdle as it follows the big crypto’s path.

- Ripple price revisits the $0.381 to $0.433 demand zone in search of fuel for its next leg-up.

Bitcoin price seems to be consolidating and forecasts a tiny rally as it approaches the lower limit of the ongoing range tightening. This development could see altcoins, including Ethereum and Ripple, trigger a quick run-up as well.

Bitcoin price ready to make its move

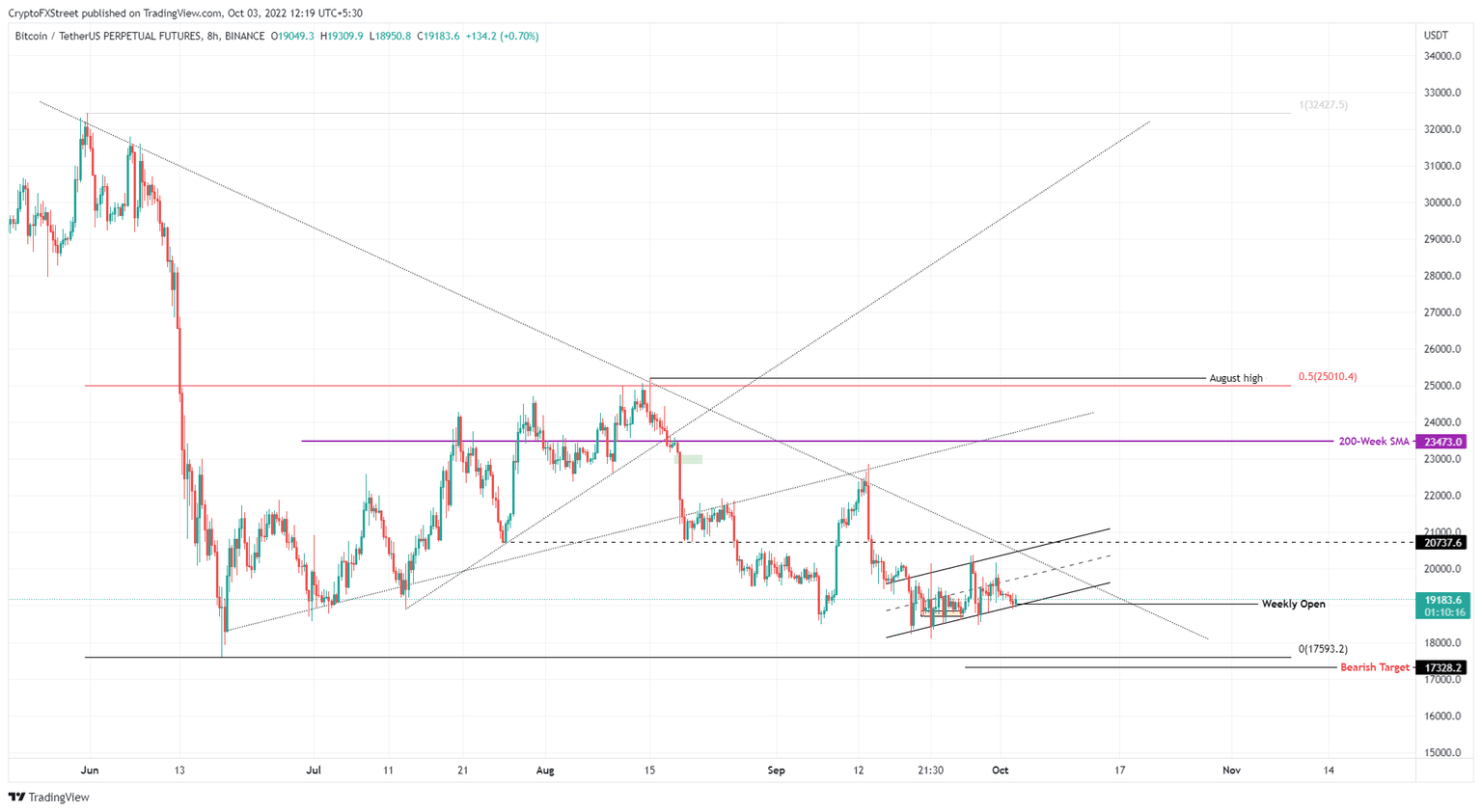

Bitcoin price has produced three higher lows and two higher highs since September 18 and connecting these swing points using trend lines describes an ascending parallel channel.

Now Bitcoin price is retesting the lower limit of the channel and a bounce is to be expected unless bears take control and catalyze a breakdown. Investors can expect BTC to rally to $20,465, where it will encounter resistance from where the declining trend line connecting the swing highs on May 31 coincides with the ascending parallel channel’s upper limit.

On the other hand, a breakdown of the $19,049 or the weekly open could trigger a crash to $17,593.

BTC/USD 1-day chart

While things are looking up for Bitcoin price in the short term, the ascending parallel channel could be interpreted as a bearish pattern as well, suggesting there is a fairly high risk of a breakdown. If BTC manages to flip the $20,737 level into a support floor, however, it will invalidate the bearish thesis.

Ethereum price at inflection point

Ethereum price is hovering around $1,280 but could retest the $1,200 support level soon. This barrier is crucial in determining where ETH will go next. A breakdown of this level is a plausible scenario, which could knock the smart contract token to $1,080, which is another stable support level.

A bounce here, combined with a bullish outlook on Bitcoin price, could be the key to triggering a rally for Ethereum price to $1,730. Flipping this hurdle could open the path to revisiting the $2,000 psychological level.

ETH/USD 1-day chart

On the other hand, if Ethereum price breaks below $1,080, it will invalidate the bullish thesis and potentially crash ETH to retest the range low at $878.

Ripple price to revisit stable foothold for more juice

Ripple price tagged the $0.381 to $0.433 demand zone on September 28, which catalyzed a 20% run-up in the next three days. However, exhaustion combined with deteriorating market conditions pushed XRP price down again and it is currently close to retesting the said demand zone.

The second attempt to rally could propel Ripple price up by 10% to $0.487. In a highly bullish case, XRP price might retest the $0.561 hurdle.

XRP/USD 1-day chart

Regardless of the $0.381 to $0.433 demand zone, a sell-off in Bitcoin price could have a knock-on effect on Ripple price, pushing it below it. A daily candlestick close below $0.381 will invalidate the bullish thesis for XRP price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.