Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets at an impasse

- Bitcoin price can retest $25,000 and $28,000 if it can overcome the inflection point at $23,000.

- Ethereum price drops 6% as it reacts to the bearish divergence seen on the 12-hour chart.

- Ripple price also shows incredible resilience as it sustains above the $0.400 support level.

Bitcoin price shows an ambiguous outlook, but Ethereum and Ripple are already showing weakness. The fate of this short-term yet exuberant rally depends on BTC and its next move.

Also read: Three reasons why crypto market is primed for a selloff

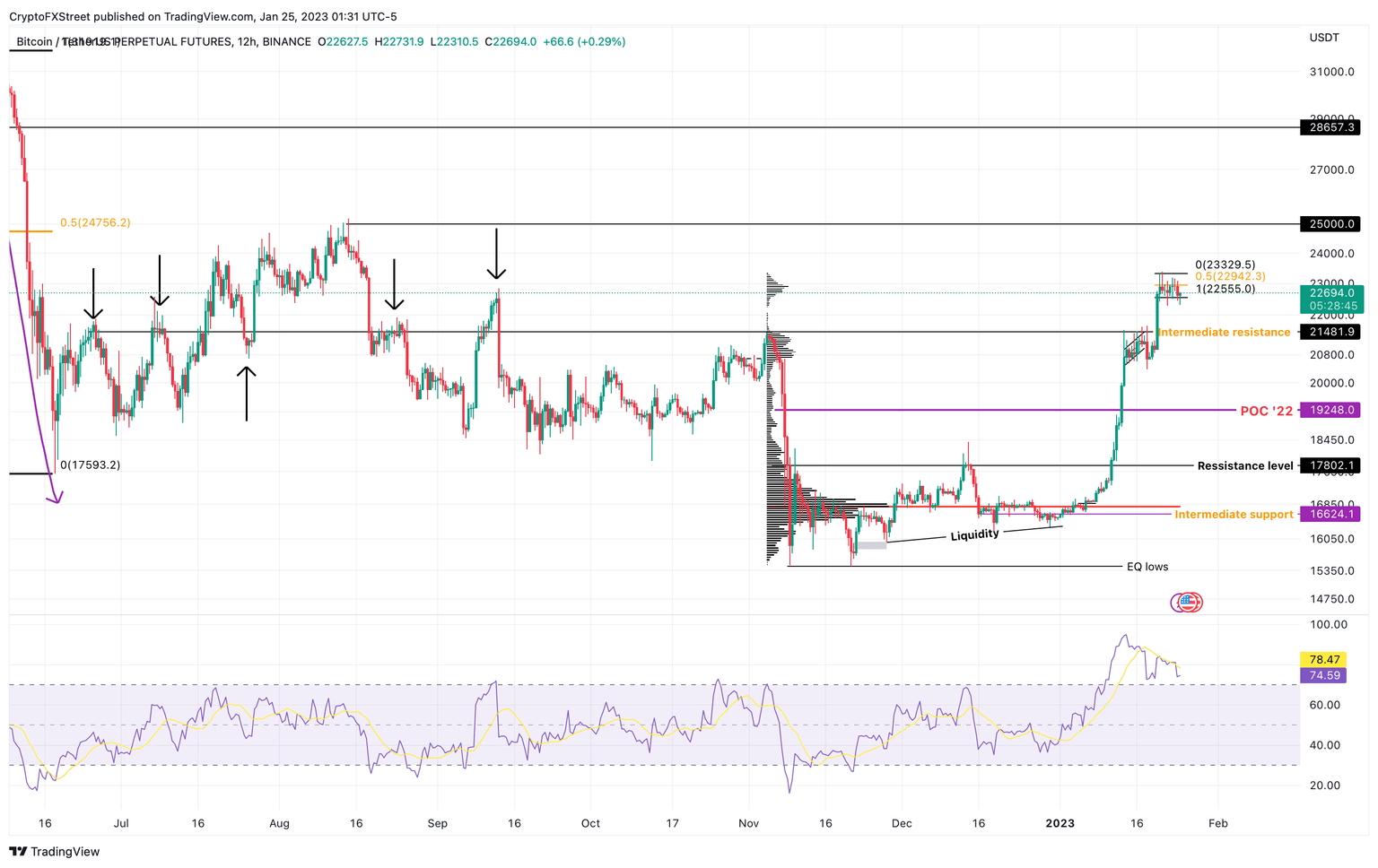

Bitcoin price sustains without breaking

Bitcoin price continues to resist a sell-off as it consolidates around the $23,000 hurdle. This level is the only one that is in the path of bulls and retesting $25,000 and $28,000 levels. However, the extended nature of this rally could be hinting at a distribution that could trigger a selloff.

From a short-term perspective, a flip of the $22,500 support level into a resistance barrier will confirm a narrative favoring bears and could cause a move down to $21,489. An extended move south will be determined by the momentum of the selling pressure.

BTC/USD 4-hour chart

On the other hand, if Bitcoin price can manage to overcome the $23,000 hurdle and flip it into a support floor, things could continue favoring the bulls. In such a case, BTC could eye a retest of the $25,000 and $28,000 levels.

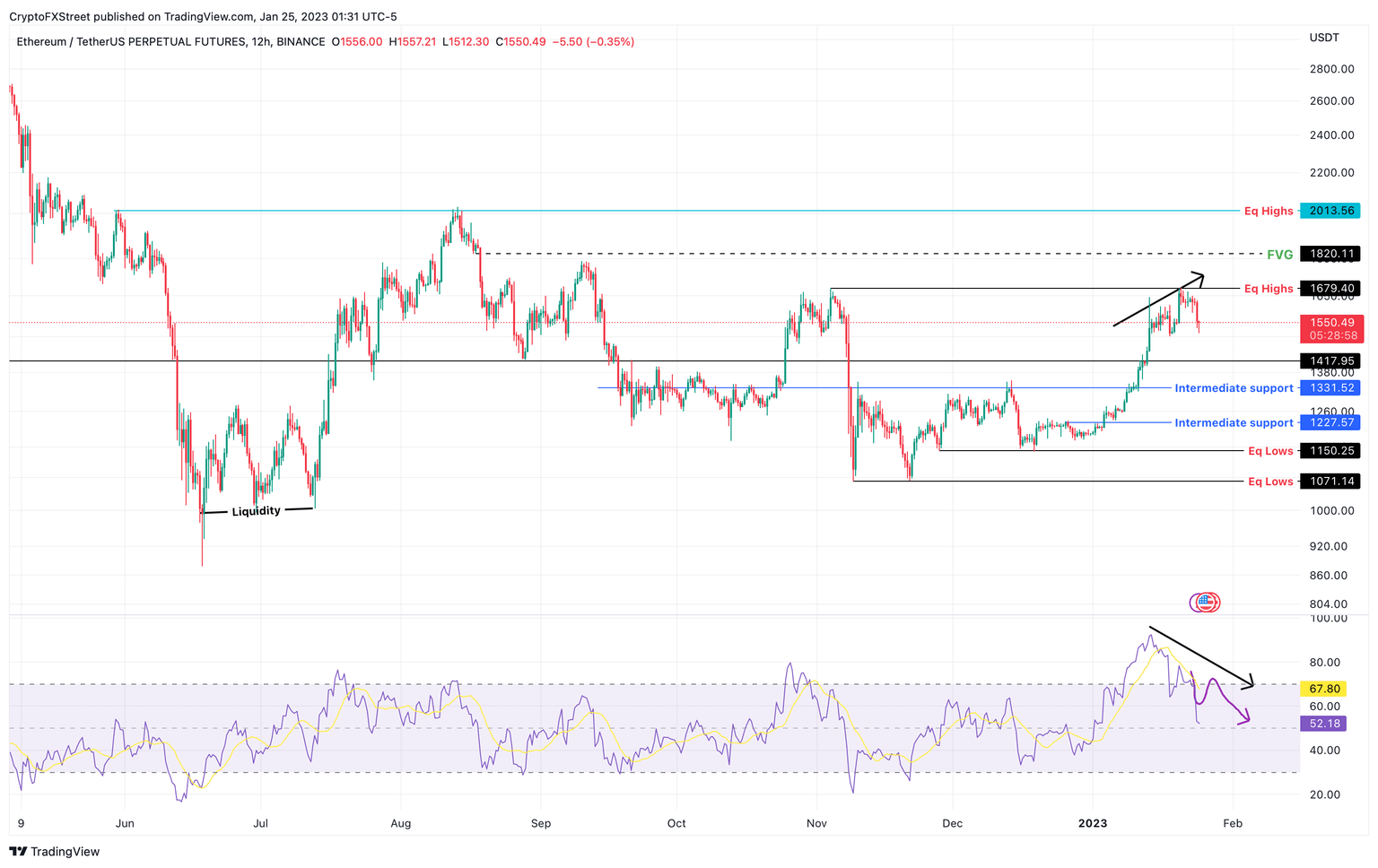

Ethereum price reacts first

Ethereum price peaked at $1,679 and has dropped roughly 10% so far. While the initial reaction seems bearish, confirmation of the same has yet to arrive. A daily candlestick close below the $1,501 will create a lower low and add credence to the pessimistic outlook.

Such a development could see Ethereum price retest the $1,417 and $1,331 support levels. Further decline in ETH’s market value will happen if Bitcoin price also continues to sell-off.

ETH/USD 12-hour chart

Regardless of the bearish implication after the recent Ethereum price move, investors need to wait for a confirmation. If the big crypto continues to spike higher, the short-term dip could be just that. If Ethereum price manages to flip $1,679 into a support floor, it will invalidate the bearish bias and trigger a move to $1,820.

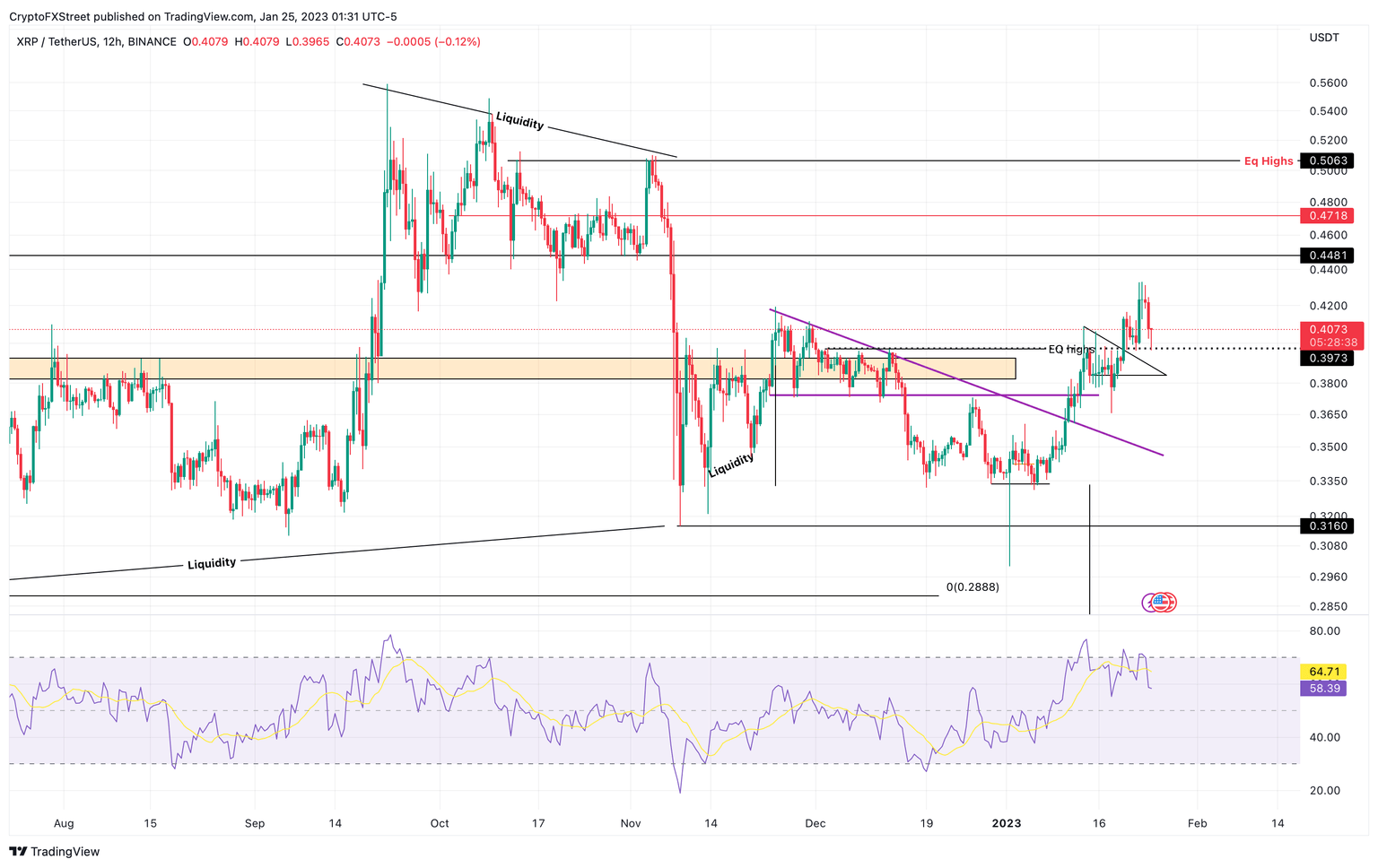

Ripple price remains neutral

Ripple price has overcome a string of important hurdles in its 2023 rally. This move has sliced through and flipped the $0.400 blockade that has plagued XRP holders for the last six months. Hence, the recent sell-off seems to have been supported by buyers at this aforementioned level.

As long as this barrier continues to provide buying pressure, things are not bearish for Ripple price. However, a breakdown of this level could see XRP price slide to $0.372 and $0.352 support floors.

XRP/USD 12-hour chart

While the neutral outlook for Ripple price makes sense, it will be undone by strong pressure from Bitcoin price moves. If BTC resumes its ascent, the next levels of interest for XRP price are $0.448 and $0.471, provided it manages to hold its ground around $0.400.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.