Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, XRP move around as market volatility resumes

- Bitcoin price has a chance at the $30,000 psychological level if it overcomes the $28,200 barrier.

- Ethereum price could extend the fall with a pending sell signal about to execute. Traders should watch for $1,585 level.

- Ripple price coils up and could breach the $0.5604 hurdle in the next lift-off.

Bitcoin (BTC) price is showing that volatility could be coming back to the market, with the same case going for Ethereum (ETH) price as the two giants recently recorded tight consolidation. Meanwhile, Ripple (XRP) price is trying to overcome a crucial hurdle, standing at a crossroads in a make-or-break moment for holders.

Also Read: Bitcoin bull market awaits as US faces 'bear steepener' – Arthur Hayes

Bitcoin price needs to clear $28,200 first

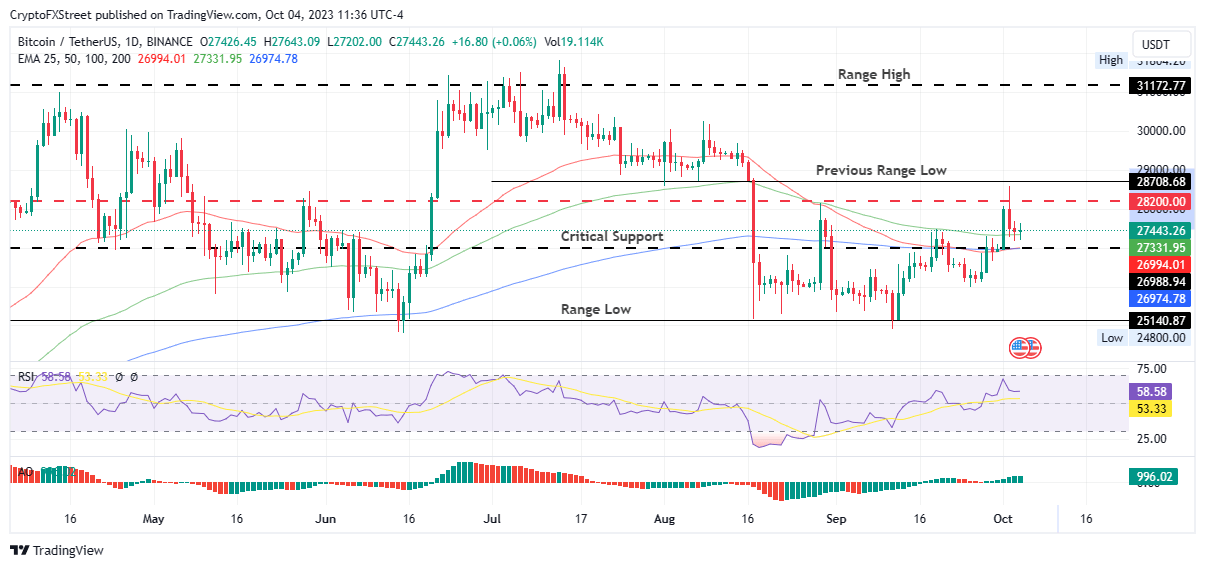

Bitcoin (BTC) price is sitting on strong support downward, presented by the 100-day Exponential Moving Average (EMA) at $27,331 and the confluence between the 50- and 200-day EMAs around the $26,988 level.

The odds still favor the upside, with the Relative Strength Index (RSI) above 50 and the Awesome Oscillators (AO) histograms still green in the positive territory.

The level to beat at this point is the $28,200 hurdle, which has proven formidable since the August 17 crash. A break and close above it would give Bitcoin price a chance at contending with the previous range low at $28,708.

Reclaiming above levels last seen pre-Evergrande catastrophe and SpaceX rumors, would make $30,000 psychological level plausible, potentially even going as high as the $31,172 range high.

BTC/USDT 1-day chart

Conversely, if Bitcoin price folds and closes below the critical support at $26,988, it could invalidate the bullish outlook, potentially dropping to the September 25 lows around the psychological $26,000, or in the dire case, extend the losses to the range low at $25,140. Such a move would constitute an 8% fall below current levels.

Also Read: Bitcoin price will likely hit $22,800 before 2024 should it follow its nine-year pattern

Ethereum price is not done with the downtrend

Ethereum (ETH) price could extend the ongoing slump and test the demand zone at the $1,600 psychological level. This view is reinforced by the RSI about to execute a sell signal by crossing below the signal line (yellow) band.

A break and close below the midline of this order block (ranging between $1,600 and $1,571) at $1,585 would confirm a downtrend, bringing the $1,552 range low in sight. The AO histogram bars are already turning red, suggesting bears are having their say.

ETH/USDT 1-day chart

On the flip side, if Ethereum price can flip the 50-day EMA back to a support floor at $1,667, prospects for more gain would revitalized, confirmed by a decisive candlestick close above the 200-day EMA at $1,731. ETH could target the supply zone at $1,733 from here.

Also Read: Ethereum ETFs fail to live up to hype: combined trading volume amounts to just $1.7 million

Ripple price readies for a steep climb

Ripple (XRP) price continues along an ascending trendline, invigorated by a positive development in the SEC vs. Ripple case. The RSI position above 50 spurs optimism and could make another move north soon as momentum grows.

The AO histogram bars support this stance, and Ripple price could shatter the $0.5604 level soon. A break and close above this level would set the tone for XRP to target the supply zone between the $0.6146 and $0.6432 range.

XRP/USDT 1-day chart

On the other hand, profit booking could cut the rally short, sending Ripple price below the support offered by the ascending trendline at $0.5199, its confluence with the 200 EMA. A decisive candlestick close below the $0.5000 psychological level would invalidate the bullish outlook.

Also Read: Ripple victory over SEC reaffirmed as Judge Torres denies regulator’s motion to appeal

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.