- Bitcoin price is eying up the psychological level at $60,000 again.

- Ethereum has defended a key support level but remains weaker.

- Ripple price had several price spikes in the past week that led nowhere.

In the past 24 hours, the cryptocurrency market managed to recover about 80$ billion in market capitalization reaching $1.81 trillion. The next target is the astronomical $2 trillion capitalization level.

Most cryptocurrencies are in the green today while Bitcoin’s dominance continues declining, dropping 2 percentage points in the past week.

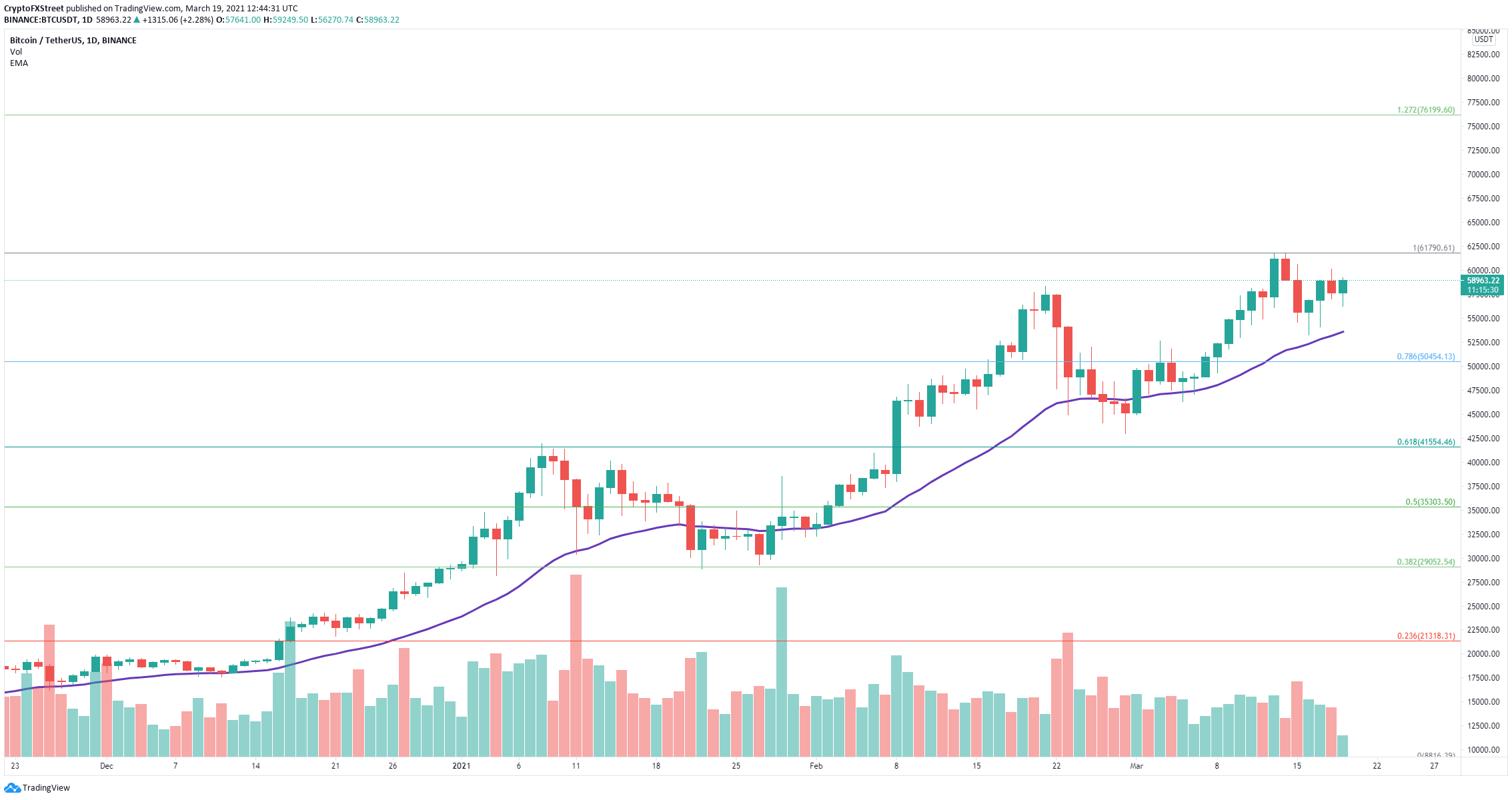

Bitcoin price faces weak resistance ahead as bulls keep the momentum

On the daily chart, the uptrend has been kept intact and Bitcoin held the key support level at $53,700, the 26-EMA. This moving average has served as an accurate guide for the bulls throughout this recent bull rally.

BTC/USD daily chart

The only resistance point is the previous all-time high of $61,844. A breakout above this point should swiftly drive Bitcoin price towards $70,000 and up to $76,200 at the 127.2% Fibonacci level.

On the other hand, losing the key 26-EMA support level at $53,650 would push Bitcoin price down to at least $50,450 at the 78.6% Fibonacci Retracement level and as low as $41,554.

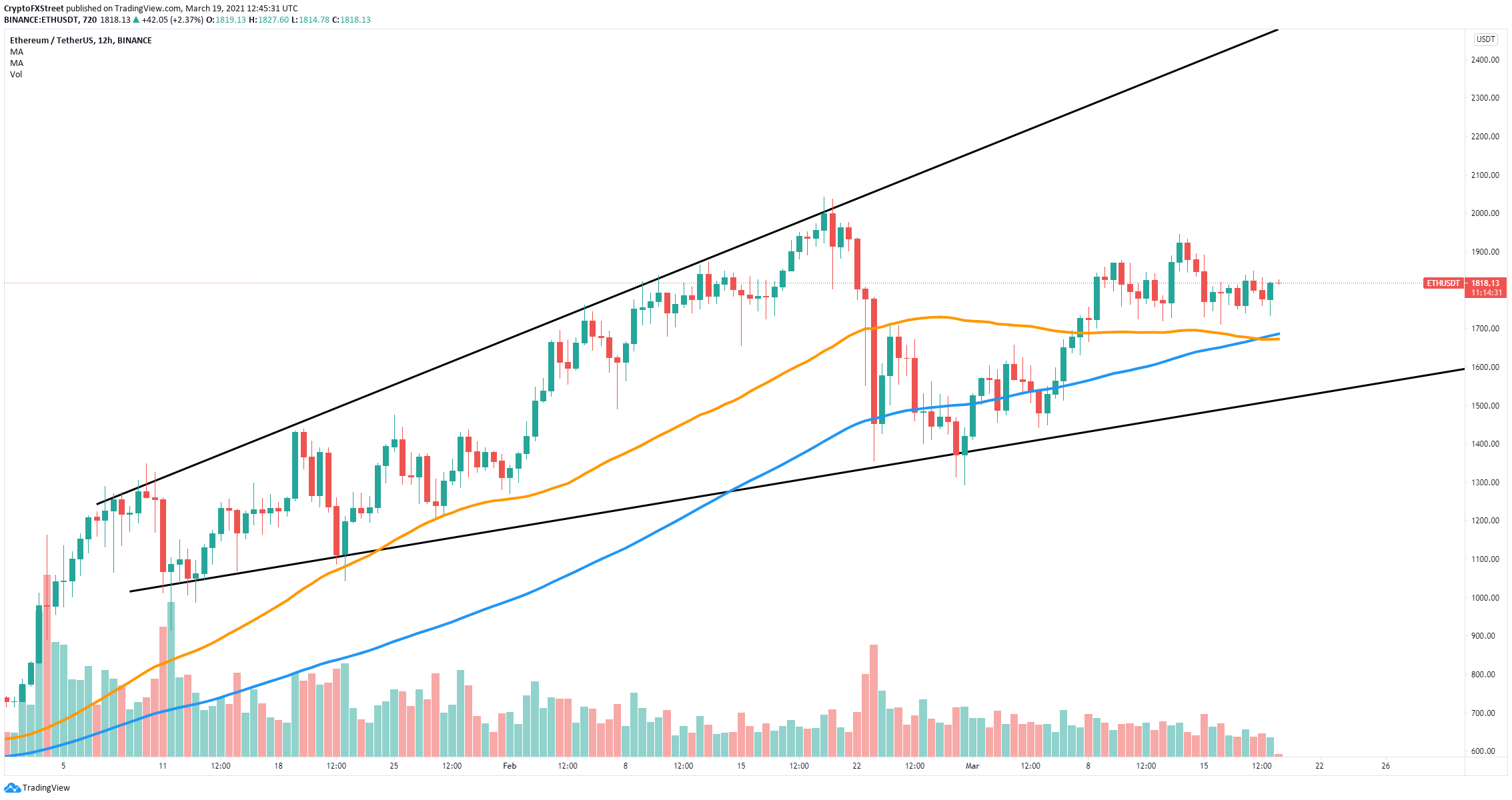

Ethereum price remains flat in the short-term

In the past week, Ethereum has been trading sideways but remains contained inside an ascending broadening wedge pattern on the 12-hour chart. There is a critical support level at $1,700 which coincides with the 50-SMA and the 100-SMA levels.

ETH/USD 12-hour chart

Holding this key support point should push Ethereum higher. The short-term resistance is located at $1,944, a breakout above this level should push ETH towards the all-time high of $2,042. Further than that, the next price target would be the top trendline of the pattern at $2,423.

On the other hand, a breakdown below the key support level at $1,700 would drive Ethereum price down to the lower boundary of the pattern at $1,520.

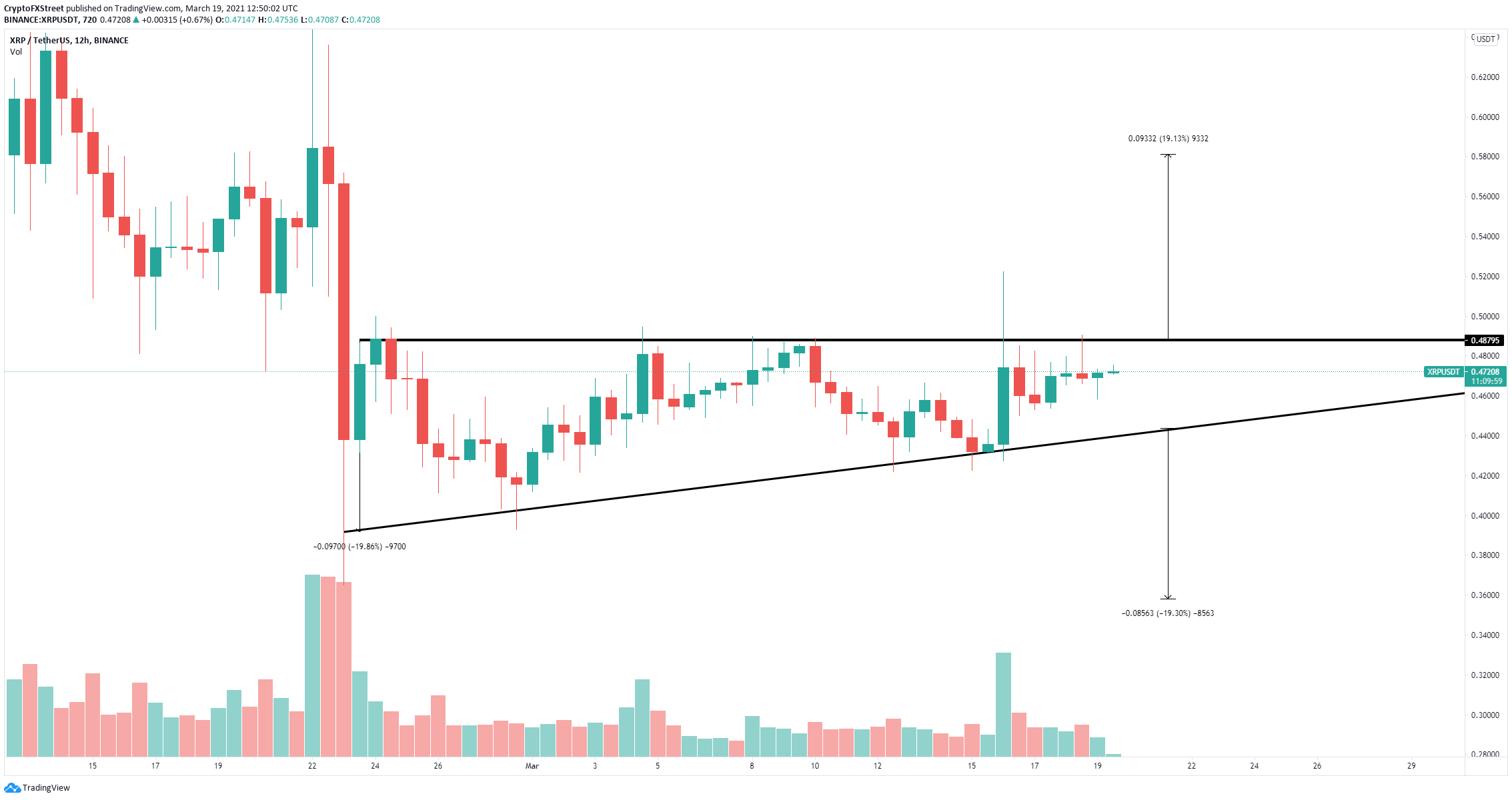

Ripple price hits a robust barrier once again

XRP has been rejected from a key resistance level at $0.488 several times in the past month. On the 12-hour chart, the digital asset formed an ascending triangle pattern.

XRP/USD 12-hour chart

A breakdown below the lower trendline support at $0.444 will drive Ripple price down to $0.36. However, if bulls can finally crack the key resistance level of $0.488, the digital asset will quickly explode towards a high of $0.581.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.