- Bitcoin is in consolidation within the confines of a symmetrical triangle, awaiting a breakout to $50,000.

- Ethereum rises to a new record high as predictions point to a spike to $2,000 in the short term.

- Ripple is pivotal at $0.3 after hitting a barrier at the 200 SMA on the 4-hour chart.

The cryptocurrency market has incurred some losses, with the total market value sliding from $1.07 billion to $1.02 billion. Bitcoin dominance holds at 65%, following a drop from levels close to 70%. In other words, altcoins are continuing to outperform the largest digital asset, mainly supported by Ethereum’s rise to a new record high of around $1,446.

Bitcoin molds the technical picture breakout to $50,000

Bitcoin is yet to hit a market top, as we discussed earlier in the day. Investors in the market are optimistic that the flagship crypto will resume the uptrend and make way above the recent record high at $42,000.

The 4-hour chart brings to light the formation of a two-week symmetrical triangle pattern. The pattern is arrived at by drawing two trendlines connecting the asset’s lower highs and higher lows. These trendlines meet at a point referred to as an apex.

A breakout is expected before the lines converge. It has a precise target measured from the highest and lowest points of the triangle. The distance between the points is then added to the breakout point, which would currently target $50,000.

To validate this uptrend, Bitcoin must recover the lost ground above the 50 Simple Moving Average and the 100 SMA. Price action exceeding $38,000 will play a significant role in the breakout materializing.

BTC/USD 4-hour chart

Investors must be aware that the symmetrical triangle may result in an opposite action, ultimately leading to a breakdown eyeing $20,000. Therefore, it is essential to wait for the confirmation of the breakout. If the latter doesn't materialize, massive losses will come into the picture leading to levels under $34,000 and $30,000, respectively.

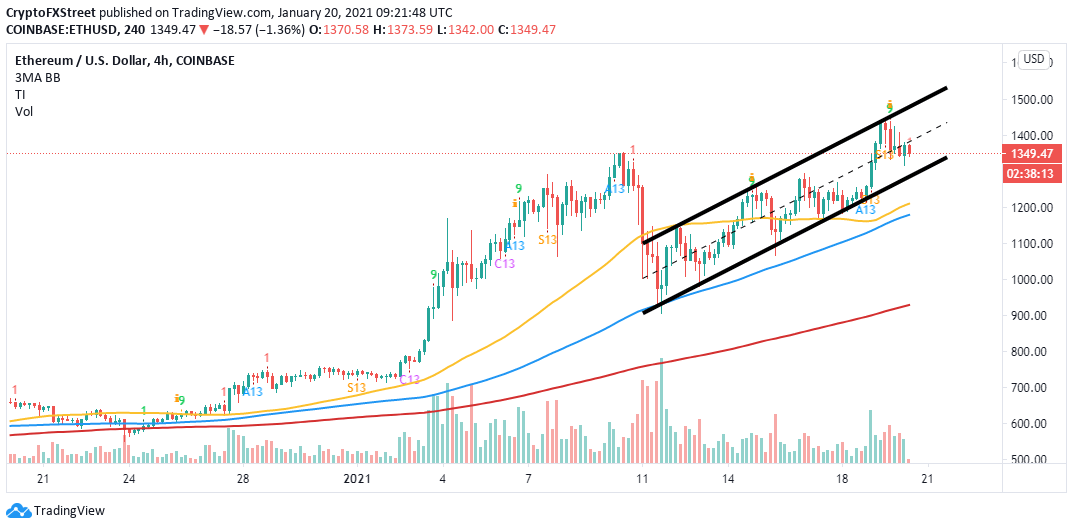

Ethereum hunts for a higher support

The pioneer altcoin has retread from the new all-time high in search of a higher low. The support at the ascending channel’s middle boundary has already been broken, leaving Ether with the lower edge anchorage of around $1,300.

To keep the uptrend sustained, Ether must stay above $1,200, as mentioned earlier, if not at $1,300. Meanwhile, the TD Sequential indicator recently presented a sell signal on the 4-hour chart. This call to sell manifested in a green nine candlestick. If validated, the pessimistic outlook could result in declines in one-to-four daily candlesticks.

ETH/USD 4-hour chart

On the other hand, another liftoff to new all-time highs will occur if Ether closes the day above $1,400. Anticipated gains to $2,000 will be confirmed by a price action beyond $1,500 and the ascending parallel channel’s upper boundary.

Ripple out to test crucial support and resistance levels

Ripple hit price levels above $0.3, but the breakout was unsustainable. The 200 SMA on the 4-hour chart was tested but remained unshaken. A correction followed shortly after, leaving XRP pivotal at $0.3.

XRP/USD 4-hour chart

On the downside, XRP/USD is held in place by the 50 SMA, which sits slightly above the 100 SMA. The support around $0.288 remains very fundamental to Ripple’s near-term uptrend. For now, the least resistance path seems downwards, especially with the Relative Strength Index rejection from levels close to the overbought area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.

%20-%202021-01-20T115830.283-637467329479802767.png)

%20(49)-637467329597619899.png)