Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin poised for a drop after falling below the $52,000 level

- Bitcoin retests its daily support level around $52,226; a close below this support could lead to further price declines.

- Ethereum is retesting its weekly support at $2,118; closing below it may lead to further price declines.

- Ripple closes below $0.544 support, signaling a shift from a bullish to a bearish market structure.

Bitcoin (BTC) and Ethereum (ETH) retested their major support levels on Monday; a break below these levels could signal a bearish trend ahead, while Ripple (XRP) closed below its key support level, indicating a likely bearish outlook in the coming days.

Bitcoin price could decline if $52,000 mark is taken

Bitcoin's price fell below the ascending trendline (drawn by joining multiple swing high levels from July 5) on August 2, leading to a 5.6% decline over the next two days. As of Monday, it is trading 6% lower at $54,585, having tested the daily support level at $52,266.

If BTC closes below the daily support at the $52,266 level, it could continue to decline 4.7% to retest its next daily support at around $49,917.

The Relative Strength Index (RSI) and the Awesome Oscillator on the daily chart have dropped below their neutral levels of 50 and zero, respectively, signaling a bearish trend according to these momentum indicators.

BTC/USDT daily chart

However, a close above the $65,596 daily high of August 2 would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 6% rise in Bitcoin's price to retest its weekly resistance at $69,648.

Ethereum price sets for decline if is falls below the $2,100 mark

Ethereum price closed below the daily support at around $2,927 on August 3 and declined 7.4% the next day. As of Monday, it continues to decline by 14% at $2,321 and retest the weekly support at $2,118.

If ETH closes below the weekly support at the $2,118 level, it could continue to decline 8.7% to retest its next weekly support at around $1,935.

The Relative Strength Index (RSI) and the Awesome Oscillator on the daily chart have dropped below their neutral levels of 50 and zero, respectively, signaling a bearish trend according to these momentum indicators.

ETH/USDT daily chart

However, a close above the $3,396 daily high of July 29 would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 5% rise in Ethereum's price to retest the July 22 high of $3,562.

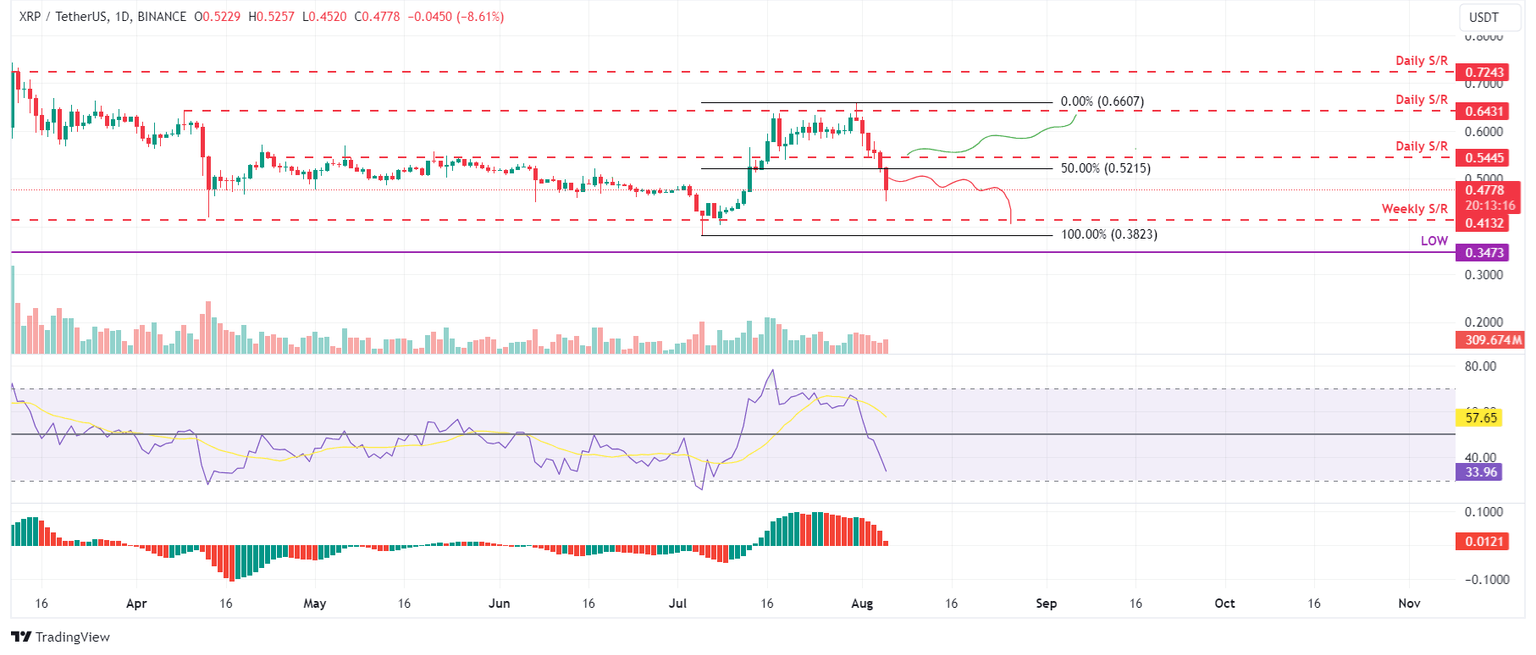

Ripple price is poised for a decline after failing to close above $0.544 level

Ripple price closed below the daily support level at $0.544 on Sunday. As of Monday, it continues to decline by 9% and trades at $0.477.

If the former daily support at $0.544 acts as resistance, XRP could continue to decline 17% to retest its weekly support at $0.413.

The Relative Strength Index (RSI) on the daily chart has briefly fallen below the neutral 50 level, and the Awesome Oscillator (AO) is approaching a similar decline; sustained weakening in these momentum indicators could signal strong bearish pressure and further declines in Ripple's price.

XRP/USDT daily chart

However, a close above the $0.544 level would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive an 18% rise in Ripple's price to retest the next daily resistance at $0.643.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.