Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP crash after major consolidation

- Bitcoin price hovers around $88,500 on Wednesday after reaching a low of $86,050 the previous day.

- Ethereum price retested its daily support level of $2,359; a firm close below would continue its downward trend.

- XRP is trading around $2.28 on Wednesday after correcting 11% so far this week.

Bitcoin (BTC) price hovers around $88,500 on Wednesday after breaking out of its prolonged consolidation phase and reaching a low of $86,050 earlier this week. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and declined by nearly 11% and 12%, respectively.

Bitcoin bears aiming for $85,000 level

Bitcoin price broke out of its prolonged consolidation phase on Monday, slipping below the $94,000 support level and closing at $91,552 after a 4.89% decline. BTC continued its correction by 3.14% on Tuesday, reaching a low of $86,050. At the time of writing on Wednesday, it hovers around $88,500 level.

If BTC continues its pullback, it could extend the decline to test its next support level at $85,000.

The daily chart’s Relative Strength Index (RSI) reads 29, pointing downwards and below its oversold levels, indicating significant selling pressure and may be due for a potential reversal or bounce. However, traders should be cautious as the RSI may remain below its oversold levels and continue its correction.

BTC/USDT daily chart

However, if BTC recovers, it could extend the recovery to retest its $100,000 psychological level.

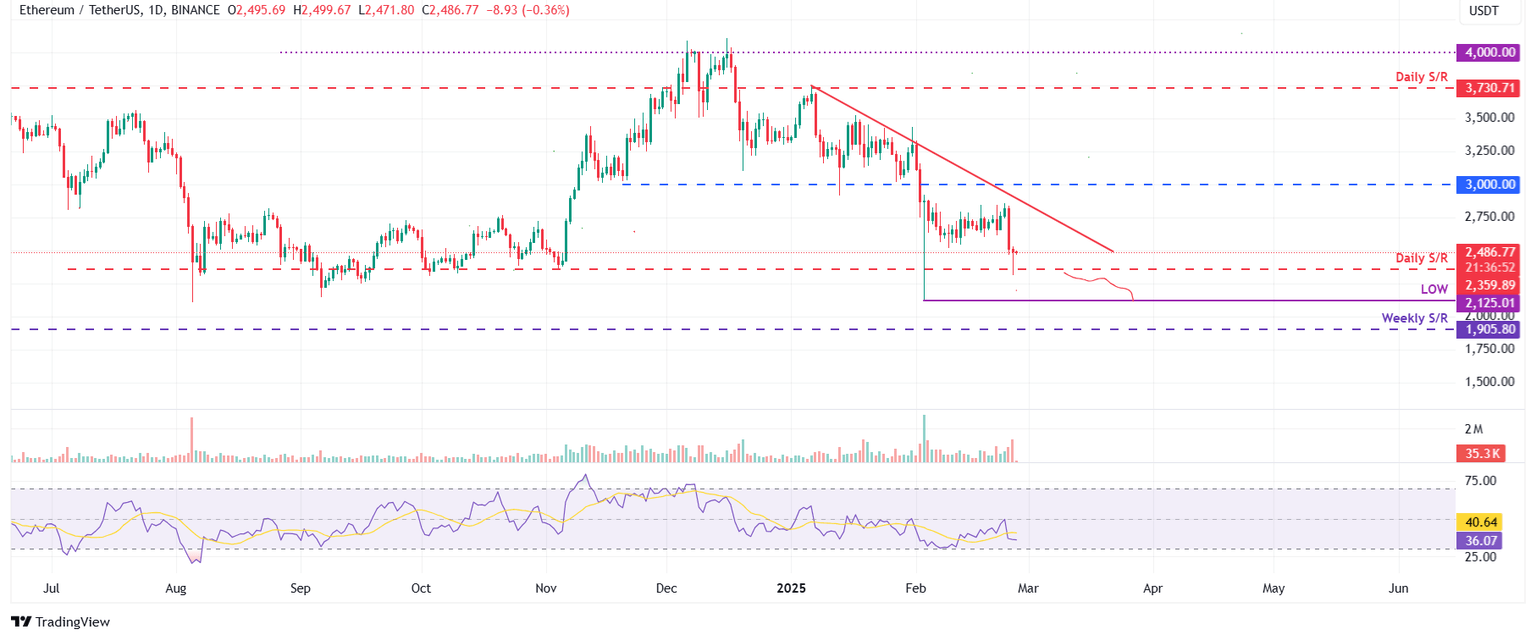

Ethereum is poised for a downleg if it closes below the $2,359 level

Ethereum price declined almost 11% on Monday. It continued its downtrend the next day and retested its daily support level at $2,359. At the time of writing on Wednesday, it hovers around $2,486 level.

If ETH continues its downtrend and closes below $2,359, it could extend the decline to retest its February 3 low of $2,125.

The RSI on the daily chart reads 36, facing rejection from its neutral level of 50 on Sunday and points downwards, indicating a bearish momentum.

ETH/USDT daily chart

On the other hand, if ETH recovers, it could extend the recovery to test its Monday high of $2,839.

Ripple price RSI reflects weakness in momentum

Ripple price declined nearly 12% on Monday and reached a daily low of $2.06 the next day. At the time of writing on Wednesday, it hovers around $2.29 level.

If the daily level of $2.72 holds as resistance, it will extend the decline to test its next support level at $1.96.

The RSI on the daily chart reads 36, rejecting its neutral level of 50 and points downwards, indicating bearish momentum.

XRP/USDT daily chart

Conversely, if XRP closes above $2.72 and finds support, it will extend the rally and retest its January 16 high of $3.40.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.