Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC kick-starts second phase of bull run, joins altcoins

- Bitcoin price has sliced through an inclined resistance level, heading toward the $50,000 psychological level.

- Ethereum price pierces through the $3,716 resistance barrier, indicating a move to $4,000 is nigh.

- Ripple price is grappling with the $1.76 supply level, a breach of which would trigger a move to $1.70.

Bitcoin price saw its uptrend being thwarted multiple times over the past week. However, the recent upswing seems to be taking a second jab at this barrier and is likely to push through it, restarting the bull run.

Ethereum, Ripple and many other altcoins have already begun rallying with some achieving new all-time highs.

Bitcoin price arrives at $50,000 psychological level

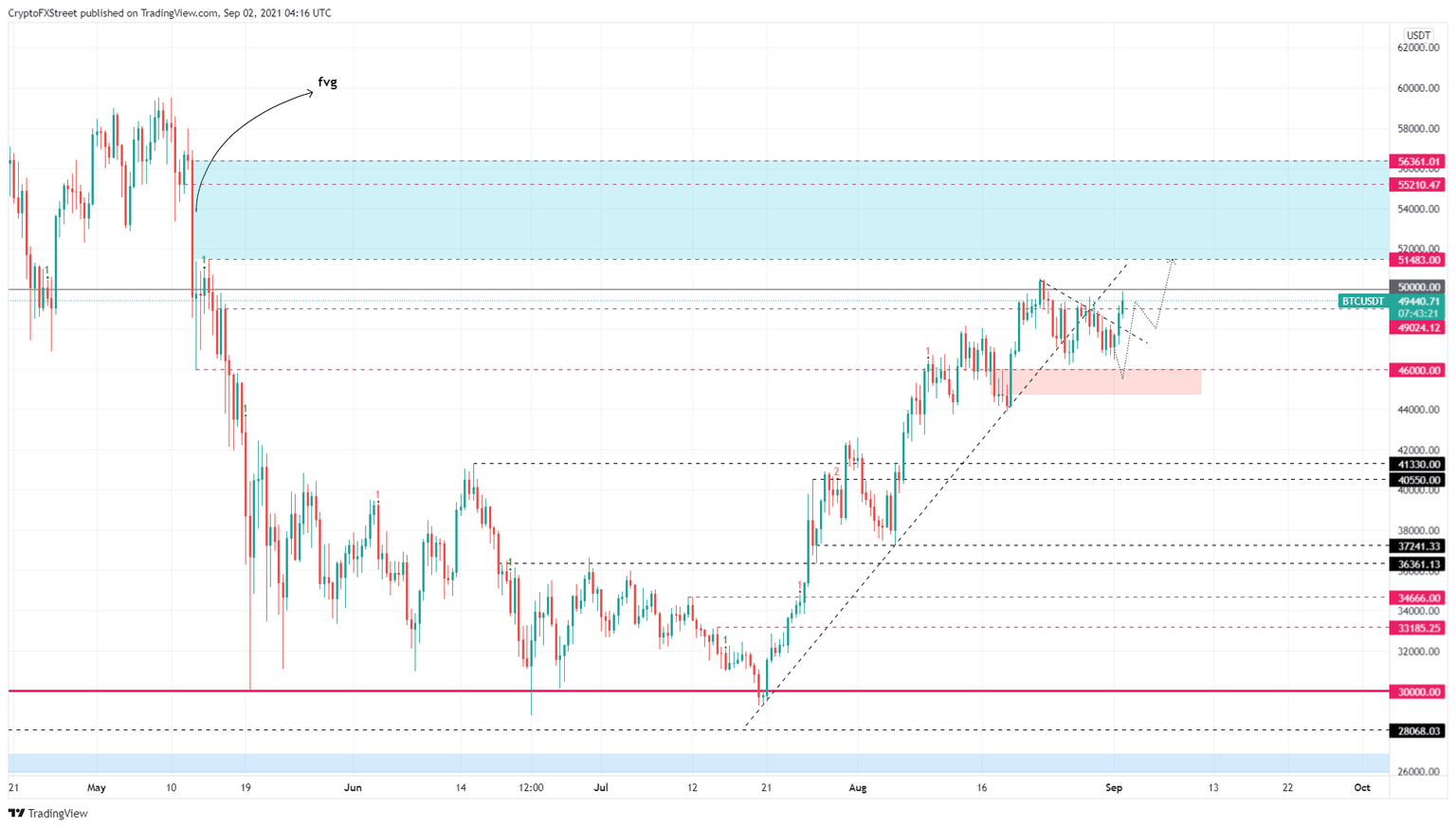

Bitcoin price breached $50,000 on August 23 but failed to sustain itself above that level, leading to a sell-off. While BTC tried recovering from this crash, it failed time and time again, leading to a tight consolidation between $50,000 and $46,000.

The recent upswing sliced through the inclined resistance level and is attempting to take over the $50,000 psychological level successfully. Assuming BTC does, this move could push Bitcoin price to $51,483.

A decisive 12-hour candlestick close above $51,483 will likely trigger FOMO, propelling it to $56,361. In some cases, this move could extend higher and even attempt to retest the all-time high.

BTC/USDT 12-hour chart

Regardless of the optimism, Bitcoin price needs to clear the $50,000 level. Failing to do so might restart the consolidation and keep it bound above $46,000.

A decisive close below $46,000 will invalidate the bullish thesis as it would create a lower low.

Ethereum price experiences exponential gains

Ethereum price stayed lull for almost a month after breaching the $3,000 psychological level on August 7. The consolidation from August 7 to August 30 set up roughly equal highs and higher lows, leading to the formation of an ascending triangle.

This bullish pattern witnessed a breakout on September 1, which led to a 20% upswing that produced a decisive daily close above a crucial resistance level at $3,716. This move opens a resistance-free path for Ethereum price up to $4,071.

Therefore, investors can expect ETH to tag another psychological level soon.

ETH/USDT 1-day chart

On the other hand, a breakdown of the $3,716 will delay the move to $4,000 and beyond. However, if Ethereum price retraces to $3,375, it will indicate a weakness among buyers and significantly postpone the uptrend.

If the bears produce a decisive close below $3,375, it will invalidate the bullish thesis and could trigger an 8% crash to $3,087.

Ripple price continues to move forward

Ripple price has been consolidating since late November 2020, forming higher highs and higher lows. Connecting trend lines along the higher highs and higher lows results in the formation of an ascending parallel channel.

So far, XRP price has managed to bounce off the lower trend line on July 20 and has also shown resilience to correction, indicating the presence of strong buyers.

Recently, Ripple bounced off the second hurdle at $1.09 and is close to targeting a resistance barrier at $1.27. If the bulls manage to produce a decisive close above $1.27, it will confirm the start of a new uptrend and propel XRP price by 36% to the third hurdle at $1.70.

In a highly bullish case, Ripple could continue this ascent and make a run at the 2021 high at $1.96 or take the bull run a step further by attempting to retest the all-time high at $3.31.

XRP/USDT 1-day chart

Ripple price has managed to hold up above the support levels without major downswings, which indicates a resilience among its investors to accumulate. Therefore, XRP price needs to hold above $1.01 to have any chance of keeping the upswing alive.

A breakdown of $1.01 will create a lower low, invalidating the bullish thesis. This move is likely to trigger a 16% sell-off to $0.842.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.