Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets bleed in preparation for massive bull rally

- Bitcoin price is correcting toward the demand zone stretching from $30,573 to $31,979.

- Ethereum price broke out of the rising wedge and is likely to find support between $2,041 to $2,106.

- Ripple price is likely to reverse its downtrend at $0.596 or $0.581 before surging 30% to tag $0.785.

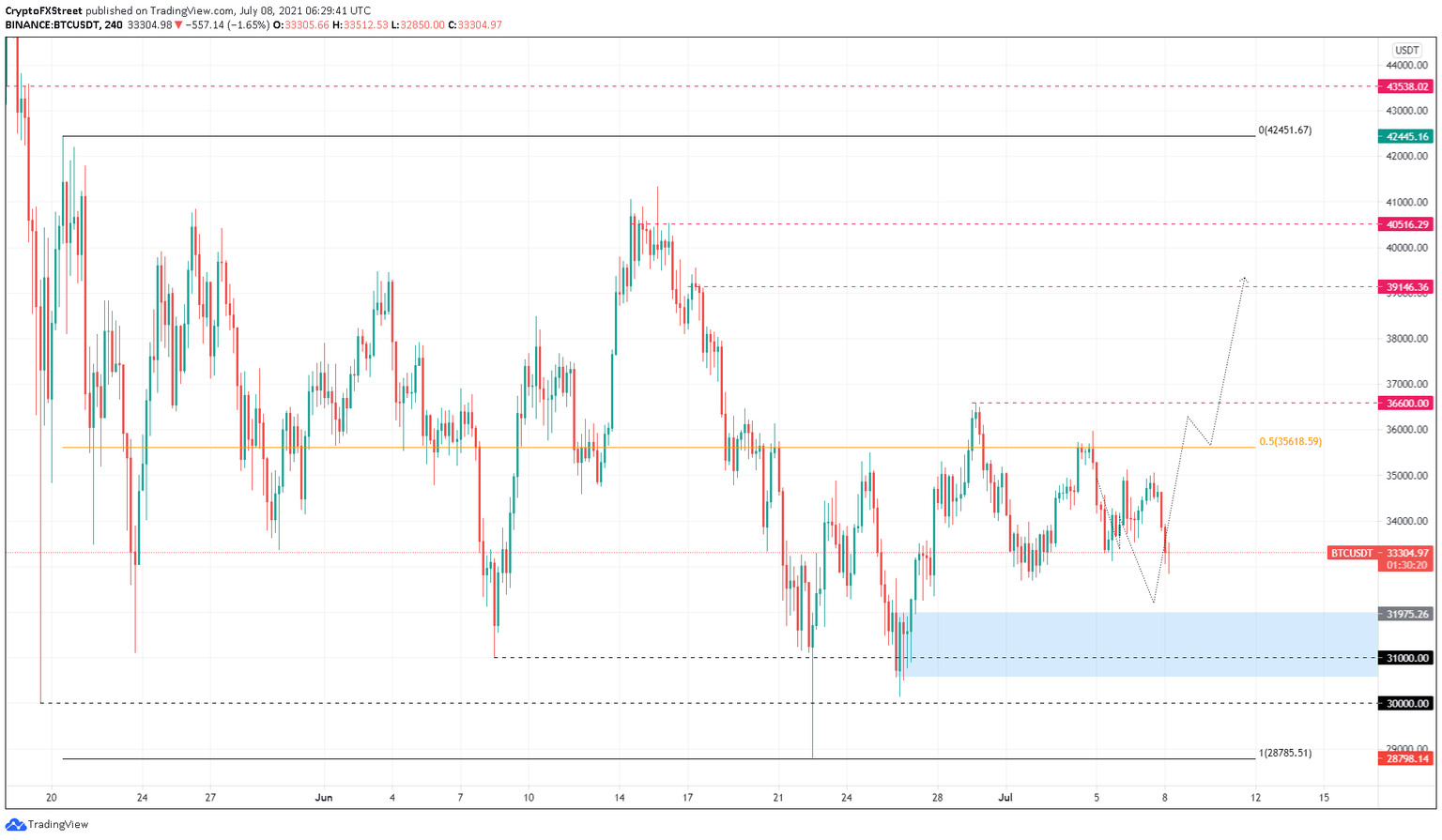

Bitcoin price rejection at the midpoint of the range has led to a slow downtrend gathering steam as of this writing. If this persists, BTC is likely to drop until it finds stable ground to kick-start another uptrend.

Ethereum, Ripple and other altcoins are likely to follow suit.

Bitcoin price sets the stage for massive run-up

Bitcoin price has set up three distinctive lower highs since June 29, indicating waning buying pressure. Moreover, BTC is hovering below the July 5 swing low at $33,125. A decisive 4-hour candlestick close would further confirm the downtrend.

If the sell-off continues, the flagship cryptocurrency will likely dip into the demand zone extending from $30,573 to $31,979. This area will serve as a foothold for reversal that could potentially catapult BTC beyond the midpoint at $35,618 in an attempt to tag the range high at $42,451.

BTC/USDT 4-hour chart

While the upside seems plausible, investors need to note that a breakdown of the $31,000 support level will inflict severe wounds on bulls. However, a decisive 4-hour candlestick close below $30,000 will invalidate the bullish thesis and trigger a potential sell-off to $28,786.

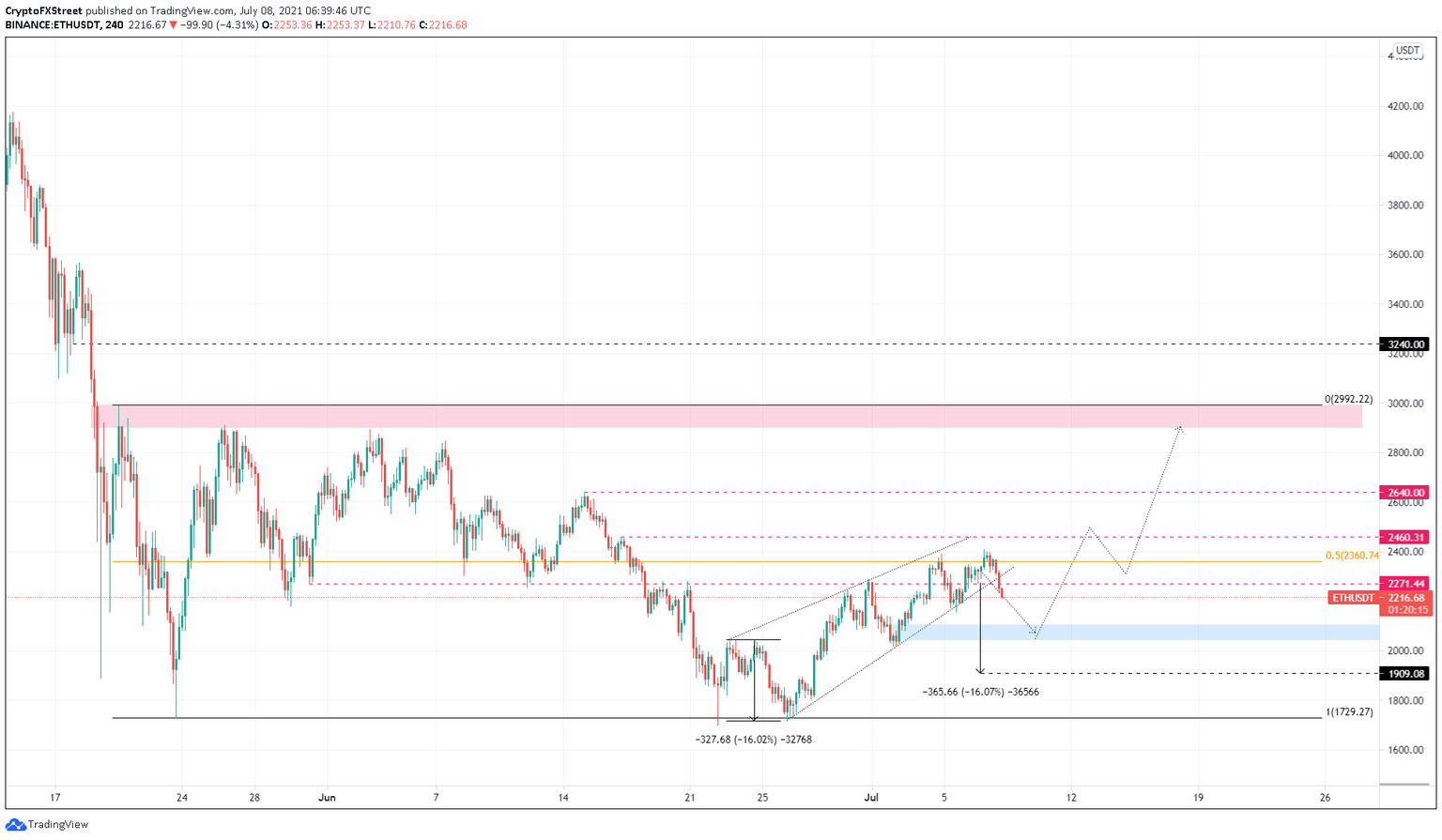

Ethereum price kick-starts its descent

Ethereum price broke out of the rising wedge pattern and has dropped roughly 6% over the past eight hours. While the bearish setup forecasts a 16% downswing to $1,909, the correction might find solace in the support zone that runs from $2,041 to $2,106.

Regardless of where the bulls rescue ETH, the potential upside targets include $2,460 and $2,640. If the bid orders continue to increase beyond this point, the bullish momentum will likely trigger an upswing pushing Ethereum price by 42% to tag the range high at $2,992.

ETH/USDT 4-hour chart

On the other hand, Ethereum price needs to stay above the demand zone’s range low at $2,041. Breaching this level might push ETH down to $1,909.

A breakdown of this barrier with the buyers unable to reclaim it would invalidate the bullish thesis and likely spark a 9% crash to $1,729.

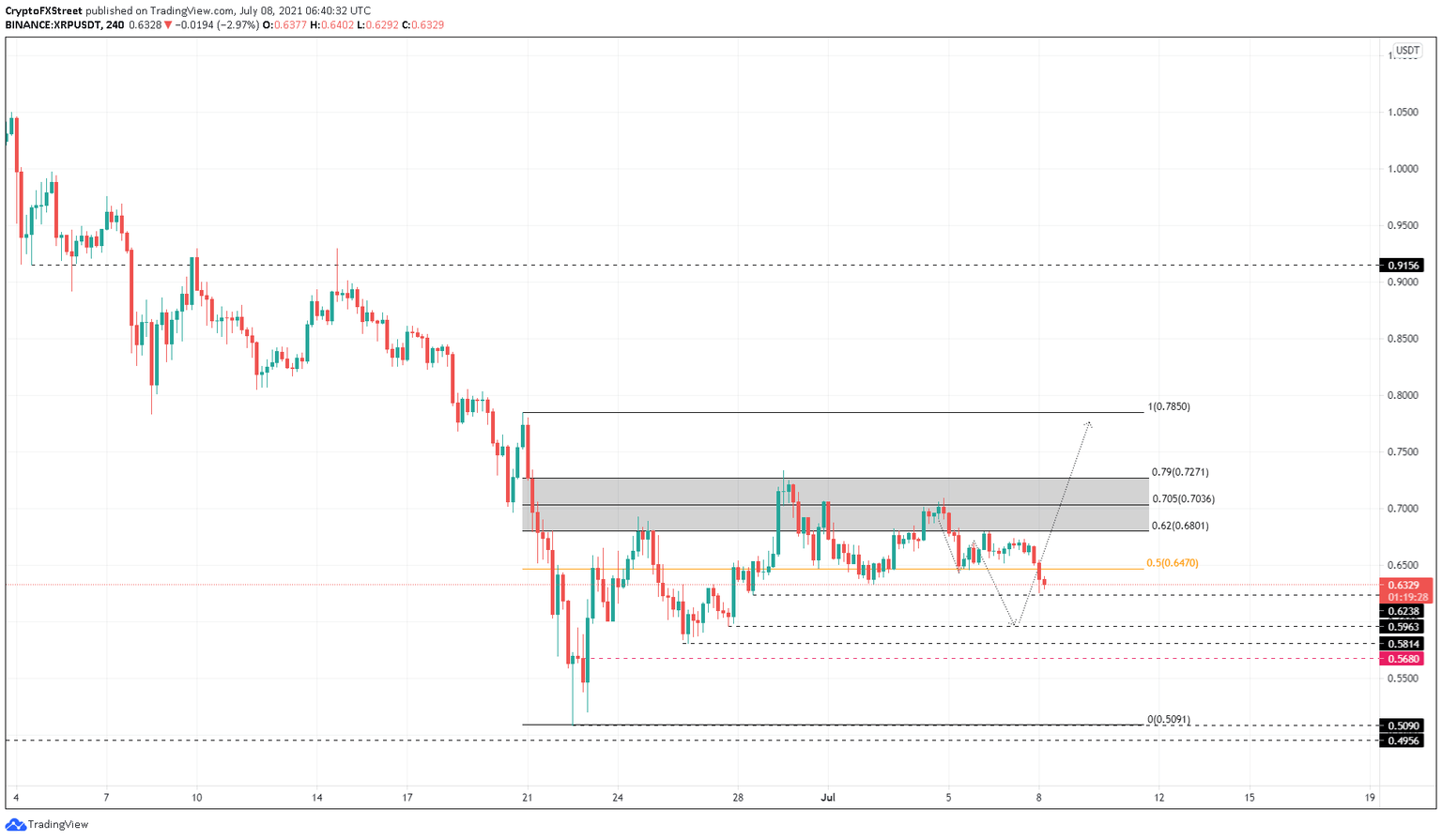

Ripple price crumbles to be reborn

Ripple price rejection at $0.68 has triggered a 7% correction that has pushed it below the 50% Fibonacci retracement level at $0.647.

XRP price hovers above the support level at $0.624, and investors can expect it to be breached. Ripple could find stable ground at $0.596 or $0.581, which could serve as a reversal point. In case the buyers come to the rescue, XRP price will kick-start its ascent.

The first major barrier that the bulls will face is the midpoint at $0.647. If the bullish momentum manages to breach through this, Ripple will enter the high probability reversal zone, ranging from $0.680 to $0.727

If the bid orders continue to pile up after a breach of $0.727, XRP price will have a high chance of retesting the range high at $0.785.

XRP/USDT 4-hour chart

On the one hand, XRP price could bounce from $0.596 or $0.581 and kick-start an uptrend that could face rejection by the reversal zone due to early profit booking from investors, leading to a pullback.

On the other hand, if the bears produce a decisive 4-hour candlestick close below $0.568, it will invalidate the bullish thesis.

In such a case, Ripple might slide 10% to tag the range low at $0.509.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.