Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto bears dominate, Ripple breaches $0.2900

- Bears return on Sunday as altcoins continue to remain favorites.

- Bitcoin battles $11,800 to regain the upside momentum.

- Ethereum and Ripple break below key support levels.

The most favorite crypto coin, Bitcoin, is trying hard to take out stiff resistance just above $11,800, in order to test the $12K mark. Ethereum is the main laggard among the top three cryptocurrencies on Sunday. Ripple breaches $0.2900 after rejection just below the $0.30 barrier. The total market capitalization of the top 20 cryptocurrencies now stands at $356.41 billion, as cited by CoinMarketCap.

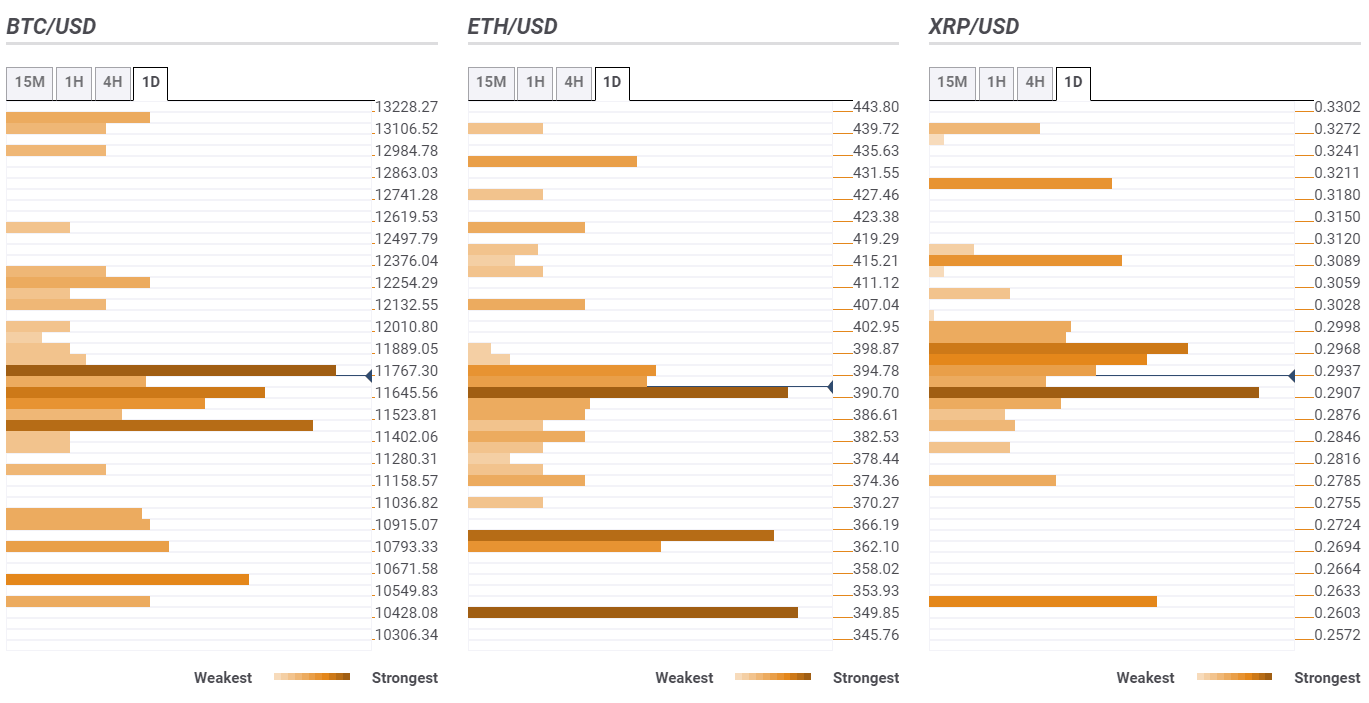

The top 3 most favorite digital assets remain on the back while heading into a fresh week, with FXStreet’s Confluence Detector tool indicating how they are positioned technically.

BTC/USD: $11,817 is a level to beat for the bulls

Bitcoin continues to keep its range play intact below the critical barrier at $11,817, the confluence of Fib 38.2% 1D, Bollinger Band 4H Middle and SMA5 4H.

The bulls will face an uphill task despite the break above the latter, as a bunch of minor resistance levels are placed around $12,000, where the previous week high and Pivot Point 1D R2 coincide.

Alternatively, minor support around $11,590 caps immediate downside. That level is the intersection of the Fibonacci 61.8% 1W, Bollinger Band 4H Lower and Previous Day Low.

A failure to resist above the aforesaid support, the selling pressure will likely accelerate towards the next cushion aligned at $11,470, the convergence of the Pivot Point 1D S2 and the previous month high.

ETH/USD: Bearish bias intact while below $392

According to Ethereum’s near-term technical view, the bearish bias remains intact while the spot trades below the critical resistance at $392, which the intersection of the Pivot Point 1M R1 and Fib 38.2% 1D.

The next upside target is located at $396.75, the confluence of the Fib 23.6% 1D, SMA5 4H and Bollinger Band 1H Middle.

To the downside, a cluster of resistances is stacked up near $388/386, which is the convergence of the Fibonacci 61.8% 1D, Bollinger Band 1H Lower and SMA200 1H.

XRP/USD: Path of least resistance is to the downside

Ripple extends the break below $0.2900 this Sunday, with the immediate support seen at the Pivot Point 1D S2 at $0.2876.

Amid a lack of healthy support levels below the latter, the sellers will then aim for $0.2785, the Fib 61.8% 1W.

Any recoveries will likely face stiff resistance at $0.2907, the convergence of the Pivot Point 1M R1 and Bollinger Band 15-minutes Lower.

A break above the last will call for a test of $0.2950. Further north, the 0.2983 will be on the buyers’ radar. At the level, the Fib 38.2% on 1D and 1W coincide.

See all the cryptocurrency technical levels.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.