Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin could see high volatility due to US CPI

- Bitcoin price is hovering around the weekly support level of $67,147.

- Ethereum price finds support around a 50% retracement level at $3,424.

- Ripple price retests its previous support at $0.467.

Bitcoin (BTC) price could undergo an initial dip before rallying, with the release of US CPI data today.

Ethereum (ETH) and Ripple (XRP) could also mirror BTC’s pattern, showcasing the synchronized dance of cryptocurrency markets.

Bitcoin price could turn volatile

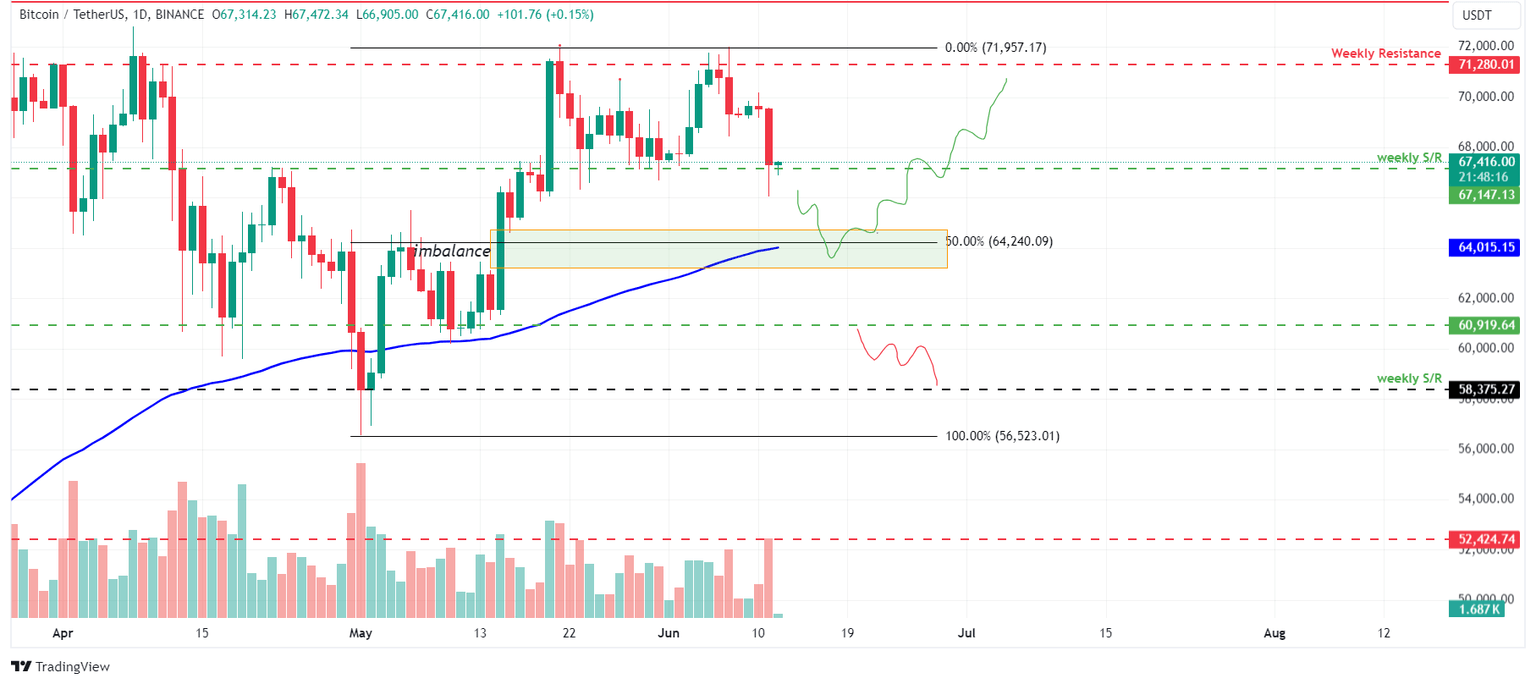

Bitcoin price has crashed 7% in the last five days as it faces resistance at the weekly close of around $71,280.

Currently, it is hovering around the weekly support level of $67,147.

Bitcoin price is likely to be volatile because of today's US CPI news. This news could trigger BTC to sweep out buy-side liquidity before rallying upside.

In such a scenario, BTC could first crash 5% from its current price level of $67,416 to find support on the following levels.

- At $63,860, the midpoint level of the price imbalance is between $63,118 and $64,602.

- The $64,240 level is a 100% price retracement level, which roughly coincides with the 100-day Exponential Moving Average (EMA).

If BTC bounces off $64,240, then it could rally 11 % to reach its previous resistance level of $71,280.

BTC/USDT 1-day chart

However, if BTC breaks and closes below $60,919, the bullish thesis could be invalidated, leading to a crash of 4%, its weekly support level of $58,375.

Ethereum price looks promising

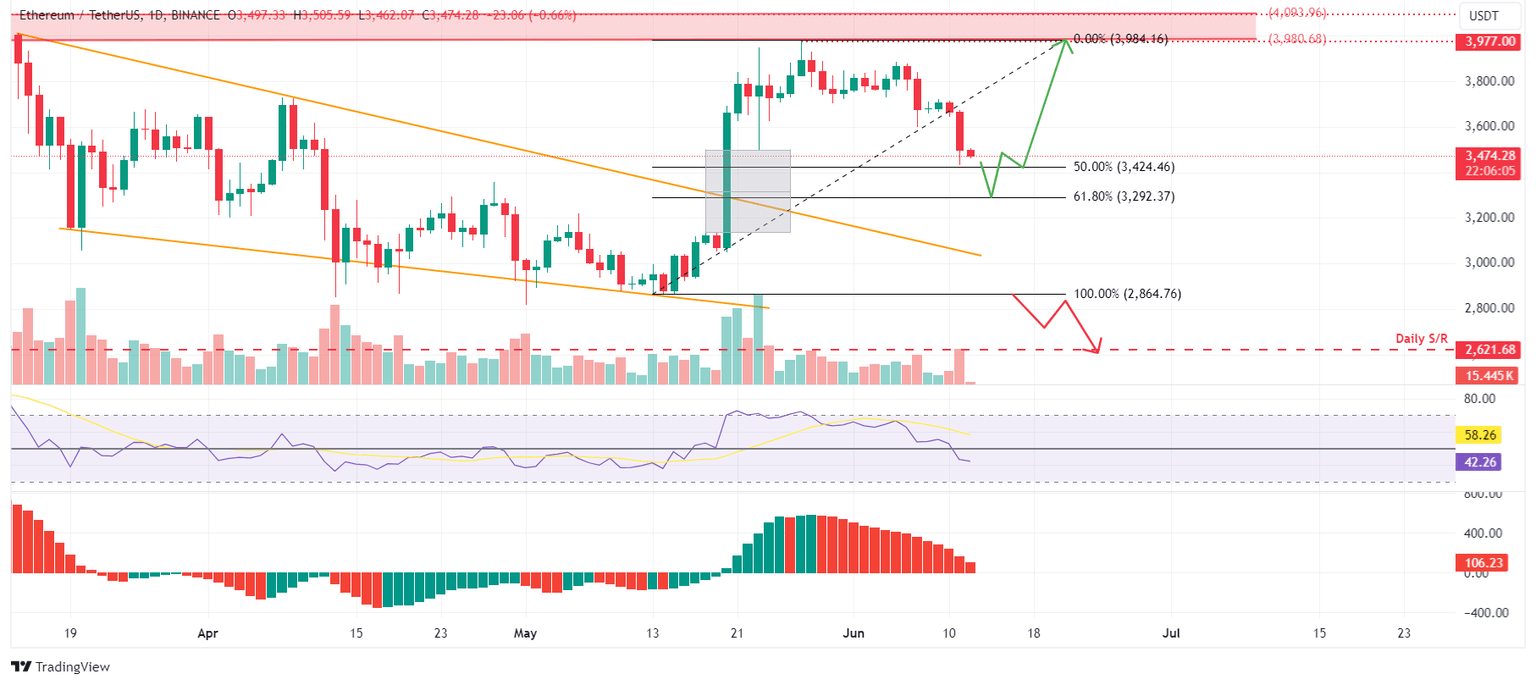

Ethereum price crashed 11% in the last six days as it failed to close above its $4,000 mark.

Currently, ETH is finding support around a 50% retracement level at $3,424, calculated from the swing low of $2,864 on May 13 to a swing high of $3,984 on May 27.

Ethereum price is likely to be volatile because of today's US CPI news. This news could trigger ETH to sweep out buy-side liquidity before rallying upside.

In such a case, ETH could first crash 5% from its current price level of $3,474 to find support at $3,279, the 61.8% Fibonacci retracement level.

If ETH bounces off $3,279, then it could rally by 20 % to reach its previous resistance level of $3,977.

ETH/USDT 1-day chart

On the other hand, if Ethereum's daily candlestick price closes below the $2,864 level, it would produce a lower low and signal a break in the market structure. This move would invalidate the aforementioned bullish thesis, potentially triggering an extra 9% crash to the previous support level of $2,600.

Ripple price seems set for liquidity sweep

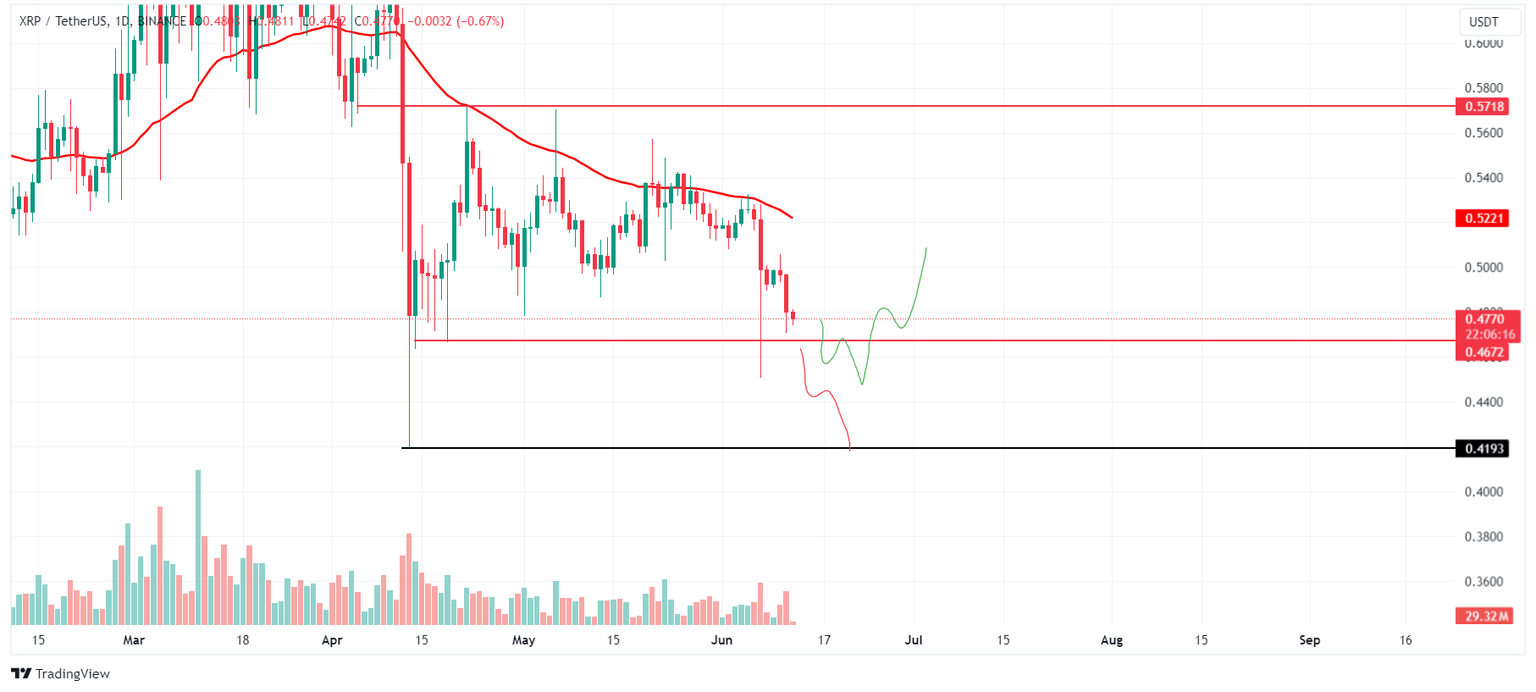

Ripple price crashed 13% on June 7 after it failed to close above the 50-day Exponential Moving Average (EMA) at around $0.526.

Currently, it finds support at the $0.467 level.

Ripple price is likely to be volatile because of today's US CPI news. This news could trigger XRP to sweep out buy-side liquidity before rallying upside.

In such a case, XRP could first crash 6% from its current price level of $0.477 to find support at $0.450, which is its previous low.

If XRP bounces off $0.450, it could rally 17 % to $0.522, the 50-day EMA level.

XRP/USDT 1-day chart

However, if the Ripple daily candlestick closes below $0.450, then XRP could crash an additional 7% to its previous support at $0.419.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.