Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin pacing toward $50,000 as $1.9 trillion US relief package risks reflation

- Bitcoin fights for a breakout above $40,000 after bouncing off the ascending triangle's x-axis.

- The relief package in the US could elevate BTC and other cryptocurrencies to higher levels as inflation grows.

- Ethereum must settle above $1,600 to give buyers ample time to rejuvenate for gains eyeing $2,000.

- Ripple's upside is capped under the 50 SMA on the 4-hour chart, while sideways trading takes precedence.

The cryptocurrency market seems ready to fly to new levels, especially with the market value having climbed above $1.2 trillion. Bitcoin is closing in on $40,000 while speculators wait for the ultimate rally to $50,000.

Ethereum has settled above $1,600 after trading a new all-time high of $1,765. XRP has also managed to hold above $0.4 despite the increasing overhead pressure.

Intriguingly, selected altcoins are performing exceptionally well. For instance, Cardano, the current fourth-largest cryptocurrency in the market, is ready to rally again. Polkadot rose to a new all-time high; Dogecoin is up 24%, Aave up 15%, and Elrond up 54%.

Bitcoin is closing in on $40,000 ahead of massive liftoff

BTC broke out of an ascending triangle as predicted on Friday. The pioneer digital asset hit levels above $40,000, but the uptrend was brief and short-lived. A correction ensued with Bitcoin retesting the triangle's x-axis support.

In the meantime, BTC has rebounded and is drawing closer to $40,000. A second break above $40,000 is likely to trigger massive buy orders as investors capitalize on the anticipated rally to $50,000. Note that, BTC supply available for trading has sunk to only 13% of the total supply, which means demand is exceptionally high amid diminishing supply.

Similarly, Joe Biden's $1.9 trillion COVID-19 relief package is likely to destabilize the global market with the US dollar's reflation. In return, investors will once again stream into the crypto market, driving prices higher.

BTC/USD 4-hour chart

Ethereum targets $2,000 as CME ETH futures begin trading

Ethereum futures contracts on Chicago Mercantile Exchange have started trading, bringing the focus back to the pioneer altcoin. The CME futures will be cash-settled, but the product's attractiveness is that the exchange is regulated.

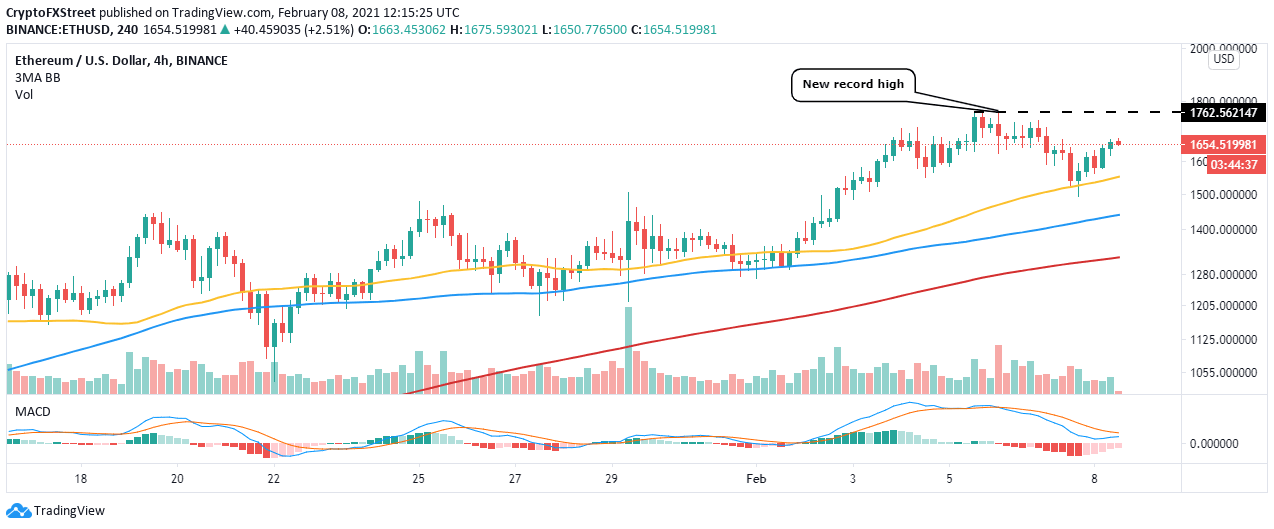

Last week's breakout saw Ether close in on the $1,800 target before the futures contracts launch. However, ETH achieved a new record high at $1,765 before a correction took precedence. As the uptrend rebuilds again, Ethereum seems to have the potential to hit new all-time highs above $2,000.

The Moving Average Convergence Divergence (MACD) might validate the uptrend if the MACD line (blue) crossed above the signal line. Notably, resistance is expected at $1,765, $1,800 and the ultimate medium-term price level at $2,000.

ETH/USD 4-hour chart

Ripple uptrend stalls under the 50 SMA

Ripple's price has been stable from the time it established support at $0.35. Recovery has been lock-step mostly due to the resistance at $0.45 and currently the 50 Simple Moving Average on the 4-hour chart.

XRP is exchanging hands at $0.42, while the upside is capped under the 50 SMA. Closing the day above this level would be a bullish signal likely to trigger massive buy orders. Although $0.45 is still a formidable resistance zone, gains to $0.75 are still possible.

The 50 Simple Moving Average has emphasized the sideways trading action on the 4-hour chart. The RSI is leveling at the midline, suggesting that the bullish camp and the bearish camp are at equal strength.

XRP/USD 4-hour chart

Key Takeaways

Bitcoin's uptrend to $50,000 will be invalidated if the price fails to close the day above $40,000. Moreover, support at $38,000 remains vital to the uptrend and must be guarded at all costs.

Ethereum bulls should hold above $1,600 for a continued uptrend toward $2,000. However, a correction eyeing $1,400 will come into the picture if the 50 SMA support is broken.

Ripple will resume the downtrend if the 50 SMA hurdle remains unshaken. On the other hand, if support at $0.4 fails, we can expect XRP to retrace toward $0.35 and $0.3.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520-%25202021-02-08T144518.709-637483851929468650.png&w=1536&q=95)

%2520(92)-637483852023691081.png&w=1536&q=95)