- Bitcoin rebounds from support at $13,000 and the 50 SMA but struggles to sustain the uptrend.

- Ethereum's recovery to $420 in the offing, but substantial obstacles lie ahead.

- Ripple is in grave danger of sliding back to $0.24, especially if it closes below the 200 SMA.

The cryptocurrency market is mixed red and green as the week grinds to a halt. Bitcoin and Ethereum are among the few assets that have accrued minor gains over the last 24 hours. ABBC Coin incurred a substantial loss in the same period, amounting to 15%. Altcoins, particularly the decentralized finance (DeFi) tokens, continue with sluggish price action, ignoring Bitcoin's recent surge.

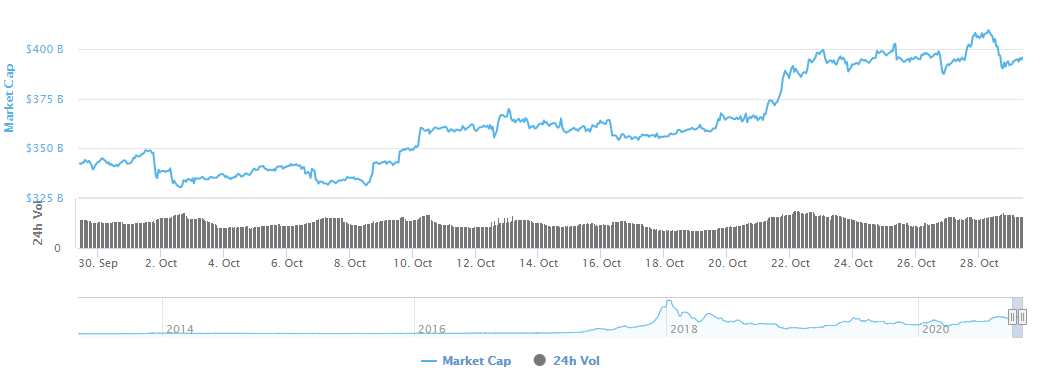

A minor change can be observed in the total capitalization for the crypto market. From $409 billion posted on Wednesday, the market cap has declined to $406 billion at the time of writing. The dip is reminiscent of the drab trading across the board and Bitcoin's slump to $13,000.

Crypto market cap chart

Bitcoin struggles with sustaining the uptrend

As reported, the flagship cryptocurrency recently hit new yearly highs after spiking past $13,000 and closing in on the June 2019's high. However, the remarkable momentum lost steam, leaving a gap that has been extensively explored by the bears.

Bitcoin embarked on a retreat as discussed but embraced support at $13,000 aided by the 50 Simple Moving Average. Meanwhile, BTC/USD is exchanging hands at $13,266 amid a struggle to nurture the uptrend.

The Relative Strength Index (RSI) sharp dive from overbought territory places BTC slightly in bears' hands. However, the immediate correction above the midline suggests that buyers are not ready to give up.

BTC/USD 4-hour chart

On the other hand, it is essential to realize that selling pressure will intensify if the price action fails to pick momentum towards $13,500. The bellwether cryptocurrency may then retest the 50 SMA support. If push comes to shove, and a dip under $13,000 occurs, losses targeting the 100 SMA will likely come into the picture.

Ethereum recovery faces challenges

The smart contract token caved into the bearish pressure below the critical $400 level. The lower leg extended to the crucial support at $380 before a shallow recovery came into the picture. In the meantime, the crypto has stepped above the 100 SMA in the 4-hour timeframe to trade at $391.

Ethereum is also sitting on the x-axis of the ascending triangle established in the early October days. The RSI shows the bulls' return, but the stalling under the midline reveals lack of buying pressure to push ETH/USD beyond $400. If Ethereum closes the day above the 50 SMA, recovery to $420 will begin.

ETH/USD 4-hour chart

It is worth mentioning that a reversal below the x-axis and closing beneath the 100 SMA will call for more sell orders. Thus, Ether could revisit support at $380 and the 200 SMA (marginally above $370).

Ripple bulls losing the tug of war

Ripple refreshed support at $0.246, as predicted on Wednesday. The down leg came after the cross-border token hit a wall slightly above $0.26. Moreover, XRP did not have the energy to build upon the x-axis of the ascending triangle.

For now, the crypto asset is teetering at $0.2462 while dealing with the immediate resistance at the 200 SMA in the 4-hour range. If bearish momentum keeps building, a slip under the hypotenuse might resume the downtrend. Glancing lower, $0.24 is the nearest target while $0.23 and $0.22 are in line to cushion XRP from falling massively below $0.2.

XRP/USD 4-hour chart

It is essential to keep in mind that the bearish outlook will be invalidated if the price closes the day above the 200 SMA. The bullish leg is likely to extend to the 100 SMA, currently at $0.25. Action towards $0.26 must bring down the hurdles at the 50 SMA and $0.255 level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

(55)-637395539791443425.png)

- 2020-10-29T095456.516-637395540237609224.png)

-637395540713419396.png)