- Bitcoin price liquidations cross $100 million after the SEC’s recent lawsuit against Binance.

- Ethereum price could retest the $2,000 psychological level if sidelined buyers join the fray.

- Ripple price to get boring for a few days before XRP reveals its directional bias.

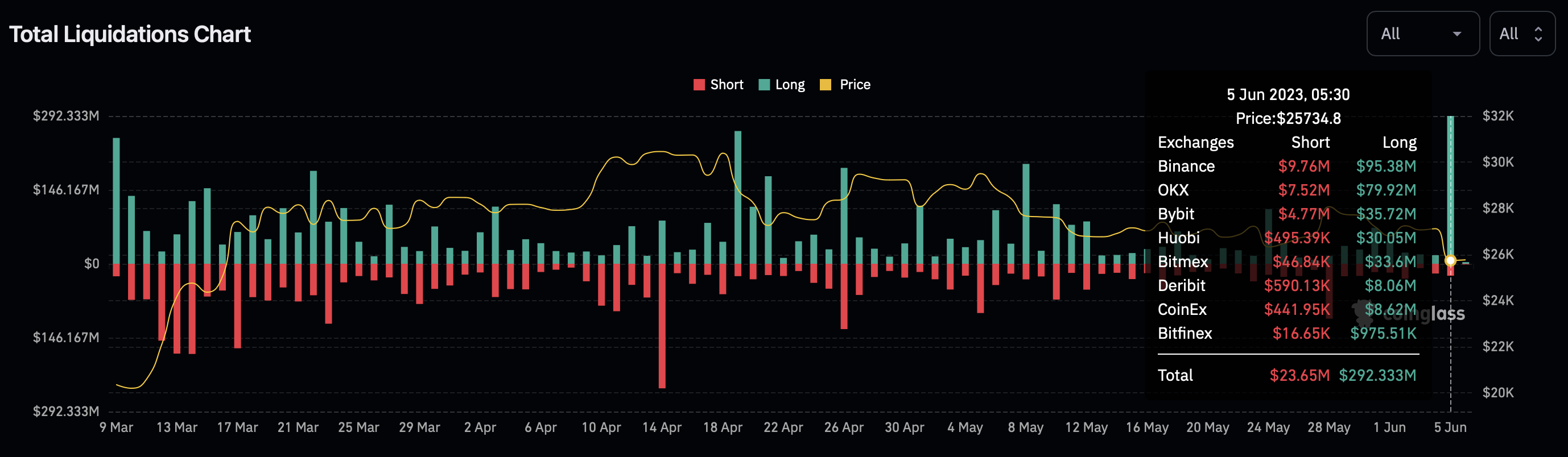

Bitcoin (BTC) price has suffered a fatal setback after the recent lawsuit that the Securities and Exchange Commission (SEC) filed against Binance and its founder, Changpeng “CZ” Zhao. The suit caused the markets to cascade, triggering a massive sell-off and causing roughly $311 million in liquidations across the entire crypto landscape.

BTC Liquidations

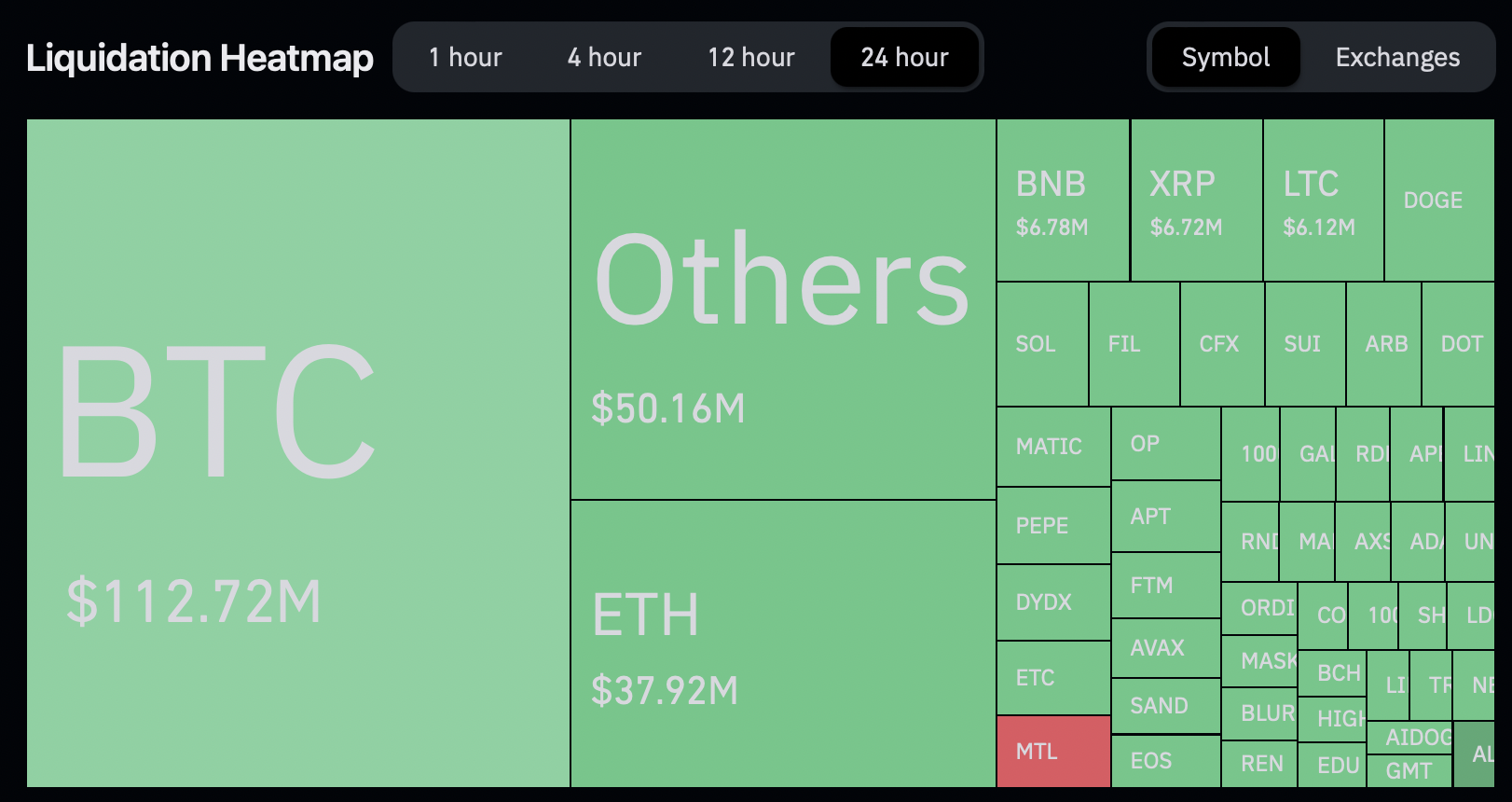

Out of the $311 million in liquidations, BTC takes the largest share with $112.27 million in liquidations, Ethereum (ETH) sits at $37.92 million and Ripple (XRP) at $6.72 million. Other altcoins make up roughly $50.16 million.

Liquidations heatmap

Also read: Binance responds to SEC claims, plans to defend the platform vigorously

Bitcoin price remains rational

Bitcoin (BTC) price action over the last 50 days has set up four distinctive lower highs and lower lows. Connecting these swing points using trend lines reveals a falling wedge formation. This technical formation is a bullish setup, but considering BTC has breached the lower trend line, investors need to wait for more information.

Additionally, Bitcoin price has come close to retesting $25,290, which is the midpoint of the 59% rally witnessed between March 10 and March 27. Hence, the likely direction Bitcoin price will head next is south to find a stable support level. The $25,290 barrier will likely provide some respite from bears.

A recovery inside the falling wedge could see Bitcoin price try and retest the upper limit of the wedge at roughly $27,395. A flip of this hurdle into a support floor could trigger a swift move to $30,048. This uptick is likely going to target the buy-side liquidity resting above this level.

BTC/USD 1-day chart

A bearish case scenario for Bitcoin (BTC) price will include BTC sliding lower to retest the 62% and 70.5% retracement levels of the 59% rally at $23,905 and $22,925, respectively. While in the short-term, this move might seem bearish, a revisit to these levels will be an opportunity for long-term holders to accumulate BTC.

Read more: Bitcoin Weekly Forecast: BTC delays inevitable crash to $25,000

Ethereum price could dip lower before a bounce

Ethereum (ETH) price currently sits below a critical support level at $1,817, leaving investors guessing where it will head next. A recovery of ETH above the aforementioned level, combined with Bitcoin’s bounce, sounds plausible and could trigger a rebound rally for Ether.

If successful, Ethereum price could continue its ascent and target the $2,028 hurdle.

ETH/USD 12-hour chart

If the after-effects of the recent sell-off continue to impact the crypto markets, Ethereum (ETH) price could slide lower. In such a case, a retest of the $1,703 support level seems likely. The aforementioned level and the zone, extending from $1,563 to $1,478, are places where long-term holders are likely to accumulate ETH.

Read more: Ethereum exchange supply hits multi-year lows, VanEck analysts predict a rally to $11,800

Ripple price to move sideways before revealing its move

Ripple (XRP) price has successfully hit targets of the inverse head-and-shoulders, as forecasted in previous publications. The recent sell-off pushed the XRP price into an inefficiency above the $0.483 support level.

Going forward, Ripple price is likely to consolidate between the $0.483 and $0.515 support levels before making a move to the upside. A successful flip of the $0.515 hurdle is likely to trigger a sweep of the $0.548 hurdle to collect the buy-side liquidity.

XRP/USD 12-hour chart

A failure to move higher after consolidation will signal a waning bullish momentum for Ripple (XRP) price. In such a case, a breakdown of the $0.483 support floor will be the obvious outcome. A further spike in selling pressure could send XRP down to retest the $0.466 barrier.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.