- Bitcoin has secured support above $43,000 but must rise above $46,500 to flip bullish enough for gains eyeing $50,000.

- Ethereum unrelenting in the battle for new highs at $2,000, needs to close the day above $1,800.

- Ripple shows stability after a consistent recovery from the recent dip to $0.3.

Bitcoin's rally seems to have lost steam or cooled off before it might resume again. The rest of the market has slowed down apart from selected altcoins, including Cardano, Avalanche, IOTA and the Graph.

On the other hand, Ethereum has settled above $1,700, but bulls are fixated on lifting towards $2,000. Ripple is also stable after stepping beyond the crucial level at $0.5. The bull run in the market is expected to continue as soon as Bitcoin secures the trajectory to $50,000.

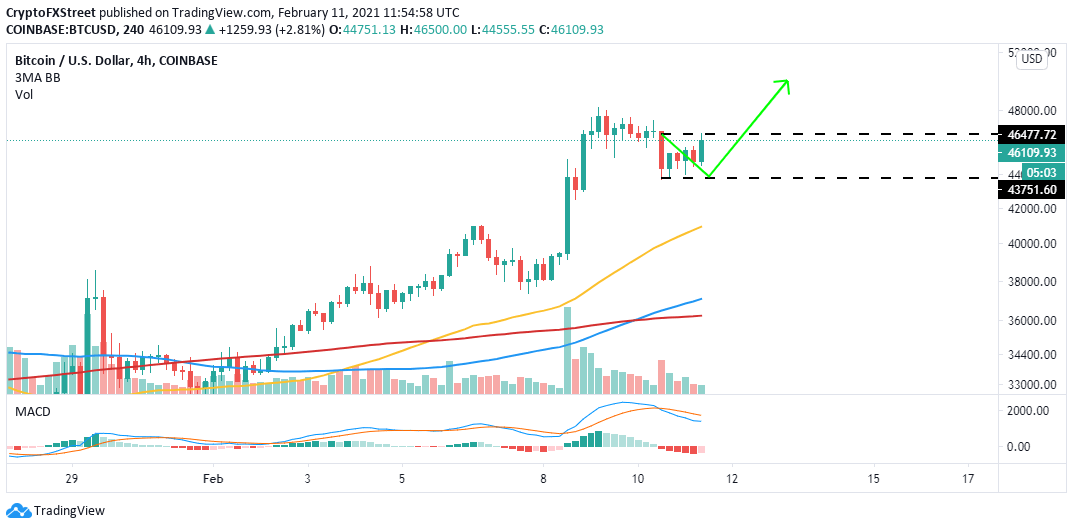

Bitcoin rebounds toward all-time highs

The pioneer cryptocurrency finally secured support above $43,000. A recovery is underway, with Bitcoin required to break the short-term hurdle at $46,500 to flip exceptionally bullish for gains above $50,000.

A golden cross pattern recently formed on the 4-hour chart after the 100 Simple Moving Average crossed above the 200 SMA. This scenario adds credibility to the bullish outlook whereby massive buy orders may be triggered as soon as BTC hits levels between $46,500 and $48,000.

BTC/USD 4-hour chart

Despite the bullish narrative, it is essential to realize that the Moving Average Convergence Divergence has printed a bearish picture. The MACD is a momentum oscillator used to identify possible sell the top and buy the bottom positions. Therefore, a correction is likely to continue if the MACD line (blue) increase the deviation from the signal line.

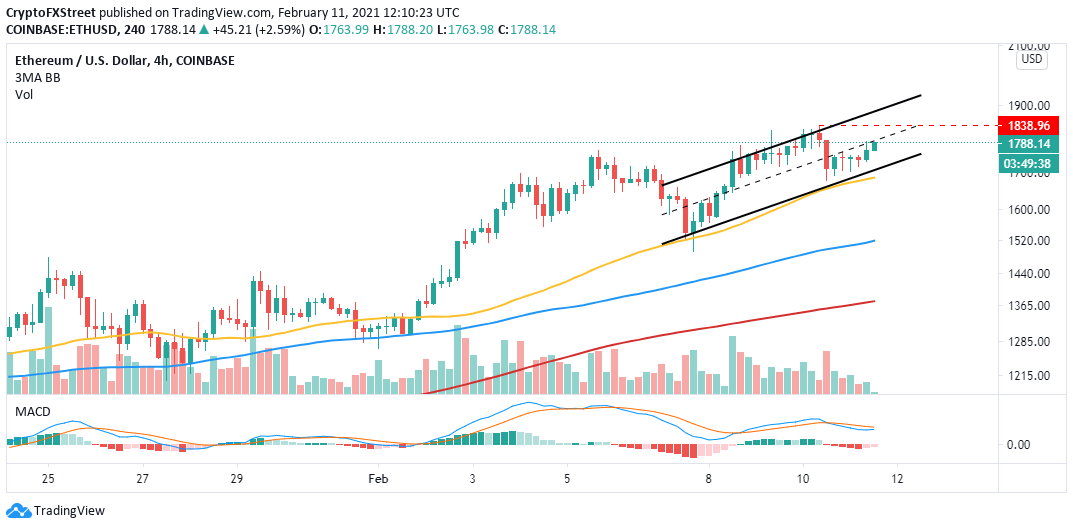

Ethereum eyes new all-time highs at $2,000

The flagship altcoin is currently nurturing an uptrend after it bounced off support at $1,675. The 50 SMA and the ascending channel lower boundary played a role in controlling the correction from the recently achieved highs of $1,838.

ETH is dancing at $1,765 amid the push for gains beyond $1,800. However, the channels' middle boundary resistance must come down for the expected upswing to materialize. It is worth noting that an extensive bullish leg will emanate after Ether extends above the upper edge and the seller congestion at $1,838.

The MACD could confirm the uptrend if it crosses above the signal line. This could be an excellent position to buy in anticipation of a breakout toward $2,000.

ETH/USD 4-hour chart

If Ethereum closes the day under $1,800, it is unlikely that the swing to $2,000 will occur as expected. Besides, overhead pressure would soar if the smart contract token slices through the enthusiastic support provided by the 50 SMA and ascending channel's lower edge.

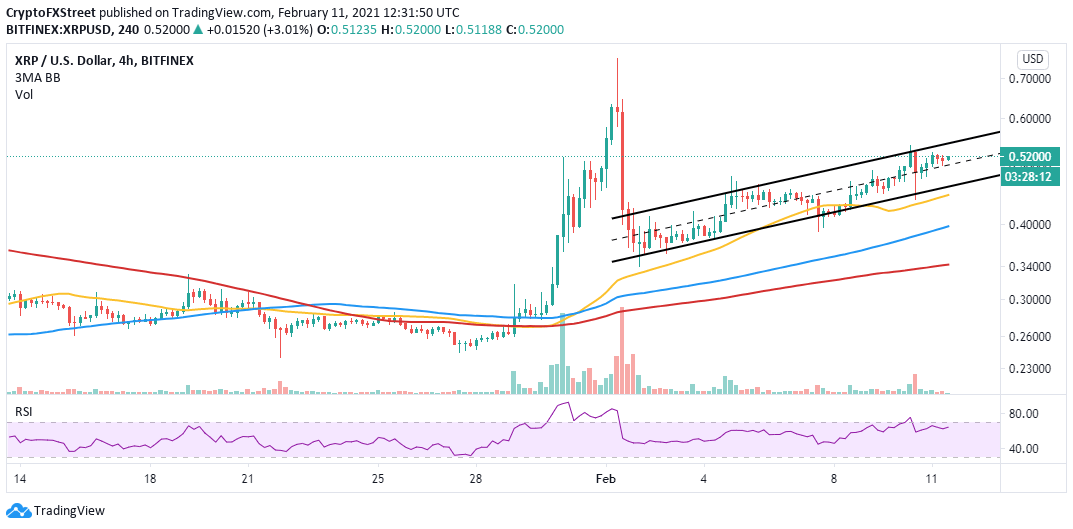

Ripple portrays stability amid recovery

XRP has sustained its recovery for almost two weeks. The price action is specular, especially for an asset that has been engulfed by uncertainty due to the ongoing lawsuits. The resilient recovery after a massive dump to $0.35 continues to urge buyers to join the market while investor sentiment flips bullish.

Meanwhile, the cross-border token is trading at $0.51 and settling in the ascending channel upper band. Closing the day above the middle boundary will confirm the stability. Simultaneously, a break above the upper edge will boost Ripple to highs above $0.6.

XRP/USD 4-hour chart

It is worth keeping in mind that slicing through the buyer congestion at $0.5 and the middle boundary would call for more sell orders. XRP is not out the wounds as any bearish signs could trigger a holders' exodus just like the pump-and-dump early last week. Support levels to focus on are the 50 SMA currently at $0.44, the 100 SMA at $0.4 and the 200 SMA holding at $0.34.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.