Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC stagnates as alt season bodes well for ETH and XRP

- Bitcoin price is facing an imminent resistance at $28,500 that prevents a more powerful market shift.

- Ethereum price trajectory hints at a breakout, with the next critical resistance area lying between $2,046 and $2,902, on-chain metric shows.

- XRP price has coiled up for a run higher, but all depends on the Ripple vs SEC summary judgment.

Bitcoin price (BTC) has been trading sideways for weeks, consolidating within a tight zone as bullish and bearish efforts collide. As a result, the flagship crypto has been unable to cross above a key resistance level. With BTC stagnating, its dominance overflows benefit altcoins as Ethereum price (ETH) continues to joyride the alt season while Ripple price (XRP) readies for a breakout catalyst.

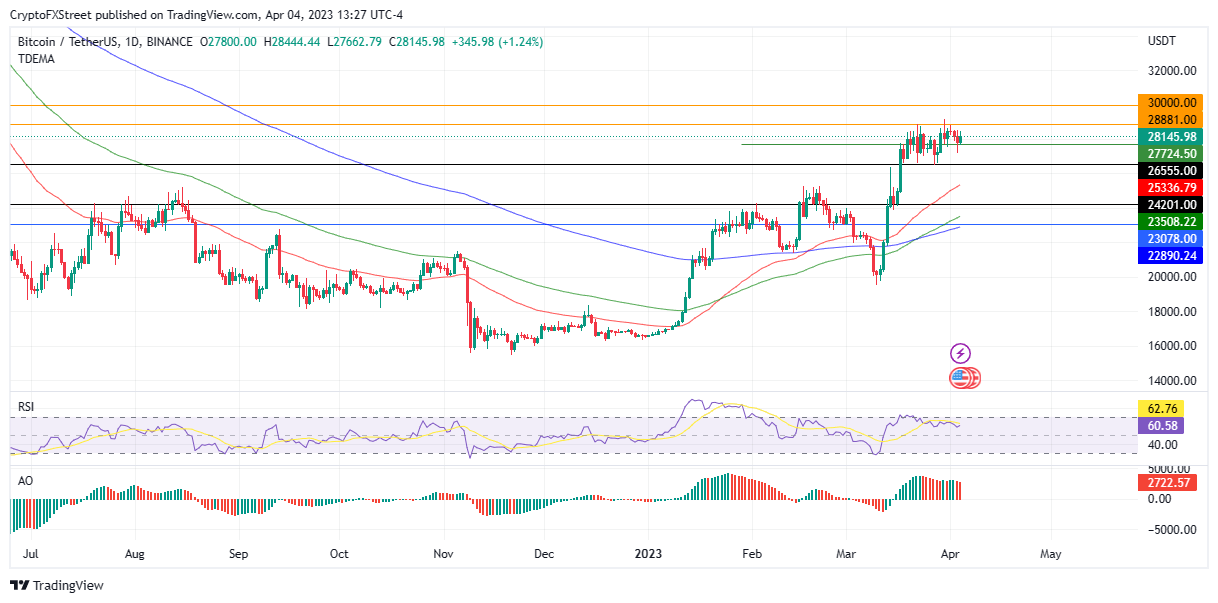

Bitcoin price primed for a selling spree

Bitcoin price has stayed shy of any bullish momentum for weeks now, trading horizontally as the price consolidated within the $28,881 and $26,555 range. At the time of writing, BTC is auctioning for $28,145 above the immediate support level of $27,724.

Amid the local headwinds, the natural volatility of Bitcoin price and the recent inability to record new local highs suggests that the flagship crypto is on the verge of a breakdown. The southbound move would be provoked by prevailing FUD around regulatory clampdown or panic selling among investors.

If selling pressure increases, Bitcoin price could fall below the immediate support level at $27,724 or lower towards the $26,555 range low. A lack of commitment from buyers could suppress the king crypto, sending it to confront the 50-day Exponential Moving Average (EMA) at $25,339. Below this level, the next opportunity for bulls to come in would be around the $24,201 support level.

BTC/USDT 1-day chart

Conversely, if bulls show commitment, they could use the $26,555 supplier congestion zone as a jumping-off point. The move could pump Bitcoin price toward the $28,881 resistance level. In highly bullish cases, BTC could tag the $30,000 resistance level. A daily candlestick close above this level could invalidate the bearish thesis.

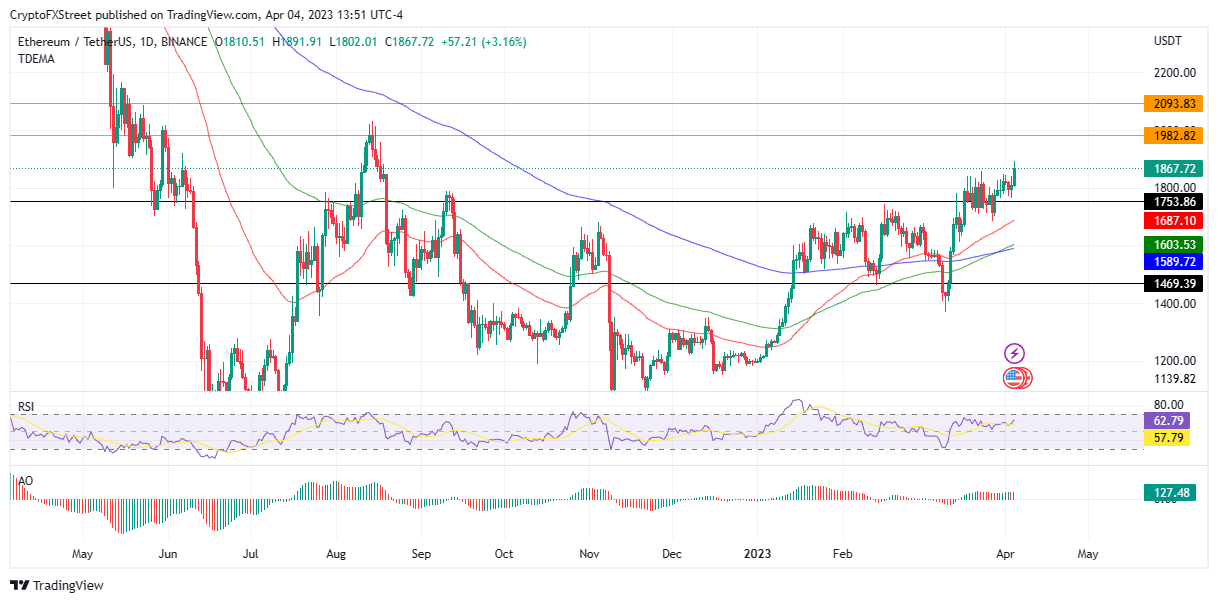

Ethereum price indicates capital rotation ahead of the Shapella Upgrade

Ethereum price (ETH) has been on an uptrend, showing the makings of a capital rotation into ETH ahead of the Shanghai/Capella upgrade. The newly found strength for the largest altcoin comes amid the alt season and is bolstered by Ether community members' hype concerning the oncoming update in the second week of April.

If Ethereum price sustains momentum against Bitcoin, it could bode well for the entire altcoin class. Notably, the altcoin market often thrives from ETH's display of strength against BTC.

An increase in buying pressure from the current level could see Ethereum price rise 6% to confront the next barrier at $1,982. In highly bullish cases, the altcoin could reach higher into the $2,000 zone and tag the $2,093 resistance level. This would denote a 12% ascent from the current price.

ETH/USDT 1-day chart

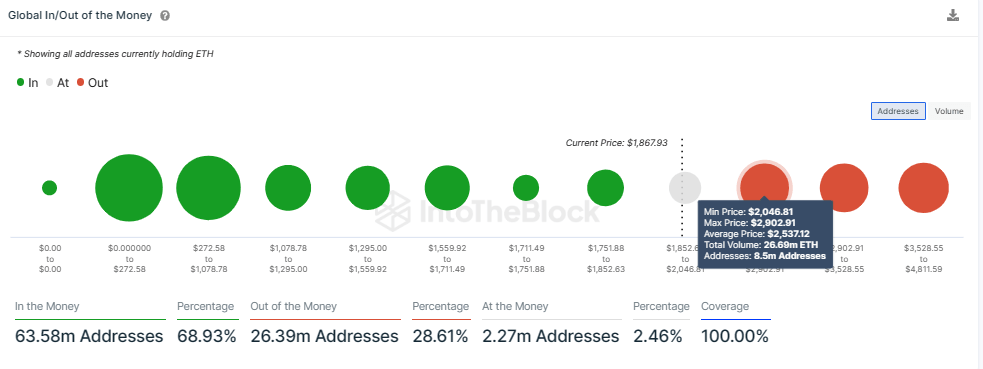

On-chain data to bolster the bullish thesis for Ethereum price

On-chain data from IntoTheBlock shows that the next critical resistance area is between $2,046 and $2,902, where 8.5 million addresses had previously purchased over 26.69 million ETH at an average price of $2,537.

On the flip side, if profit takers book early profits, Ethereum price could correct southward, first losing the $1,753 support level. A break below this buyer congestion level would expose ETH to a free fall towards the 50-, 100-, and 200-day EMAs at $1,687, $1,603, or $1,589 levels, respectively.

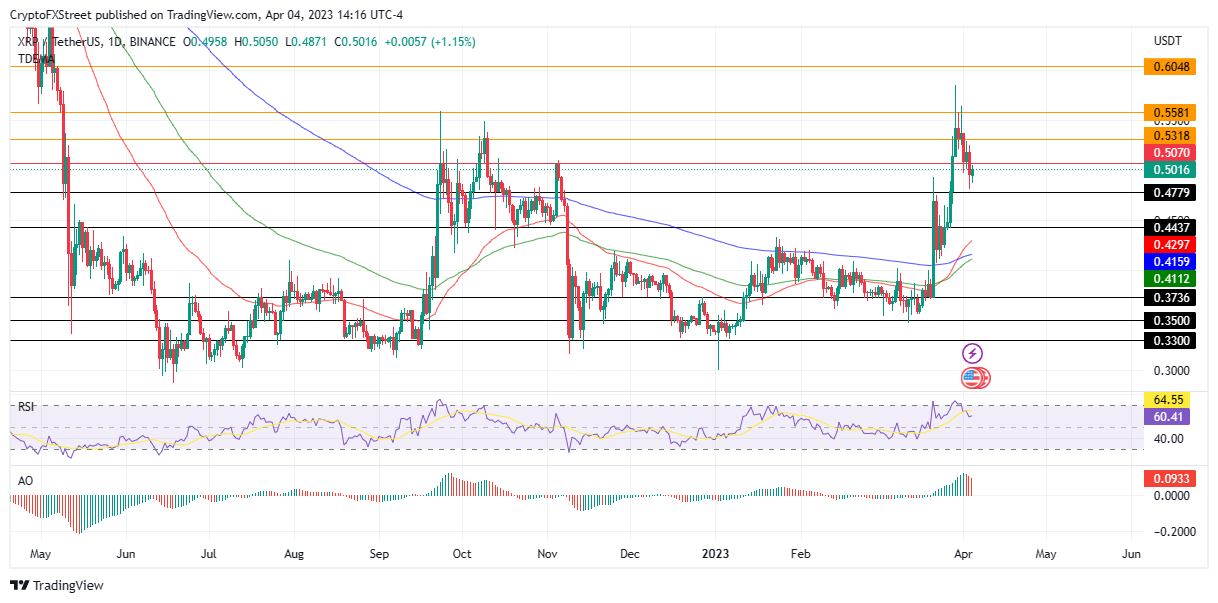

Ripple price coils up for a breakout as investors await summary judgment

Ripple price (XRP) broke below what was formerly a critical support at $0.507 three days after US attorney John Deaton hinted at a prolonged wait before Judge Analisa Torres gave her summary judgment. The revelation weakened the bullish momentum for XRP, causing the remittance token to start the month with a downtrend.

However, all hope is not lost, as community members still anticipate a favorable ruling. Accordingly, the current downtrend provides sidelined investors with the opportunity to accumulate the altcoin at discounted rates.

If this cohort of buyers takes the bait, Ripple price could restore above the $0.507 resistance level, flipping it back to support before confronting the $0.531 area. Above this barricade, XRP could aim at the late March highs at $0.558. This would open the path for a continued northbound move for the altcoin.

XRP/USDT 1-day chart

On the other hand, if selling pressure increases, Ripple price could continue south to break below the $0.477 support level. In extreme cases, XRP could extend a leg down to tag the $0.443 zone. This would denote a 12% downswing from the current level.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.