Update: US inflation rate hit 9.1% and despite bearish sentiments in the financial markets, Bitcoin, Ethereum and Ripple prices are in the green. CPI data is key to the cryptocurrency market as the Fed is battling hard inflation with heavy interest rate hikes, and the risk of recession is growing, in turn damaging capital inflow to crypto assets. Both the S&P 500 and tech-heavy Nasdaq suffered a decline from the Federal Reserve’s monetary policy tightening and cryptocurrencies act in a similar way.

The cryptocurrency market recovered from the decline in market capitalization after rising 5% over the past 24 hours. Bitcoin price climbed to $19,880, recovering from its six month low at the $19,047 level.

If Bitcoin price flips $20,300, analysts have predicted a climb to the $21,600 level. Altcoin Sherpa, a leading crypto analyst notes that overall Bitcoin price action is choppy, a failure to cross $20,300 could result in a drop to the $17,000 level.

BTC-USD price chart

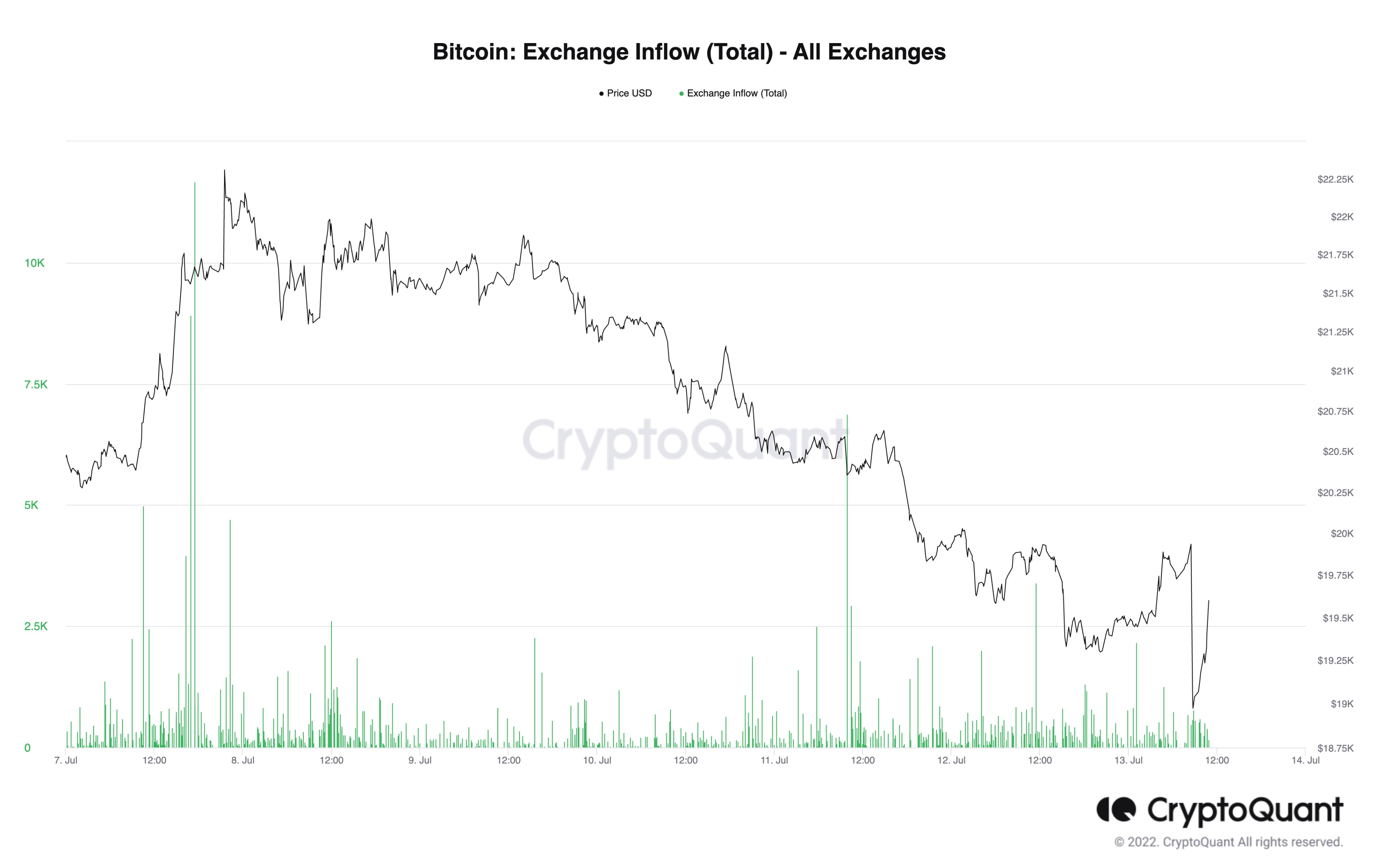

Ki Young Ju, CEO of CryptoQuant believes US CPI data is already reflected in Bitcoin price. The data release was therefore not an unpredicted black swan event, which typically result in mass inflow of Bitcoin to exchange wallets.

Bitcoin: Exchange Inflow (Total)

- Bitcoin price shows a bearish pennant breakout, hinting at a 42% crash to $11,202.

- Ethereum price looks to find a stable support floor to trigger a breakout of the $1,284 hurdle.

- Ripple price might revisit the four-hour demand zone, extending from $0.286 to $0.306, in an attempt to rally.

Bitcoin price has formed an extremely bearish setup that could trigger a sell-off not just for itself but the entire market as well. Adding credence to this outlook is the June month’s Consumer Price Index announcement that is scheduled to be released on Wednesday at 12.30 GMT.

The forecasts suggest that the CPI could be 8.8%. The last announcement was on June 10, when the actual CPI exceeded forecast, triggering a sell-off in Bitcoin price from roughly $30,000 to $17,600.

Hence, investors need to pay close attention to today’s announcement and how BTC could react to it.

Bitcoin price reveals a bearish outlook

Bitcoin price action between June 6 and July 13 seems to have formed a bearish pennant. This technical formation contains a flagpole and a pennant and is termed a continuation pattern.

The 42% sell-off between June 6 and June 18, which pushed BTC to form a swing low at $17,591, forms the flagpole. And the consolidation that followed in the form of lower highs and higher lows is termed a pennant.

This setup forecasts a 42% downswing to $11,202, obtained by adding the flagpole’s height to the breakout point at $19,623, which occurred on July 12. This development adds confirmation to the bearish future for BTC.

BTC/USD 1-day chart

While things are looking gloomy for Bitcoin price, a quick recovery above $22,559 – the 200-week Simple Moving Average (SMA) – will invalidate this bearish pennant formation. In such a case, investors can expect BTC to attempt a move to $25,000.

Ethereum price in search of stable floors

Ethereum price has crashed below the midpoint of the $878-to-1,284 range at $1,081. This move is the third rejection at the equal highs formed at $1,284. Interestingly, the third rejection was also due to the presence of the 200 four-hour SMA.

A recovery attempt above the midpoint seems like a plausible attempt from bulls. However, rejection appears to be more likely considering the way Bitcoin price is positioned.

In such a case, investors can expect ETH to revisit the range low at $878.

ETH/USD 1-day chart

Regardless of the pessimistic outlook, if Ethereum price produces a daily candlestick close above the range high of $1,284, it will invalidate the bearish outlook and trigger a potential ascent to $1,500 or higher.

Ripple price to continue within downtrend

Ripple price is hovering below the high-time-frame support level at $0.332, after weeks of consolidation. A confirmation of a flip of this foothold into a resistance barrier is most likely to trigger a 40% crash to the volume point of control (POC) at $0.187.

A POC is the highest-volume traded level; for Ripple, the volume profile extends from January 2017 to July 2022. Hence, a retest of the level should see some buyers come in and rescue the token.

However, a breakdown of said barrier could extend the sell-off to $0.134.

XRP/USD 1-day chart

On the other hand, if Ripple price produces a weekly candlestick close above $0.322, it will alleviate the bearish outlook. However, to invalidate this scenario, XRP price needs to flip the $0.509 hurdle into a support floor.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.