Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC hints bearish outlook amid worsening geopolitical conditions

- Bitcoin price is slithering on the edge of a bearish pattern, a breakout from which could result in an 18% downswing.

- Ethereum price continues to bounce between the $1,280 support level and the $1,423 resistance area.

- Ripple price is likely to pull back to $0.498 before rallying 20%.

Bitcoin price is at an inflection point, a decisive move here will determine the next course of action for the crypto markets. From a point of view that is unbiased by BTC’s bearishness, both Ethereum and Ripple price look ready to bounce.

While crypto markets continue to remain choppy, recent reports suggest that Russia has fired missiles targeting key infrastructure in Ukraine. President Volodymyr Zelenskyy confirms the same and adds that Russia's second target was people.

Bitcoin price to establish directional bias soon

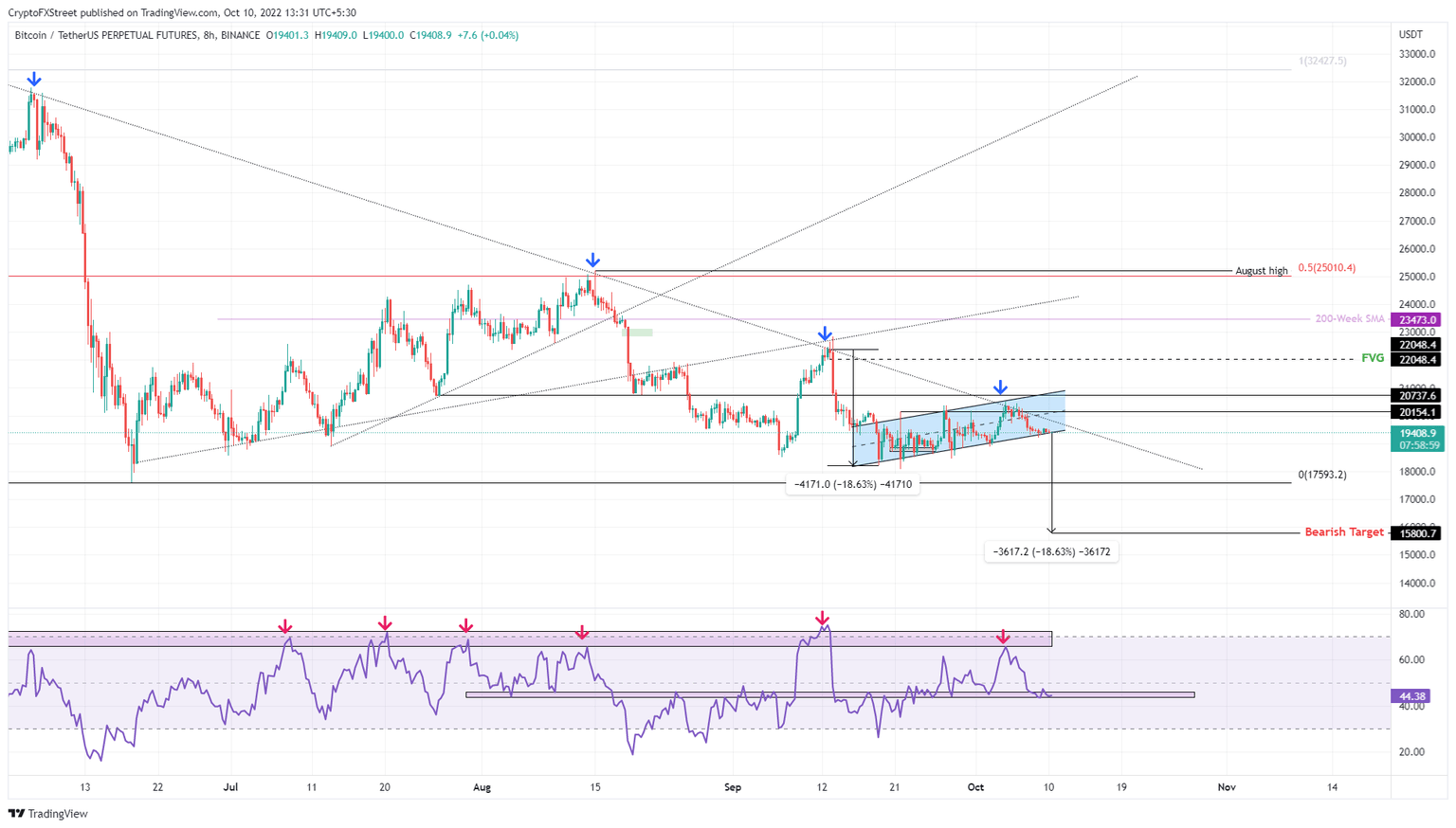

Bitcoin price has been retesting the lower limit of the bear flag over the last two days. As discussed in the previous article, this setup forecasts an 18% downswing if BTC produces a decisive close below the flag’s lower limit and flips it into a resistance level.

However, investors need to be patient and also expect a small rally before this bearish breakout triggers an 18% downswing. A minor run-up to $20,154 or $20,737 might be underway for the Bitcoin price as the RSI bounces off the 43 to 46 support level for the fourth time in under two weeks.

A subsequent breakdown from the bear flag could see BTC revisit the June 18 swing low at $17,593. In case of a strong sell-off, Bitcoin price will reach the forecasted target at $15,800.

BTC/USD 8-hour chart

On the other hand, if Bitcoin price flips the $20,737 hurdle into a support level, it will invalidate the bearish theiss. Such a development could see BTC revisit the $22,048 and $23,473 barriers.

Ethereum price remains rangebound

Ethereum price has been testing the patience of holders as it remains bound between the $1,280 and $1,423 levels. The recent sweep of the equal lows at $1,315 was a cue for bulls to take over and trigger a quick run-up.

The buyers, however, have decided not to take a step forward. As a result, Ethereum price is lingering above the $1,315 level. Investors can expect volatility, potentially favoring bulls to propel ETH to $1,383 in the end, and, in some cases, the $1,423 hurdle.

ETH/USD 4-hour chart

Regardless of the bullish outlook, if Ethereum price fails to hold above the $1,282 hurdle, it will indicate a weak bullish momentum. This development will invalidate the bullish thesis for XRP price and potentially trigger a correction to $1,191 via $1,234.

Ripple price ready to tackle more hurdles

Ripple price has tagged the inverse head-and-shoulders target at $0.5440, as mentioned in the previous article. After a 13% rally and rejection at $0.5380, the remittance token is likely to retrace to $0.4980 and rebalance the imbalance present there.

A bounce from the current level should have enough momentum to propel the altcoin to $0.5990 – the midpoint of the $0.2860 to $0.9120 range. This range was formed when XRP price crashed 69% between late March and mid-June.

Therefore, a surge in buying pressure after a minor pullback would make sense for a mean reversion move that would propel Ripple price to $0.5990 or roughly $0.6000.

XRP/USD 4-hour chart

While things are looking up for Ripple price, a breakdown of $0.4791 would invalidate the bullish thesis. In such a case, XRP price could crash 8% and revisit the $0.4400 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.