Top 3 Price Prediction, Bitcoin, Ethereum, Ripple: BTC cements new support, is the bull cycle in full swing?

- Bitcoin price is cementing new support in the weekly timeframe around $26,473, suggesting the completion of a bull cycle.

- Ethereum price could soon offer opportunities for bulls to accumulate around $1,786.

- Ripple price eyes the $0.55 range high as XRP coils up for a 20% explosion.

Bitcoin (BTC) price is bullish despite the lack of momentum, with bulls looking to breach the $30,000 level at all costs. However, the price action indicates the completion of a bull cycle, meaning some buyers could turn to sellers soon. The gloomy expectation, or lack thereof, in the crypto king could harm Ethereum (ETH) and Ripple (XRP) price as altcoins tend to follow on the heels of BTC.

Also Read: Bitcoin likely to remain in red through the next quarter if history is any indication

Bitcoin price suggests the end of a bull cycle

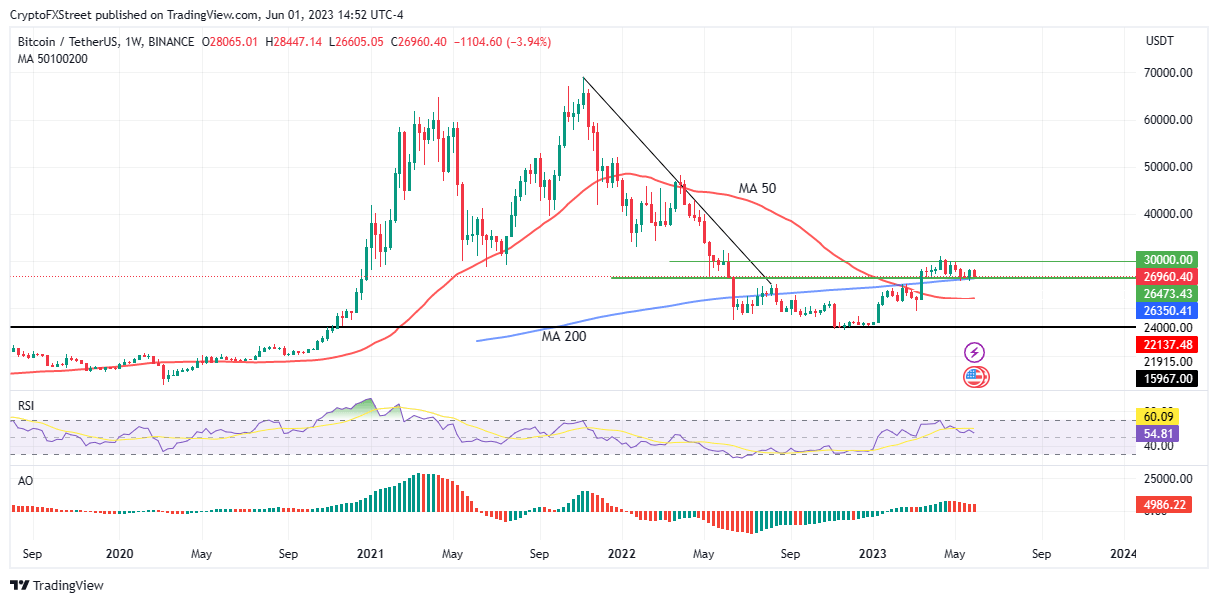

Bitcoin (BTC) price has been trading with a bullish bias on the weekly timeframe indicated by the Parabolic SAR flipping below the price in January. This comes after a massive multi-month drop beginning November 2021, indicated by lower highs on the chart below. However, a weakening momentum indicated by the flattening 200-Moving Average (MA) has caused a horizontal consolidation as the crypto king cements a new support level. This suggests the end of a bull cycle.

A bull market is the condition of a financial market in which prices are rising or are expected to rise. Waning momentum for a prolonged duration could indicate the end of such a run, especially when the asset’s price trades within a range for months. Based on the chart below, Bitcoin price is setting a new support level in stone, around $26,473.

Once a bull cycle ends, some buyers become sellers in the distribution phase discussed recently, where the two opposing forces are at equilibrium. Accordingly, BTC could drop to the $24,000 range.

BTC/USDT 1-Week Chart

Conversely, increased buyer momentum could restore control of Bitcoin price to the bulls, conferring enough gusto for the BTC to break above the $30,000 range.

Ethereum price to offer traders a buying opportunity soon

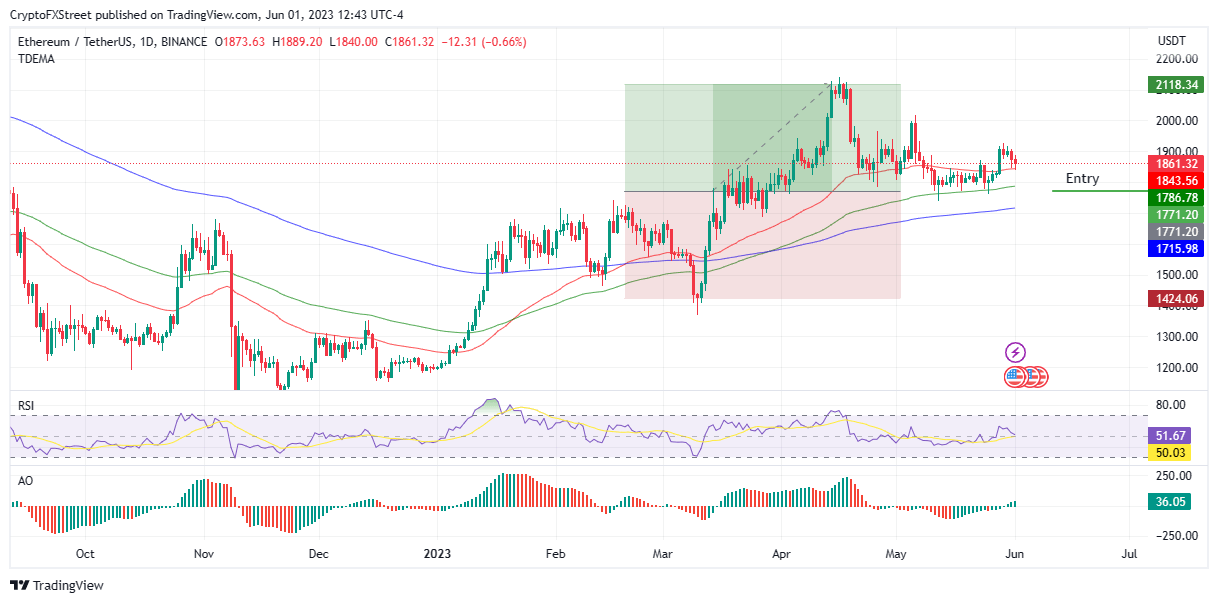

Ethereum (ETH) price is trading within the premium zone, but a lack of momentum could see the largest altcoin by market capitalization reach equilibrium, where traders can buy ETH at a fair market value of around $1,771.

Traders would also have the opportunity to buy ETH at a discount below the equilibrium level before the Ethereum price rallies back to the recent high. Considering the context behind the current outlook for Ether is bullish, the PoS token could record another impulsive move, potentially clearing the equal highs around $1,907.

In a highly bullish case, Ethereum price could escape above $2,000 to record a new range high above $2,118.

ETH/USDT 1-Day Chart

Conversely, if selling pressure abounds, Ethereum price could flip the support offered by the EMAs, extending south to collect liquidity below the $1,424 level.

Also Read: Ethereum vs. SEC: Implications of Wahis’ insider trading settlement on ETH

Ripple price coils up for a 20% rally

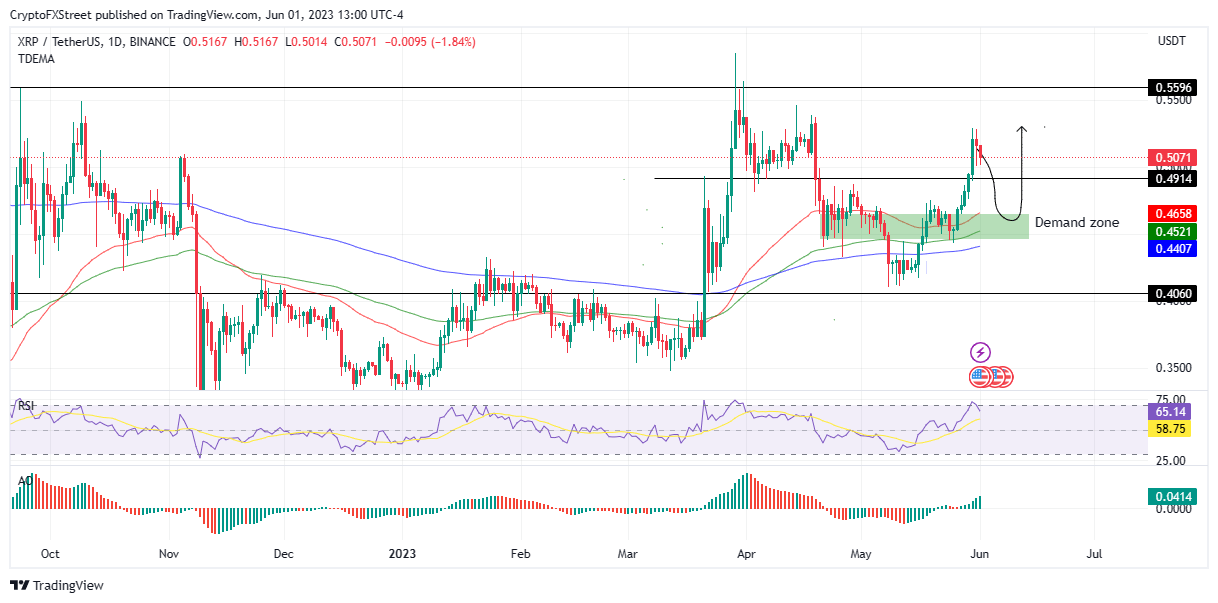

Ripple (XRP) price is coiling up for another break, after a 30% rally beginning May 12. The downtrend comes after XRP was overbought, indicated by the Relative Strength Index (RSI) position above 70 on May 30.

As Ripple price enjoys robust support downward at $0.49 and is backed by the 50-, 100-, and 200-day Exponential Moving Averages (EMA) at $0.46, $0.45, and $0.44, respectively, XRP could make a 20% breakout to $0.55 after a retest of the demand zone between $0.46 and $0.44.

A demand zone denotes a price range that signals the start of a sharp uptrend, as either a bullish reversal (like in this case) or an uptrend continuation. Within the demand zone, accumulation or buying occurs. Traders are therefore advised to watch this accumulation zone as the next entry position to avoid missing the next uptrend.

XRP/USDT 1-Day Chart

On the flipside, there was a lot of uncollected liquidity slightly above the $0.40 support level and just above the $0.35 range, meaning Ripple price could descend to these levels before a potential pullback.

Also Read: XRP unlocks tokens worth $500 million as SEC vs. Ripple verdict looms

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.