Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls reenter the market ahead of US crypto bill

- Bitcoin price eyes retest of yearly open at $46,198 it bounces off a crucial support level.

- Ethereum price looks primed for a 20% upswing to retest $3,200.

- Ripple price finishes its breakout, hinting at a 20% ascent to $0.855.

Bitcoin price shows strength as it undertakes a quick, impulsive move toward a long-standing barrier. Ethereum, Ripple and other altcoins are following suit and also undergoing bullish expansions. Interestingly, this reaction in the major three could be a response to US Treasury Secretary Janet Yellen's comments on crypto markets.

The comments, which favor digital assets and their innovation, were posted earlier on the Treasury website but were later removed.

"The executive order will address risks related to illicit finance, protecting consumers and investors, and preventing threats to the financial system and broader economy," read Yellen’s deleted message.

Bitcoin price shows strength

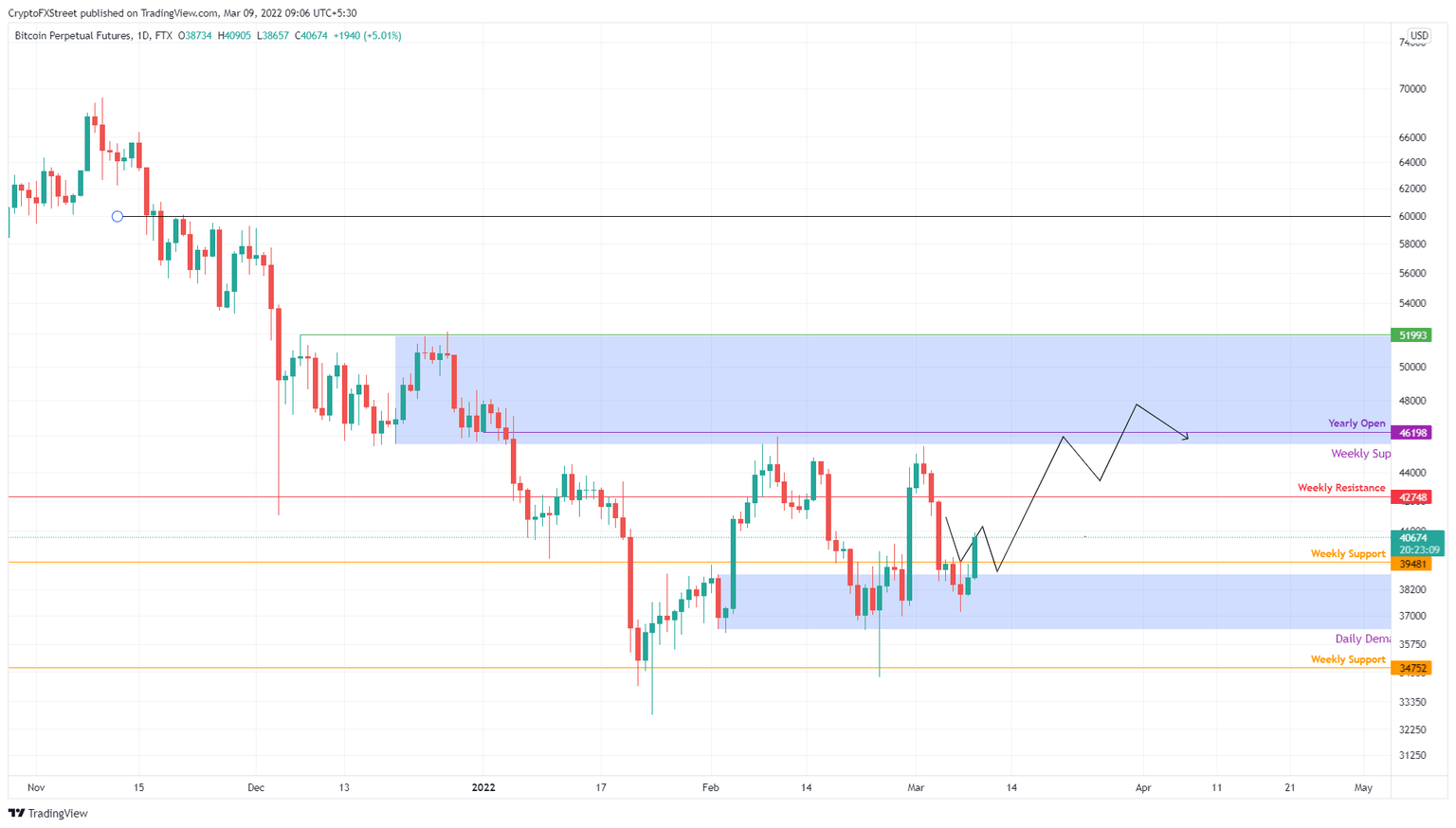

Bitcoin price rallied 7.8% on March 9 after dipping inside the $36,398 to $38,889 demand zone. The resulting uptrend will make contact with the weekly resistance barrier at $42,748 before retesting the weekly supply zone, ranging from $45,550 to $51,860.

Bitcoin price, therefore, has anywhere between 2% to 25% upside. Only a daily candlestick close above $52,000 will indicate the start of an uptrend. Anything below the aforementioned level will indicate that the big crypto is consolidating.

BTC/USD 1-day chart

On the other hand, if Bitcoin price breaches the daily demand zone, extending from $36,398 to $38,889, it will reveal a weakness among buyers. This move will crash BTC to a vital support level at $34,752, a breakdown of which will lead to the invalidation of the bullish thesis.

Ethereum price returns to pavilion

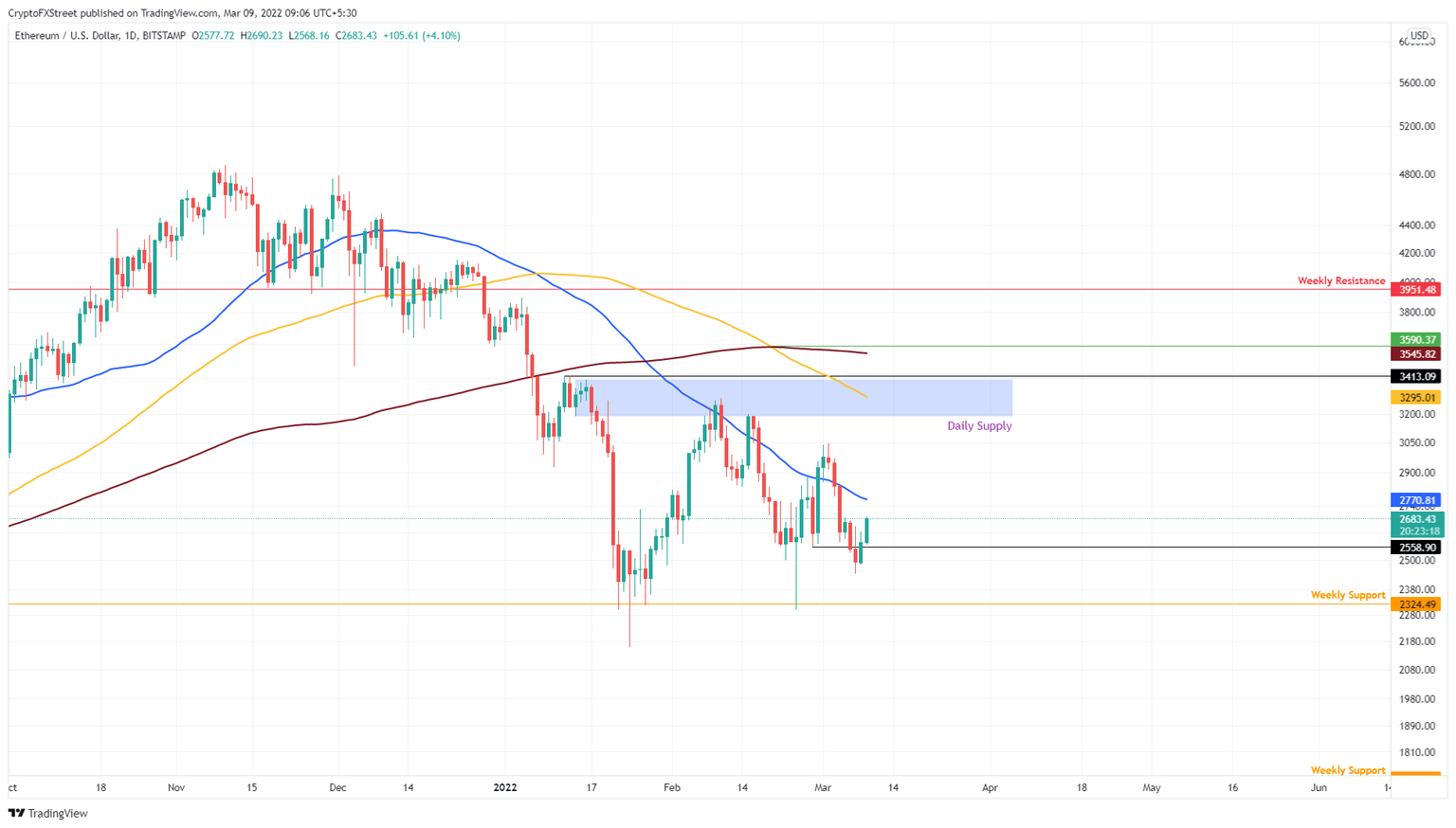

Ethereum price has risen 5.7%, a smaller gain compared to BTC, but it is eying a retest of the 50-day Simple Moving Average (SMA) at $2,771. A breakout of this level will open the path for ETH bulls to retest the daily supply zone, extending from $3.188 to $3,393.

A move beyond this resistance area seems unlikely due to the 100-day SMA. Hence, investors can expect Ethereum price to form a local top around $3,200.

ETH/USD 1-day chart

Regardless of the bullishness surrounding Ethereum price, a breakdown of the $2,324 support level will create a lower low, invalidating the bullish thesis.

Ripple price ready for a takeoff

Ripple price broke above a downward trend line on February 28. The retest of this trend line on March 7 confirmed a successful breakout, suggesting the possibility of a move higher. Investors can expect the XRP price to slice through the $0.797 hurdle and make a run at the $0.855 resistance barrier.

In total, this move would represent a 20% ascent and is likely where a swing high will form, leading to consolidation or retracement. In a highly bullish case, Ripple price might revisit the $0.917 ceiling and collect the liquidity resting above it.

XRP/USD 6-hour chart

While things are looking up for Ripple price, a six-hour candlestick close below $0.686 will invalidate the demand zone and the bullish thesis. In this case, the XRP price could crash lower and retest the $0.633 support barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.