Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC unfazed as the SEC engages exchanges for spot ETFs

- Bitcoin price remains under the $36,500 level as the absence of momentum leaves BTC susceptible to a slump.

- Ethereum price risks at least 5% slump to the $1,864 level if it loses critical support at $1,935.

- Ripple price risks a 10% drop to the late October lows if the support at $0.5981 gives way.

Bitcoin (BTC) price remains steadfast below the $36,500 level as the US Securities and Exchange Commission (SEC) misses its target. Nevertheless, a new development concerning the sane has equally not done anything for BTC, with ETF specialist Erica Balchunas saying the financial regulator wants ETFs to do cash creats.

Meanwhile, both Ethereum (ETH) and Ripple (XRP) are losing ground as profit taking escalates.

Bitcoin price likely to drop

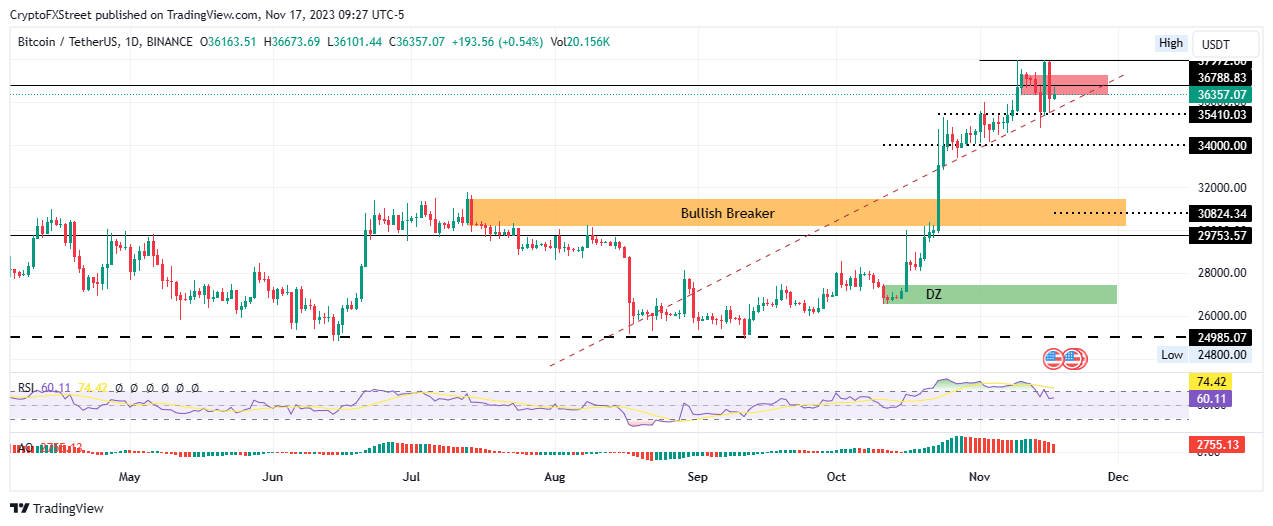

Bitcoin (BTC) price remains trapped under the $36,500 level as hope for a spot BTC ETF approval in 2023 wears thin. All indicators show that momentum is waning due to multiple sell-signals in play. This leaves the king of cryptocurrency susceptible to a fall.

Unless sidelined investors enter the fold, Bitcoin price could lose the support offered by the ascending trendline at $35,410. The ensuing selling pressure would then likely plunge BTC to $34,000.

Further, south, the slump could see Bitcoin price extend below the $32,000 mark before a test of the bullish breaker extending from $30,126 to $31,524. A break and close below the midline of this order block at $30,824 is likely to send BTC to the forecasted $30,000 psychological level.

BTC/USDT 1-day chart

On the other hand, increased buying pressure could see Bitcoin price confirm its move north above the supply zone extending from $36,276 to $37,301 by decisively closing above the $36,788 level. Past this level, the likely move would be to clear the $37,972 barrier before an extension to the $40,000 psychological level.

Also Read: Bitcoin price hit $38,000 despite US financial regulator’s decision to delay two BTC ETF decisions

Ethereum price losing $1,935 support will be detrimental to ETH holders

Ethereum (ETH) price is testing the critical support at $1,935, and losing this level could send the largest altcoin by trading volume to the depths of $1,864, 5% below current levels.

In a more dire case, the fall could extend toward the $1,800 psychological level with the next support level likely to present itself around the $1,753 mark.

ETH/USDT 1-day chart

Conversely, if the $1,935 mean threshold and ultimately the order block spanning from $1,864 to $2,004 holds as a support level, Ethereum price could pull north, restoring above the ascending trendline at $2,029.

In a highly bullish case, the gains could extend to the $2,136 range high, with such a move constituting a 10% climb above current levels.

Also Read: Ethereum is a commodity, but SEC will not admit it, expert says amid ongoing ETF race

Ripple price extends fall with 10% pullback possibly in the cards

Ripple (XRP) price could fall 10% below the $0.5981 support level to test the $0.5392 support, as the remittance token continues to extend its losses after breaking out of the symmetrical triangle.

The Relative Strength Index (RSI) shows momentum is falling as it nosedives south, mirrored by the Awesome Oscillator (AO), whose histogram bars are soaked in red and edging south. This adds credence to the bearish thesis.

XRP/USDT 1-day chart

On the flip side, a re-entry by sidelined investors and late bloomers could see Ripple price correct, pulling north and potentially restoring above the lower boundary of the triangle at $0.6603. In a highly bullish case, the gains could extrapolate past the $0.0700 psychological level, balancing out the inefficiency represented by the Fair Value Gap (FVG) at $0.7512 with the potential to hit the $0.8000 psychological level.

Also Read: XRP price fails to show parity with Ripple’s important victory over SEC, 5% pullback seems likely

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.