- Bitcoin price could head lower since it is approaching a confluence of resistance levels.

- Ethereum price is also considering a downside move as it climbs toward the swing high at $2,910.

- Ripple price seems to have begun its downtrend after tapping the supply zone’s lower limit at $0.986.

Bitcoin price rally that started on May 30 hit a dead end by June 3, which led to a steady downswing. Investors can expect a leg lower as its most recent attempt to head higher will face a stiff resistance barrier.

In such a case, Ethereum price will follow BTC’s footsteps. Ripple price, on the other hand, has already kick-started its downtrend.

The next step in BTC adoption

Despite this bearish outlook that BTC and altcoins exude, a major development took place over the weekend, where El Salvador’s President Nayid Bukele announced that he would propose a bill to the Congress that would make Bitcoin legal tender.

This development came during the Bitcoin 2021 conference held in Miami, Florida.

The move toward adopting Bitcoin comes as prominent economists and authorities mentioned that BTC was too volatile to be considered money or legal tender.

Considering that remittances constitute a significant chunk of El Salvador’s gross domestic product, the proposed policy would set the stage for improving the country’s financial infrastructure. Additionally, if Nayid Bukele’s plans would be approved, it would mark the first major adoption after institutions’ decision to add BTC to their treasuries over the past 12 months.

Bukele further added,

In the short term, this will generate jobs and help provide financial inclusion to thousands outside the formal economy. And in the medium and long term, we hope that this small decision can help us push humanity at least a tiny bit into the right direction.

Although the plans are unclear at this point, there’s a high chance it gets ratified, especially with Bukele’s party named “Nuevas Ideas,” or New Ideas, which resonates with Bitcoin, itself a relatively new idea.

Additionally, the president’s overwhelming success in the recent legislative elections makes it easier to sway the legislature in the bill’s favor.

Bitcoin price to give upswing another try after a brief swing low

Bitcoin price rallied roughly 18% between May 30 and Jun 3, exhausting its bullish momentum. As investors began booking profits, BTC started heading lower and is currently looking to dip into the 4-hour demand zone that extends from $31,111 to $33,900.

This bearish move would result from the confluence of the 50 four-hour and the 100 four-hour Simple Moving Averages (SMA) that are present around $36,775, which coincides with the 50% Fibonacci retracement level.

Therefore, a rejection at this level would lead to a 7% downswing to the said demand zone.

While the short-term scenario is bearish, investors can expect BTC to spring back up after this brief dip.

In such a case, a decisive close above the 50% Fibonacci retracement level at $36,775 will signal the start of an uptrend. If this were to happen, Bitcoin price might continue its ascent toward the resistance barriers at $39,450, $40,841 or the range high at $42,452.

BTC/USDT 4-hour chart

On the flip side, if BTC surges past the confluence at $36,774 and produces a decisive close above $39,450, the bearish thesis will face invalidation.

Under these newly developed circumstances, Bitcoin price could rally to $40,841 or the range high at $42,451.

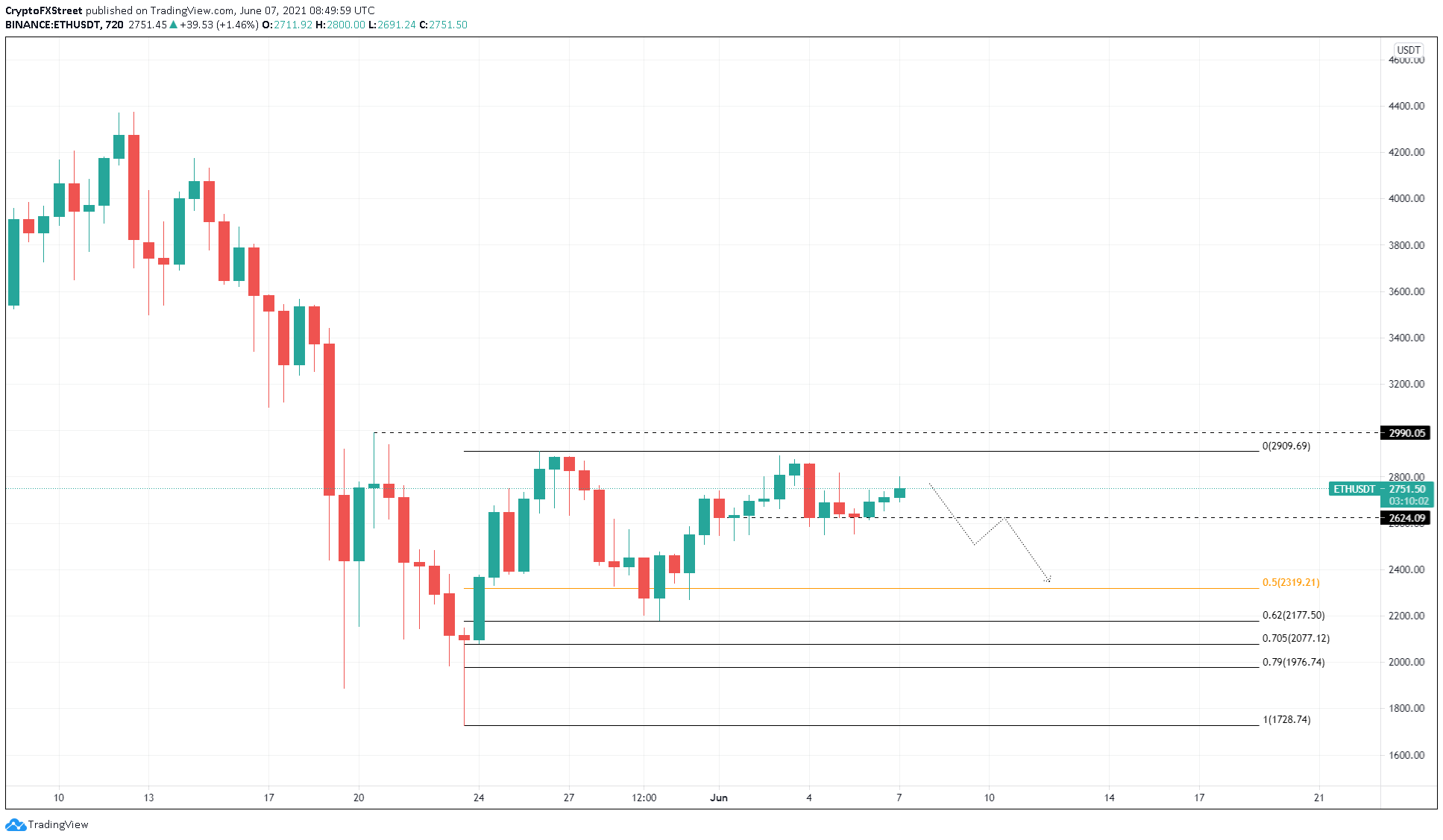

Ethereum price approaches local top

Ethereum price has been more reactive than Bitcoin when it comes to impulse waves. As a result, ETH has set up three swing highs, all in proximity at the range high of $2,910. However, the smart-contract token has never tagged the said level.

Although ETH has rallied 9% over the past day or so, there is a high chance it will not tag the swing high at $2,910.

Even if the bulls manage to push Ethereum price to sweep this high, it is unlikely for this upswing to sustain itself. The primary reason for the bearishness is the correlation of Ether with the flagship cryptocurrency.

Therefore, investors can expect ETH to retest the 50% Fibonacci retracement level at $2,319, roughly a 15% sell-off from the current position.

ETH/USDT 12-hour chart

On the flip side, if Ethereum price manages to sustain above the range high at $2,981, the bearish thesis will face invalidation.

Ripple price kick-starts a down move

Ripple price made three attempts to breach past the supply zone extending from $0.986 to $1.050 but failed to do so. The most recent jab at an upswing was foiled on June 5 as XRP price faced rejection at $0.986, which has led to a 4% correction to where the remittance is currently trading, $0.958.

Market participants can expect this downswing to continue until it retests $0.875, the midpoint of the range that stretches from $0.745 to $1.10.

Perhaps XRP price might get another sweep at the demand zone’s lower limit at $0.986 before the sell-off begins. Either way, the remittance token is primed for a move lower.

If the ask orders continue to pile up, XRP price might dip to the 62% Fibonacci retracement level at $0.822.

XRP/USDT 4-hour chart

Regardless of the bearishness surrounding Ripple, a potential uptick in buying pressure that slices through $1.05 and produces a four-hour candlestick close above it will invalidate the pessimistic outlook.

In such a case, XRP price could rise by 5% to the range high at $1.10.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.