- Bitcoin price saw a 10% rebound from its low at $50,931 and the entire market had a significant recovery.

- Ethereum price is closer to all-time highs and has outperformed BTC.

- XRP is fighting to stay above a critical resistance level on the daily chart.

The total cryptocurrency market capitalization had a steep drop on April 17 from $2.27 trillion to a low of $1.9 trillion, losing more than $300 billion in just 24 hours. Bitcoin has lost some of its market dominance in the last week but continues to influence the entire sector.

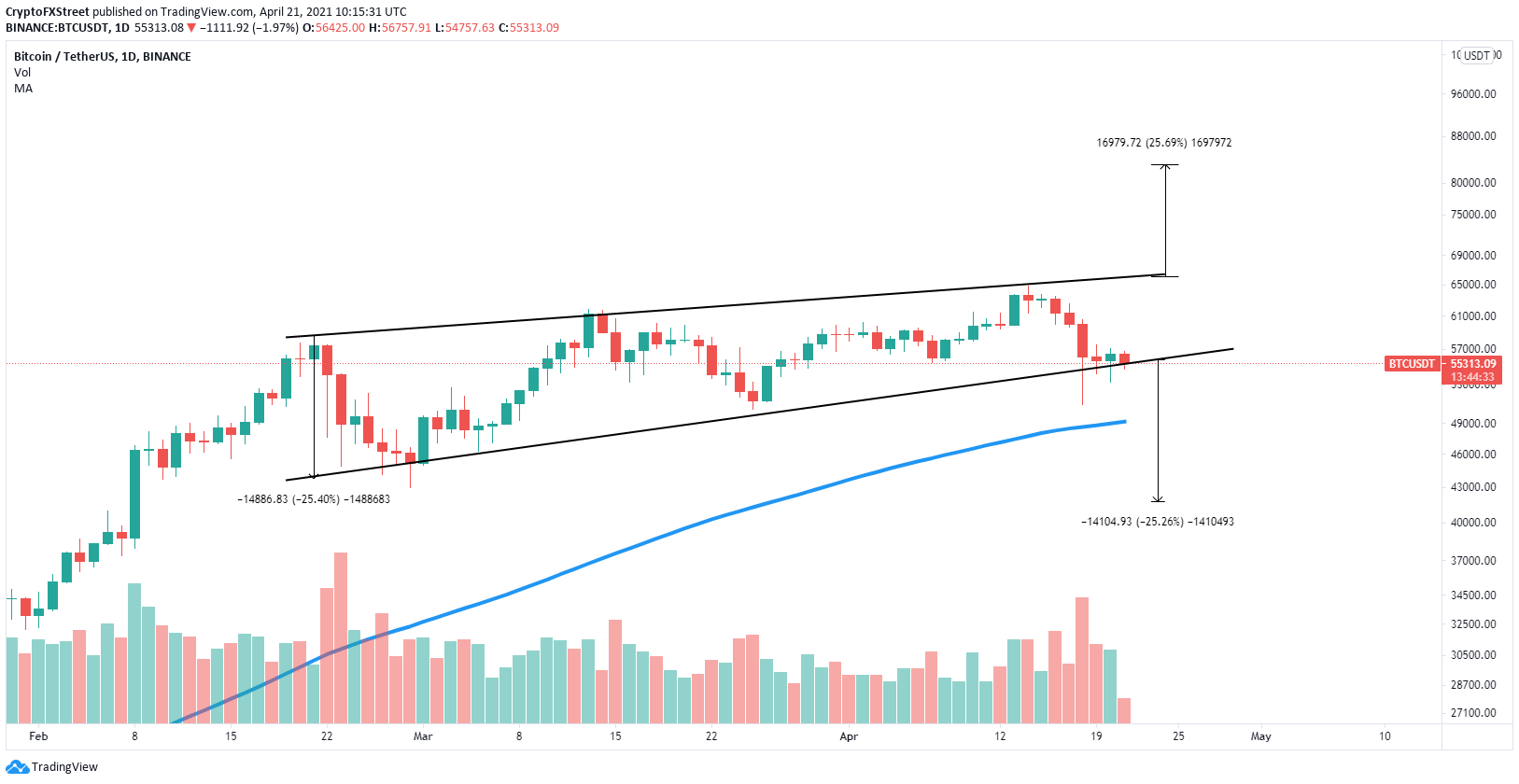

Bitcoin price to trigger significant leg down if key level breaks

On the daily chart, Bitcoin is trading inside an ascending wedge pattern and it is close to losing the lower trend line support level at $55,400.

A daily candlestick close below $55,400 would confirm a breakdown that has a long-term price target of $42,000.

BTC/USD daily chart

The initial price target of the bears would be the psychological level at $50,000 and then the 100 SMA support on the daily chart located at $49,000.

However, if the bulls can hold the lower boundary support, BTC could quickly jump toward the upper trend line at $66,120, which would be a new all-time high. A breakout of this point has a long-term price target of $83,000.

The percentage of BTC coins inside exchanges has sharply dropped in the last week despite a significant correction

BTC Supply on Exchanges

Since April 14, this percentage dropped by 0.52%, which is significant and the lowest value since June 2019. This indicates that investors are not interested in selling despite prices dropping, adding credence to the bullish outlook.

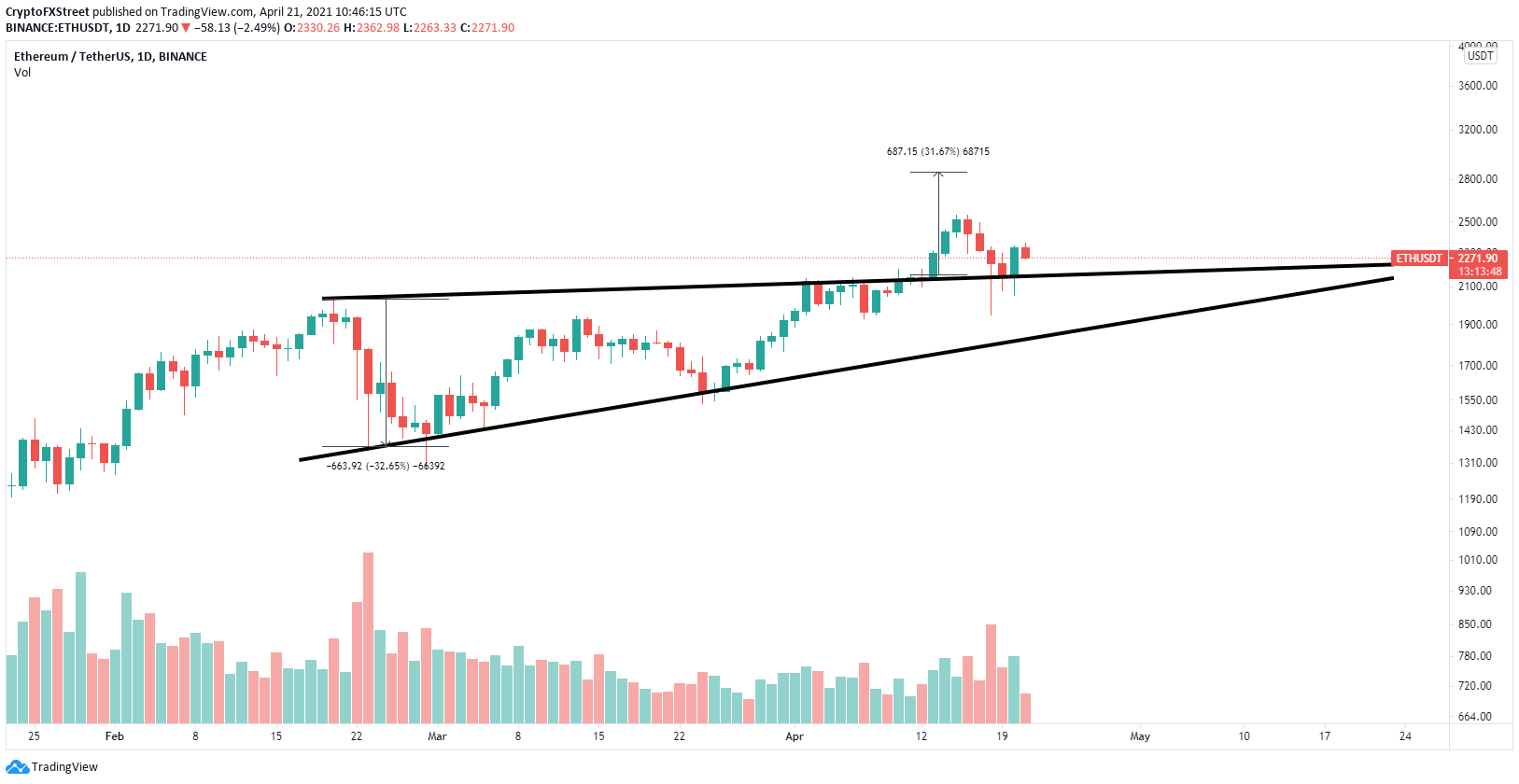

Ethereum price remains on the path to $3,000

On the daily chart, Ethereum had a breakout from an ascending wedge pattern on April 13 and successfully defended the previous resistance trend line.

The digital asset is now bouncing toward the pattern’s long-term price target at $2,850, with some resistance at $2,550.

ETH/USD daily chart

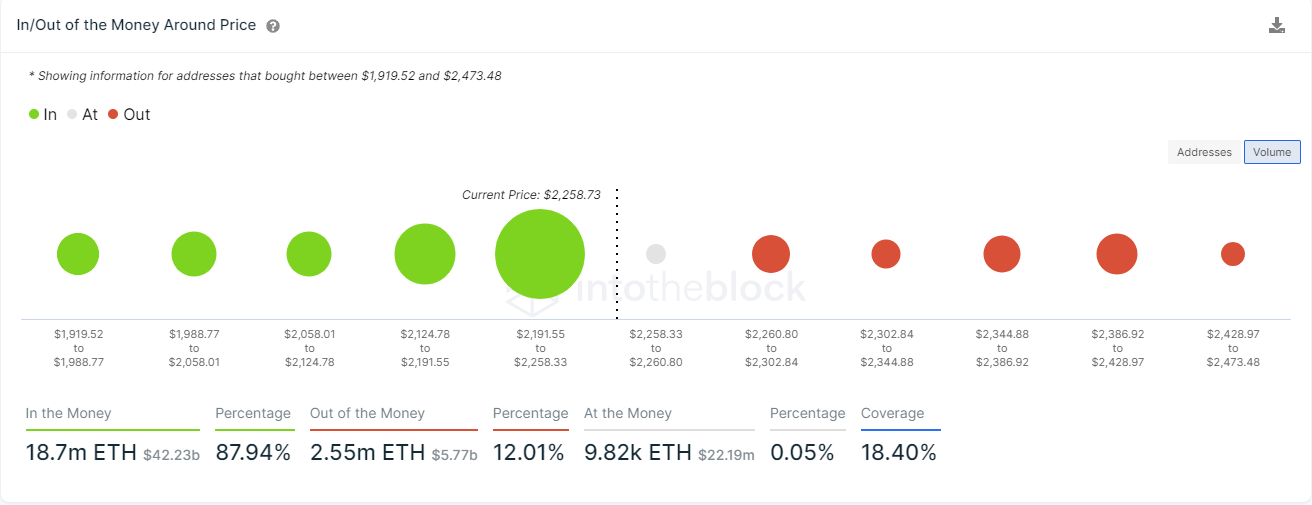

On the other hand, the In/Out of the Money Around Price (IOMAP) chart shows only one crucial support area between $2,200 and $2,258 where 421,000 addresses purchased over 11 million ETH.

Losing this critical point would be a notable bearish breakdown and can easily drive Ethereum price down to $2,000 and even as low as $1,900.

ETH IOMAP chart

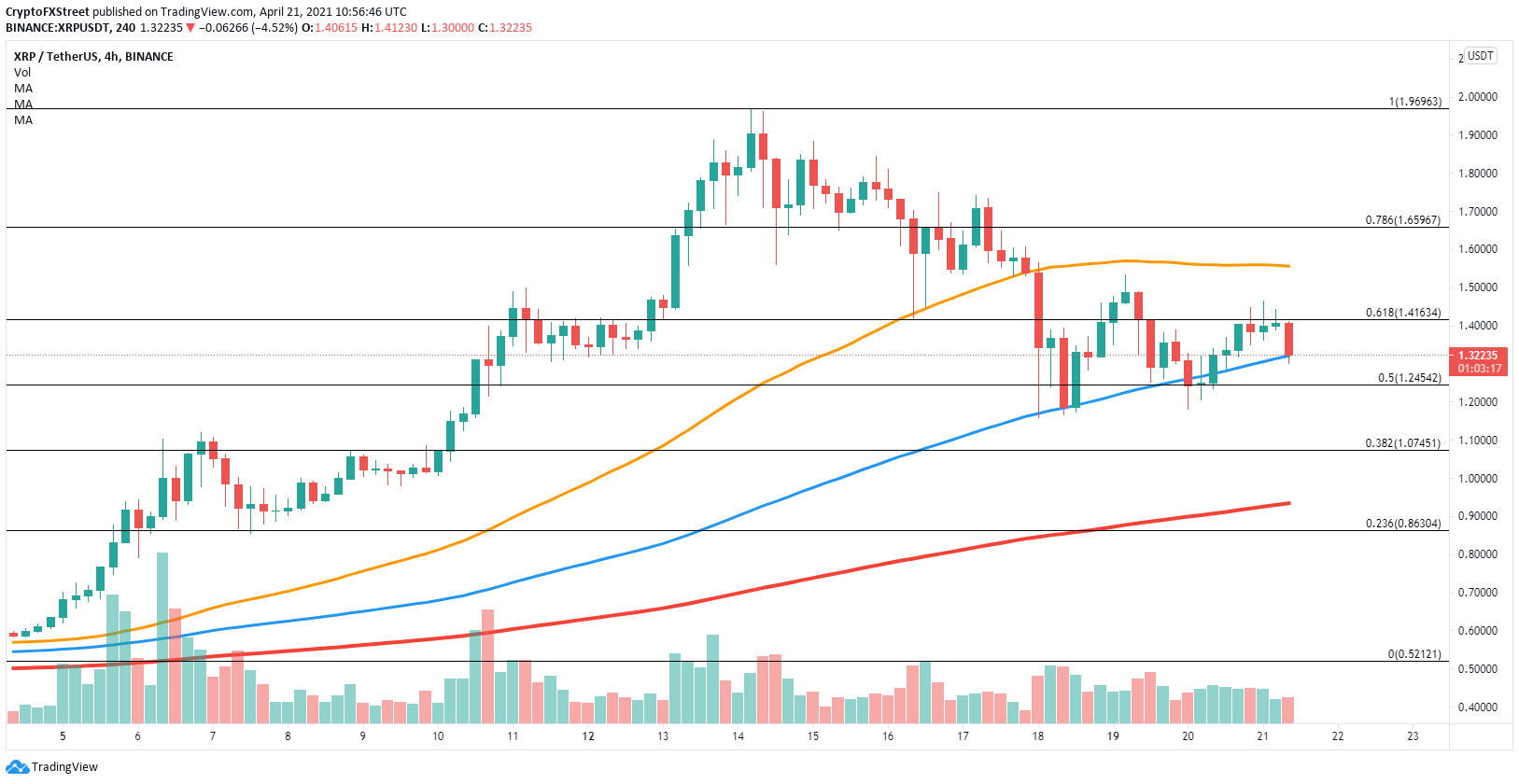

XRP price losing its bullish momentum

The digital asset is trying to remain above a crucial support level on the 4-hour chart. The 100 SMA at $1.31 must hold, otherwise, XRP can quickly fall down to $1.24 at the 50% Fibonacci retracement level.

XRP/USD 4-hour chart

XRP could also drop toward $1.07 at the 38.2% Fibonacci level, $0.92 which is the 200 SMA, and $0.86 at the 23.6% level.

On the other hand, successfully defending the 100 SMA should push Ripple toward the 61.8% Fibonacci level at $1.41 and even to $1.55 at the 50 SMA.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[14.30.21,%2021%20Apr,%202021]-637546006235210851.png)