- Bitcoin price tanked Thursday as price action clings on a quick rebound.

- Ethereum price sees bulls stepping in and not letting bears erase their hard-earned profit.

- XRP price is underpinned as bulls eagerly buy into the price action for a quick swing higher.

Bitcoin price, Ethereum and other cryptocurrencies got a cold shower on Thursday over some very strong Producer Price Index numbers. Not only were the recent numbers higher, but the previous numbers were revised upwards as well. This means that the situation in terms of inflation is not so rosy at all, but markets must not forget that US Fed Chair Jerome Powell warned that the actual impact of what the Fed is doing could be seen filtering through with a delayed effect.

Bitcoin price will pop back up above $23,880 to continue its rally for this week

Bitcoin (BTC) price had a bit of a gut punch on Thursday, but price action kept the losses quite contained. The risk of a bigger fade to the downside was expected, seeing as US Dollar strength was what pushed US equities to the downside. With the PPI numbers higher, bulls need to think ahead since the Federal Reserve warned this could happen.

BTC needs to see bulls refocus on the element that the Fed has already hiked quite substantially, and the smaller increments now point to the fact that the Fed is nearing its endpoint. This means good news for the markets as market conditions will start to ease with inflation coming back down again. Once Bitcoin bulls realize this, expect to see BTC pop back above $23,878 and try to head for $26,000 over the weekend when tail risk submerges.

BTC/USD daily chart

Risk currently hangs in the balance with the possibility of a rejection on the top side and a dead-cat-bounce in the making. If that happens, expect to see further losses emerge with $21,969 coming into play for support. If that does not work, just below there the monthly pivot could be the cushion for a soft landing of this correction.

Ethereum price simply undergoes a hiccup and is still focused on $1,800 toward Sunday

Ethereum price (ETH) only saw a minor 2% decline being written in the quote books as bulls were unable to maintain price action above $1,688 over the US PPI numbers. With the numbers out of the way, several economists are signaling that the US economy is hitting a tipping point as several confidence numbers are starting to point to very negative, contractionary outcomes. This means that the Fed's measures will start to kick in with a delayed effect.

ETH will rise quickly out of its ashes and pierce through $1,688 again toward where it was trading on Thursday. Going into the weekend, expect bulls to buy across the board in risk assets with equities and cryptocurrency on the front foot near the US closing bell this Friday evening. During the weekend, bulls should not have any hurdle to jack prices in ETH up toward $1,928.

ETH/USD daily chart

The biggest risk comes with the US session, which could ad another selling round in the market. Expect bulls to get out of the way and see ETH tank toward $1,500. Luckily, plenty of support is to be found with the monthly pivot and the 55-day Simple Moving Average (SMA) lining up.

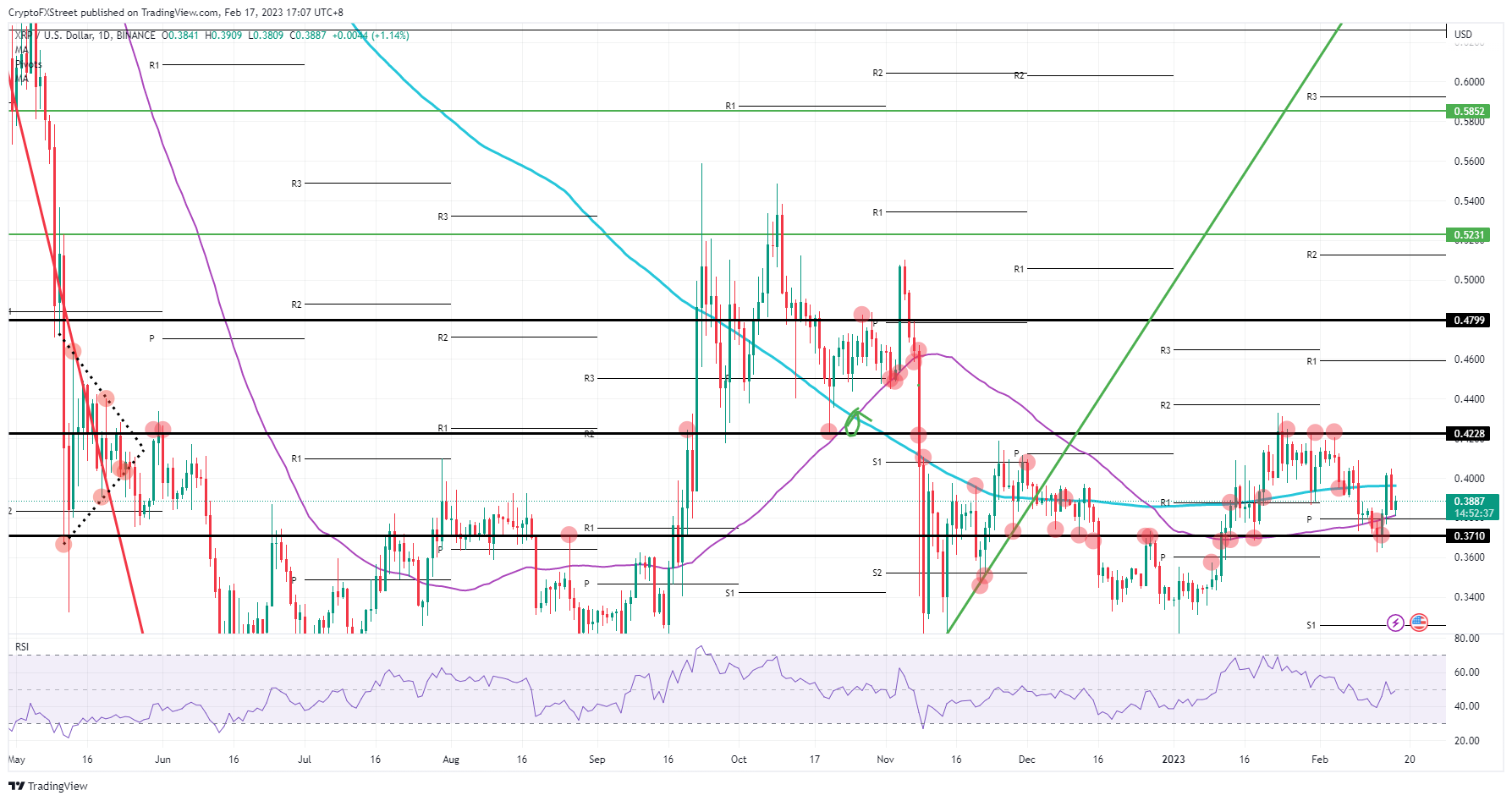

XRP price on course for $0.48 by the end of February with 25% gain on the table

Ripple (XRP) price saw a big drop of over 4% on the back of the US PPI numbers and US Dollar strength on Thursday. Ripple price shows good signs of price action being well underpinned as bulls already halted the correction even before it touched the 55-day SMA near $0.38. A few cents below, the monthly pivot was the insurance just in case the 55-day SMA could not hold.

XRP now sees bulls coming in as the risk appetite diverges between asset classes. While European equities sell-off and US futures point to red opening numbers, cryptocurrencies are tying up with green numbers. This shows the bullish appetite in XRP that will see $0.42 being broken to the upside over the weekend.

XRP/USD daily chart

Risk elements for today look to be small as traders will rather focus on US GDP and European inflation data. Should the new numbers next week further support the concept that inflation is sticky or even crunching higher, that would mean that markets are wrong-footed. Expect the rally to be priced out again if that is the story and see XRP dipping below $0.37 with at risk a full 7-cent drop toward $0.30.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.